The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Microsoft (MSFT) Looking for Zigzag Pullback

Read MoreMicrosoft (MSFT) is correcting in wave ((4)) as a zigzag before it resumes higher. This article and video look at the Elliott Wave path.

-

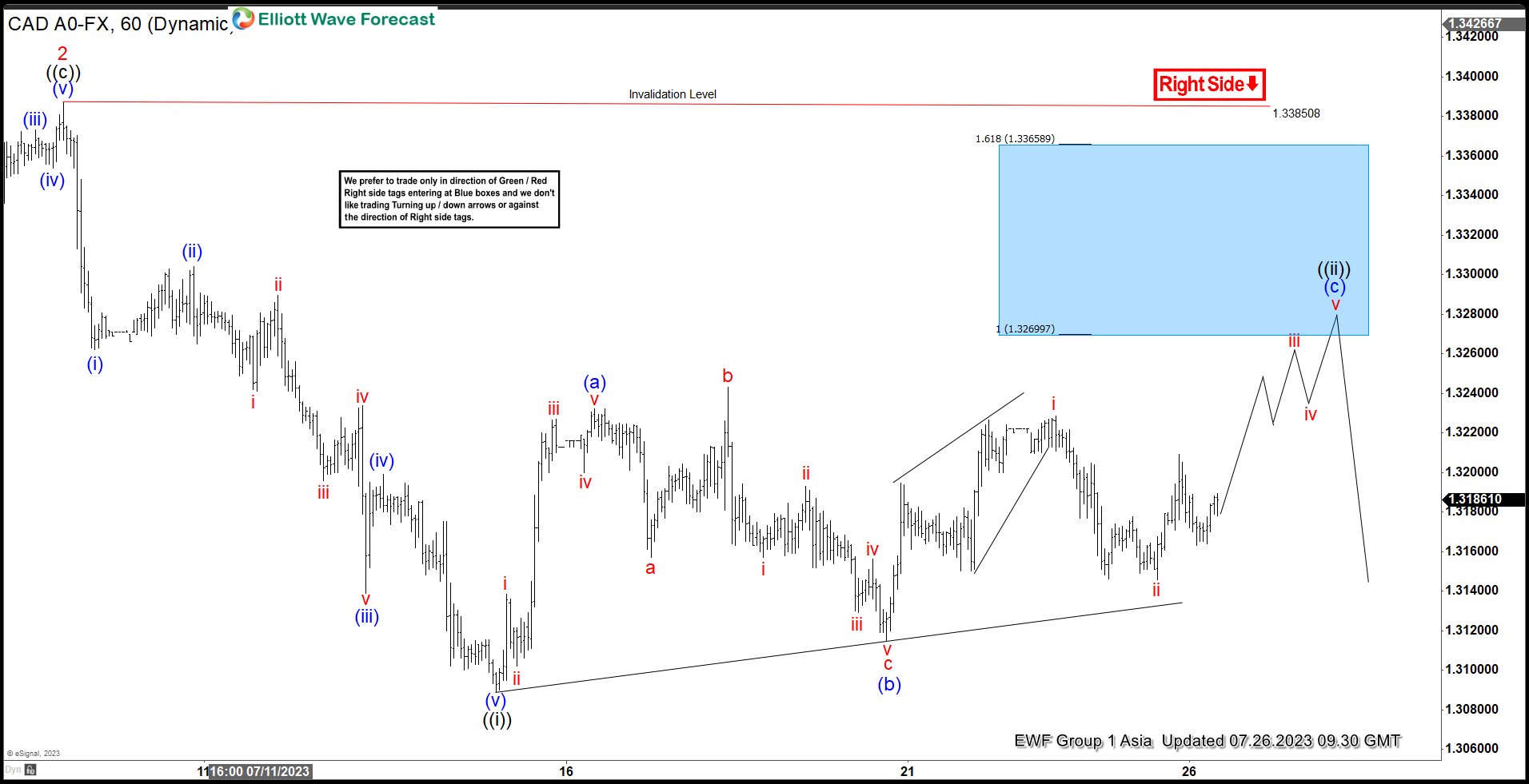

Elliott Wave View: USDCAD Rally Expected to Fail

Read MoreUSDCAD rallies to correct cycle from 7.7.2023 high as a zigzag. This article and video show where rally should fail and sellers should appear.

-

Travelers (TRV) Is Correcting The Cycle From March 2020 Low.

Read MoreThe Travelers Companies, Inc., TRV, is an American insurance company. It is the second-largest writer of U.S. commercial property casualty insurance, and the sixth-largest writer of U.S. personal insurance through independent agents. Weekly TRV Chart July 2023 TRV ended a great super cycle in the year of 2019 reaching a peak at $154.86 which we call […]

-

SPDR S&P Bank ETF (KBE) Bouncing from Daily Blue Box Area

Read MoreSPDR S&P Bank ETF (KBE) is a widely-tracked exchange-traded fund that provides exposure to the banking sector within the S&P 500 index. As an essential component of the financial markets, KBE offers investors an opportunity to participate in the performance of leading banks and financial institutions. This article will explore the current outlook for KBE, based […]