The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

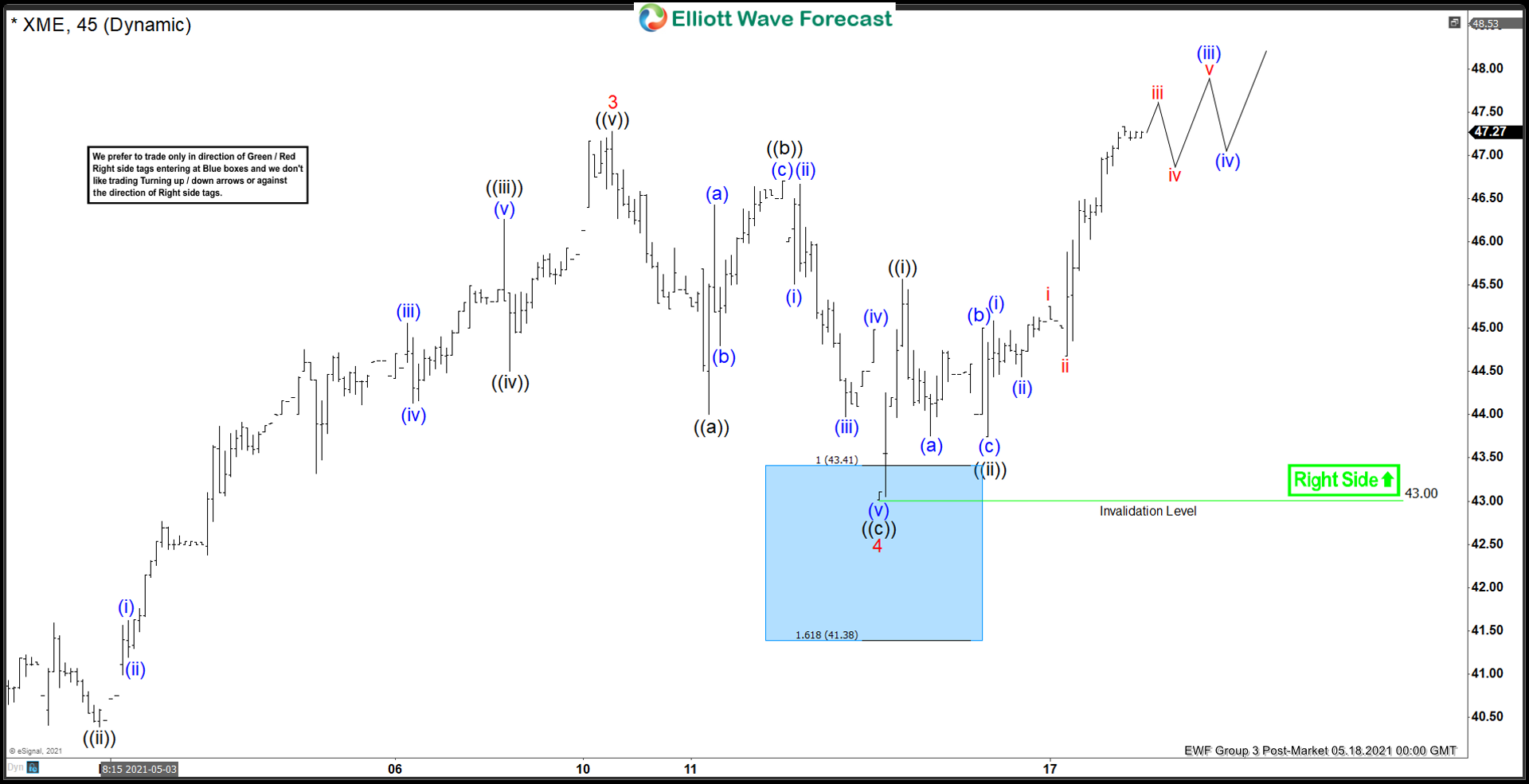

Elliott Wave View: XME Should See Further Upside

Read MoreXME (S&P Metals and Mining ETF) continues to extend higher and dips should be supported. This article and video look at the Elliott Wave path.

-

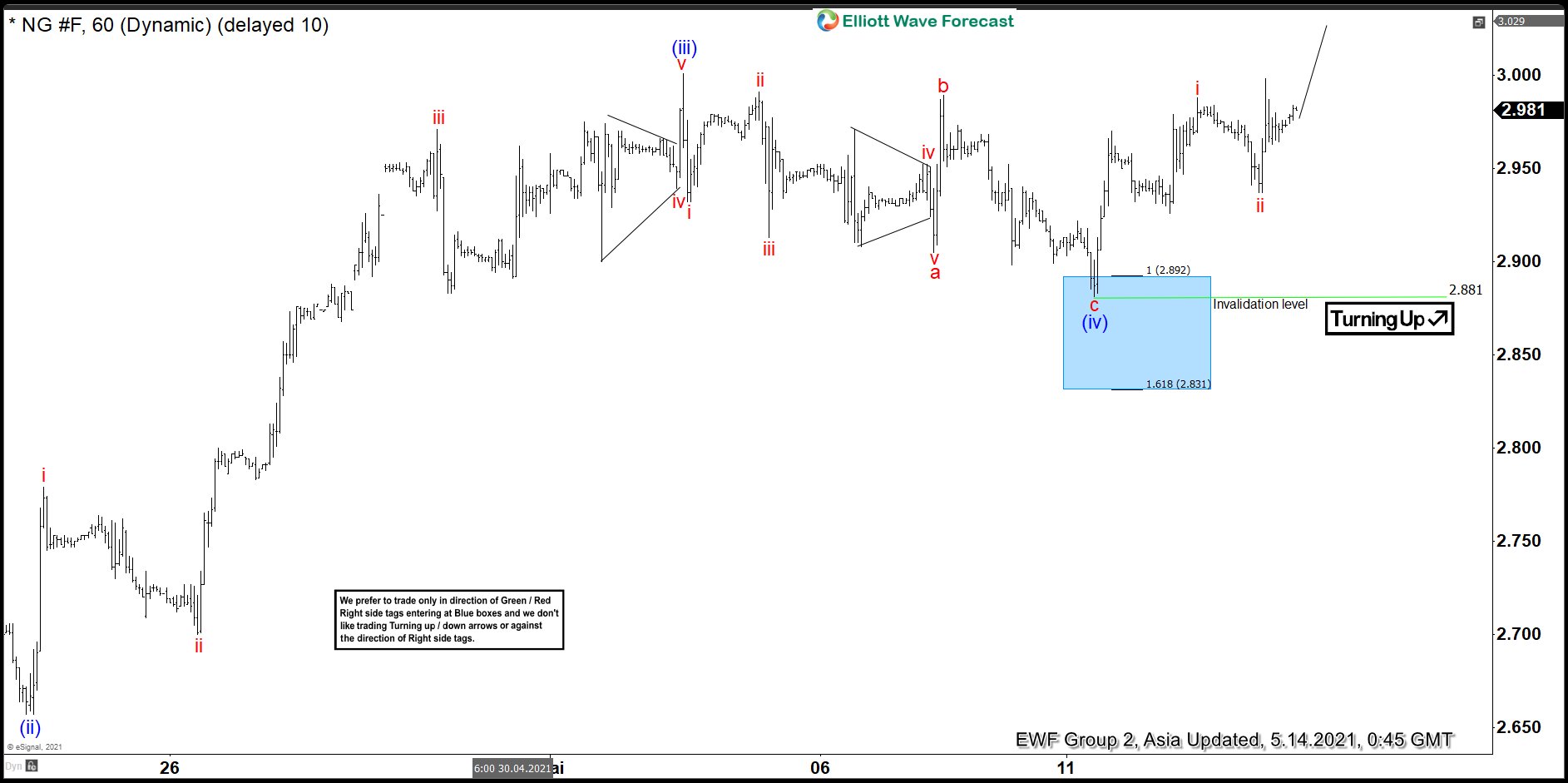

Natural Gas (NG) Reacts Higher From The Blue Box

Read MoreNatural Gas Resumed Higher After It found Buyers In The Blue Box In this blog, we take a look at the short term view on Natural Gas reaching the blue box and reacting higher after finding buyers. On the 1 hour chart from 5/11/2021, the commodity rallied in 5 impulse waves in the subminuette (red) degree. This […]

-

IBEX Elliott Wave : Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of IBEX index published in members area of the Elliottwave-Forecast . As our members know, IBEX is another index that has given us good trading opportunity recently. The index is showing impulsive sequences in the cycle from […]

-

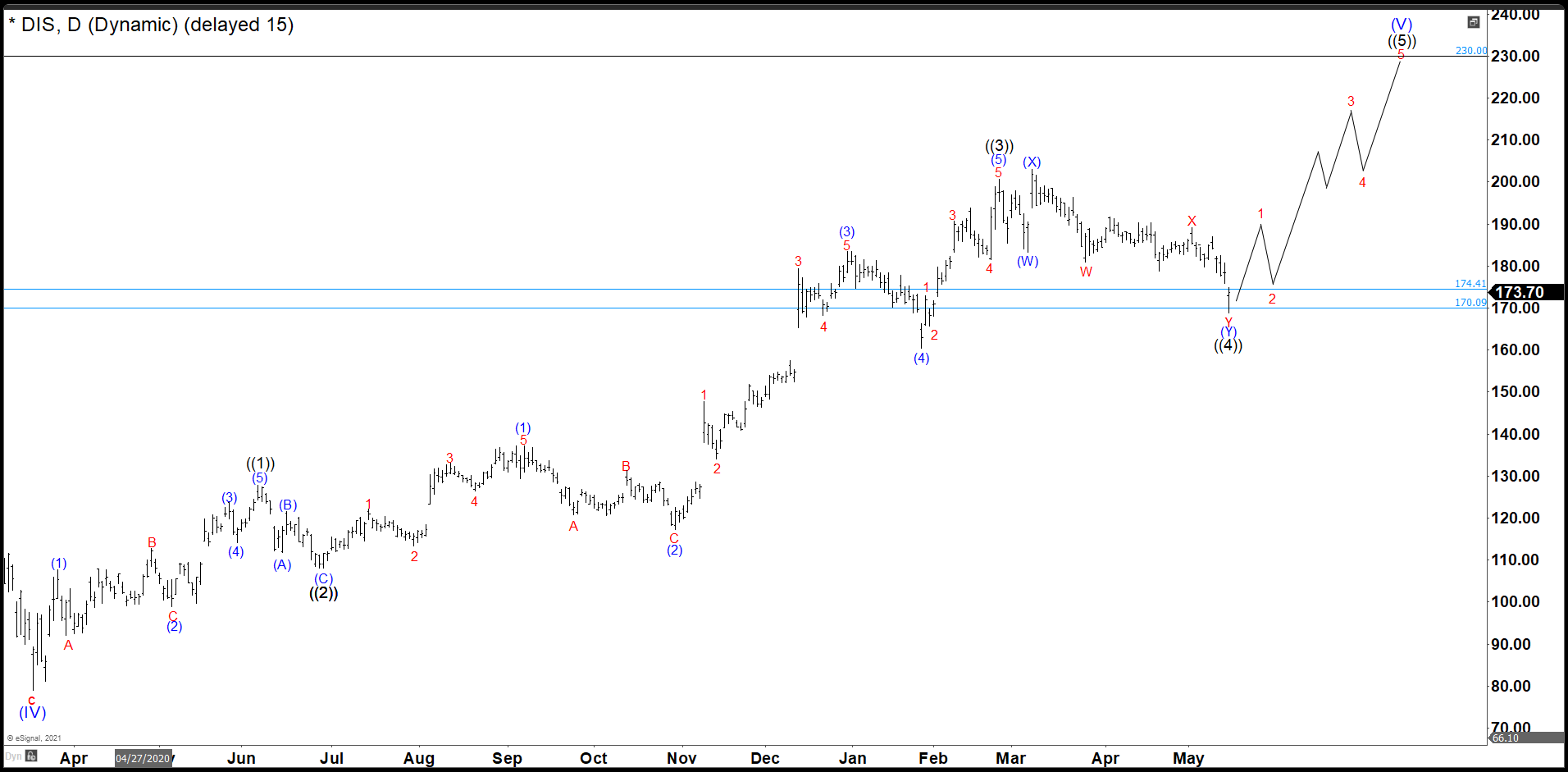

Disney Reached Our Wave ((4)) Target And It Should Continue Higher

Read MoreSince the crash of March 2020, all stocks have tried to recover what they lost, and Disney was no exception. Disney did not only recover the lost, but It also reached historic highs. Now, we are going to try to build an impulse from the March 2020 lows with a target around $230. Target measured […]