The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

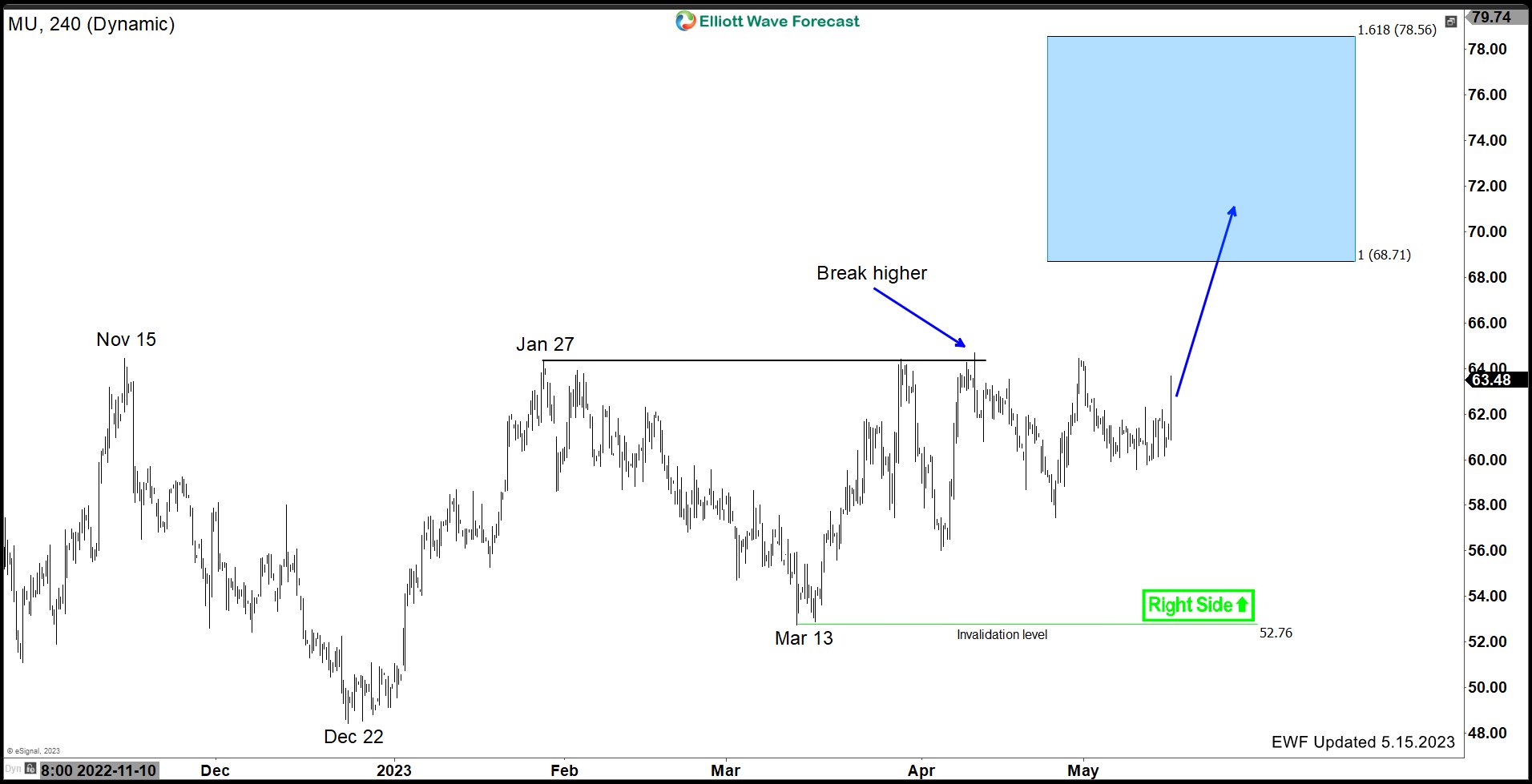

Micron Technology Inc. ($MU) is calling for more upside in the Tech Sector.

Read MoreHello Traders! Today, we will look at the shorter cycles of Micron Technology Inc ($MU) and explain why the stock should remain supported in the near term. This is how we saw it back in March 2023 expecting a bounce to take place first before lower again. $MU 4H Elliott Wave Analysis May 15th 2023: The stock has […]

-

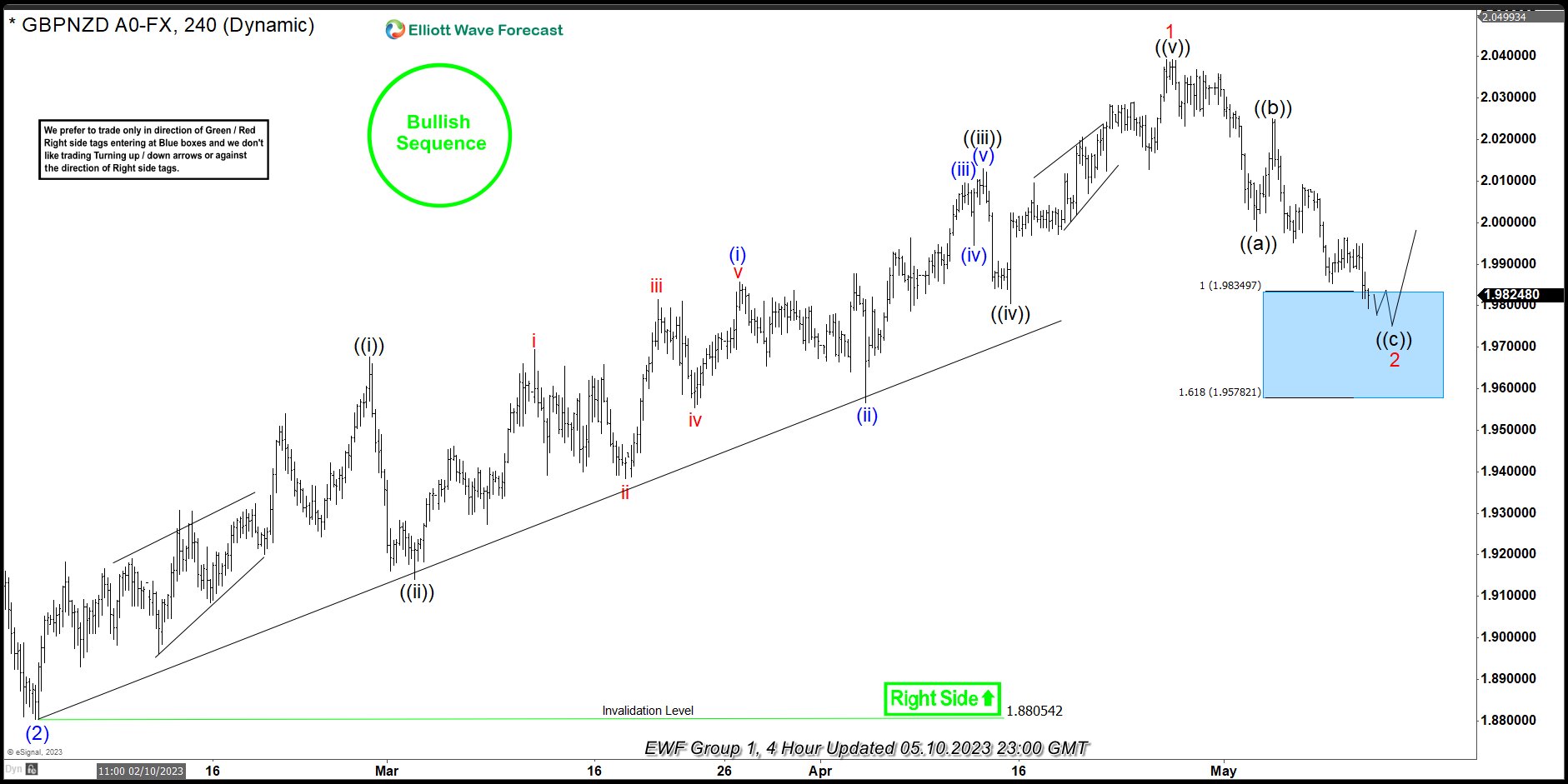

GBPNZD Reacting Strongly From The Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of GBPNZD. In which, the rally from the 03 February 2023 low unfolded as an impulse sequence and showed a higher high sequence with a bullish sequence stamp. Therefore, we knew that the structure in GBPNZD is incomplete & should […]

-

Cameco (CCJ) Still Sideways and Looking for Direction

Read MoreCameco Corporation (ticker: $CCJ) is the world’s largest publicly traded uranium company, based in Saskatoon, Saskatchewan, Canada. In 2015, it was the world’s second largest uranium producer, accounting for 18% of world production. This article provides the Elliott Wave technical outlook of the company. $CCJ Monthly Elliott Wave Chart Monthly chart of Cameco above shows […]

-

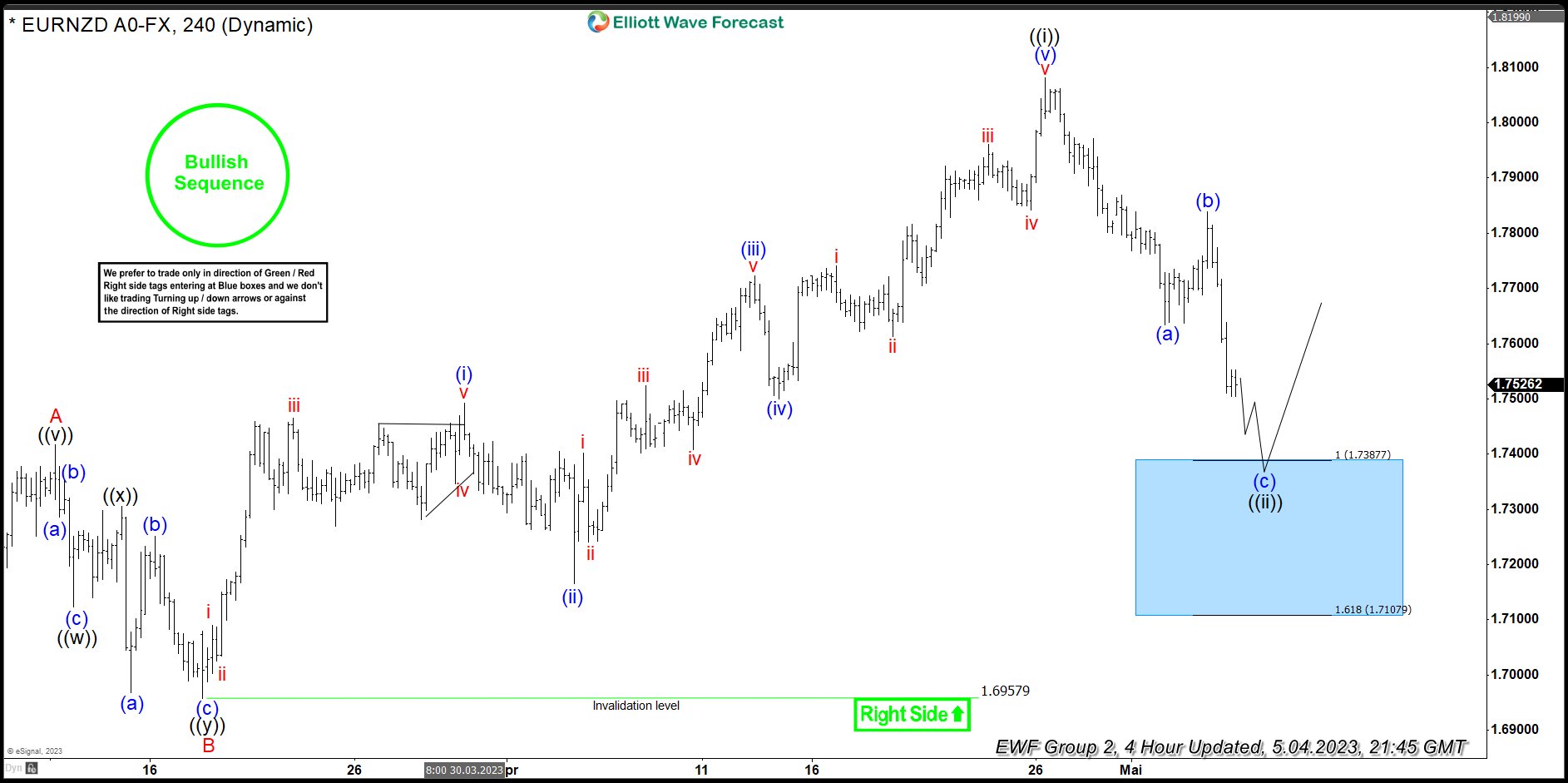

EURNZD Buying The Dips At The Blue Box Area

Read MoreHello fellow traders. In this technical article we’re going to take a quick look at the Elliott Wave charts of EURNZD published in members area of the website. As our members know, the pair is showing bullish sequences in the cycle from the April 2022 low. Our team recommended members to avoid selling , while […]