The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave Analysis: S&P 500 (ES) Nearing Diagonal Wave 5 Completion

Read MoreS&P 500 E-mini Futures (ES) is looking to complete a diagonal wave 5. This article and video look at the Elliott Wave path of the Index.

-

Elliott Wave Update: VST Corrects in Wave ((2)) Before Potential Surge

Read MoreVistra Corp., (VST) operates as an integrated retail electricity & power generation company in the United States. It operates through five segments like Retail, Texas, East, West & Asset Closure. It comes under Utilities sector & trades as “VST” ticker at NYSE. As discussed in the previous article, VST favored rally in impulse ((1)) from […]

-

TXN Elliott Wave Analysis Update: Calling Resurgence From Pullback

Read MoreAfter it completed a 5-wave resurgence from the April 2025 blue box, TXN is about to correct this bullish cycle to a zone where it could attract fresh bids it would need to launch a new bullish cycle. Texas Instruments (TXN) is a global semiconductor company known for designing and manufacturing analog and embedded processing chips. […]

-

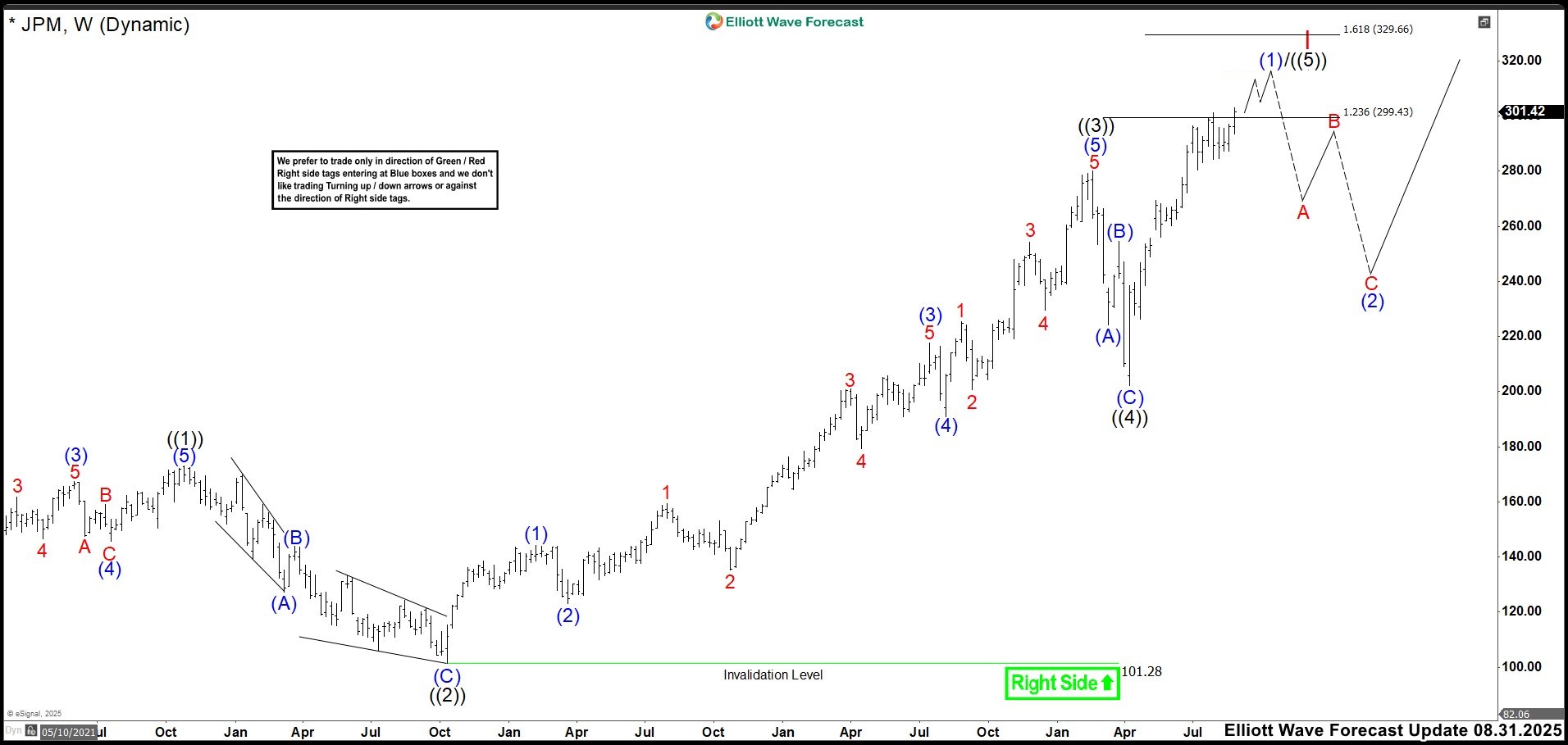

Cycle Maturity in JPM: Bulls Fatigued, Bears Warming Up

Read MoreJPMorgan Chase (JPM) trades at $301.42, testing a breakout zone near its 52-week high. This level signals strong bullish momentum. The stock remains above its 50-day and 200-day moving averages by 3.39% and 15.00%, respectively. Investors continue to show confidence in JPM’s earnings and strategic direction. Despite macro uncertainty and policy shifts, the bank maintains […]