The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Elliott Wave View: GBPCAD Rally Should Fail for Further Downside

Read MoreShort Term Elliott Wave View in GBPCAD suggests rally to 1.5367 ended wave ((iv)). Wave ((v)) lower is in progress to complete a cycle from August 2, 2022 high. Internal subdivision of wave ((iv)) unfolded as a zig zag Elliott Wave structure. Up from wave ((iii)), wave (a) ended at 1.5314 and pullback in wave […]

-

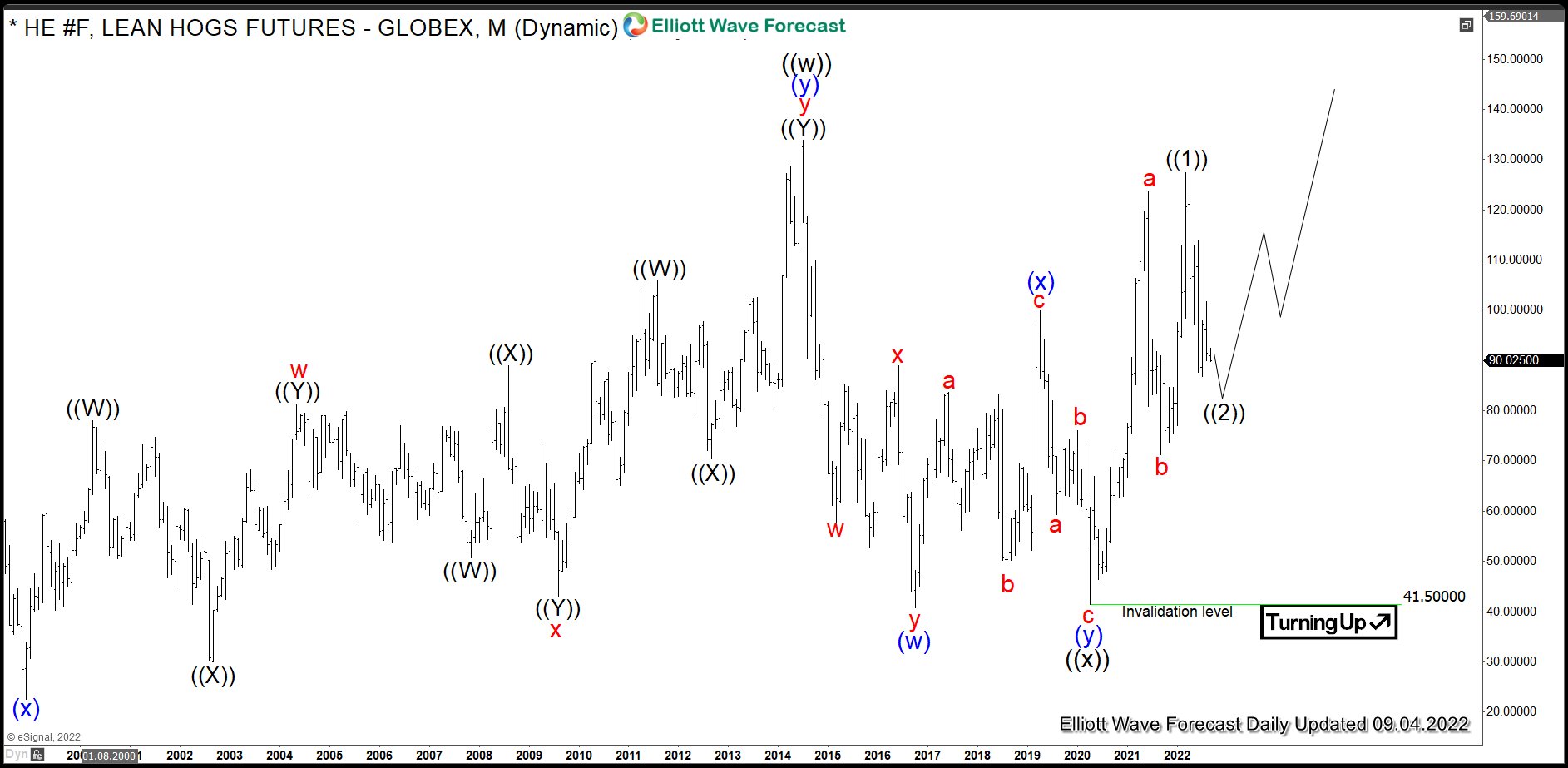

HE #F: Pork Prices to Double as Lean Hogs Prices Rally

Read MoreLean Hogs is a livestock commodity within the agriculture asset class, along with live cattle, feeder cattle and pork cutouts. One can trade Lean Hogs futures at Chicago Mercantile Exchange in contracts of 40’000 pounds each under the ticker HE #F. As a matter of fact, the futures prices are widely used by U.S. pork […]

-

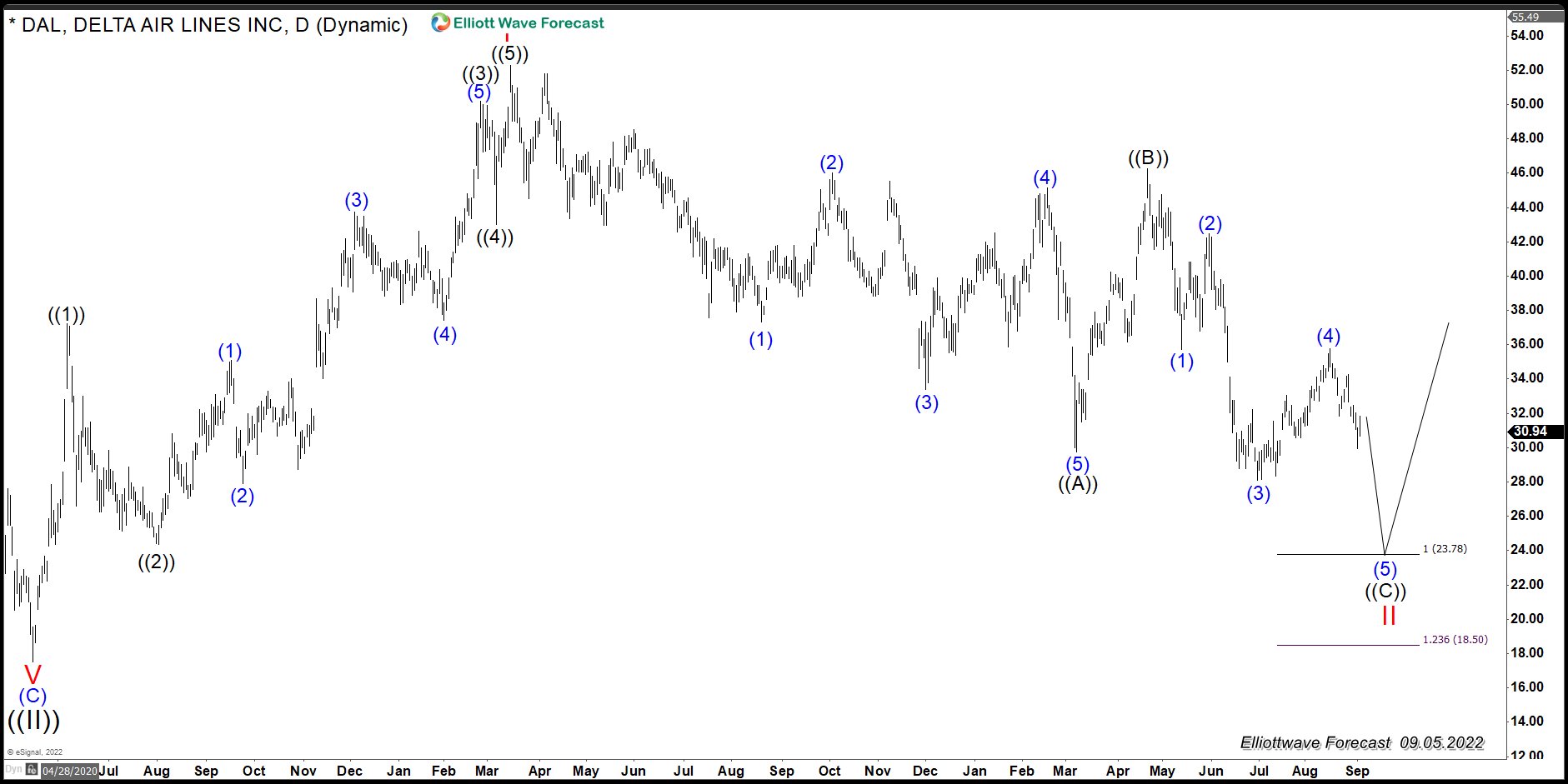

$DAL (Delta Air Lines INC): Another Buying opportunity In the Horizon

Read MoreDelta Airlines (DAL) shows an impulse from all-time low and 2020 low & should give a buying opportunity soon. This article looks at the Elliott Wave chart.

-

GMAB : Should Expect Sideways To Lower Before Upside Resumes

Read MoreGenmab A/S (GMAB) develops antibody therapeutics for the treatment of the cancer and other diseases. The company is based in Copenhagen, Denmark, comes under Healthcare – Biotechnology sector & trades as “GMAB” ticker at Nasdaq. GMAB made an all time high at $49.07 & currently favors correcting lower the sequence up since 2013 low. It […]