The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Kaspa (KAS) Found Support at The Blue Box Area

Read MoreKaspa is a proof-of-work (PoW) blockchain that implements the GHOSTDAG protocol with rapid block processing and minimal confirmation durations. It’s ative cryptocurrency KAS is used for on-chain transactions and mining rewards. In today’s video bog, we’ll explore Elliott Wave pattern taking place within the short term cycle and explain the potential path based on the theory. KAS […]

-

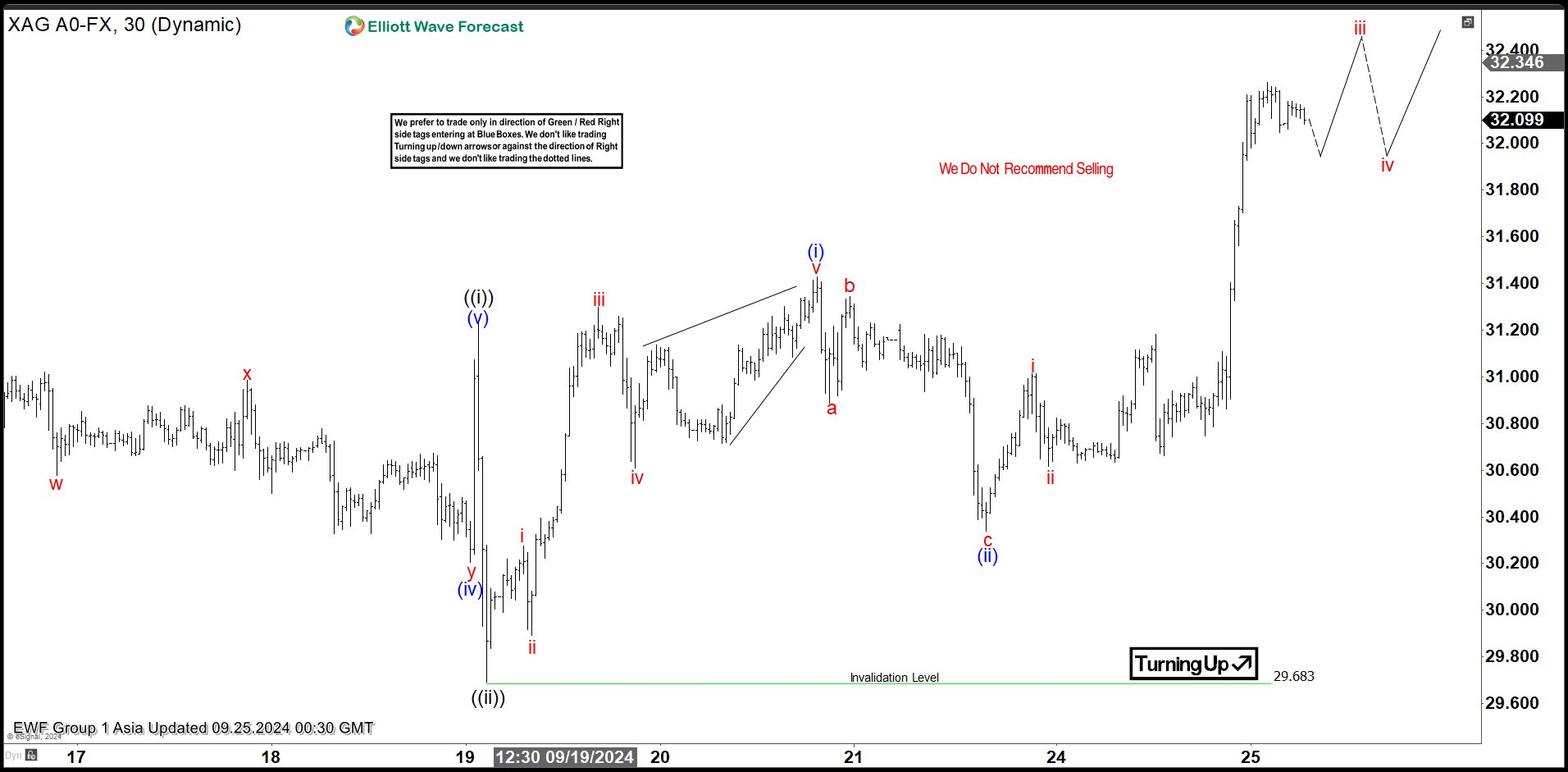

Elliott Wave Expects Silver (XAGUSD) to Continue Bullish move

Read MoreSilver (XAGUSD) is about to break above previous peak on 5.20.2024 high which confirms the bullish outlook. This article shows Elliott Wave path.

-

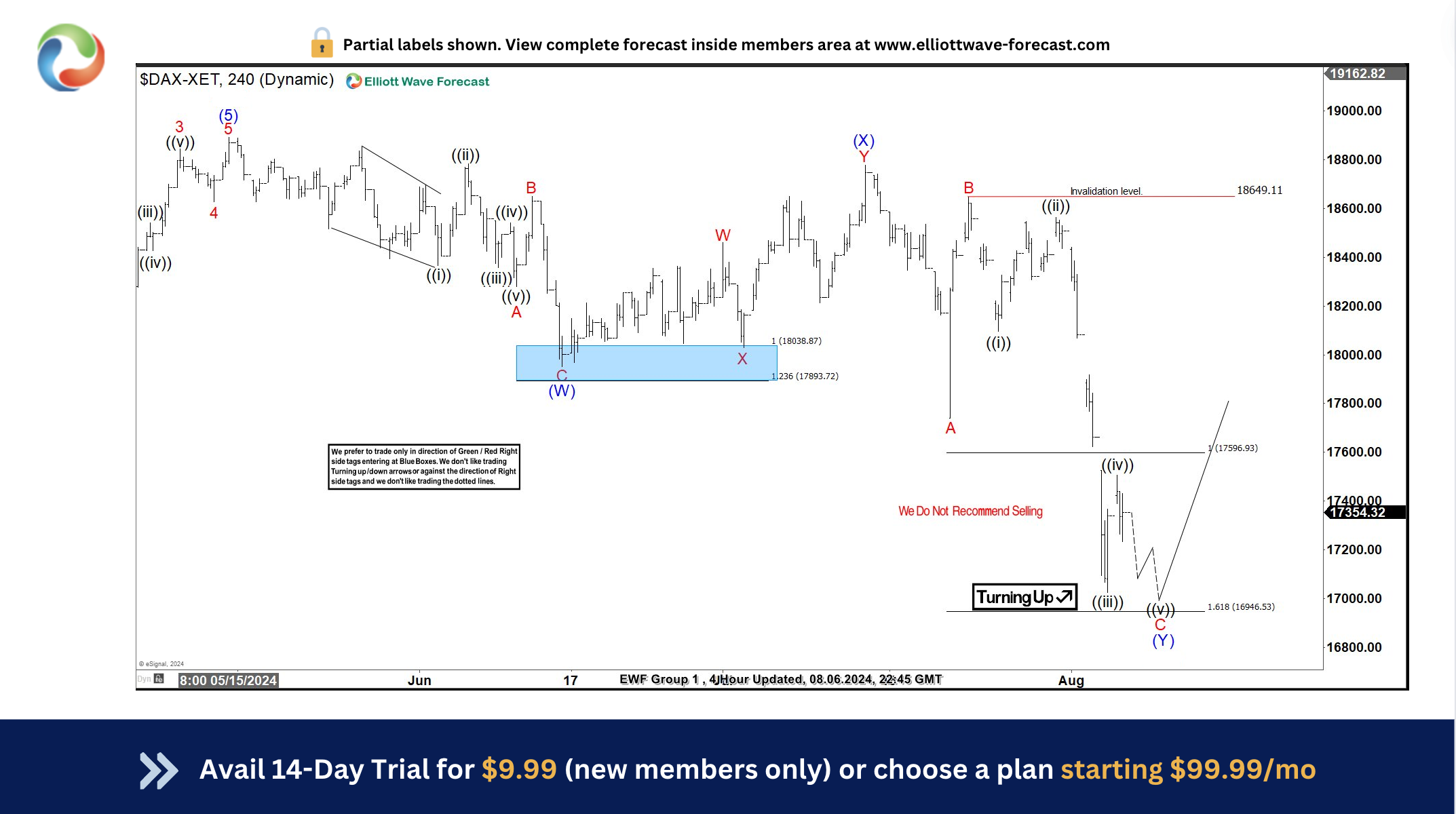

DAX Provided Very Good Buying Opportunity At The Extreme Area

Read MoreIn this blog, we take a look at the past performance of DAX charts. In which, the DAX provided very good buying opportunity at the extreme area.

-

Elliott Wave Update on Gold Miners Junior (GDXJ)

Read MoreThe VanEck Junior Gold Miners ETF (GDXJ) is an exchange-traded fund that aims to replicate the performance of the Junior Gold Miners. This index tracks small-cap companies primarily involved in gold and silver mining. Launched on November 11, 2009, GDXJ offers investors exposure to a diversified portfolio of junior miners, which are often in the […]