Binance Coin is the cryptocurrency issued by Binance exchange and carries BNB symbol. With a volume of $7.6 billion, as of Q2 2022, Binance Exchange was the largest cryptocurrency exchange in the world. One-fifth of Binance exchange’s profits are used to repurchase and permanently destroy, or “burn,” Binance coins held in its treasury. Binance was created […]

-

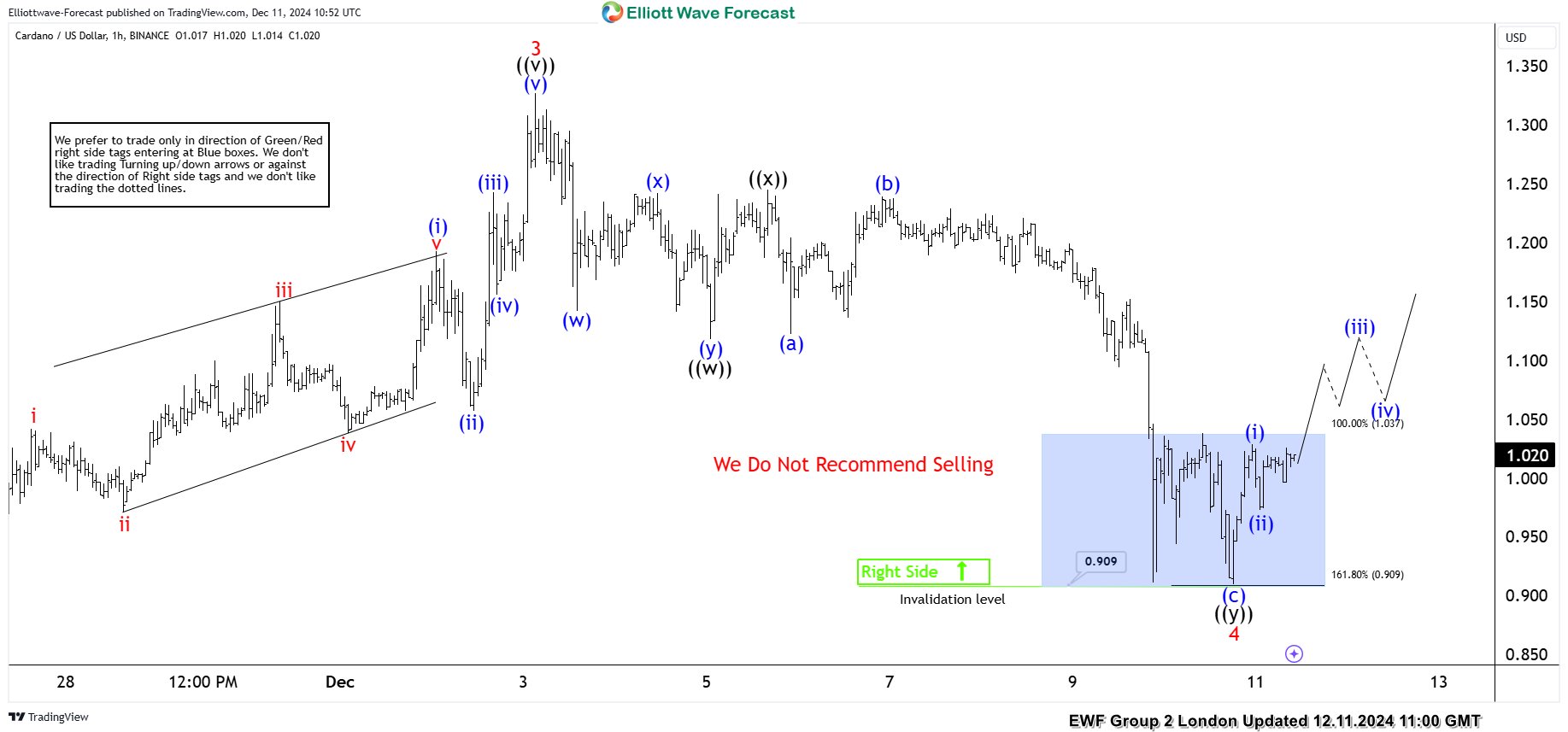

Cardano (ADAUSD) journeys toward $2 from blue box

Read MoreHello traders. Welcome to a new blog post where we discuss trades that Elliottwave-Forecast members took from the blue box. In this post, we will discuss Cardano with symbol ADAUSD ($ADA.X). Cardano is a decentralized blockchain platform and cryptocurrency (ADA) designed to provide a more secure and scalable infrastructure for the development of decentralized applications […]

-

Bittensor TAO Bullish Path Leads To Break Above $1000

Read MoreBittensor TAO is a decentralized infrastructure for building and deploying machine learning models on the blockchain. It’s pioneering the decentralized production of artificial intelligence and its coin TAO has currently a $4.62 Billion Market capitalization. In this article, we’ll explain the bullish Elliott Wave structure within the daily cycle and provide a potential projection of the future price. Since August […]

-

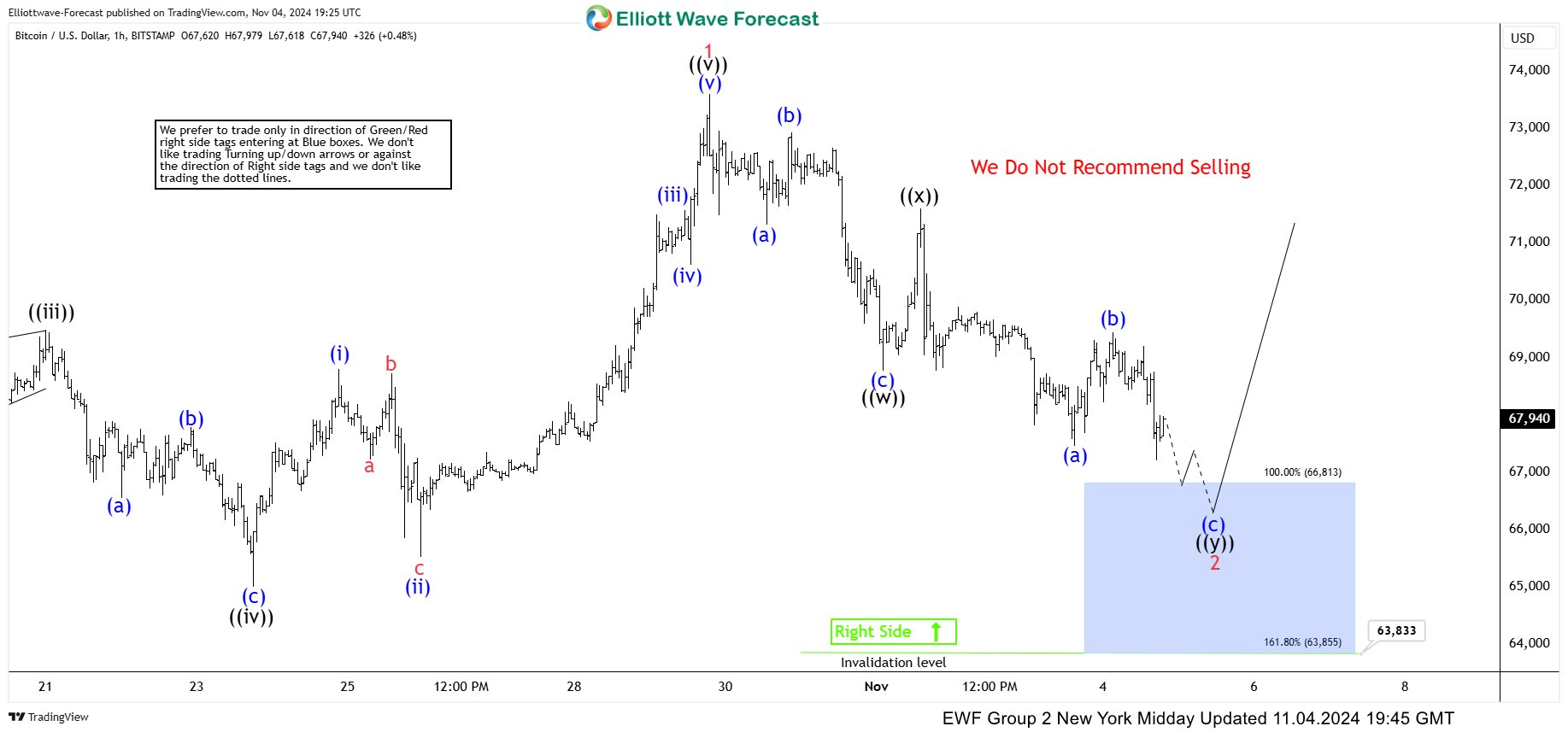

Bitcoin BTCUSD gained 50% from our buying zone – here’s how we did it

Read MoreIn this article we’re going to take a quick look at the Elliott Wave charts of Bitcoin BTCUSD published in members area of the website. As our members know BTCUSD is showing impulsive bullish sequences in the cycle from the 52598 low , that are calling for a further strength. Recently we got a pull […]

-

BTCUSD Made Rally Toward New All-Time Highs After Double Three Pattern

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of Bitcoin BTCUSD published in members area of the website. Our members know BTCUSD is showing impulsive bullish sequences in the cycle from the 50186 low. Recently, it made a clear three-wave correction. The pull back […]

-

KARRAT Coin Gearing Up for Bullish Nest Breakout

Read MoreKARRAT coin is a governance token supporting the KARRAT Protocol, a decentralized gaming infrastructure layer. In this article, we’ll plain the current bullish Elliott Wave structure taking place within the daily cycle. Since April 2024, KARRAT did a corrective 3 waves ZigZag structure in wave ((2)). The decline took the coin lower toward $0.25 where it ended […]

-

SuperVerse Initiating The Elliott Wave SUPER Rally

Read MoreSuperVerse SUPER is building the Web3 infrastructure for Gaming and expected to be one of the leading pioneers in the industry. In this article, we’ll explore the potential bullish Elliott Wave path. SUPER initially rallied within an impulsive 5 waves advance since October 2023 and it ended wave ((1)) at $1.6 on March 2024. The token did […]