The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: Further Upside Expected in Amazon

Read MoreAmazon (ticker symbol: AMZN) broke above July 11, 2019 high (2035.8) a few weeks ago after reporting strong earnings. The stock now shows an incomplete bullish sequence from December 24, 2018 low favoring further upside. In the short term chart below, the rally to 2133.74 ended wave (1) and the pullback to 1998.29 ended wave […]

-

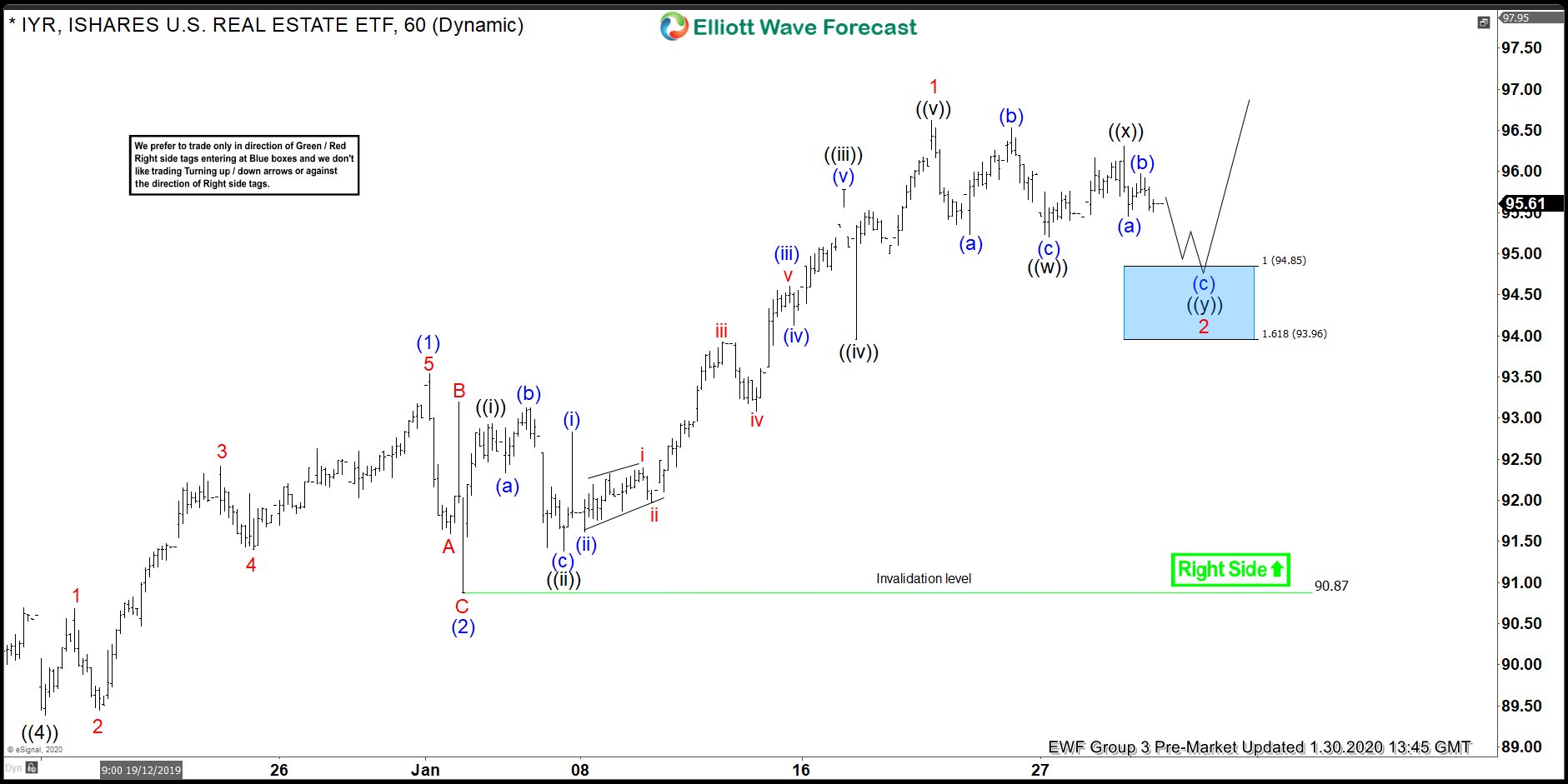

IYR Forecasting The Rally & Buying The Dips At The Blue Box

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of IYR published in members area of the Elliottwave-Forecast . As our members know, IYR is showing incomplete bullish sequences within higher time frames cycle. Break of 10/22 peak made ETF bullish against the 89.39 low […]

-

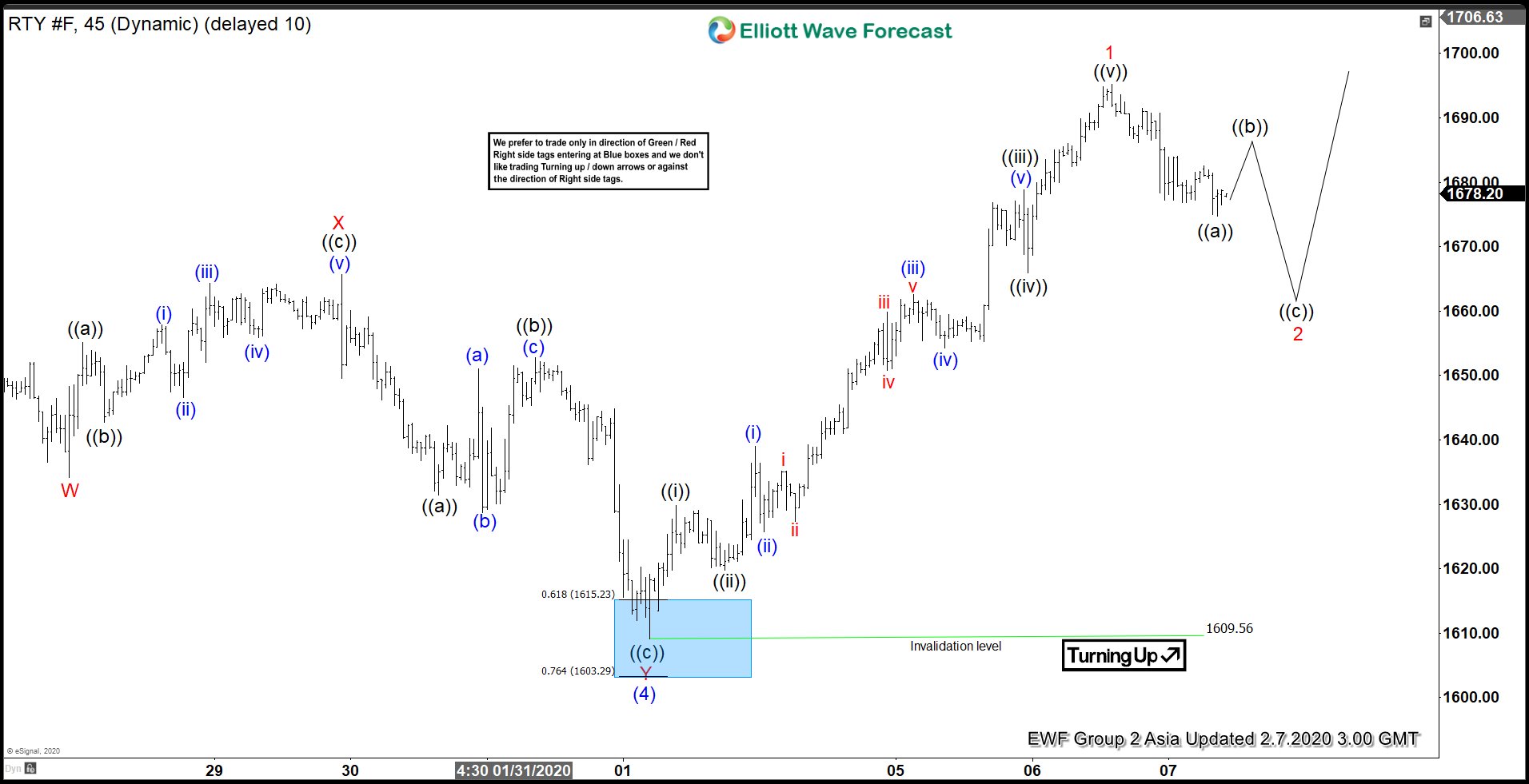

Elliott Wave View: Pullback in Russell Should See Support

Read MoreRussell 2000 rally from Feb 1 low is impulsive and should see further upside while pullback stays above there. This article looks at the Elliottwave path.

-

AUDJPY Forecasting The Bounce From The Blue Box Area

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of AUDJPY. The rally from August 26, 2019 unfolded as 5 waves impulsive move up in wave (A) as a leading diagonal. Based on Elliottwave theory, the impulsive move up will be followed by 3 waves correction before extending higher. Therefore, […]