The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

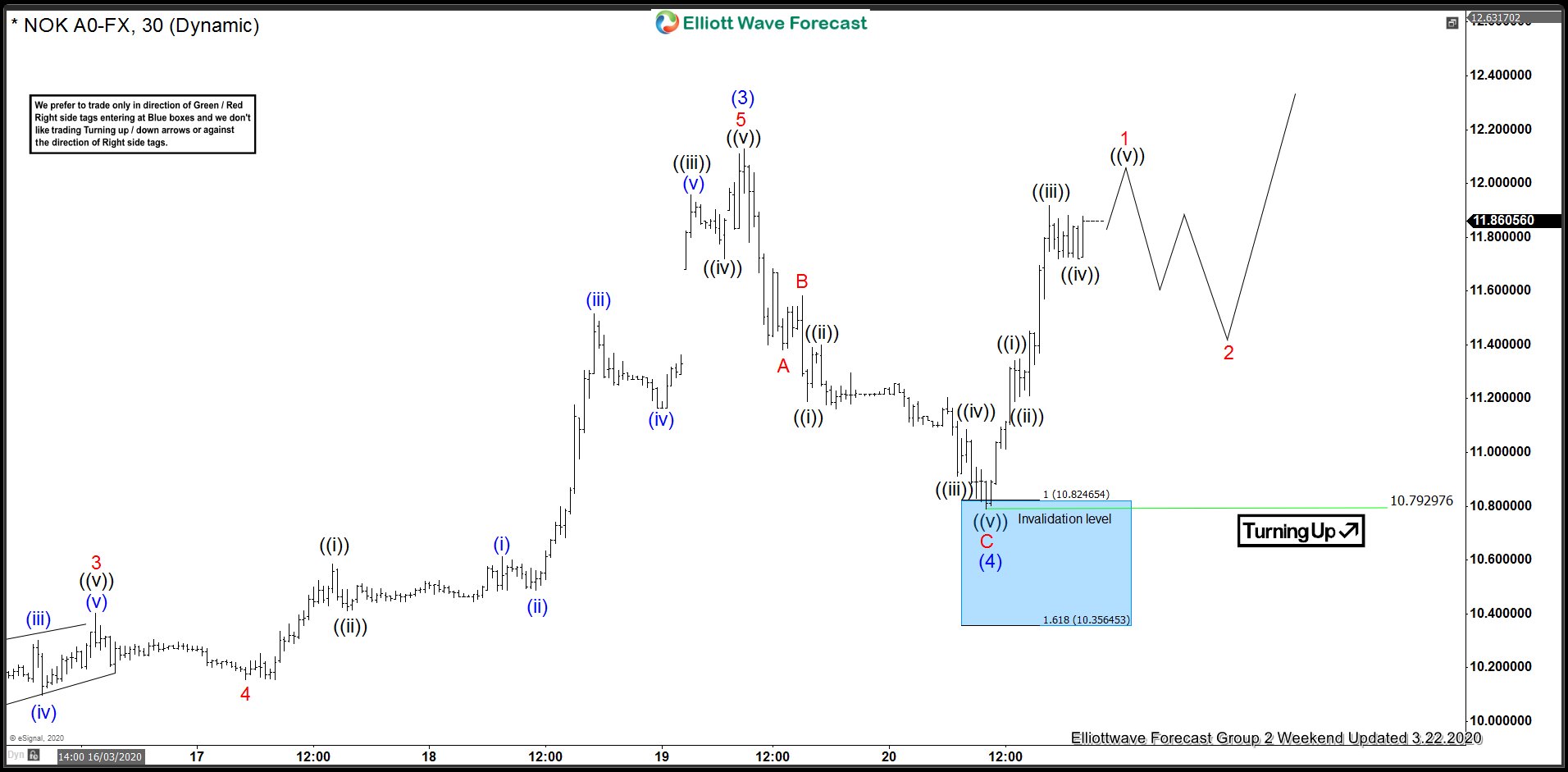

USDNOK Buyers Continue To Respect Blue Boxes

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of USDNOK. The chart from March 13 London update shows that the cycle from March 9, 2020 low unfolded as 5 waves impulsive structure. The rally in wave ((iii)) ended at 10.2785 high. Based on Elliottwave theory, a 3 waves pullback […]

-

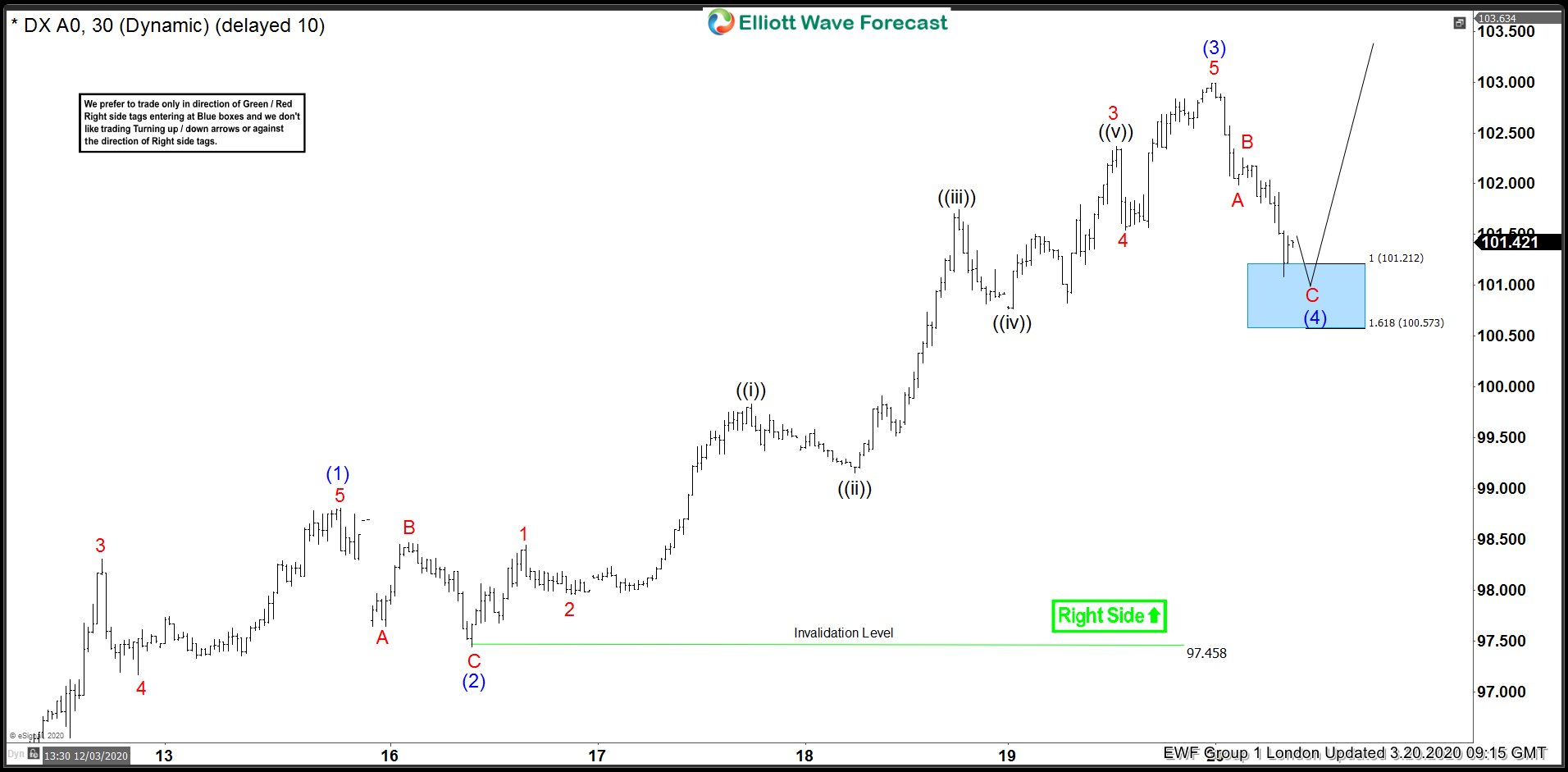

$USDX Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. USDX is another instrument that we have been trading lately . In this technical blog we’re going to take a quick look at the Elliott Wave charts of USDX, published in members area of the website. As our members know, USDX is showing bullish impulsive sequences in the cycle from the February […]

-

US Dollar Continues to Firm As Supply Tightens

Read MoreU.S Dollar demand is so high as a result of the corona virus pandemic that now there’s a squeeze in the credit market. The dollar soared this week as investors liquidated positions across a broad range of assets, including stocks, gold, and bonds, to meet margin calls and raise cash. . Big corporations around the […]

-

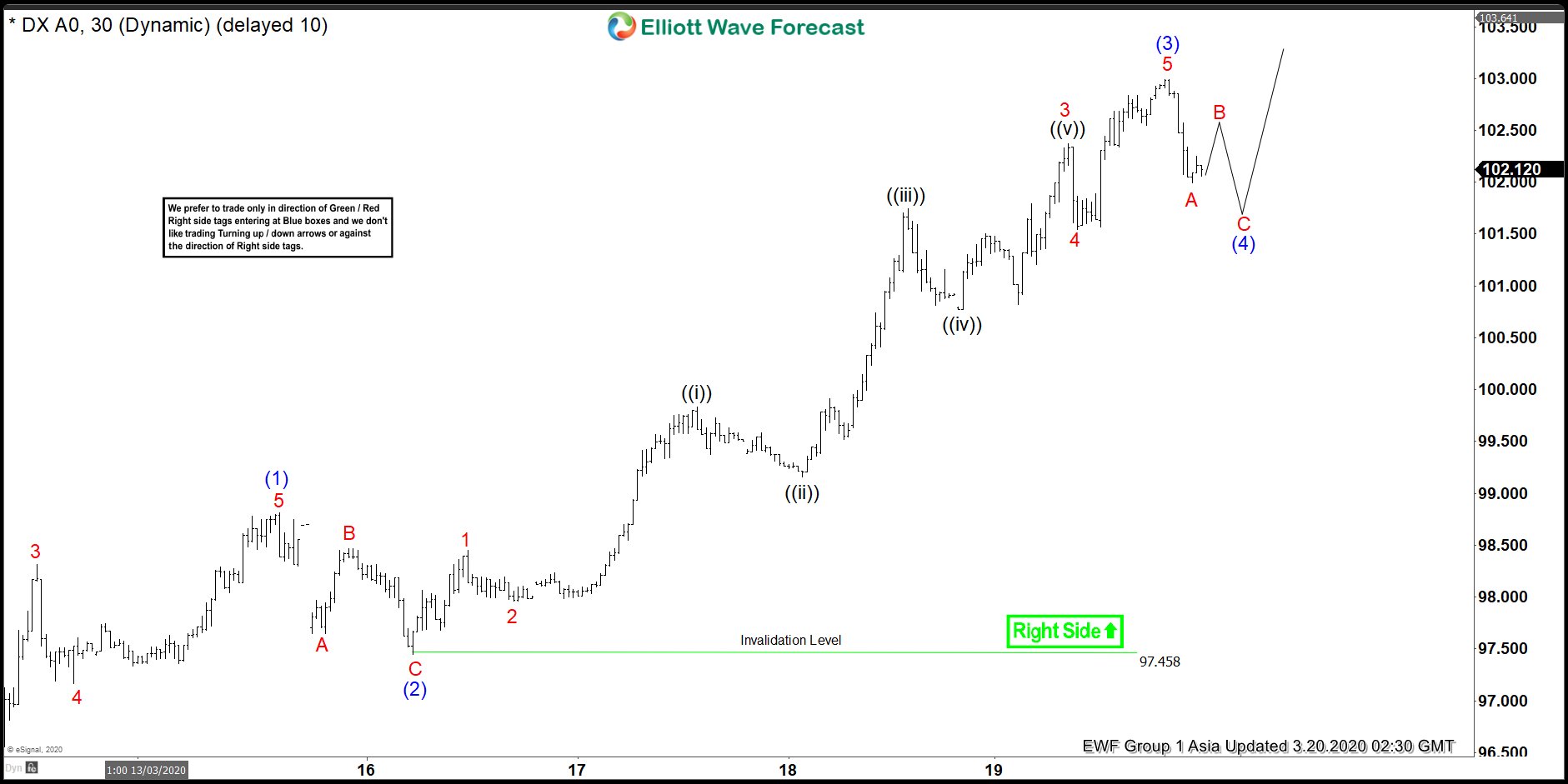

DXY Elliott Wave View: Pullback An Opportunity For Bulls

Read MoreDXY cycle from March 09, 2020 low is showing an impulse rally favoring more upside. This article & video looks at the Elliott Wave path.