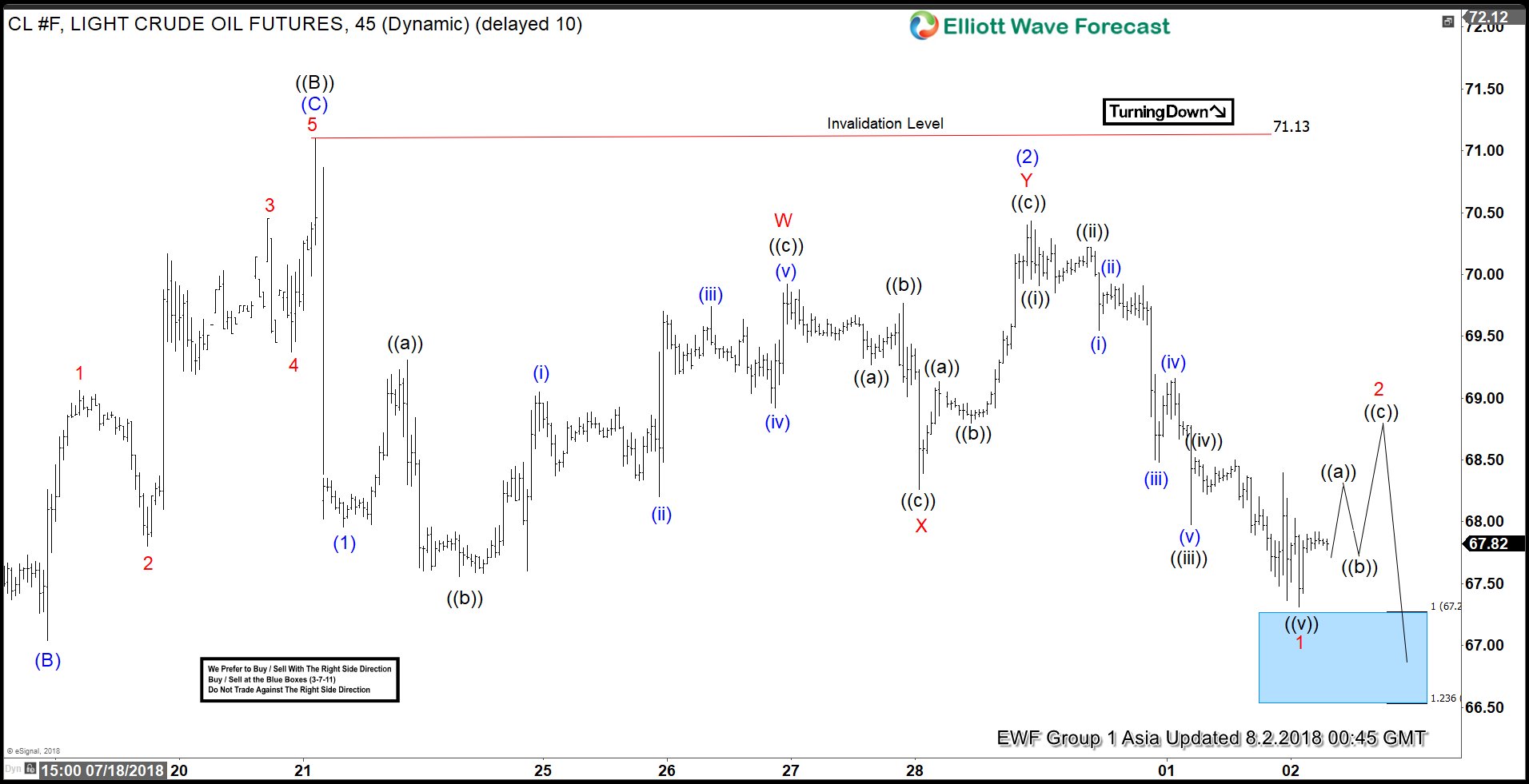

OIL short-term Elliott wave analysis suggests that the bounce to $71.13 high ended primary wave ((B)) bounce against 7/03/2018 peak ($75.27). Primary wave ((C)) lower currently remains in progress as Elliott Wave impulse structure looking for more downside. Down from $71.13 high, the decline to $67.96 low ended intermediate wave (1) in 5 waves structure. Above from there, the bounce to $70.43 high ended intermediate wave (2). The internals of Intermediate wave (2) unfolded as Elliott Wave double three structure where the initial rally to $69.92 completed Minor wave W of (2) as a Flat.

The subsequent pullback to $68.26 low ended Minor wave X of (2) as Elliott Wave Zigzag correction. Finally, the third leg higher in Minor wave Y of (2) ended at $69.92 high as Zigzag structure. Down from there, Intermediate wave (3) lower is in progress as an impulse and started nesting with Minor wave 1 ended in 5 waves at $67.31 low. Up from there, Minor wave 2 recovery remains in progress in 3, 7 or 11 swings & expected to fail below $70.43 high in first degree and against $71.13 in the second degree for more downside. As far as rally fails below 71.13, expect Oil to see further downside.