The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

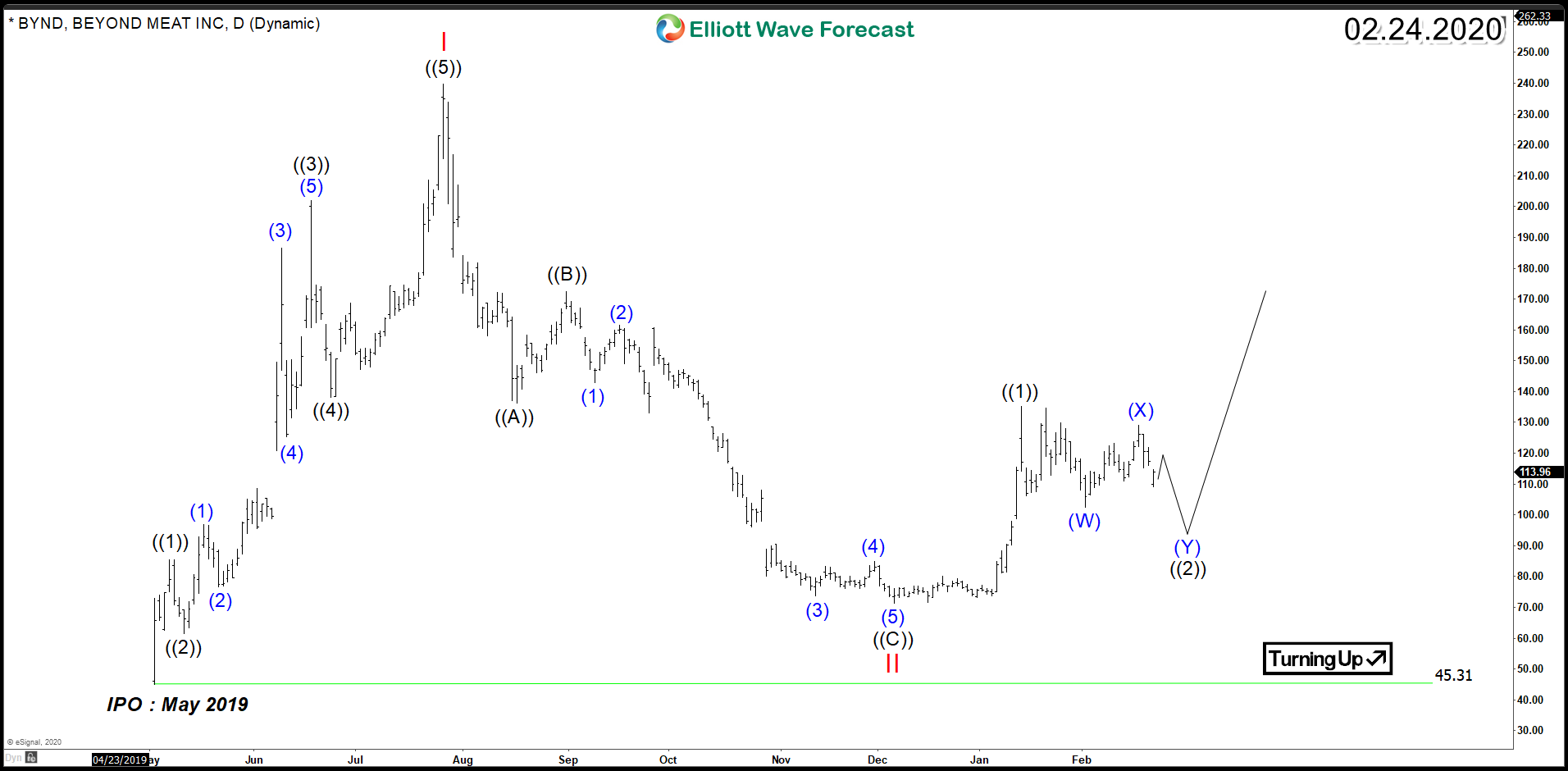

Beyond Meat Inc (NASDAQ: BYND) – Starting an Impulsive Cycle

Read MoreBeyond Meat Inc (NASDAQ: BYND) is a producer of plant-based meat substitutes including products designed to simulate chicken, beef, and pork sausage. After IPO, BYND surged 250% for 3 months then it came down erasing all gains and settling around 15% on December 2019. Last month, the stock soared 46% looking to start a new cycle similar to last year. So let’s […]

-

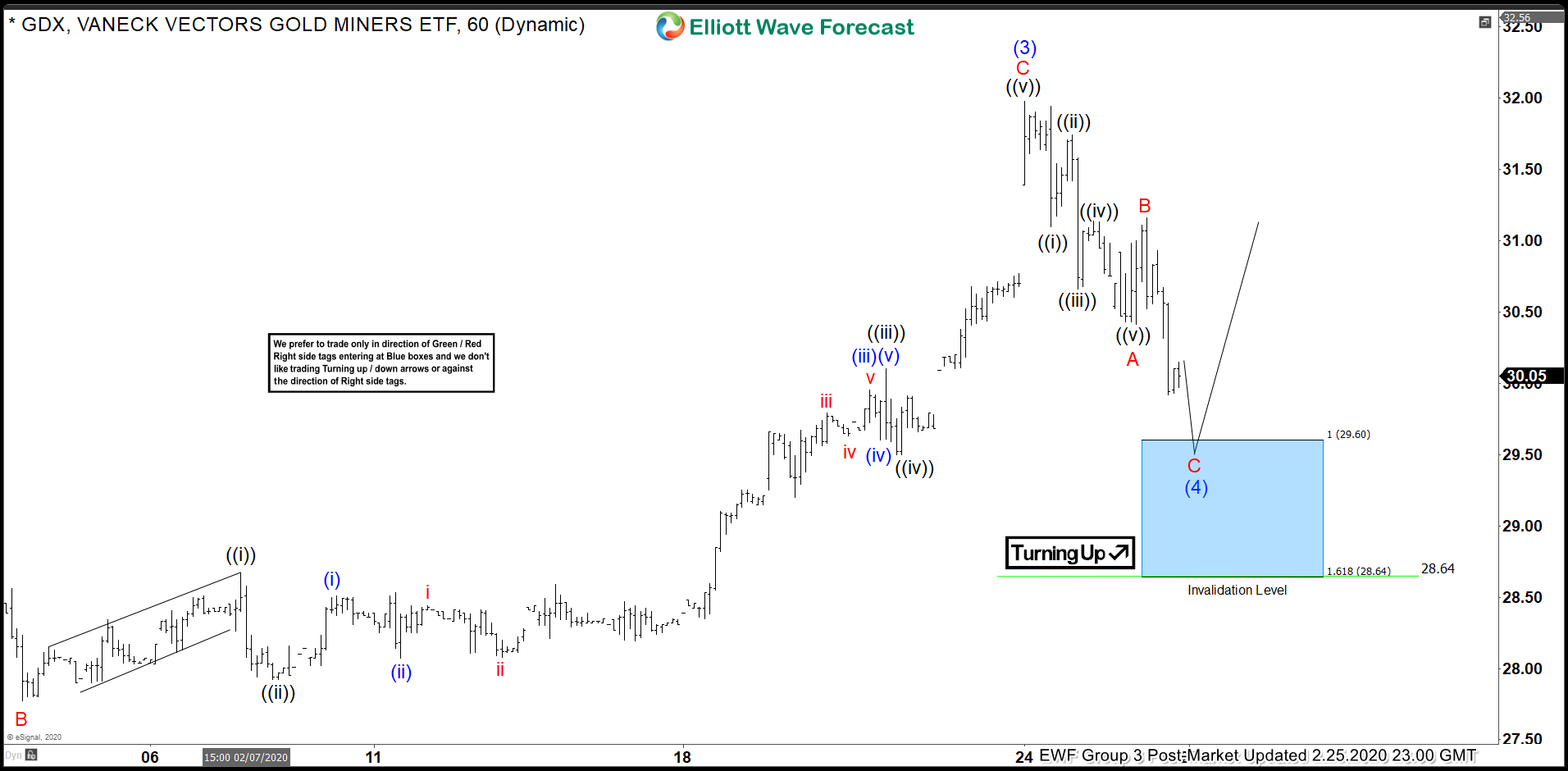

Elliott Wave View : GDX Looking to Extend Higher

Read MoreGDX rally from Nov 2019 low is unfolding as 5 waves and the ETF still can see 1 more push higher at least.This article looks at the Elliott Wave path.

-

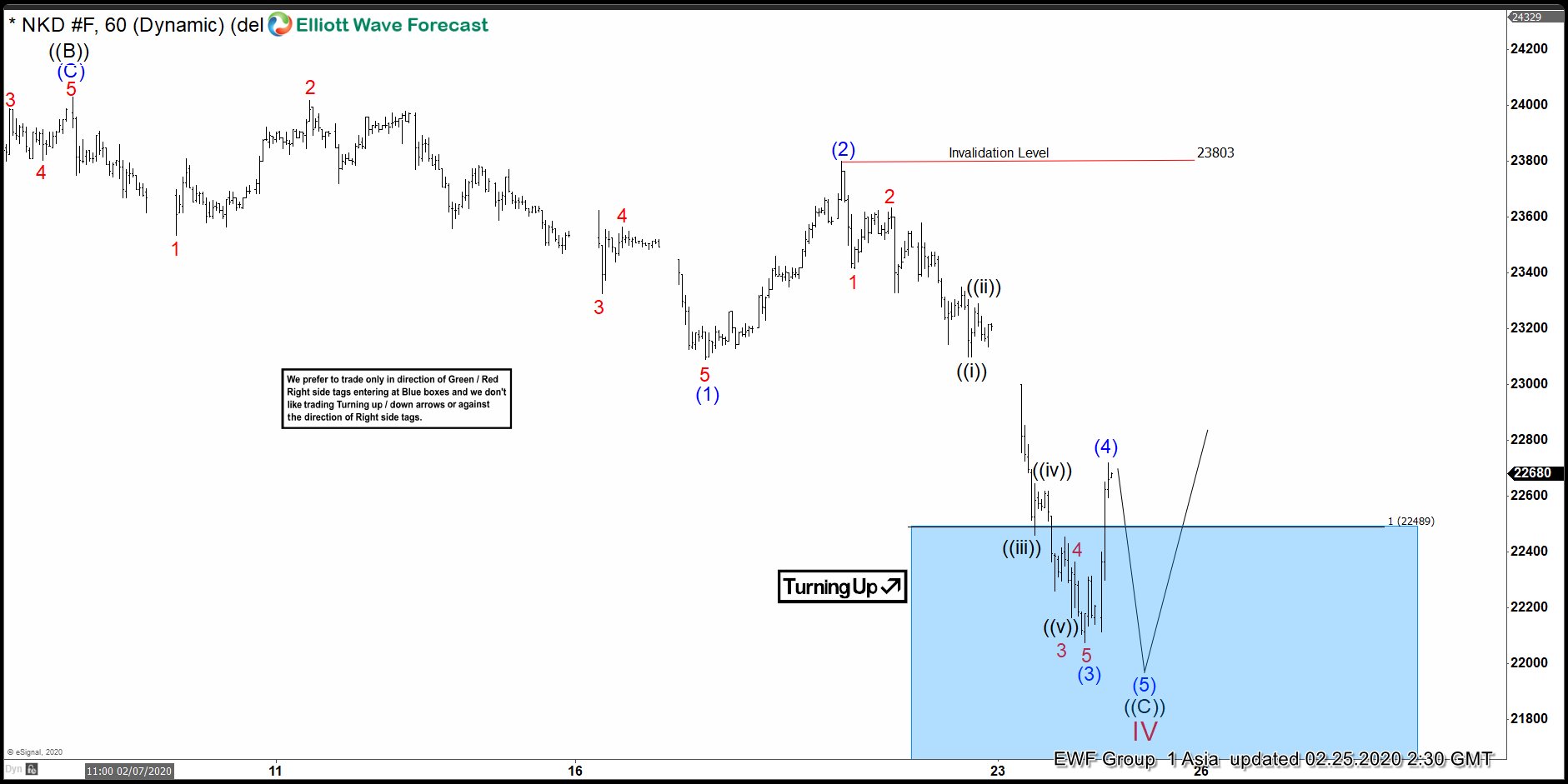

Elliott Wave View: Nikkei (NKD_F) Reaching Support Area

Read MoreNikkei has reached 100% extreme area from December 2019 high and may see support and larger bounce soon.This article looks at the Elliott Wave path.

-

GBPUSD Incomplete Bearish Sequences Calling The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPUSD, published in members area of the website. As our members know GBPUSD has incomplete bearish sequences in the cycle from the 12/13 peak. The pair is targeting 1.2668 area ideally . Consequently, we advised […]