The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

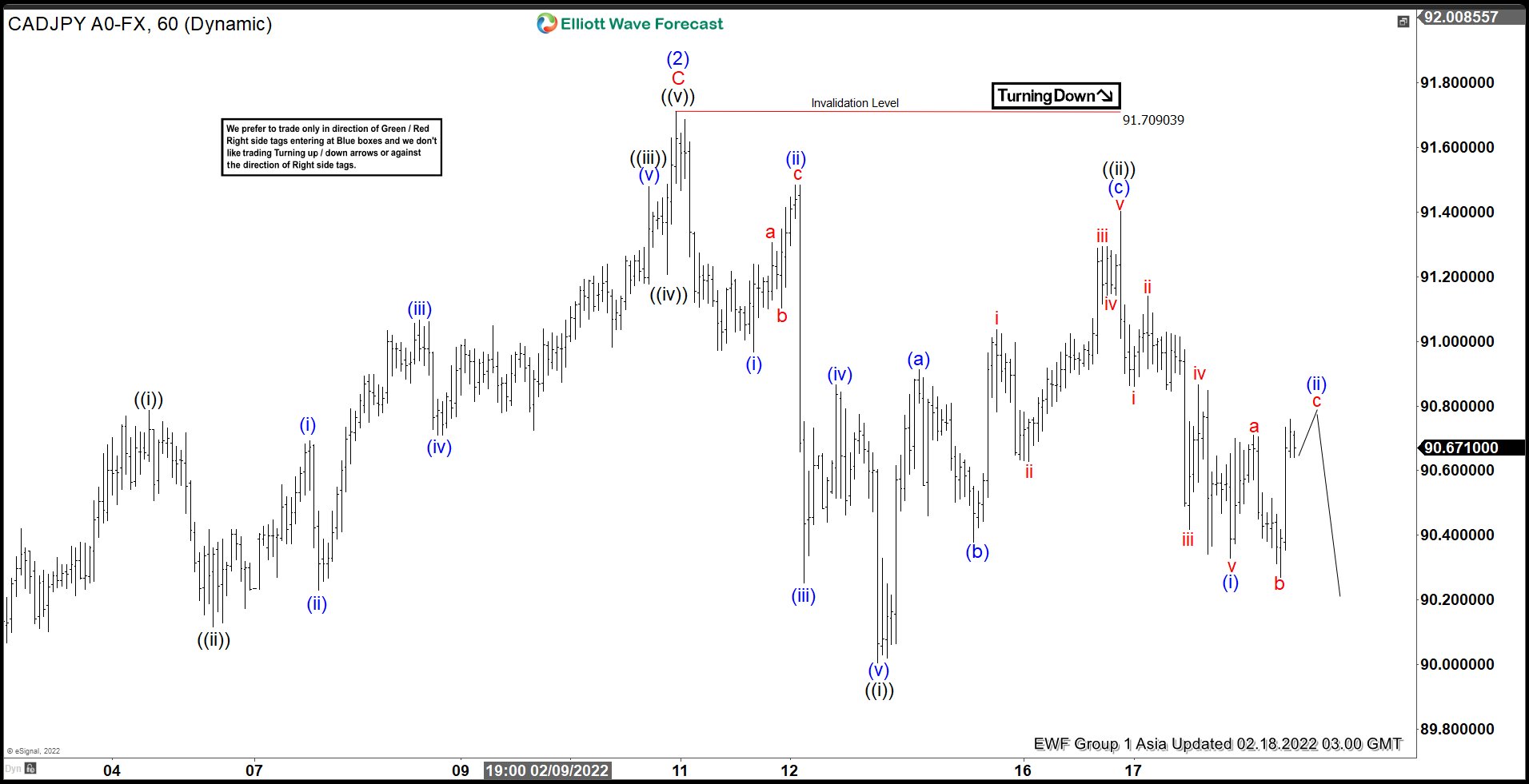

Elliott Wave View: CADJPY Looking for Further Downside

Read MoreCADJPYn is looking to extend lower in an impulsive structure. This article and video look at the Elliott Wave path of the pair.

-

Top Trading Blogs to Follow in 2024

Read MoreThe right education is very important to be a good trader. In fact, it is not only important to be a good trader but also to earn profits. Many traders spend hours and hours on research just to make the right investment decision. In today’s world where information is just a click away, following the […]

-

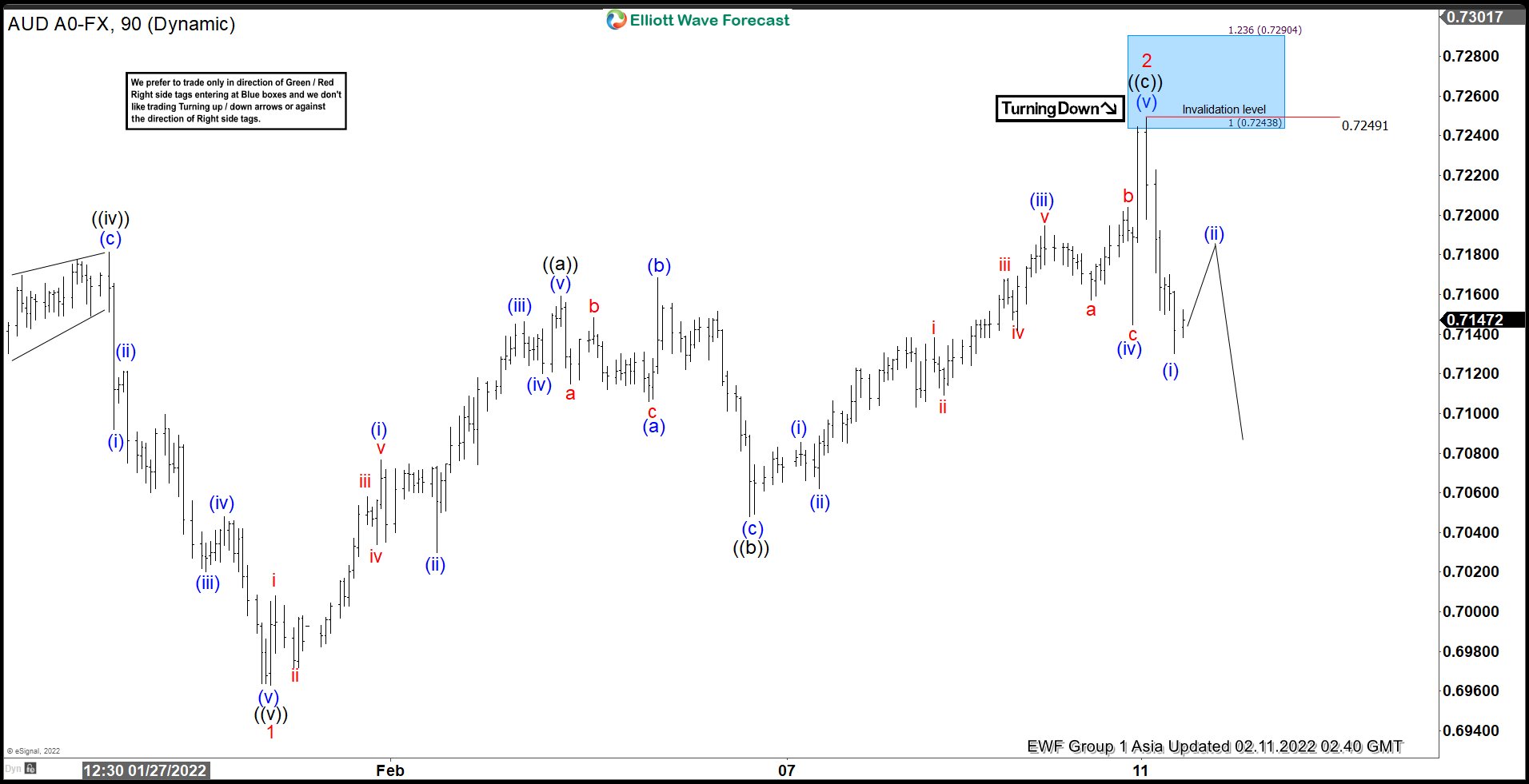

AUDUSD Selling The Bounce At Extreme Area

Read MoreIn this technical blog, we will look at the past performance of 1 hour Elliott Wave Charts of AUDUSD. In which, the decline from 13 January 2022 high unfolded as an impulse sequence and showed a lower low sequence. Therefore, we knew that the structure in AUDUSD is incomplete to the downside & should see more weakness. […]

-

Elliott Wave View: USDSEK Looking for Another Leg Higher

Read MoreUSDSEK is correcting cycle from February 4 low before the next leg higher. This article and video look at the Elliott Wave path.