The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Apple Stock (AAPL) Elliott Wave : Buying the Dips at the Blue Box Area

Read MoreIn this technical article we’re going to take a quick look at the weekly Elliott Wave charts of Apple Stock (AAPL) , published in members area of the website. As many of our members are aware, the stock has given us good buying opportunities recently. AAPL hit our buying zone and completed a correction at […]

-

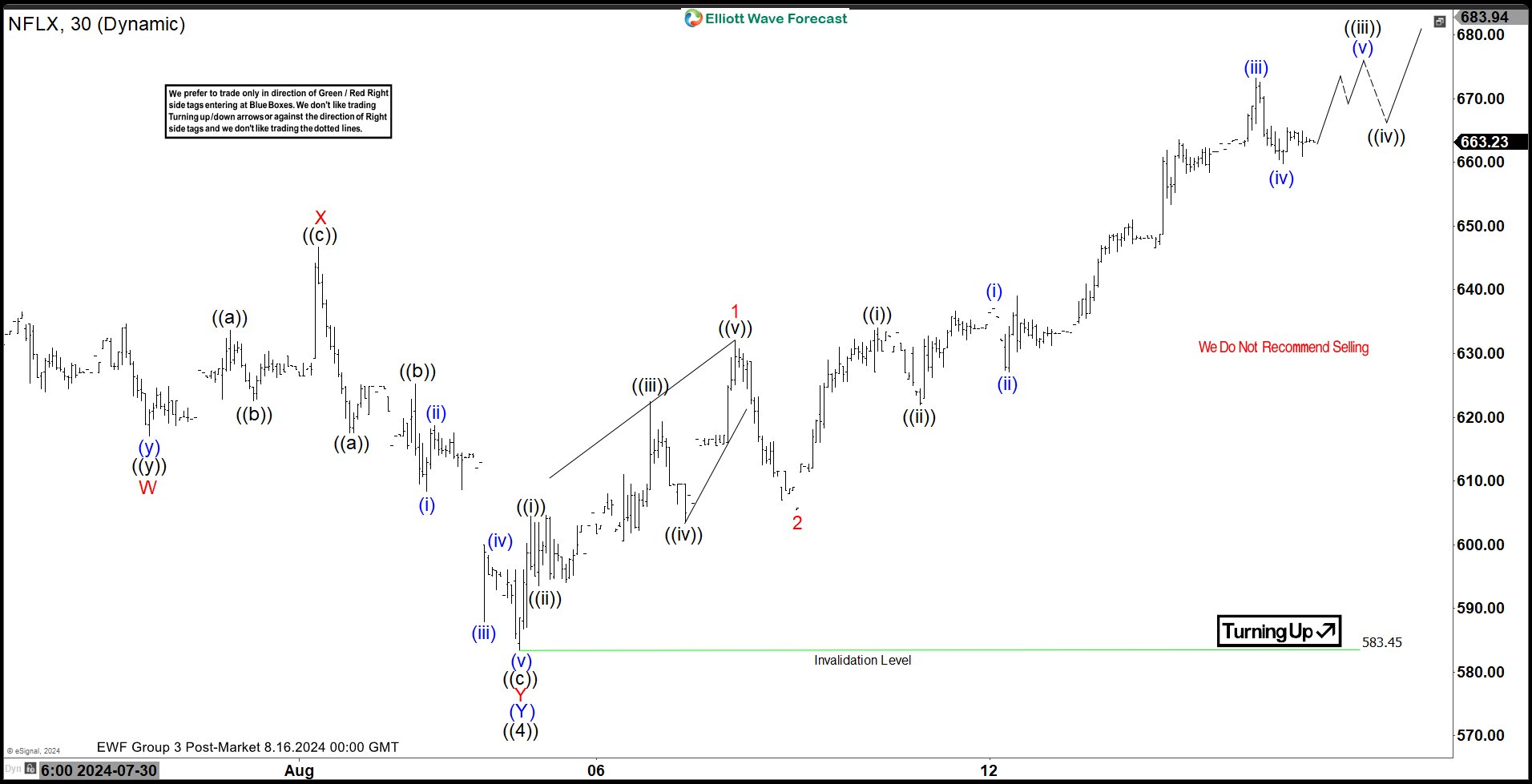

Elliott Wave Intraday Analysis: NFLX Should Continue Rally

Read MoreShort Term Elliott Wave in NFLX suggests that the Stock has completed a bearish sequence from 7.05.2024 high. The decline made a double correction Elliott Wave structure. Down from 7.05.2024 high, wave (W) ended at 600.00 low. Rally in wave (X) ended at 678.97 with internal subdivision as a zig zag correction structure. Up from […]

-

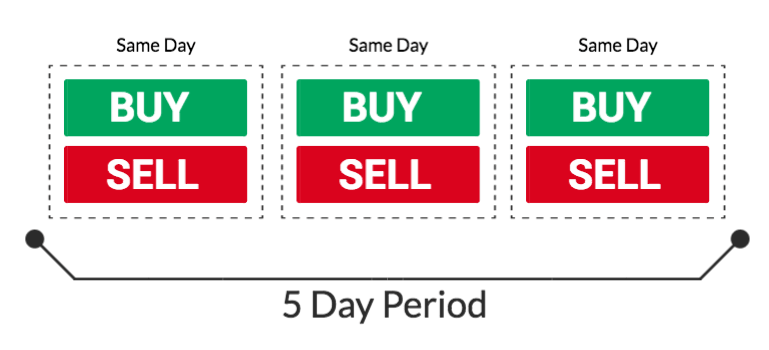

How to Start Trading with a Small Account – Avoid Pattern Day Trader Rule

Read MoreWhen I started out trading back in 2020, there was the allure of starting with a small amount of money and turning it into a large fortune. Since then I have learned several ways of starting with a small amount of money, and growing it exponentially, without having to deal with the Pattern Day Trader […]

-

Elliott Wave Intraday Analysis: USDJPY is Correcting Before Resuming Lower

Read MoreShort Term Elliott Wave USDJPY suggests that the pair is developing a bearish sequence from 07.03.2024 high. The decline made a double correction Elliott Wave structure. Down from 07.03.2024 high, wave A ended at 155.36 low. Rally in wave B ended at 157.86 high with internal subdivision as zig zag structure. Then, the pair resuming lower […]