The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

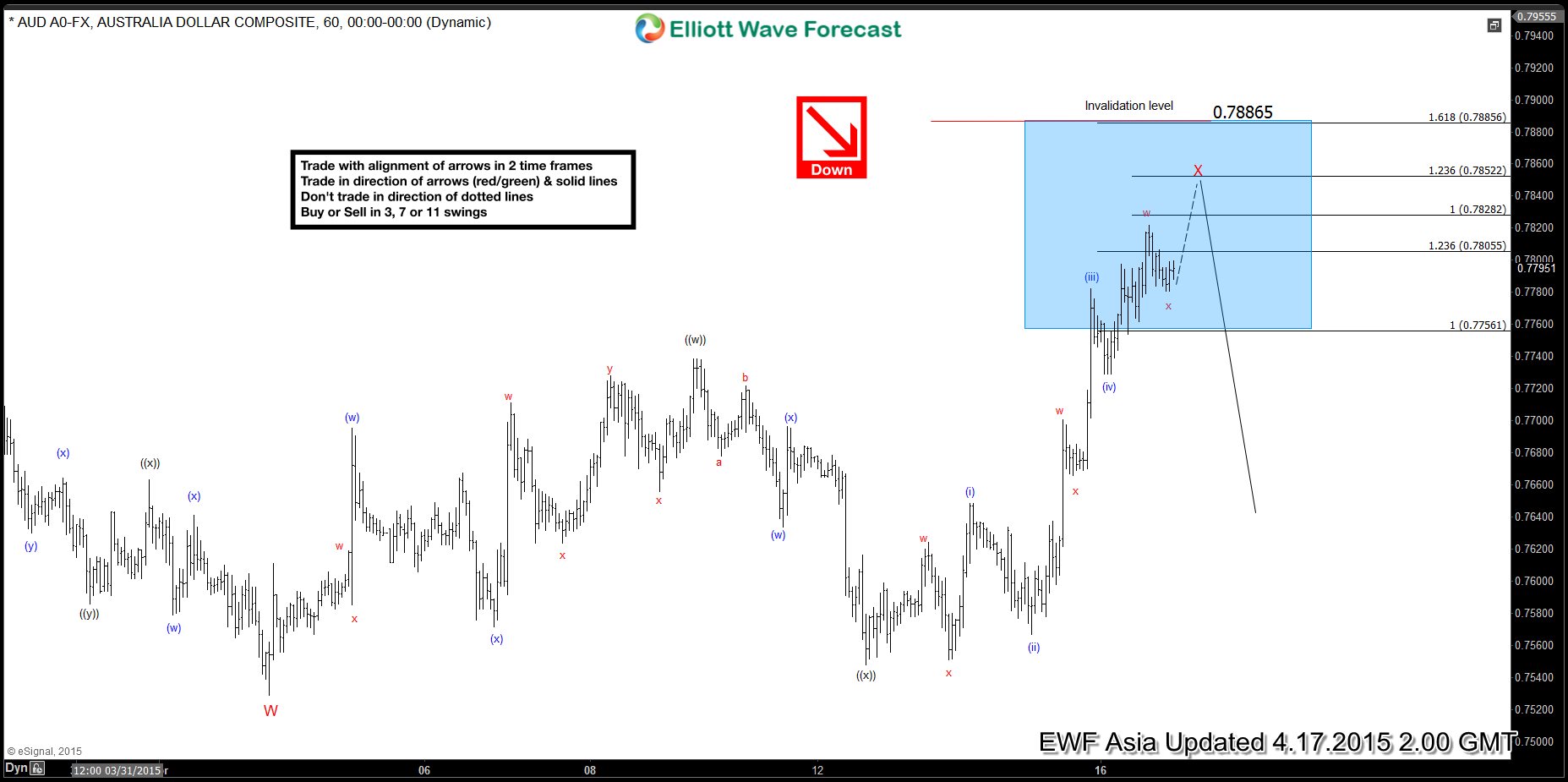

AUDUSD Short-term Elliott Wave Analysis 4.16.2015

Read MoreOur preferred Elliott wave suggest AUDUSD downtrend is mature in the higher time frames but mid-term cycles still remain bearish against 3/24 (0.7937) high. Decline from 0.7937 – 0.7529 took the form of triple three structure and completed wave “W”. Wave “X” bounce is in progress and has already reached 1.236 ext of ((w))-((x)) at […]

-

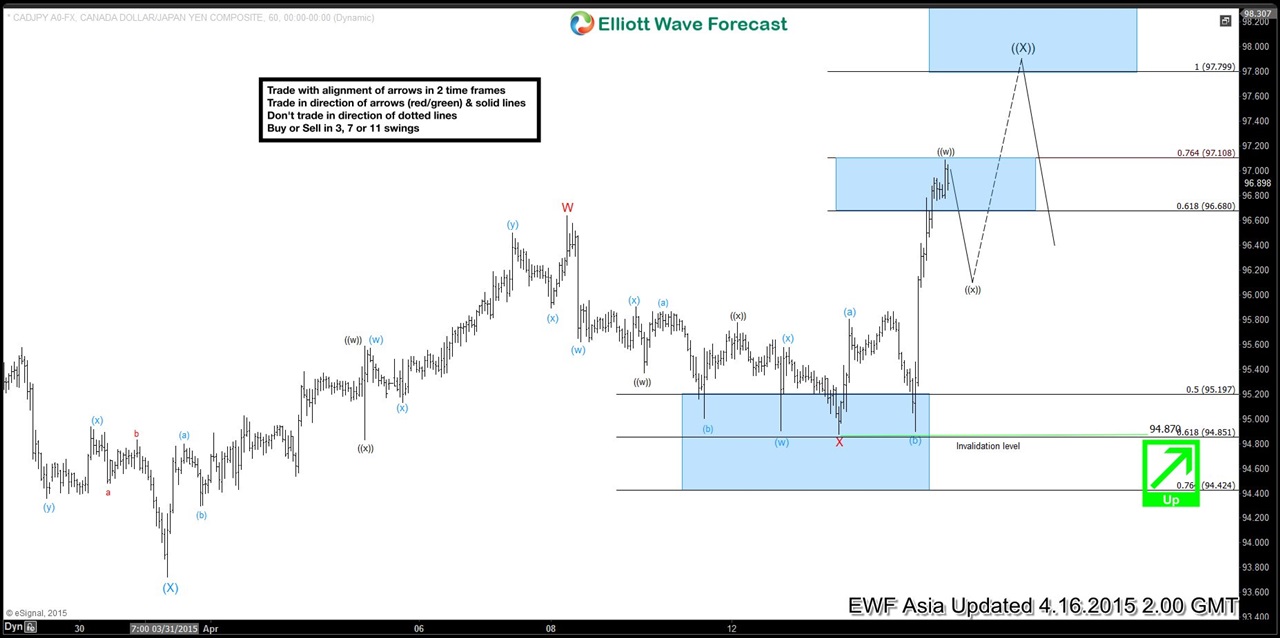

CADJPY Short-term Elliott Wave Analysis 4.15.2015

Read MoreWe can see 3 swings rally from wave (X) low at 3/31 with the first leg red wave W, the second leg red wave X, and the pair is currently finishing the third leg towards equal leg 97.79 – 98.5. Short term, the pair can see a pullback in wave ((x)). The pullback can reach as […]

-

CADJPY Ending a cycle from 1.30.2015

Read MorePair has rallied in 3 swings from wave (X) low at 3/31 with the first leg red wave W, the second leg red wave X, and the pair is currently finishing the third leg towards 97.79 – 98.5 equal leg area. Short term, the pair can see a pullback in wave ((x)), and the pullback can reach […]

-

EURAUD Short-term Elliott Wave Analysis 4.15.2015

Read MorePreferred Elliott wave view suggests EURAUD cycles remain bearish against 6th April high (1.4447). Decline from 1.4447 – 1.3753 was a double three Elliott wave structure i.e. (w)-(x)-(y) when wave (w) completed at 1.4118, wave (x) completed at 1.4221 and wave (y) completed at 1.3753 making a higher degree wave ((w)). Pair is currently in […]