The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

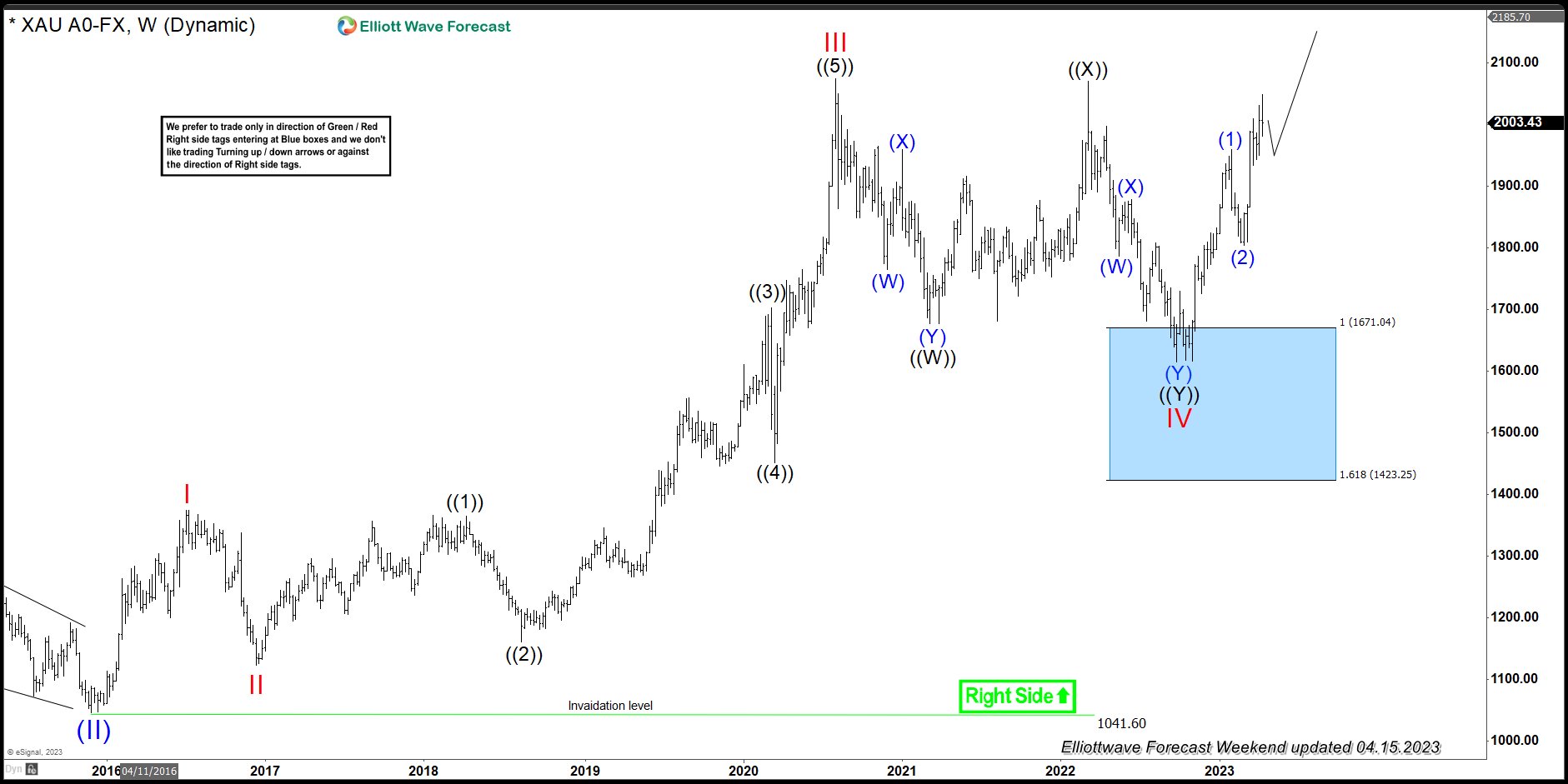

Is The Elliott Wave Principle Objective or Subjective?

Read MoreThe Elliott Wave Principle is generally considered to be a subjective tool for technical analysis. This is because the interpretation of the wave patterns and counts relies on the experience and analysis of the price movements. The Principle involves identifying repetitive patterns in price movements and using those patterns to make predictions about future price […]

-

PepsiCo (NASDAQ: PEP) Gains Momentum as market volatility subsides

Read MoreWith a market capitalization of over $200 billion, PepsiCo (NASDAQ: PEP) is a global leader in the food and beverage industry. It has recently broken into new all-time highs, indicating a potentially bullish outlook for the stock. Despite ongoing market volatility and changing consumer preferences, the company’s strong revenue and profits suggest a solid business […]

-

Nasdaq 100 ETF (QQQ) Resumes Higher in Elliott Wave Impulse

Read MoreNasdaq 100 ETF (QQQ) has resumed higher in Elliott Wave Impulse structure. This article and video look at the Elliott Wave path.

-

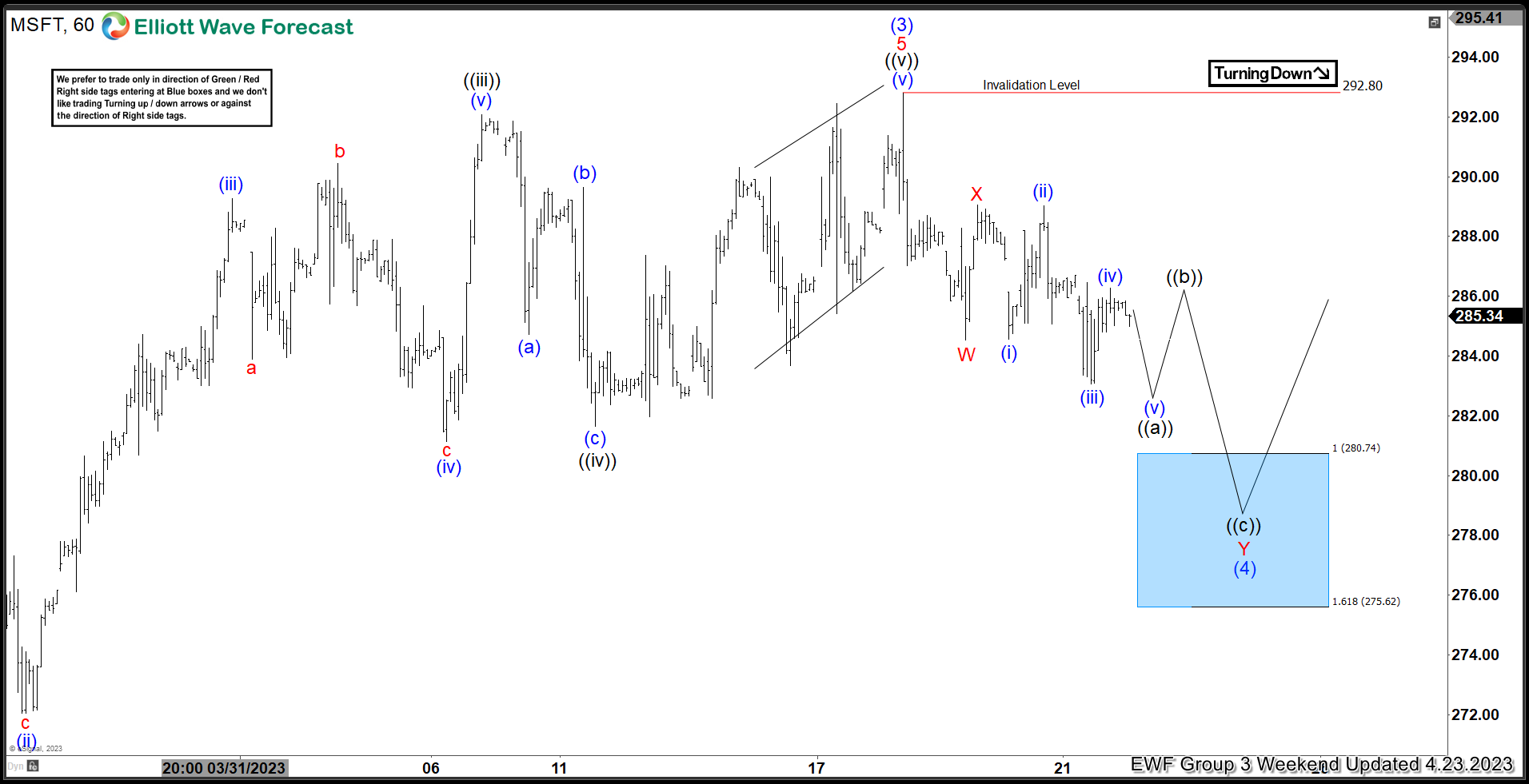

Microsoft (MSFT) Forecasting The Rally From The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of Microsoft (MSFT) stock. As our members know, the stock is trading within the cycle from the November 2022 low. We have been calling for the rally in the stock after 3 waves pull back. Our […]