HINDCOPPER Elliott Wave Update – Blue Box Reaction Delivers Strong Rally and Keeps Bullish Outlook Intact

Hindustan Copper (NSE: HINDCOPPER) has shown an impressive Elliott Wave performance. It respected the bullish structure shared earlier. In our previous update, we highlighted a high-probability blue box area. This was where buyers were expected to step in again. The price reacted strongly from this zone and rallied more than 200%. This confirmed the Elliott Wave forecast and strengthened the bullish outlook. It also shows how price action, structure, and Fibonacci levels work together in Elliott Wave theory.

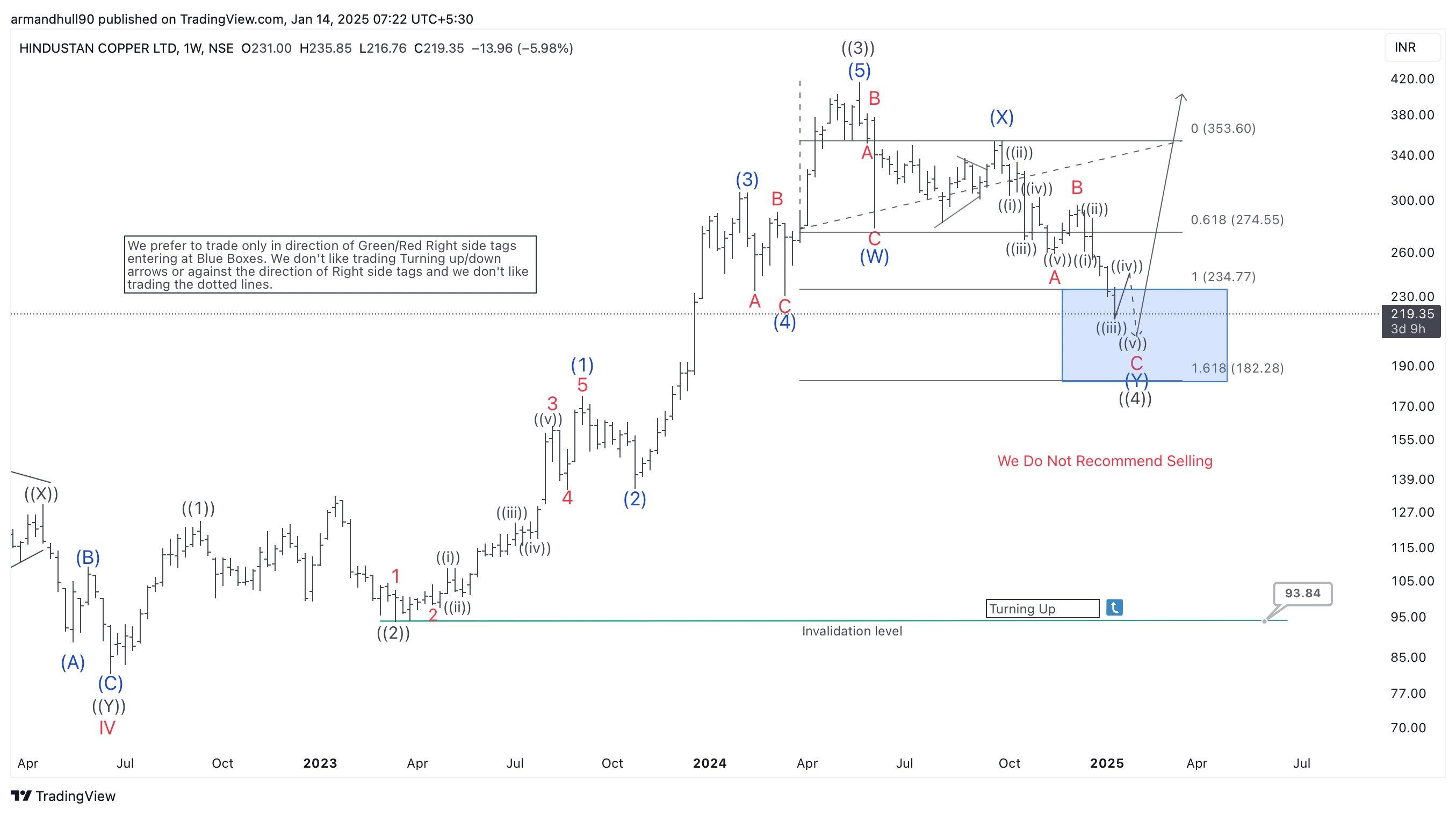

This Is How We Saw It in Early January 2025

Strong Reaction From Blue Box – Bullish Sequence Resumes

Earlier, Hindustan Copper completed a multi-leg corrective pullback into the blue box area, positioned between the 100% and 161.8% Fibonacci extension. This region is typically where we expect corrections to end and the main trend to resume. The decline unfolded as a double three (W-X-Y) corrective structure, and wave ((4)) completed inside the box near the 1.618 extension support.

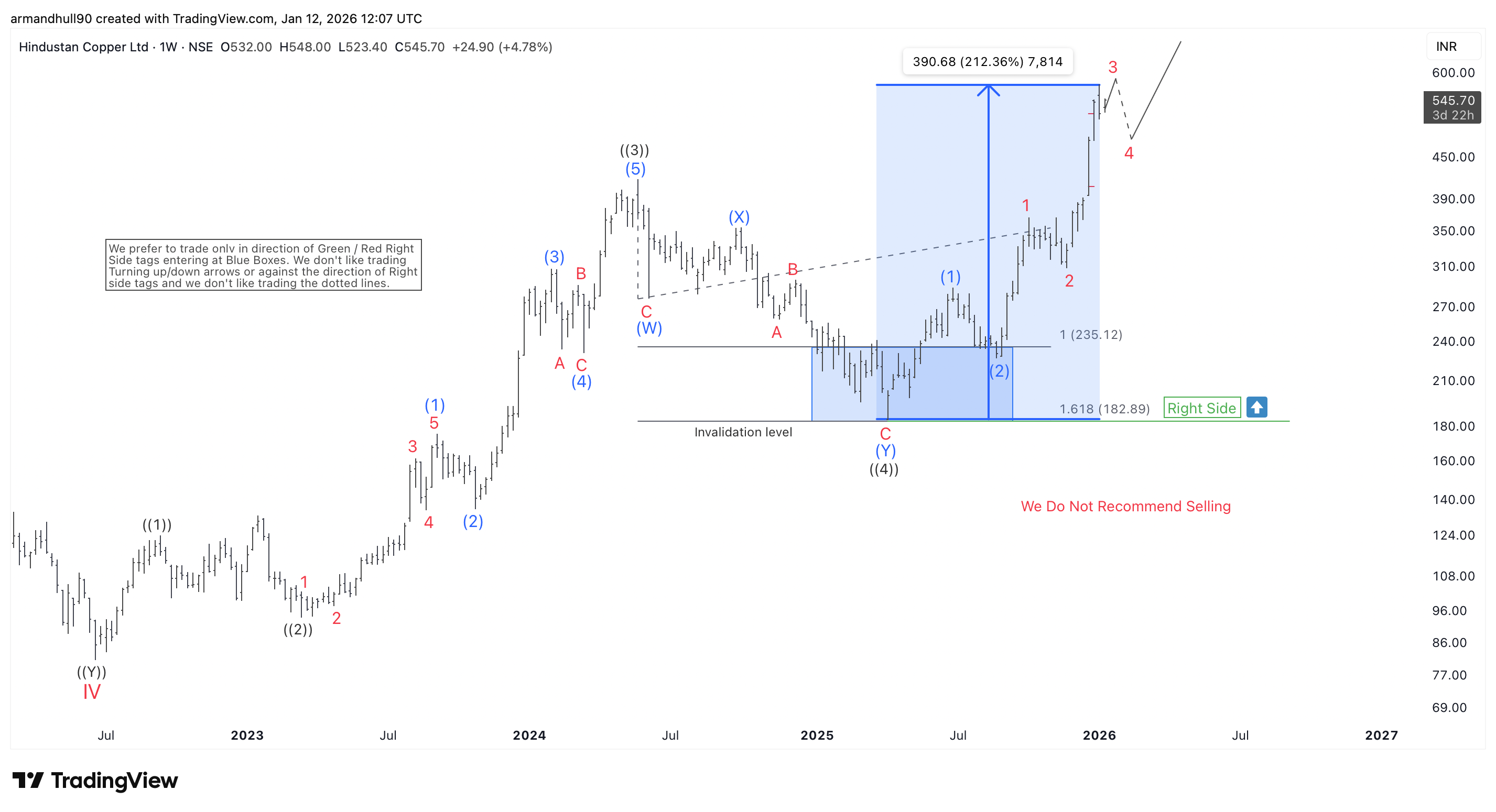

From that zone, buyers stepped in aggressively. The stock reversed sharply higher, broke key resistance levels, and eventually achieved a massive bullish acceleration of more than 200% from the blue box area. This confirmed that the correction had ended and a new bullish cycle had begun. It resulted in a clear Blue Box Win, with price behaving exactly as projected and continuing in the intended direction.

Elliott Wave Structure – What Has Happened and What Comes Next?

After the strong reaction from the blue box area, Hindustan Copper confirmed that the correction had finished and a new bullish phase had begun. The bounce triggered a fresh impulsive rally, establishing wave (1) and then pulling back slightly to complete wave (2). Price has now resumed higher again within wave (3), which is typically the strongest and most extended part of an Elliott Wave cycle. As long as key support levels remain intact, the stock is expected to maintain its bullish momentum.

From the earlier lows, Hindustan Copper has been progressing in a clear impulsive bullish cycle in wave (3). The market first completed wave 1 and 2, followed by a powerful advance in wave 3. This bullish leg still has some room to extend further before it becomes mature. Once that happens, we may see a controlled pullback in red wave 4, which should hold above support and keep the broader bullish trend intact before the next move higher resumes.

Outlook Remains Bullish

The structure continues to favor further upside in Hindustan Copper. We do not recommend selling against the prevailing bullish trend. As long as price holds above key support levels, it is expected to extend higher and work toward new bullish targets.

Hindustan Copper has respected Elliott Wave guidelines exceptionally well, delivered a textbook blue box reaction, and produced a rally exceeding 200% from that region. The stock remains in a strong technical position, and the broader trend continues to favor the upside.