The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

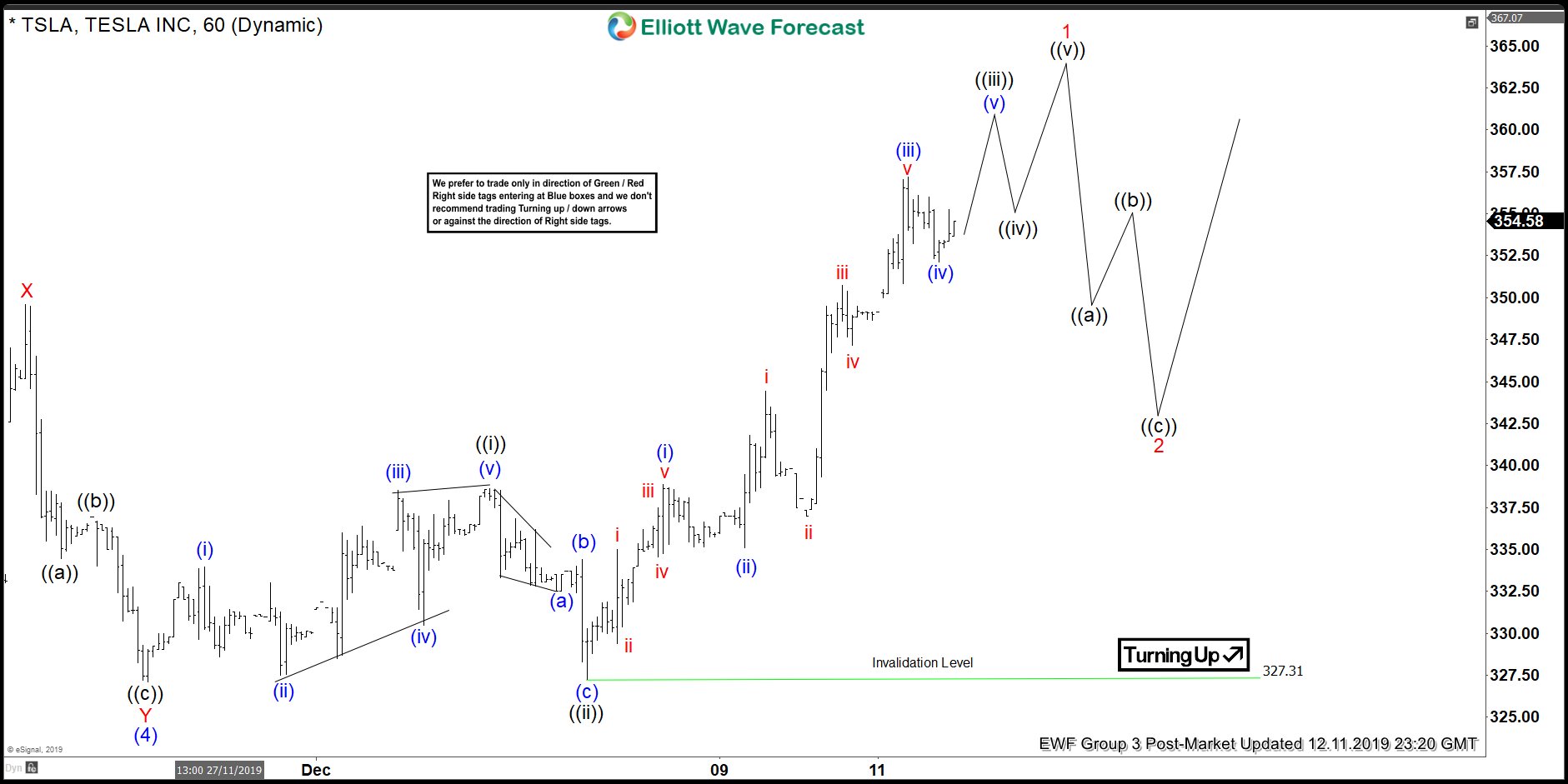

Elliott Wave View: Tesla Resumes Higher

Read MoreTesla (TSLA) is rallying as an Elliott Wave impulse structure and near term can see further upside while above Nov 27 low.

-

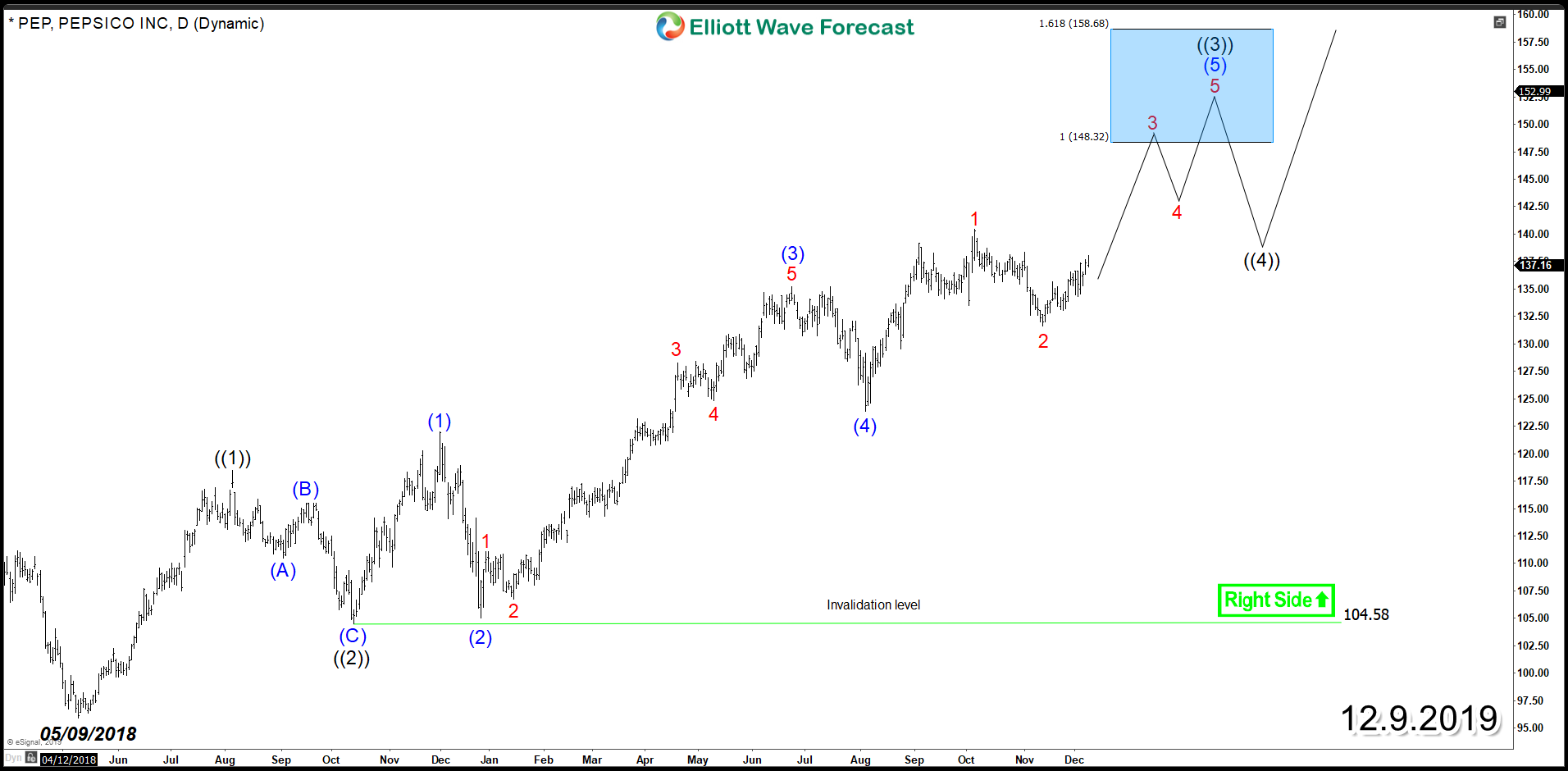

PepsiCo (NASDAQ: PEP) Impulsive Rally Still in Progress

Read MorePepsiCo (NASDAQ: PEP) is an American multinational food, snack, and beverage corporation offering food (brands include Frito-Lay and Quaker) and drinks, including Pepsi, Tropicana, and Gatorade. PEP rally since May 2018 is unfolding as an impulsive Elliott Wave structure which currently can still see further upside within an extended wave (5) of of wave ((3)) and reach equal legs area […]

-

Elliott Wave View: Copper Rallying as an Impulse

Read MoreShort-term Elliott Wave view in Copper (HG_F) suggests that the metal is rallying as a 5 waves Elliott wave impulsive structure from November 15, 2019 low. Up from there, wave ((i)) ended at 2.69, and wave ((ii) pullback ended at 2.619. Subdivision of wave ((ii)) unfolded as a double zigzag. Wave (w) of ((ii)) ended at 2.653, […]

-

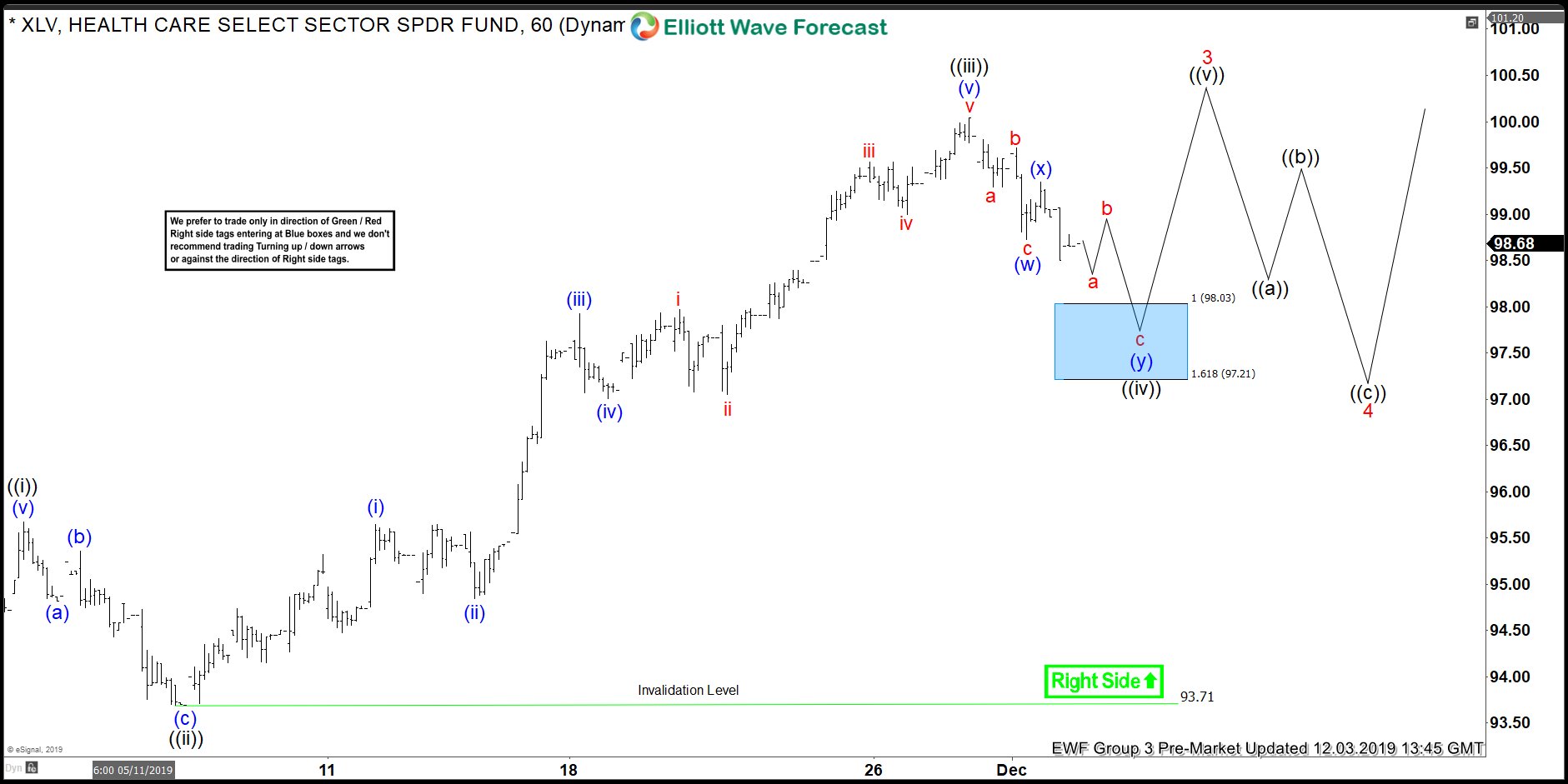

XLV Buying The Short-term Pullbacks At Blue Box Areas

Read MoreIn this blog, we take a look at the past performance of 1 hour Elliott Wave charts of XLV. In which our members took advantage of the blue box areas.