The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

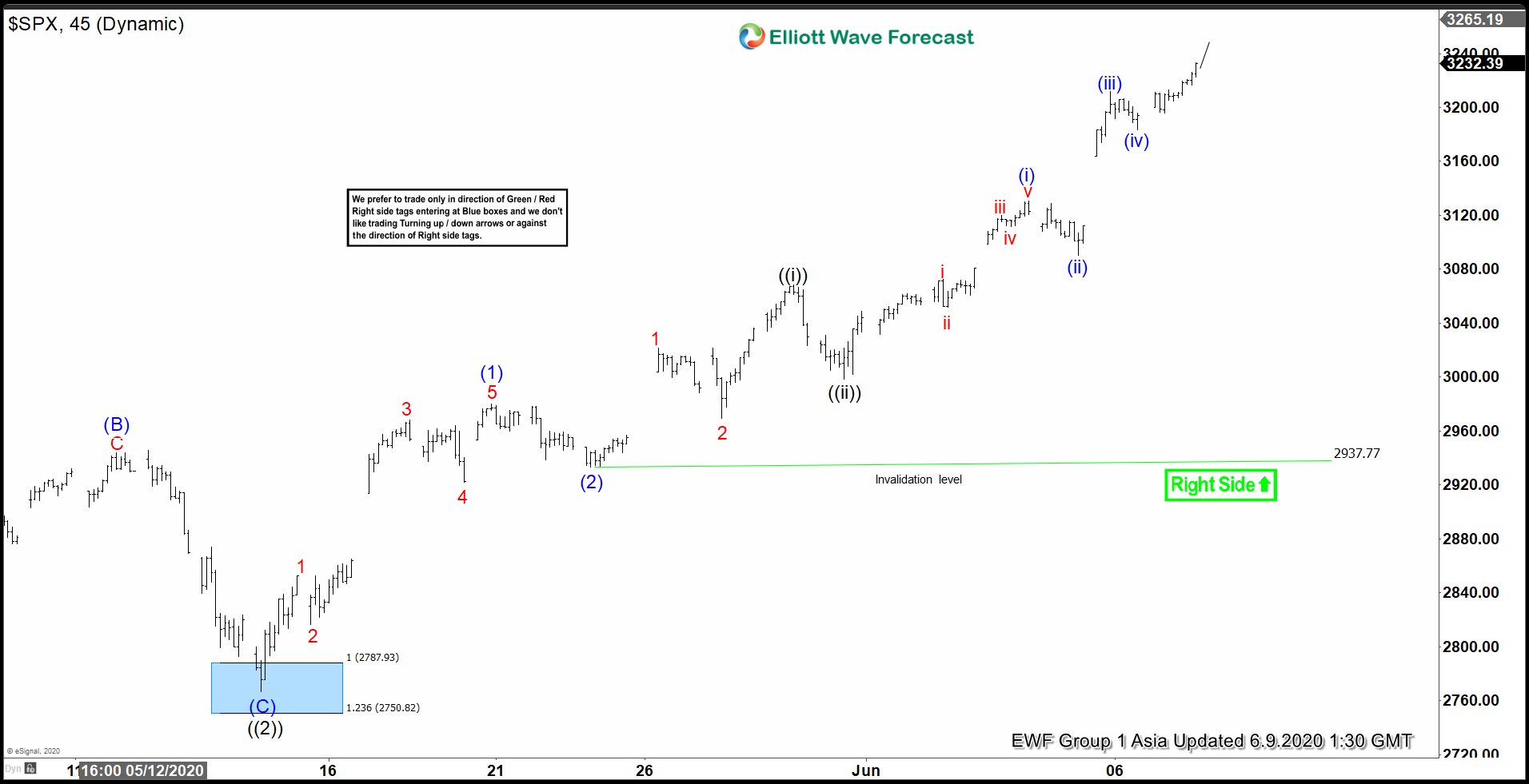

Elliott Wave View: SPX Should Extend Higher

Read MoreCycle from March 23, 2020 low remains in progress in $SPX & the Index should see further strength. This article and video look at the Elliott wave path.

-

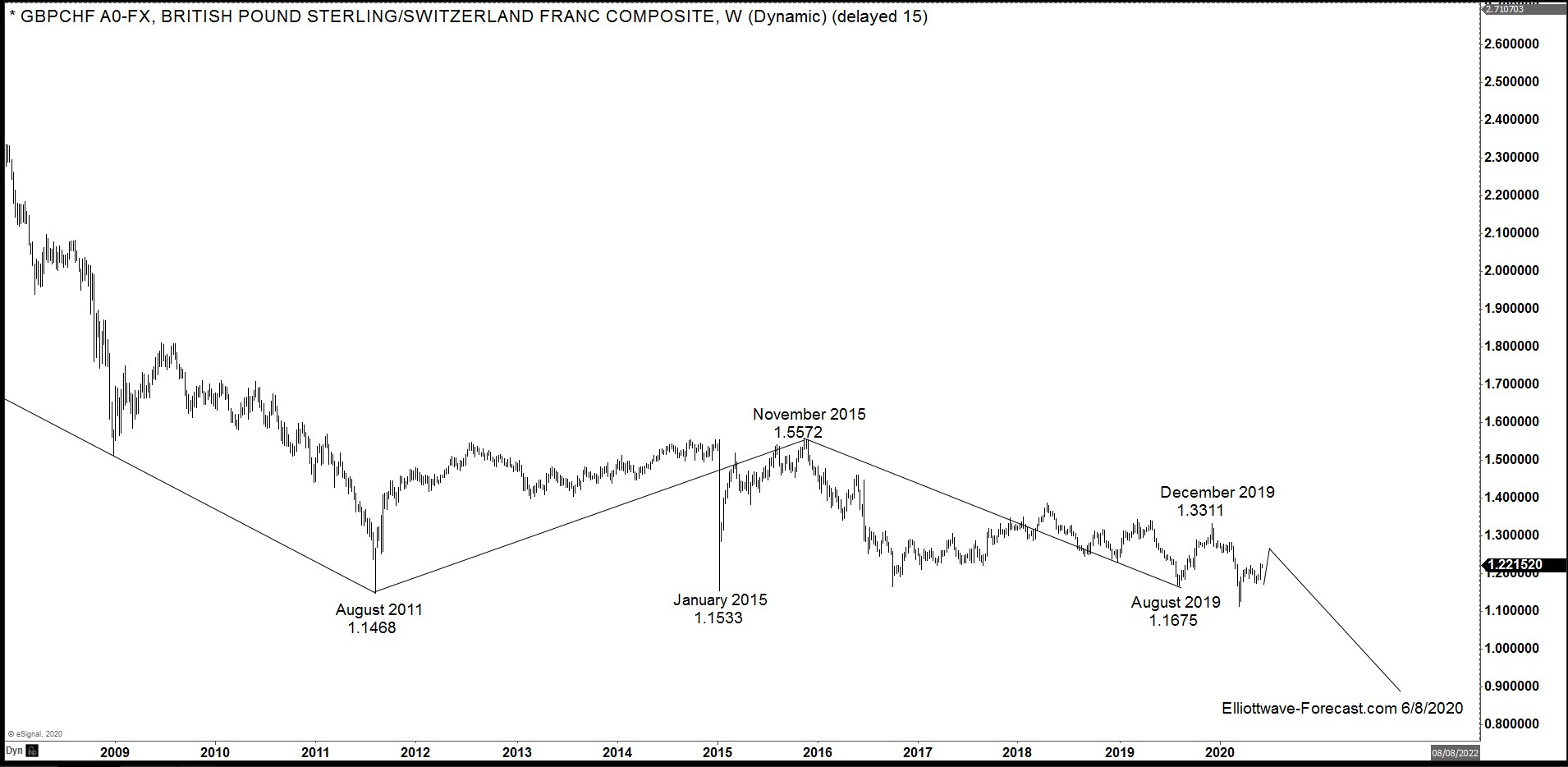

$GBPCHF FX Pair Swings & Long Term Cycles

Read More$GBPCHF FX Pair Swings & Long Term Cycles Firstly as seen on the monthly chart below there is data back to the early 1970’s readily available in the pair. It obviously had a central bank intervention during the month of October 1974 where price topped out at 6.3387. Most all Elliott Wave practitioners are geared […]

-

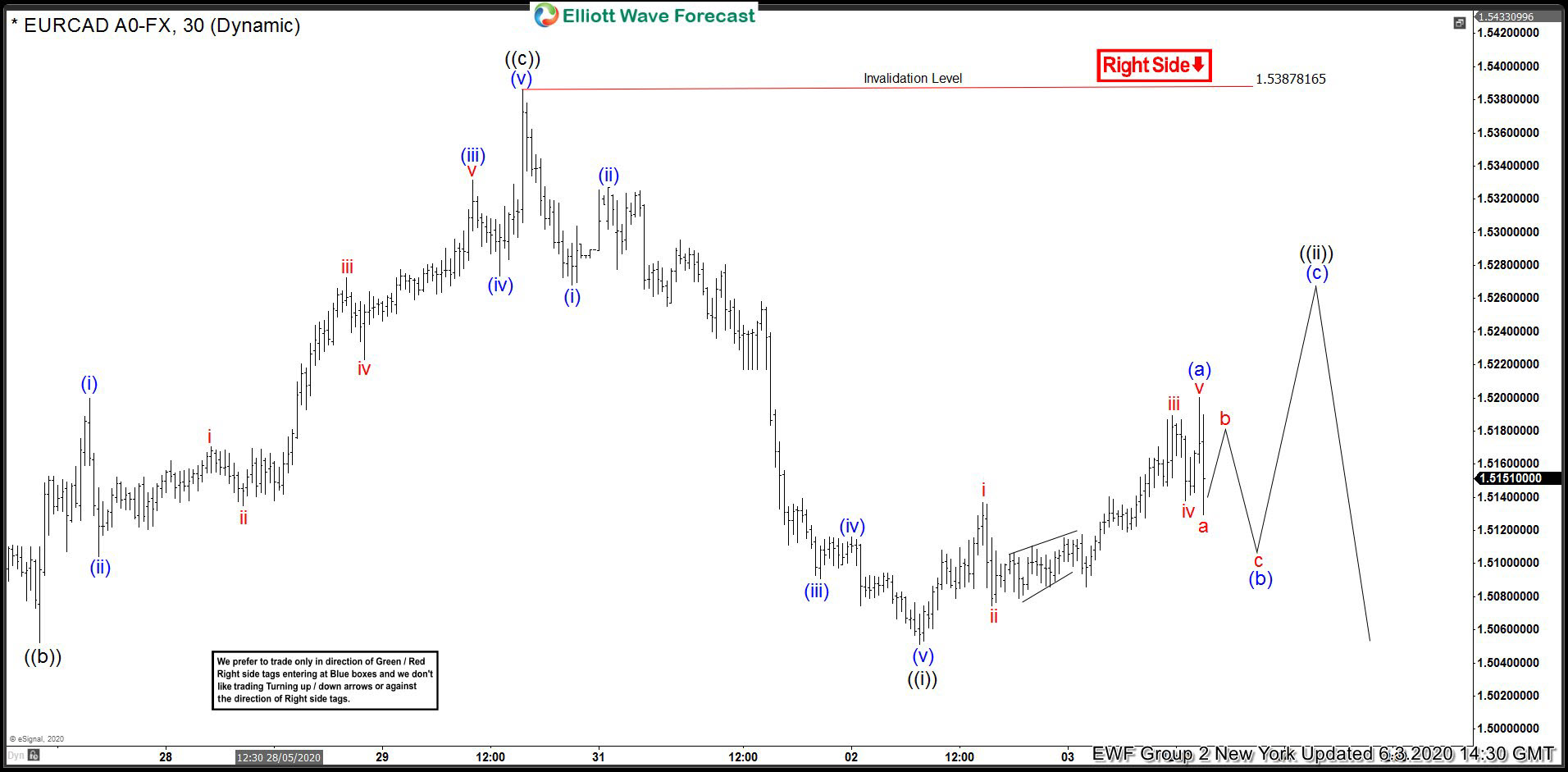

EURCAD Forecasting The Decline After Elliott Wave Zig Zag

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of EURCAD. As our members know, recently the pair gave us 3 waves bounce against the 1.53878 peak. Recovery unfolded as Elliott Wave Zig Zag pattern (a)(b)(c). Once the price reached equal legs (a)-(b) we knew […]

-

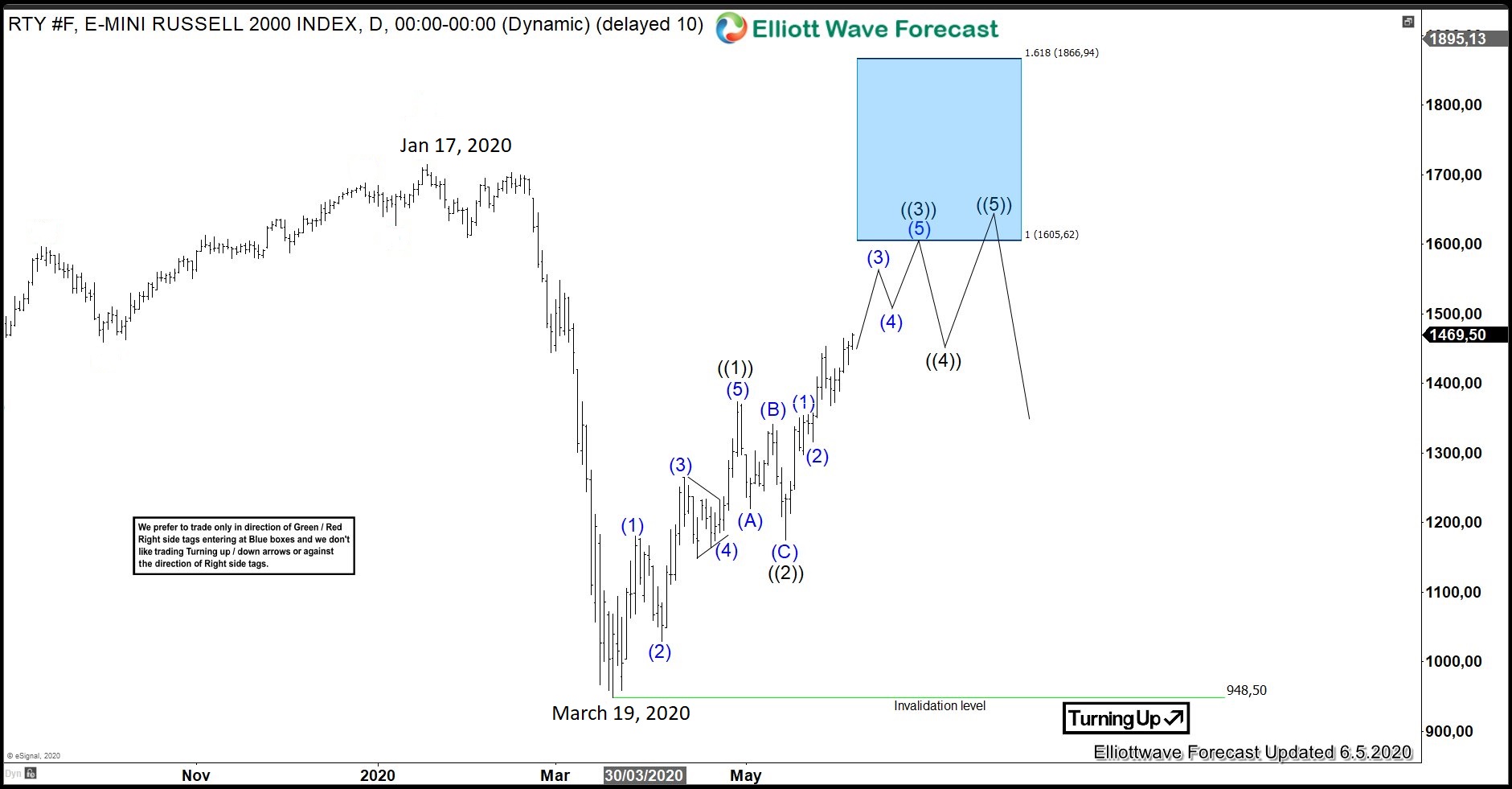

More Upside For RTY_F (Russell 2000) In The Near Term

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of RTY_F. Daily chart below shows that RTY_F ended the decline from January 17, 2020 high at 948.50 low. Since reaching that March 19 low, the index has continued to extend higher. From 948 low, the index extended higher in wave […]