The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

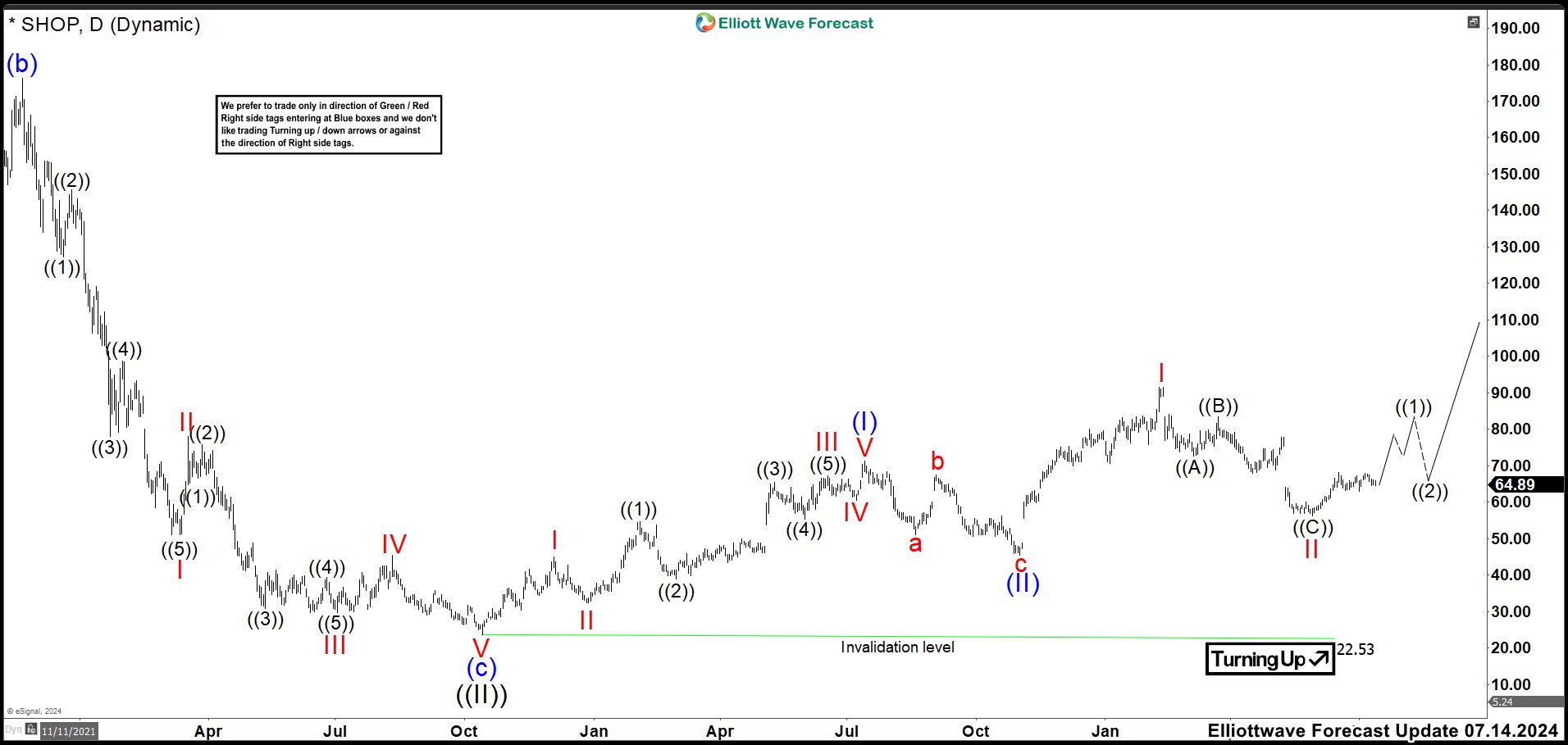

Shopify (SHOP) is Nesting looking for a Rally

Read MoreShopify Inc. is a Canadian multinational e-commerce company in Ottawa, Ontario. Shopify (SHOP) is the name of its proprietary e-commerce platform for online stores and retail point-of-sale systems. The Shopify platform offers online retailers a suite of services including payments, marketing, shipping and customer engagement tools. SHOP Daily Chart July 2023 Shopify ended a Grand Supercycle in July 2021 and we labeled it as wave ((I)). Since then, […]

-

Elliott Wave Favors Further Upside in GBPUSD

Read MoreGBPUSD shows bullish sequence from 4.22.2024 low favoring upside. This article and video look at the Elliott Wave path of the pair.

-

USDSGD Elliott Wave Analysis expects extensive decline

Read MoreHello traders. Welcome to a new blog post. In this one, we will discuss the future path for the USDSGD forex pair based on the Elliott wave theory. The path will include both long-term ideas and where we can find opportunities along the shorter cycles. $USDSGD is one of the 78 instruments we analyze for […]

-

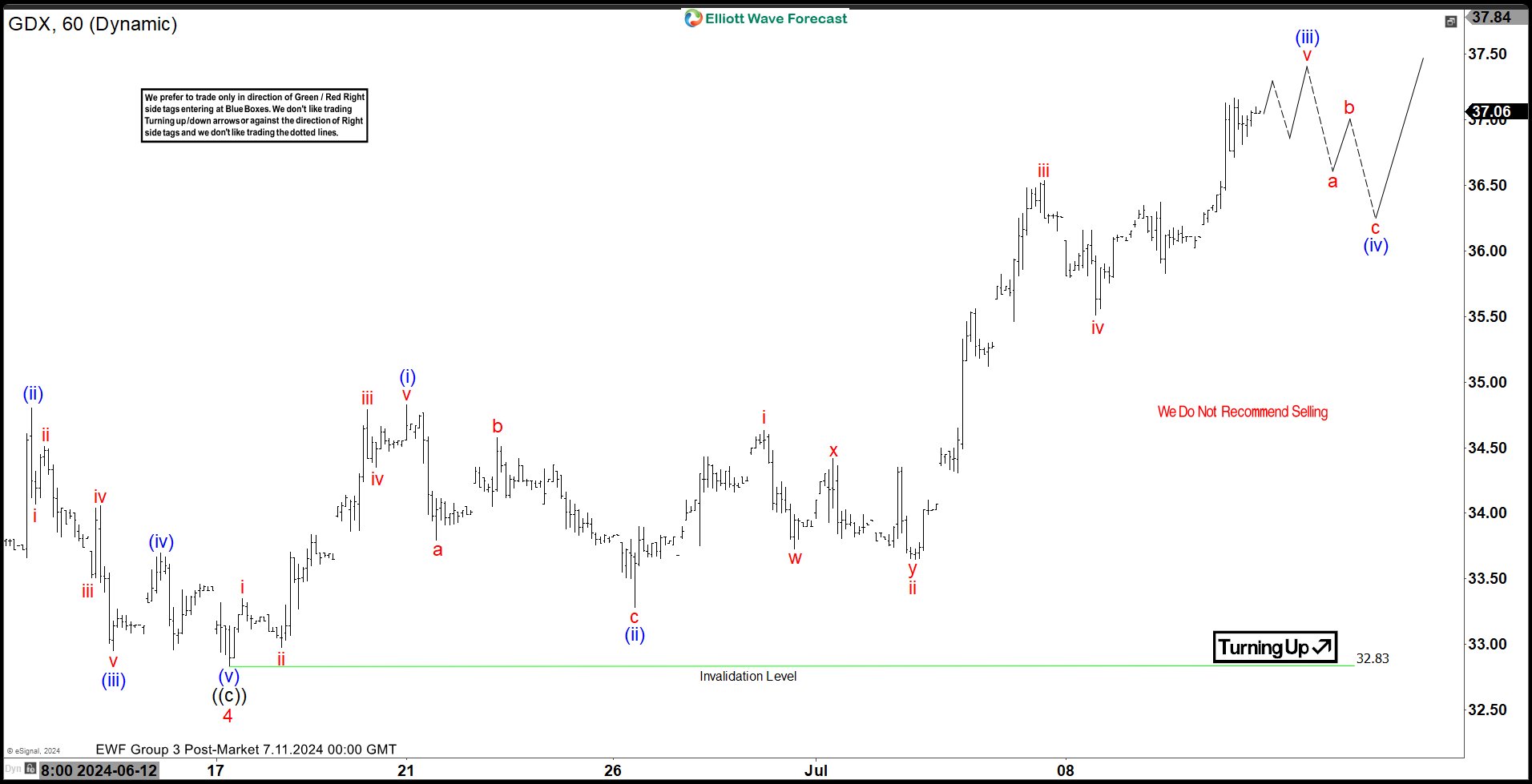

Elliott Wave Expects Gold Miners ETF (GDX) to Continue Rally

Read MoreGold Miners ETF (GDX) is rallying as an impulse and should extend higher. This article and video look at the Elliott Wave path.