The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

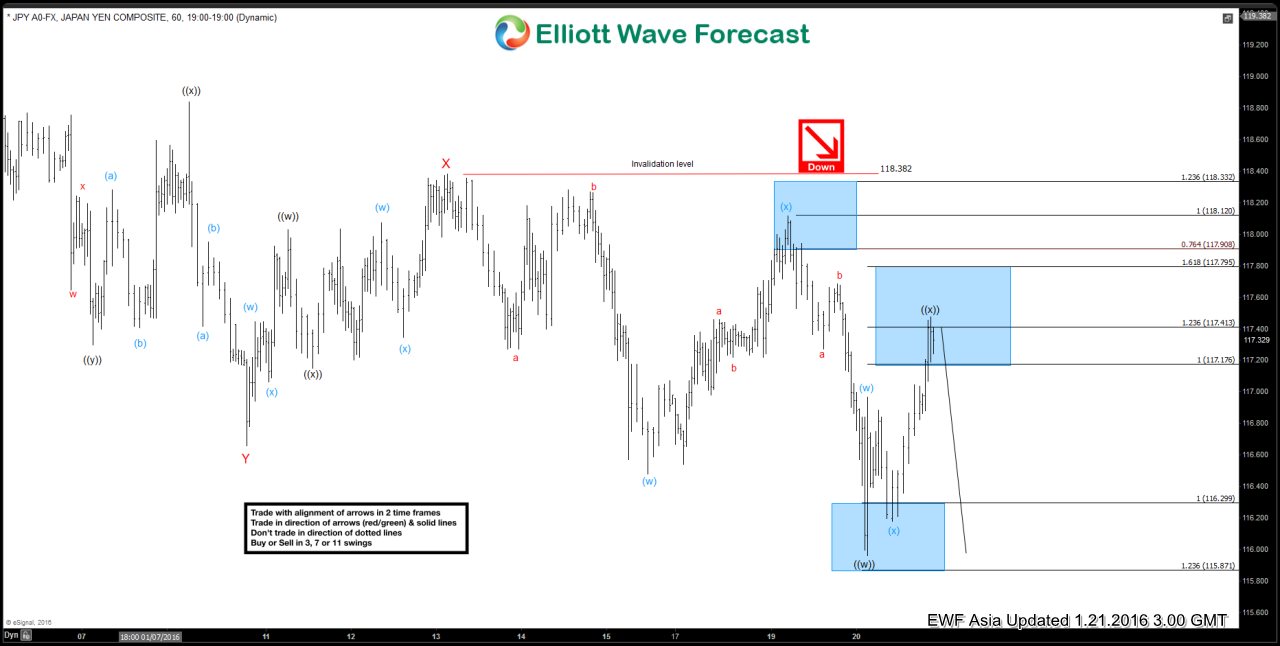

$USDJPY Short Term Elliott Wave Analysis 01.21.2016

Read MoreShort term Elliott Wave cycle suggests decline from wave X at 118.38 is unfolding in a double three structure where wave ((w)) ended at 115.96 and wave ((x)) bounce is proposed complete at 117.48. While below 117.48, but more importantly as far as 118.38 pivot stays intact, pair is expected to resume lower in wave ((y)) towards […]

-

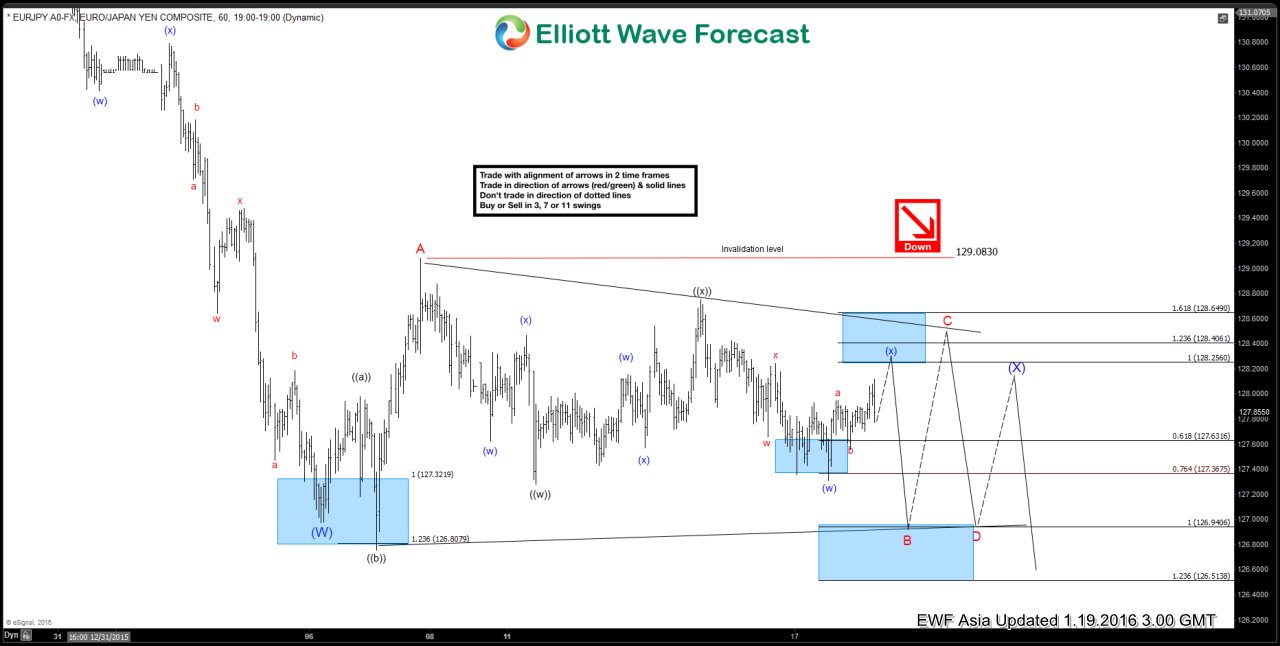

$EURJPY Short Term Elliott Wave Analysis 01.20.2016

Read MoreShort term Elliott Wave cycle suggests cycle from 12/4 peak at 134.58 remains alive as a double three where wave (W) ended at 127 and wave (X) bounce is in progress as a triangle. Wave A of (X) in the triangle is proposed complete at 129.08, and as far as bounces stay below this level, the triangle idea remains […]

-

$EURJPY Short Term Elliott Wave Analysis 01.19.2016

Read MoreShort term Elliott Wave cycle suggests cycle from 12/4 peak at 134.58 remains alive as a double three where wave (W) ended at 127 and wave (X) bounce is in progress as a triangle. Wave A of (X) in the triangle is proposed complete at 129.08, and as far bounces stay below this level, the triangle idea remains valid […]

-

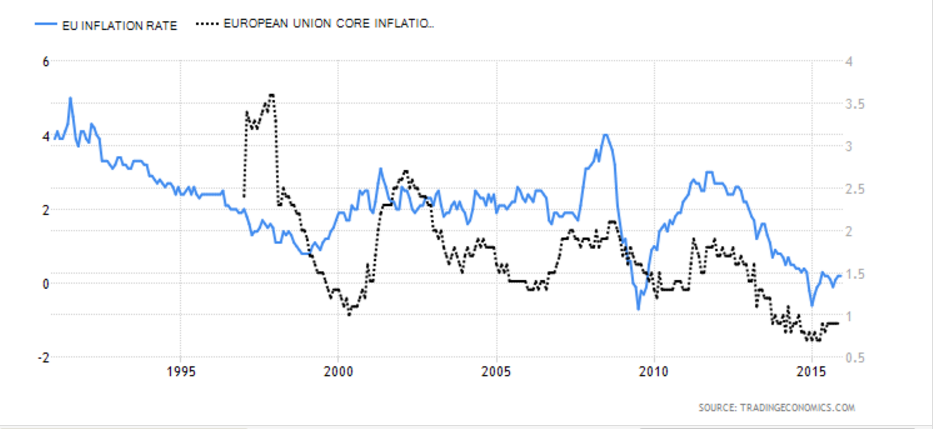

Where is Euro going next?

Read MoreThe combination of commodity selloff, prospect for more U.S. Dollar interest rate hikes, and Emerging Market capital outflow has put pressure in risky assets to start 2016. In this environment, USD performance is mixed: rising against commodity-linked and Emerging Market currencies, but not doing as well against Developed Market surplus currencies. Current dynamics in fact […]