The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Why do wave counts change? Part 2

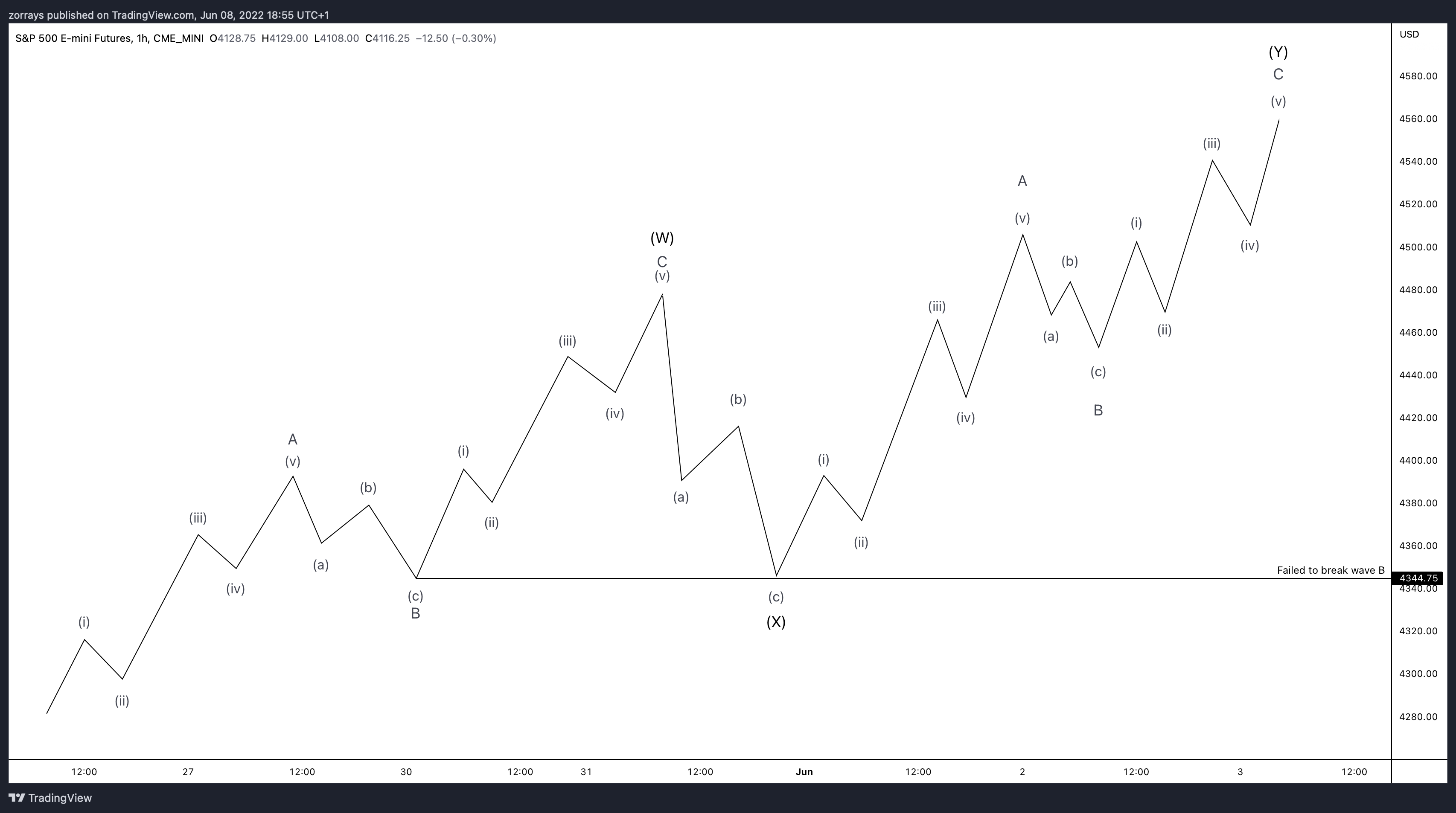

Read MoreSo, in my previous blog I mentioned the reasons why wave counts must change and be adjusted. Most of it is to do with the fact that rules are violated. Let’s go into a bit more detail on why else they may change and potentially trick you if you’re on top of the count. When […]

-

Elliott Wave View: USDCHF Shows an Impulsive Rally

Read MoreUSDCHF rally from 5/27/2022 low is in 5 waves impulse favoring more upside. This article and video look at the Elliott Wave path.

-

Why do wave counts change? Is it a good thing or detrimental to your trading?

Read MoreWe get asked a lot from novice Elliott Wave traders on why our counts change as the market progresses. One day we may have a bullish count, the next day it is bearish. We could be calling a corrective pattern a Zig-Zag, then a Double Correction and then next thing you know it turned into […]

-

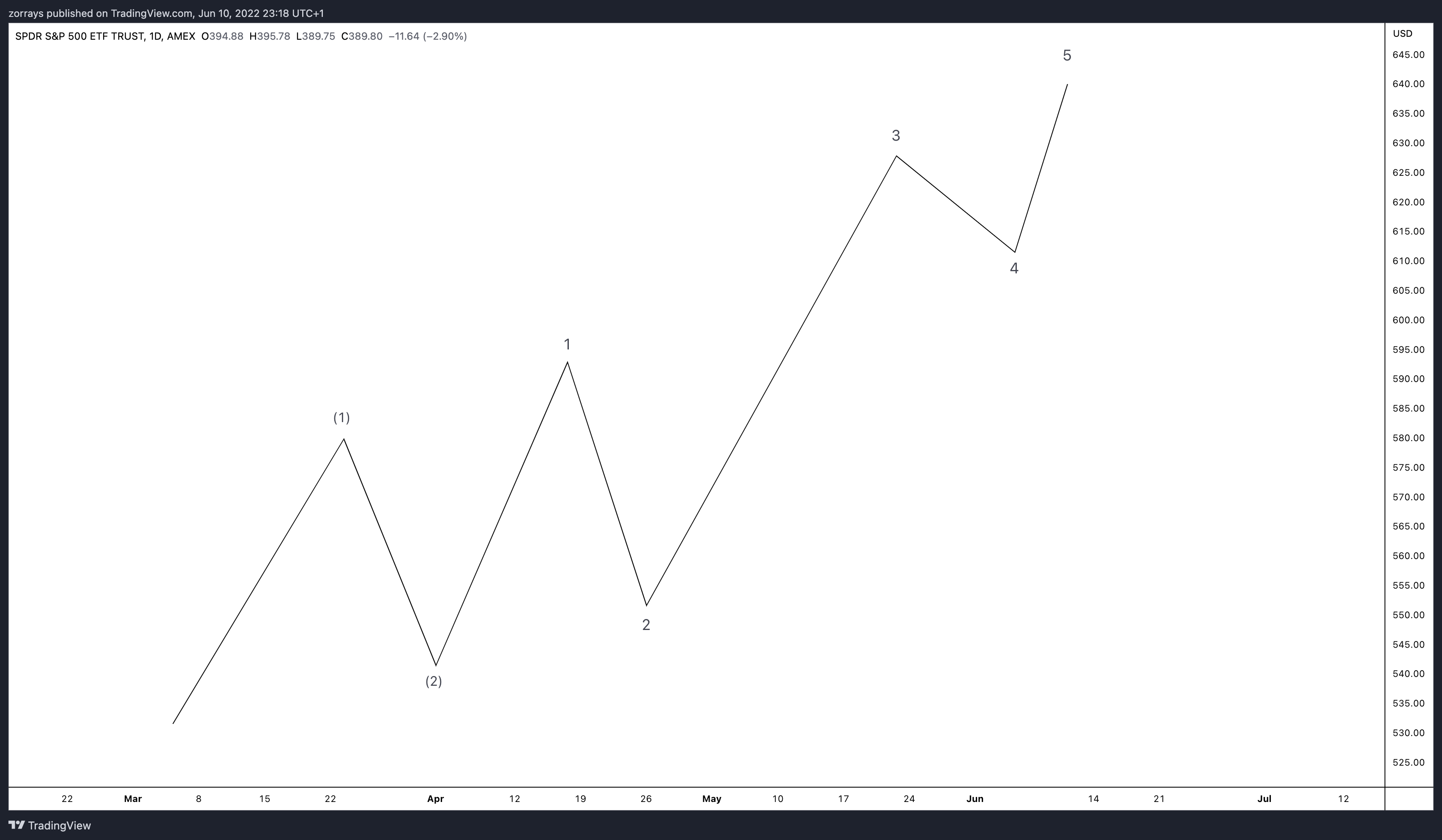

Elliott Wave View: DAX Looking to Start a New Bullish Cycle

Read MoreRally from DAX from March 2022 low is unfolding as an impulse and can see more upside. This article and video look at the Elliott Wave path.