The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

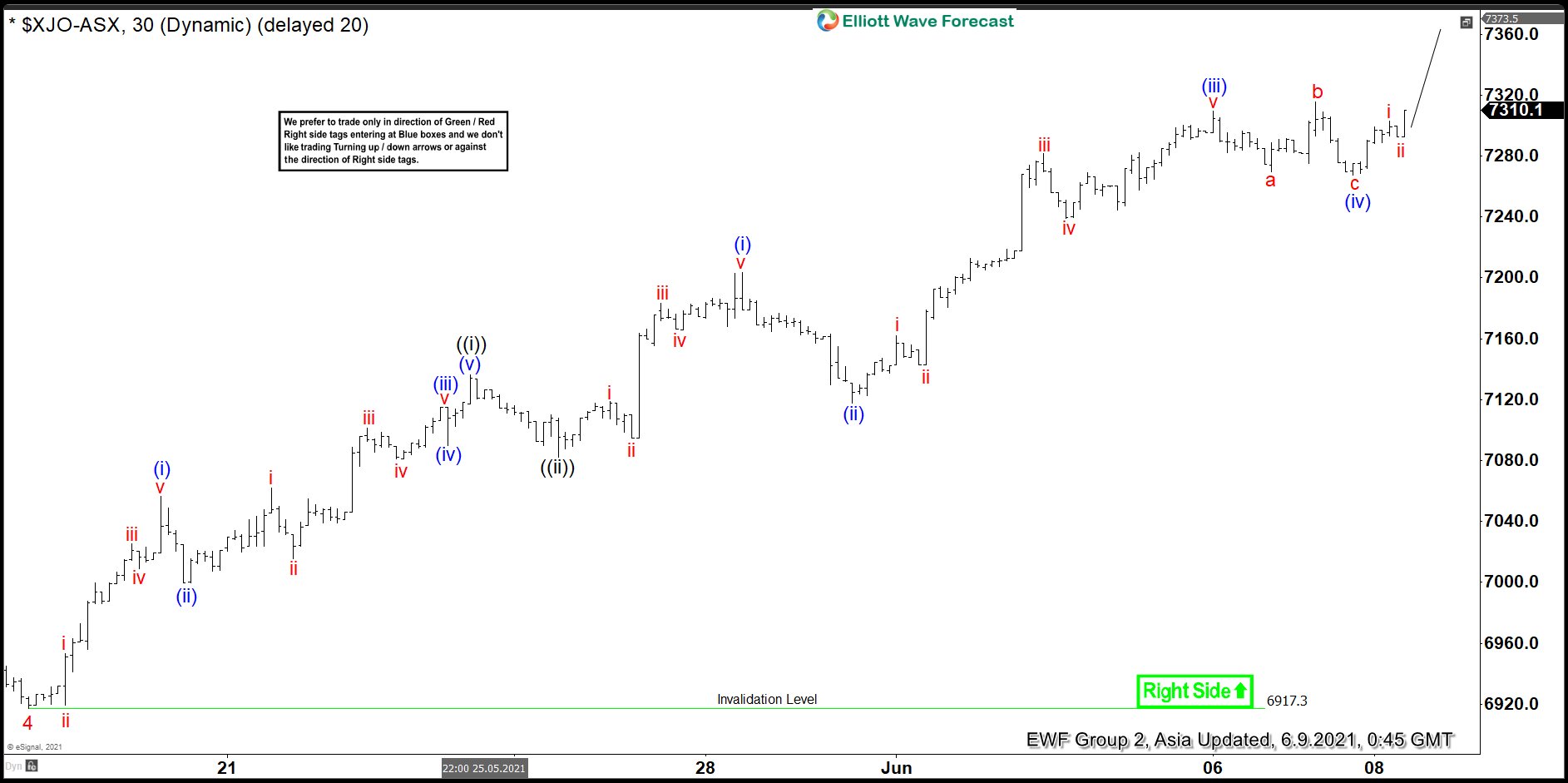

Elliott Wave View: ASX 200 (XJO) Looking to Complete Wave 5

Read MoreASX 200 (XJO) is looking to complete a 5 waves impulse move from February 1, 2021 low. This article and video look at the Elliott Wave path.

-

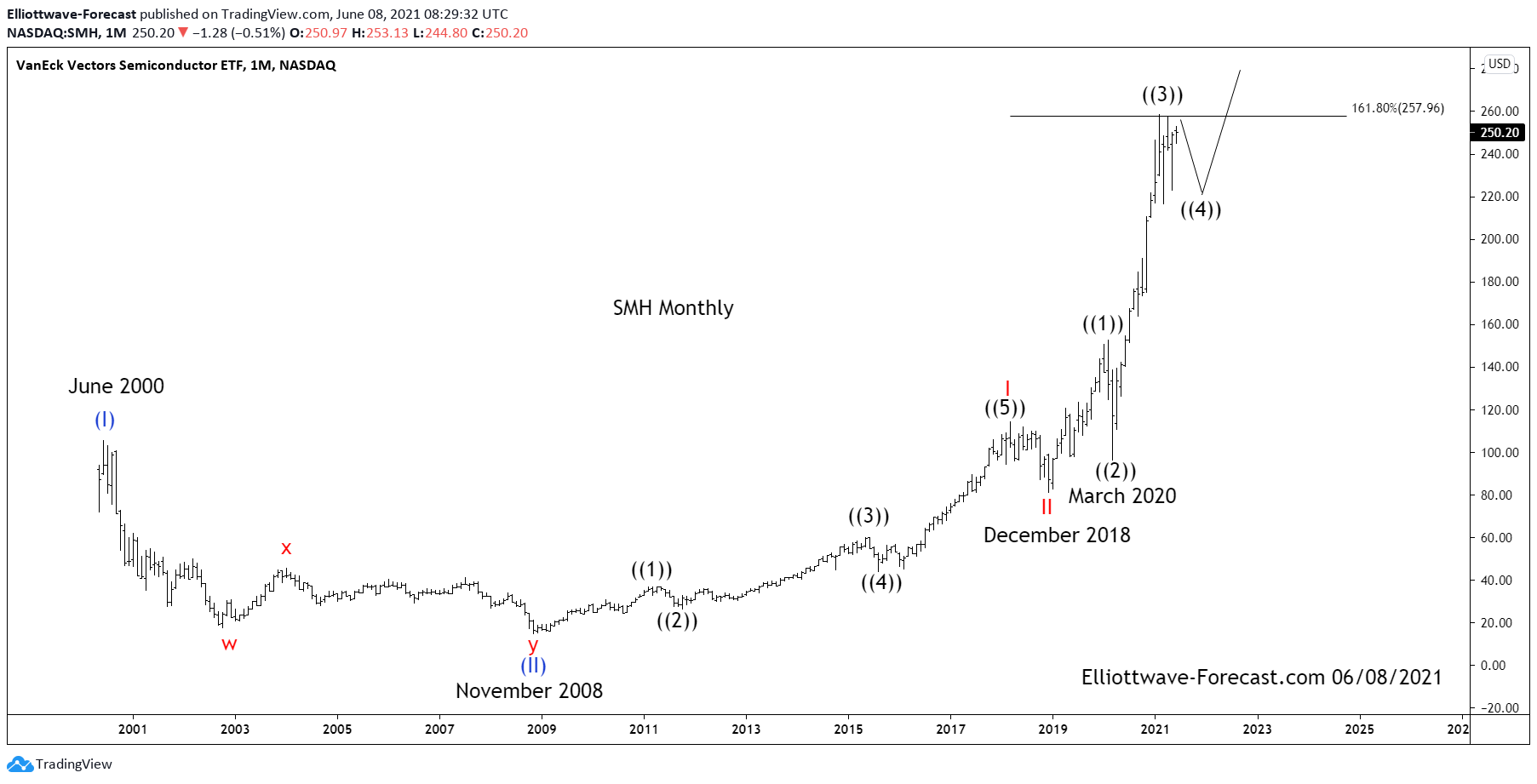

$SMH Semiconductors Elliott Wave & Longer term Cycles

Read More$SMH Semiconductors Elliott Wave & Longer term Cycles Firstly as seen on the monthly chart shown below. There is data back to May 2000 in the ETF fund. Data suggests the fund made a low in November 2008. This low has not been taken out in price. The cycles in this instrument tends to reflect the […]

-

Elliott Wave View: SPX (S&P 500) Wave 5 In Progress

Read MoreS&P 500 (SPX) is within wave 5 in an impulse rally with further upside to end. This article and video look at the Elliott Wave path for the Index.

-

XME Calling The Rally & Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of XME ETF published in members area of the Elliottwave-Forecast . As our members know, XME is showing impulsive bullish sequences in the cycle from the 13.82 low. Consequently we recommended members to avoid selling it , […]