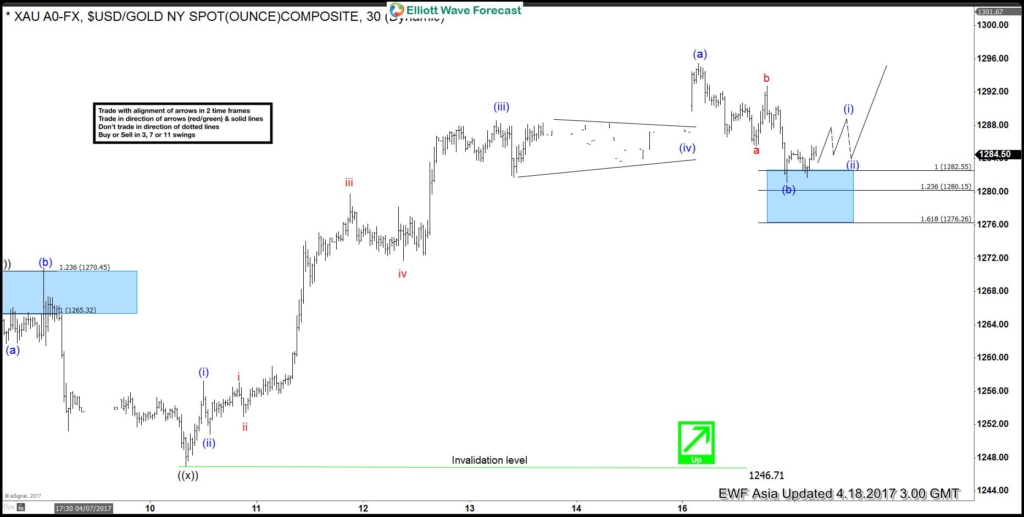

Short term Elliott Wave view in Gold (XAUUSD) suggests that cycle from 4/10 low (1246.92) is unfolded as an impulse Elliott wave structure where Minutte wave ((i)) ended at 1257.2, Minutte wave (ii) ended at 1250.8, Minutte wave (iii) ended at 1279.75, Minutte wave (iv) ended at 1271.69 and Minutte wave (v) of (a) ended at yesterday’s peak 1295.6. Below from there metal has started the Minutte wave (b) pullback to correct 4/10 (1246.9) cycle and that could be done already in 3 swings at earlier low 1281, where Sub minutte wave a ended at 1285.6 and Sub minutte wave b ended at 1292.6. However metal needs to break 1295.6 peak first for final confirmation of next leg higher started, If it fails to rally from here then Double correction from the peak within the Minutte wave (b) pullback can’t be ruled out yet before the rally resume, where we would like to be buyer’s again. Now as far as trading above earlier low 1281 and more importantly as far as pivot from 4/10 low remains intact metal has scope to resume the upside. We don’t like selling the metal into the pullbacks & favors the upside in metal as far as pivot from 4/10 low remains intact.

Gold 1 Hour Elliott Wave Chart

Back