The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

CADJPY May See More Downside After BOC Cut Rates

Read MoreOn Friday, Bank of Canada (BOC) made another rate cut for the third time this month. The central bank lowered the interest rate by 50 basis points to 0.25%. This unscheduled rate cut is intended to provide support to the financial system and the economy during the COVID-19 pandemic. Prior to the cut, Canada has […]

-

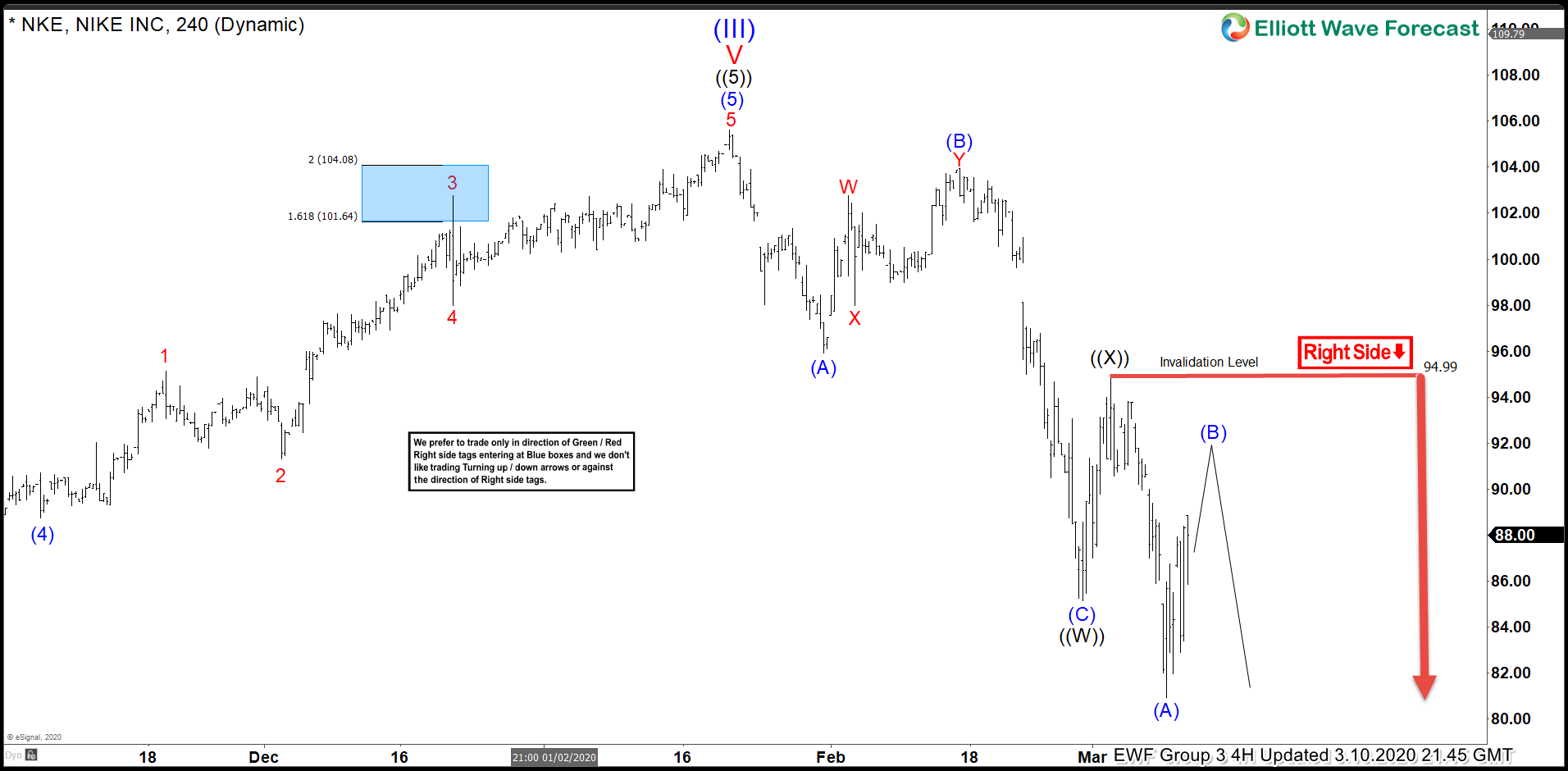

NIKE ( $NKE ) Forecasting The Decline & Selling The Rallies

Read MoreHello fellow traders. Another instrument that we have been trading lately is NIKE stock. In this technical blog we’re going to take a quick look at the Elliott Wave charts of NIKE, published in members area of the website. As our members know, NIKE had incomplete bearish sequences in the cycle from the 01/21 peak, […]

-

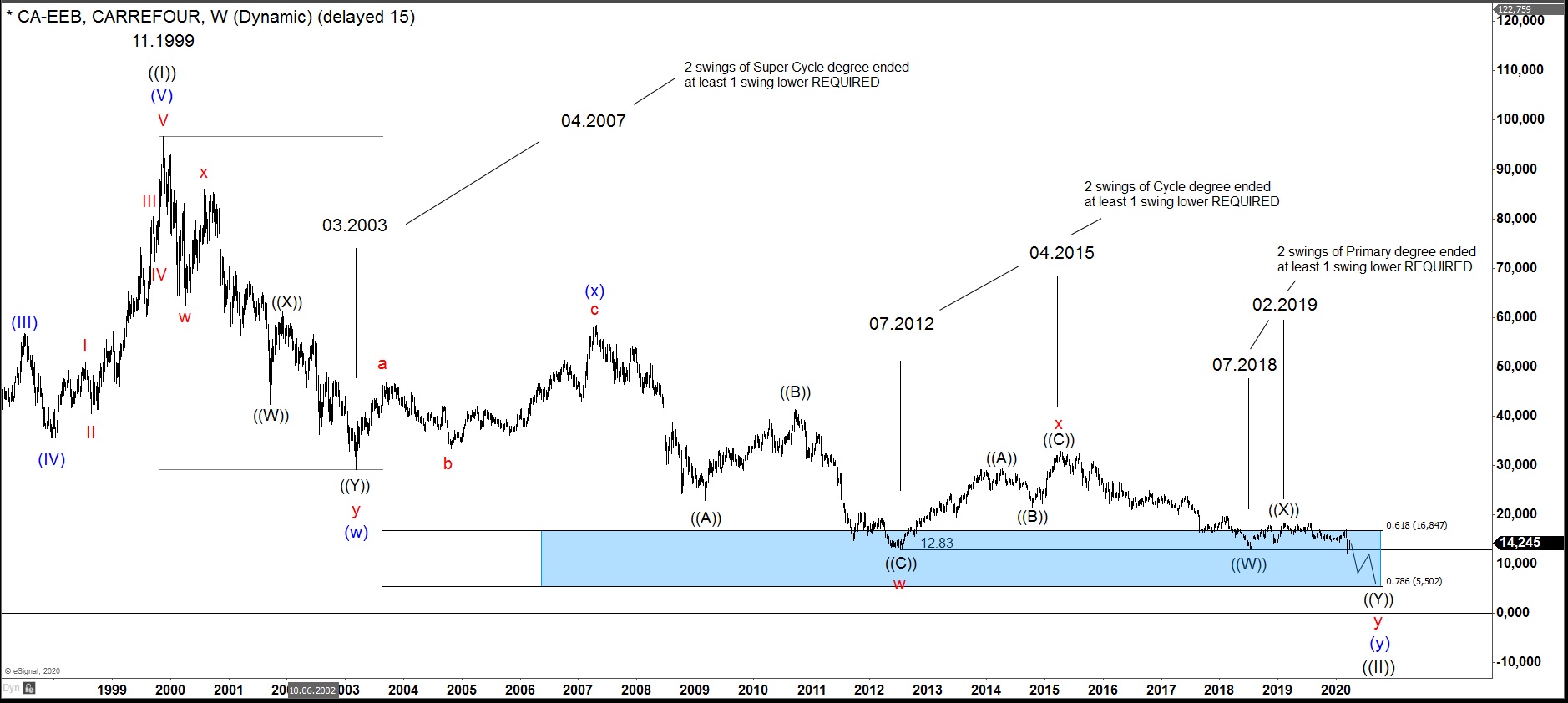

$CA : Carrefour stock struggling with lack of space

Read MoreThe weekly technical structure of the Carrefour stock price is a good example of a market correction struggling with the lack of space. Hereby, we observe a situation where the price extends lower in a Elliott Wave double three pattern of multiple cycle degrees. However, the view of the bottom line forces the stock price into […]

-

EURGBP Elliott Wave: Pair May Find Buyers Soon

Read MoreBank of England (BOE) decided to leave interest rate unchanged at a record low of 0.1% last week. This allows EURGBP to correct from seven month highs. After reaching the high at 0.95, EURGBP pulled back to 0.89 after BOE injected liquidity into the market The BOE has already cut the interest rate by 65 […]