The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

$EURGBP 1 Hour Elliott Wave Analysis Mar.10.2014

Read MorePreferred view is that wave (( B )) low is in place at 0.8153 and pair has turned higher as expected. Short-term, expect a test of 0.8380 – 0.8398 region to complete wave A after which pair should pull back in wave B in 3, 7 or 11 swings and continue higher. We don’t like […]

-

$USDCHF holds 0.8931 for new lows

Read MoreUSDCHF is showing an 11 swing structure down from 0.9157 January high when 0.8931 was 2nd wave (( x )). As far as price stays below this level or pivot at this level keeps holding, we like more downside in the pair toward 0.8642 – 0.8697 from where we should see a bigger recovery in […]

-

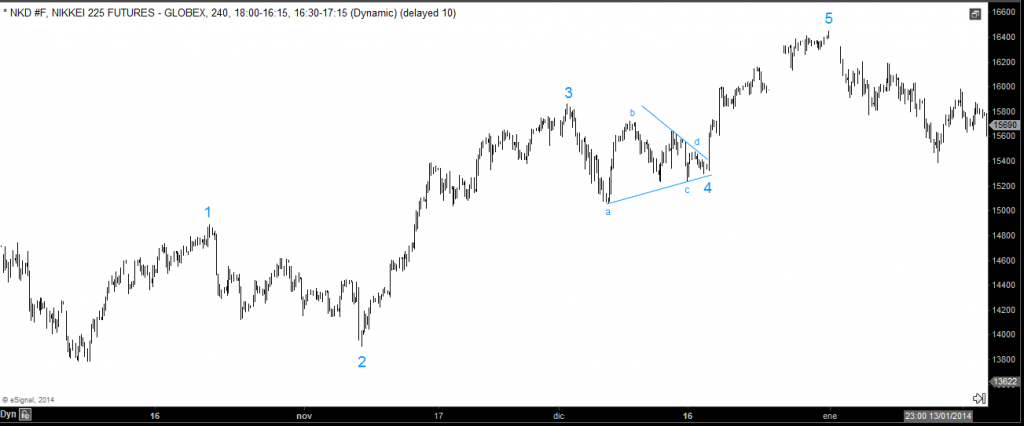

Triangle as a Wave 4

Read MoreIn the Chartism you could find out triangles any where using two trendlines to fix the geometric form. But there are certain triangles that are not so important by type but location and these are displayed on a wave 4 of a Elliott wave impulse. If you have a well structured impulsive count and after […]

-

$USDCAD looking for 7th swing lower

Read MorePair is showing 5 swings down from 1.1195 peak which is not a diagonal and hence the structure / swing sequence is incomplete. We believe 6th swing is in place at 1.1117 and pair is trading lower in the 7th swings to complete the sequence. Drop from 1.1160 – 1.1034 was in 5 waves so […]