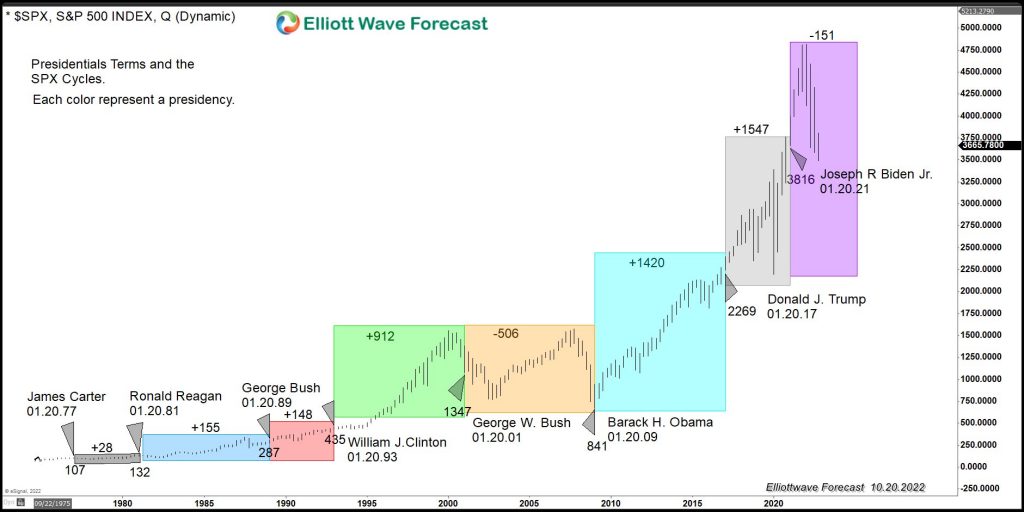

A lot has been said and written about both the Democrat and Republican economic plans for a better economy. We believe in free enterprise and limited regulation, allowing humans to create and expand at their own will for the better but there is a vast difference between the two parties regarding the economic agenda. Most […]

-

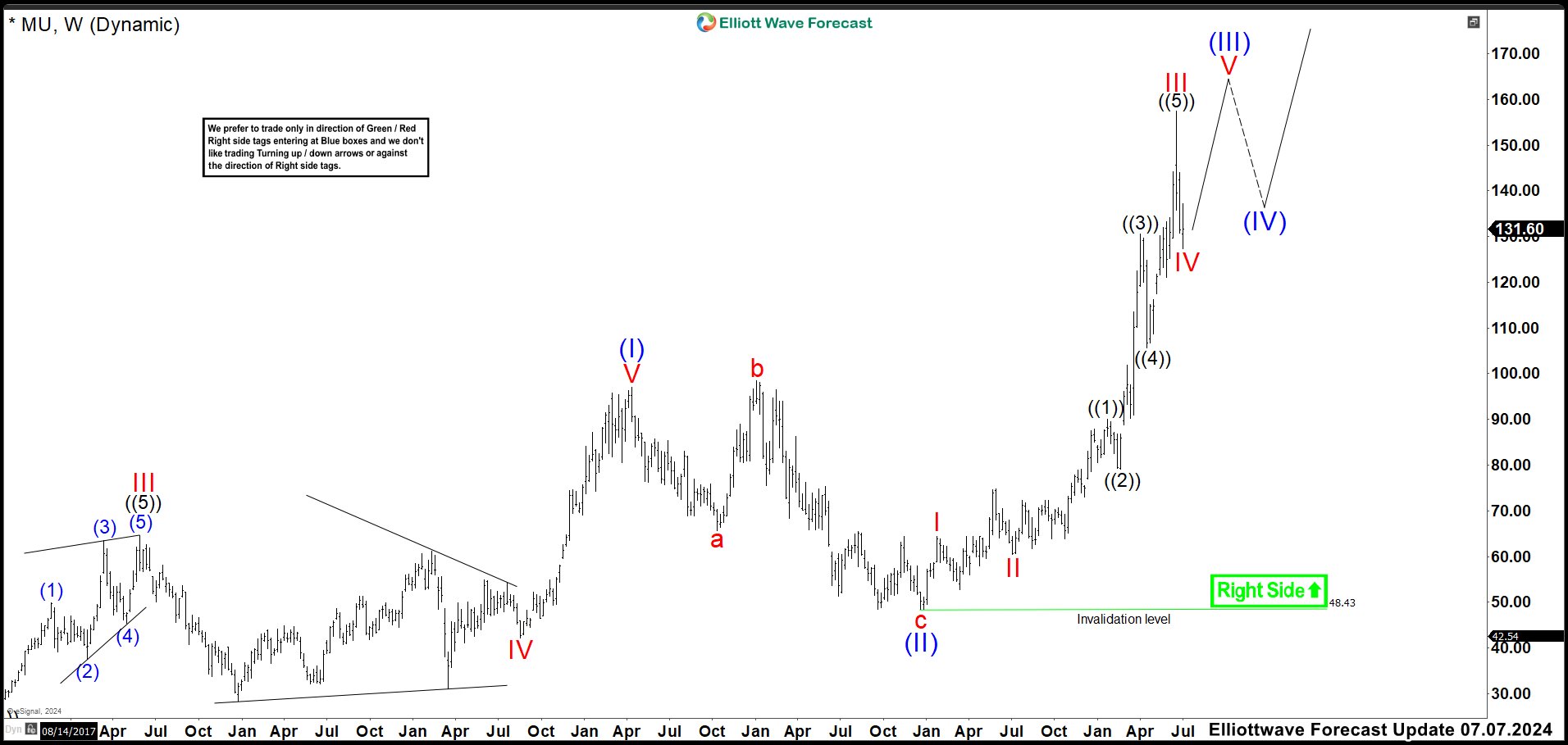

Micron Technology Inc (MU) Rallied as Expected Making More than 200%

Read MoreMicron Technology, Inc. (MU) designs, develops, manufactures, and sells memory and storage products worldwide. The company operates through four segments: Compute and Networking Business Unit, Mobile Business Unit, Embedded Business Unit, and Storage Business Unit. Micron Technology, Inc. was founded in 1978 and is headquartered in Boise, Idaho. MU Weekly Chart March 2023 The last time […]

-

DAX Elliott Wave: Buying the Dips at the Blue Box Area

Read MoreHello fellow traders. In this article we’re going to take a quick look at the Elliott Wave charts of DAX published in members area of the website. As our members know DAX is showing impulsive bullish sequences and we are keep favoring the long side. Recently we got a 3 waves pull back that has […]

-

S&P 500 (SPX) Bullish Elliott Wave Sequence Remains in Play

Read MoreSPX impulsive rally remains in progress and Index should see further upside. This article and video look at the Elliott Wave path.

-

VanEck Gold Miners ETF ( $GDX ) Perfect Reaction From The Blue Box Area.

Read MoreHello everyone! In today’s article, we will look at the past performance of the 4H Hour Elliott Wave chart of VanEck Gold Miners ETF ( $GDX ) . The rally from 2.28.2024 low at $25.64 unfolded as a 5 waves impulse. So, we expected the pullback to unfold in 3 swings and find buyers again. […]