The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Amazon Reacting Higher From Elliott Wave Blue Box Area

Read MoreIn this blog, we take a look at the past performance of 4 hour Elliott Wave charts of Amazon, In which our members took advantage of the blue box areas.

-

Elliott Wave View: Further Downside to End Gold Correction

Read MoreGold still has scope to extend lower to reach the extreme area from August 7 high before buyers appear. This article and video look at the Elliottwave path.

-

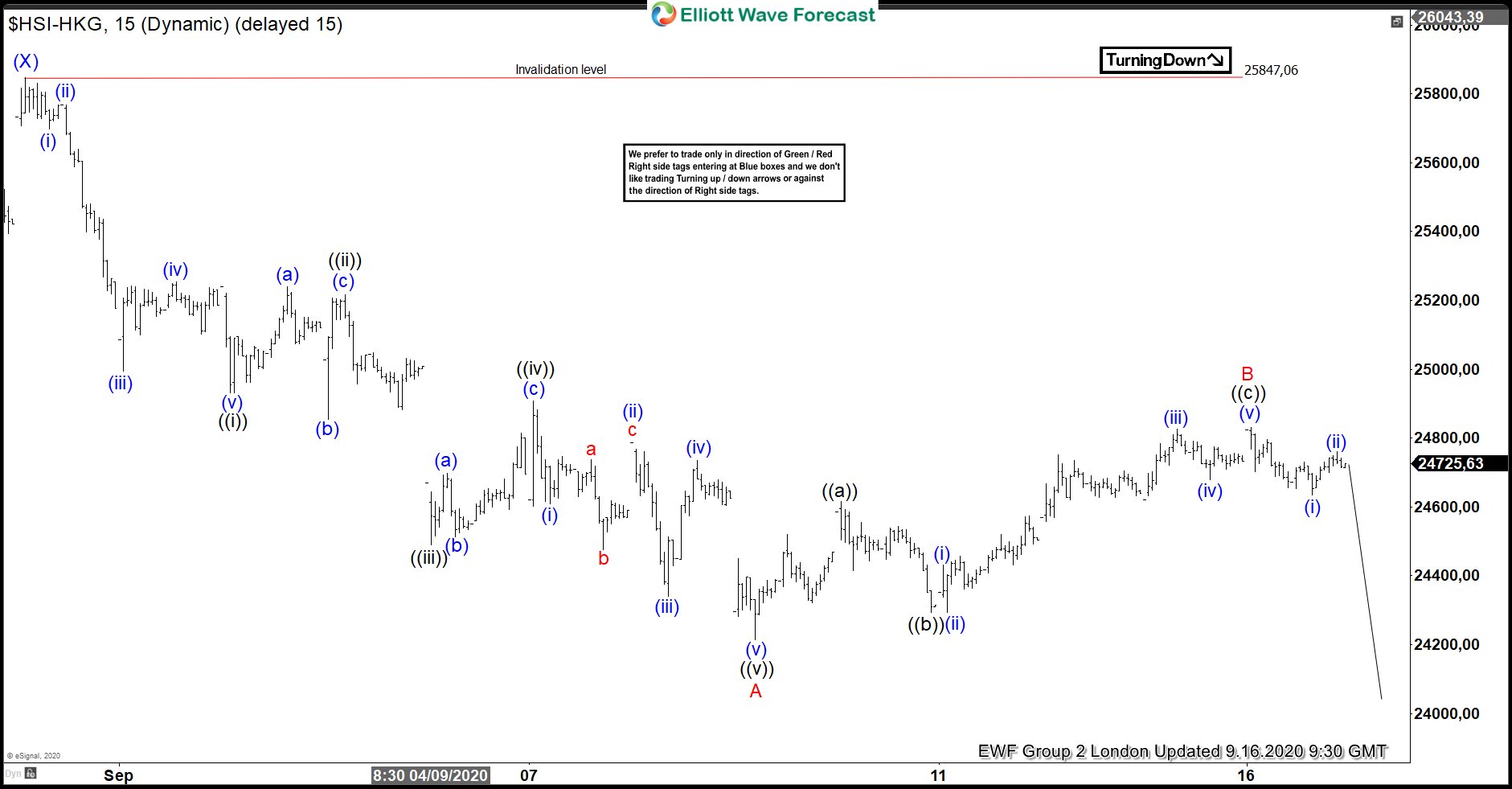

Hang Seng ( $HSI_HKG ) Forecasting The Decline

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the charts of Hang Seng published in members area of the website. As our members know, Hang Seng has given us a decent pull back recently. We got decline within the cycle from the July 6th peak ,when the price […]

-

Wheat Continued Rally Higher After Zigzag Correction

Read MoreIn this blog, we are going to take a look at the Elliott Wave chart of Wheat Futures (ZW_F). The 4 hour chart update from September 9 shows that wheat has ended the cycle from August 12 low as wave 3 at 568.4 high. A 3 waves pullback in wave 4 is expected to unfold […]