The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

BX – Correction Expect to Continue Before Rally Resumes

Read MoreBlackstone Inc., (BX) is an alternative asses management firm specializing in real estate, private equity, hedge fund solutions, credit, secondary funds of funds, public debt & multi-asset class strategies. The firm typically invests in early stage companies. It is based in New York, comes under Financial services sector & trades as “BX” ticker at NYSE. […]

-

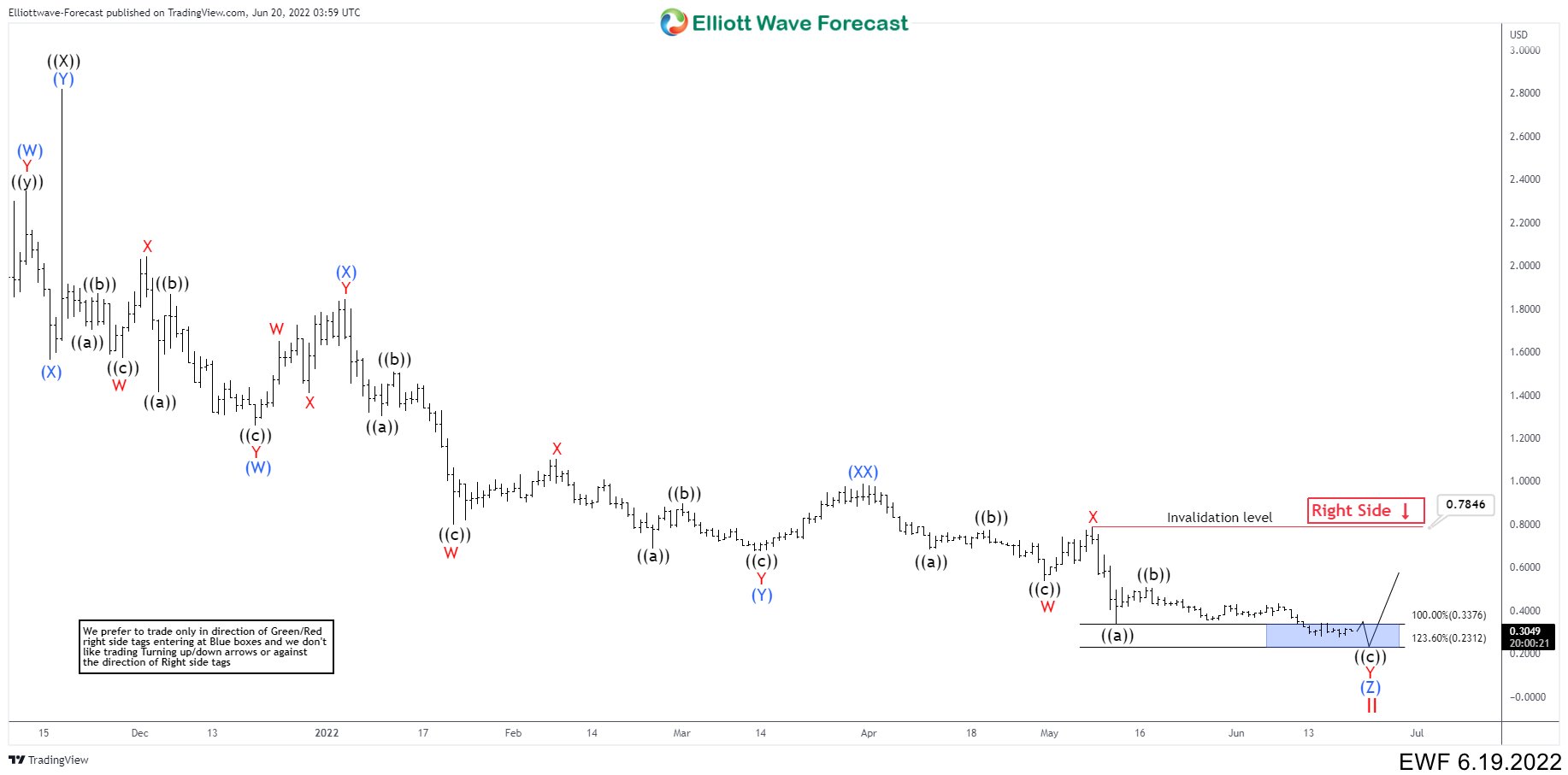

How We Saw Algorand Cryptocyrrency (ALGO) And What To Expect

Read MoreAlgorand is a proof-of-stake blockchain cryptocurrency protocol. Algorand’s native cryptocurrency is called ALGO. It was founded in 2017 by Silvio Micali, a professor at MIT, composed of a company and a foundation. Algorand Foundation manages ecosystem growth, award funding, cryptographic research primitives, on-chain governance, and decentralization of the Algorand network, including nodes. The core development […]

-

Newmont Mining (NEM) Support Area in Pullback

Read MoreNewmont Mining (NEM) starts a pullback to correct cycle from 2015 low. In this article we will look at the potential target and support for the stock.

-

UNFI : Expect Pulling Back Before Next Leg Higher

Read MoreUnited Natural Foods Inc., (UNFI) together with its subsidiaries, distributes natural, organic, specialty, produce & conventional grocery & non-food products in the US and Canada. It operates in two segments, wholesale and retail. It is based Providence, Rhode Island, comes under Consumer Defensive sector and trades as “UNFI” ticker at NYSE. UNFI made all time […]