The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

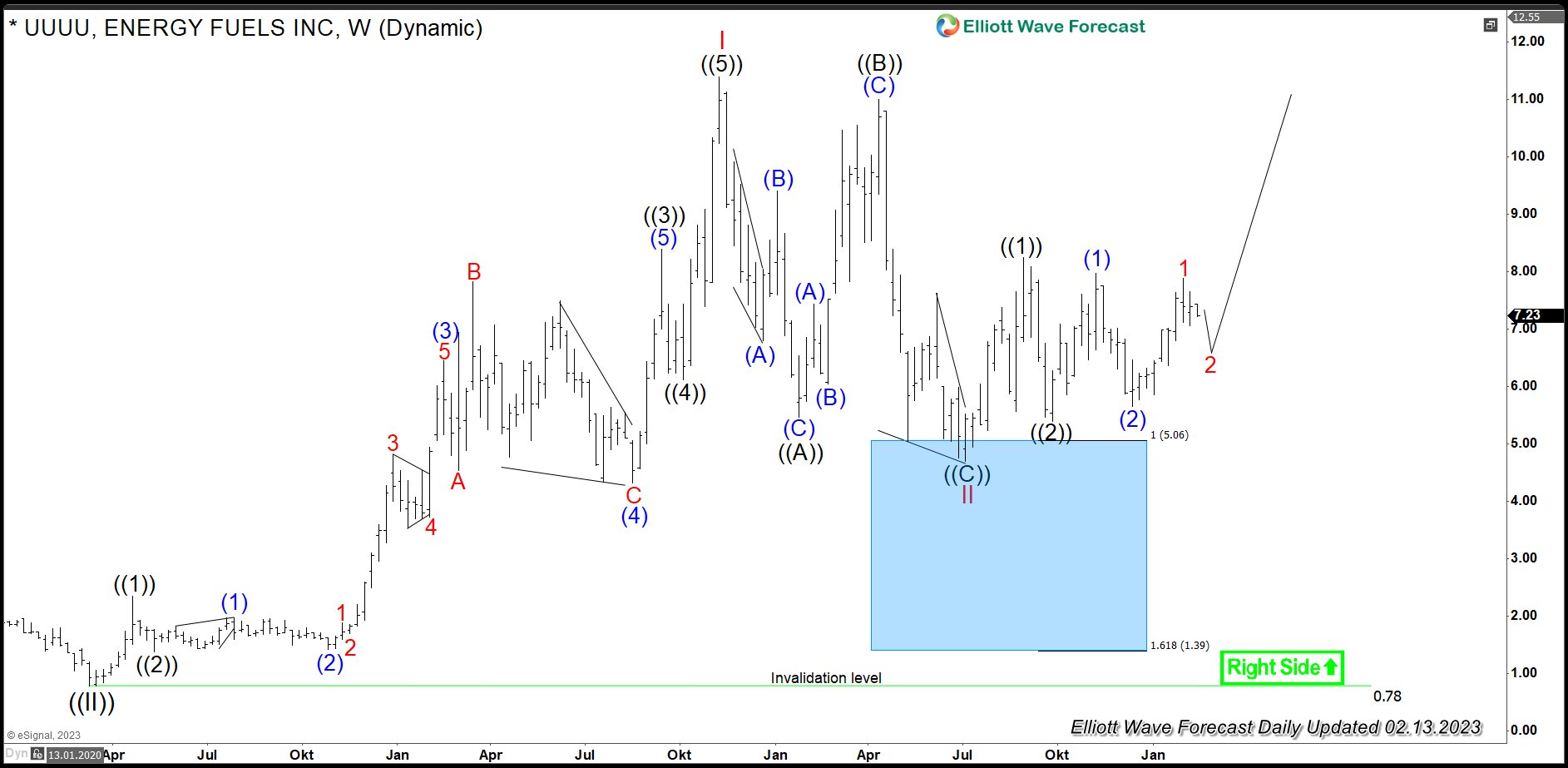

$UUUU : Uranium Miner Energy Fuels Reacts from Weekly Blue box

Read MoreEnergy Fuels is the largest US miner of the uranium. It produces the uranium both in form of triuranium octoxide and uranium hexafluoride. Besides the core business, the secondary products of Energy Fuels are rare earth elements and vanadium. Founded in 2006, the company has its headquarters in Lakewood, Colorado. One can trade it under […]

-

CL_F: Crude Oil Futures Found Support From Equal Legs Area

Read MoreHello Traders in this blog we will see how CL_F Crude Oil Futures found support from equal legs area and reacted higher within wave 2. Many traders are wondering whether Crude Oil will still trade lower or higher after it’s larger degree peak it made from March 7th, 2022. In this article we will only […]

-

Silver Miners ETF (SIL) Looking to Correct Cycle from September 2022

Read MoreSilver Miners ETF (SIL) has ended the correction to the cycle from March 2020 low on Sept 26, 2022 low at 21.26. It has started to rally the next leg higher. However, it formed intermediate high on January 26 at 31.9. It ‘s now pulling back to correct cycle from Sept 26 low in larger […]

-

Elliott Wave Suggests 20+ Yr Bond ETF ($TLT) Should Remain Supported.

Read MoreHello Everyone! In this technical blog, we are going to take a look at the Elliott Wave path in the 20 Year Bond ETF ($TLT). The iShares 20+ Year Treasury Bond ETF seeks to track the investment results of an index composed of U.S. Treasury bonds with remaining maturities greater than twenty years. $TLT 4H Elliott Wave […]