Welcome traders, today we will look at a couple of Oil futures (CL_F) charts given to our members. The following short Elliott wave analysis will give you a brief understanding on how our bullish/bearish sequence stamps work and how we act on them.

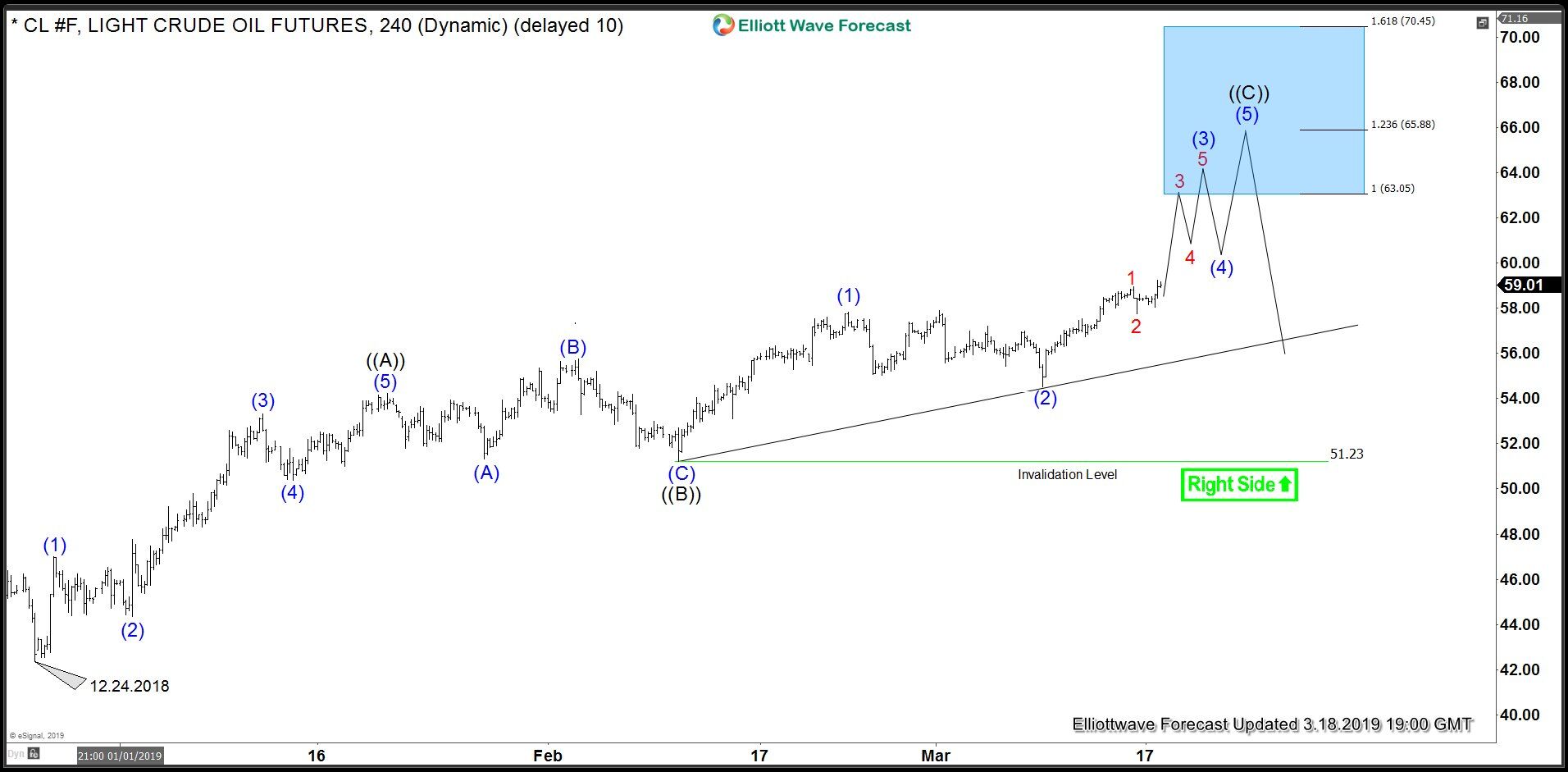

First of all, we start on March 18 where the right side of the markert favored the upside assuming a finished wave ((B)). From there, an invalidation level and a high probability target are provided. This is based on Elliott wave zigzag structure guidelines. Moreover, really notice how higher highs occur after the identified wave ((B)). Due to the price action observed, we take an aggressive approach on a shorter time frame.

Oil 3.18.2019 4-Hour Chart Elliott Wave Analysis

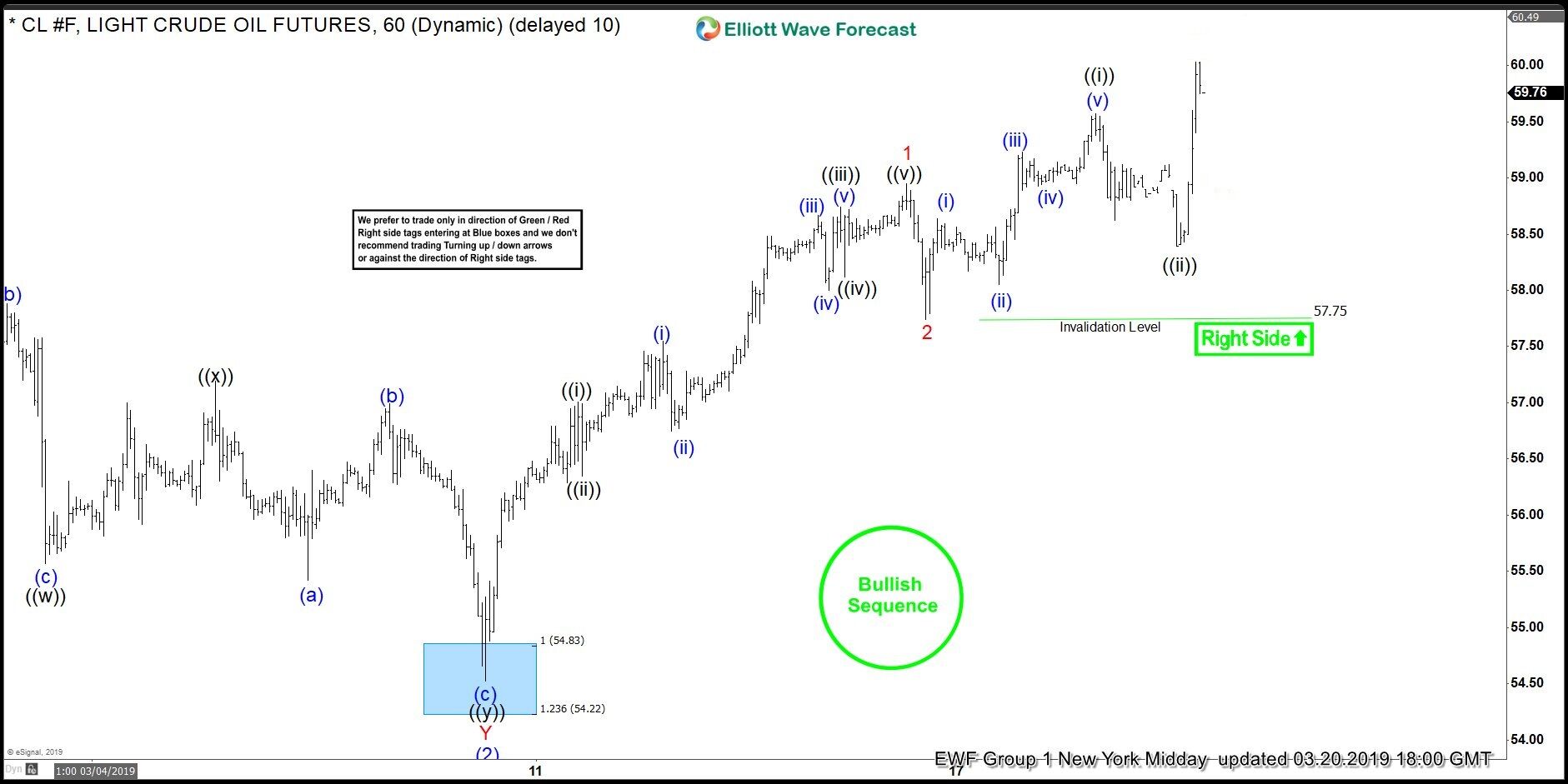

In the chart below, from March 20th, you can now see a bullish sequence stamp. This sequence stamp means an incomplete number of swings is currently observable. A crucial rule in our methodology is a sequence must finish as a complete 3,7 or 11 swing move. For reference, from the start of the rally from the blue box area, there is a total of 8 swings completed and the 9th swing is in progress. So, based on this, our members are fully encouraged to take long position in this particular case. Any pullback at this point is an opportunity for the upside.

Oil 3.20.2019 4-Hour Chart Elliott Wave Analysis

*Note : Keep in mind the market is dynamic and the presented view might have changed after the post was published.

If you like what you read or if you are interested on our Elliott Wave theory application, visit us at Elliott Wave Forecast. We cover 78 instruments in total for which we provide daily live analysis. Up-to-date Elliott wave analysis, and potential reversal target areas are always available. And if that was not enough, we provide support through a 24/7 chat room.

As always, newcomers can always try us out for 14 days with our Trial Plan. Or, if you are ready, check out our available Subscription Plans.

Trading success is a journey and you will never be perfect at it, but you can always master your reaction to the market.

Back