The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$USO United States Oil Fund Elliott Wave & Longer Term Cycles

Read More$USO United States Oil Fund Elliott Wave & Longer Term Cycles Firstly the USO instrument inception date was 4/10/2006. CL_F Crude Oil put in an all time high at 147.27 in July 2008. USO put in an all time high at 119.17 in July 2008 noted on the monthly chart. The decline from there into the […]

-

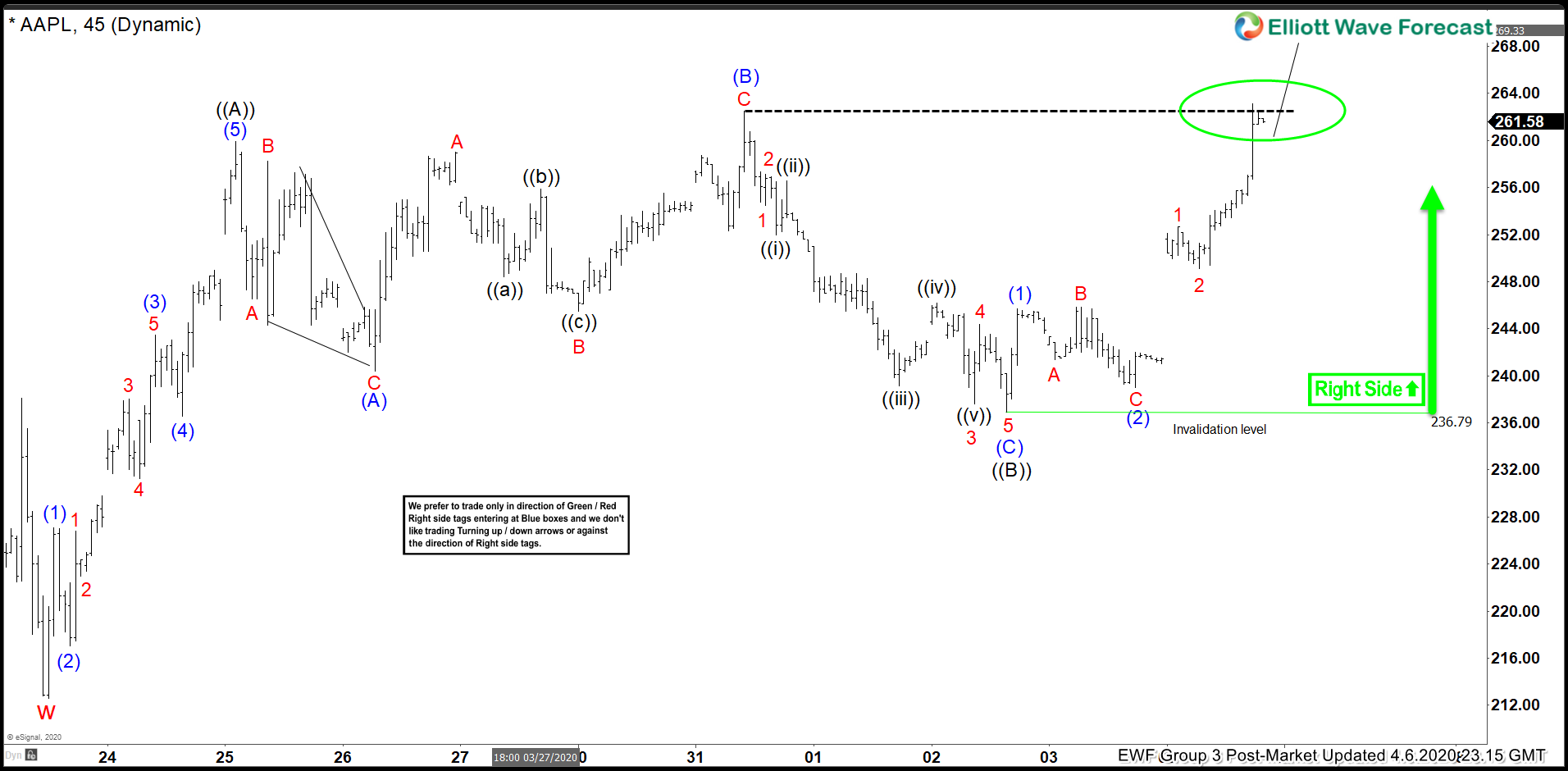

Apple ( $AAPL) Elliott Wave: Forecasting The Path

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of Apple stock, published in members area of the website. As our members know, Apple has been showing incomplete Higher- High Sequences in the cycle from the March 23rd low, calling for further rally. Consequently we […]

-

EURJPY: Rejection in Blue Box Starts Next Leg Lower

Read MoreEURJPY has been under pressure since forming a lower high 121.15 on 25th March. It is yet to break below 10th March low but the bounces look corrective which increase the likelihood of a break lower. Moreover, other Yen pairs like CADJPY and SEKJPY are showing incomplete bearish sequence which also supports the idea of […]

-

Nvidia (NASDAQ: NVDA) Aiming for All-Time High

Read MoreNvidia (NASDAQ: NVDA) is up 25% Year-To-Date outperforming the Semiconductor Sector which is currently down 9%. Despite, the sell off that took place last month around the entire stock market, NVDA along few other stocks managed to sustain its main bullish trend because it was trading within a powerful wave ((III)) as mentioned in our previous […]