The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

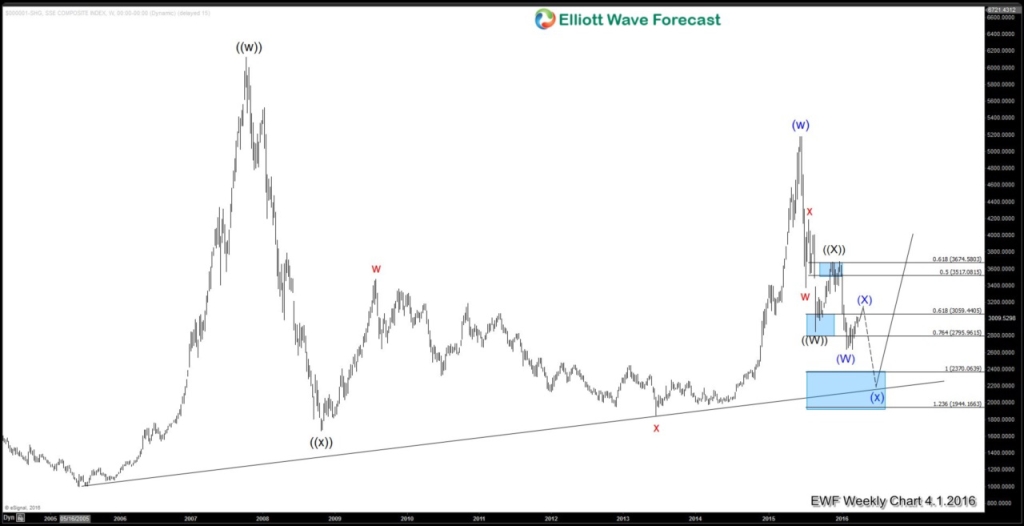

Revisiting Shanghai Index for the Path of Global Indices

Read MoreLast year, in our video dated November 2, 2015 we warned our viewers that the Chinese stock market still has more downside to go. We argued that Shanghai Composite Index may retest the 2008 low towards 1944 – 2370 area. The forecast proved accurate and the Chinese stock market resumed a strong selloff in the first one and half months in 2016. The […]

-

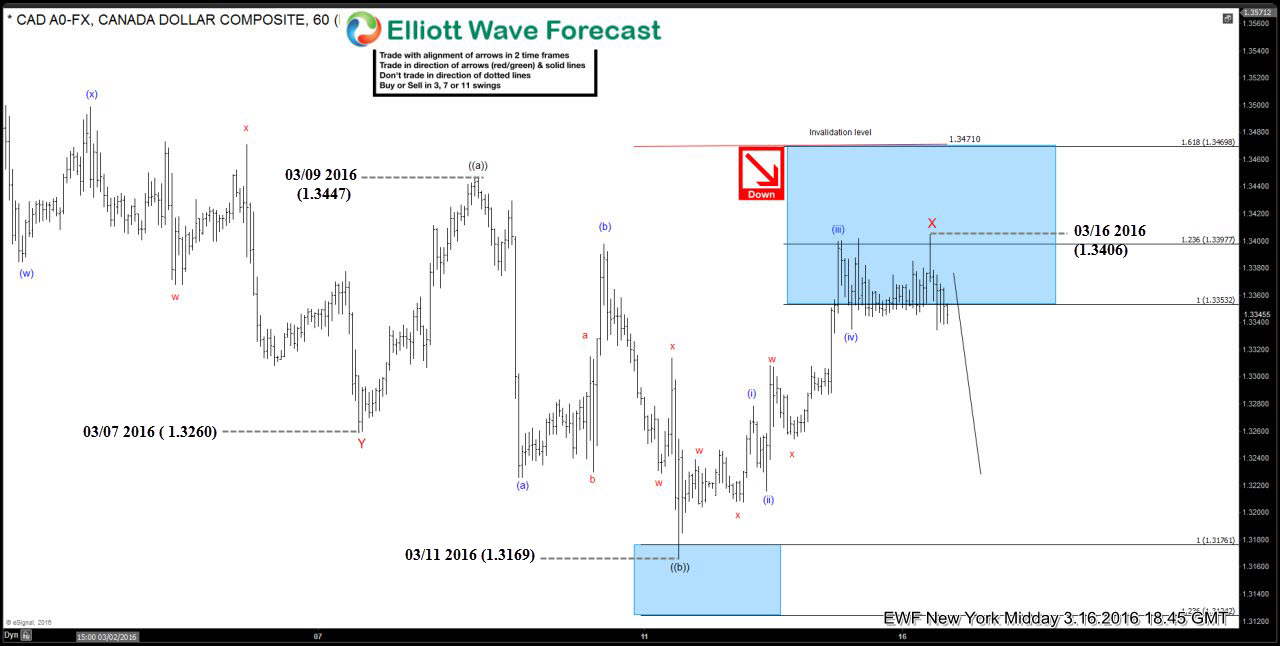

Elliott Wave Quiz: Could you recognize the structure ?

Read MoreLately we were doing a lot of educational blogs, explaining various Elliott Wave Patterns through real Market examples. Now we invite you to take this short Quiz in order to test your Elliott Wave knowledge. $USDCAD chart below shows our forecast from 16. March 2016 .It’s calling x red connector completed at 1.3347 and suggesting further […]

-

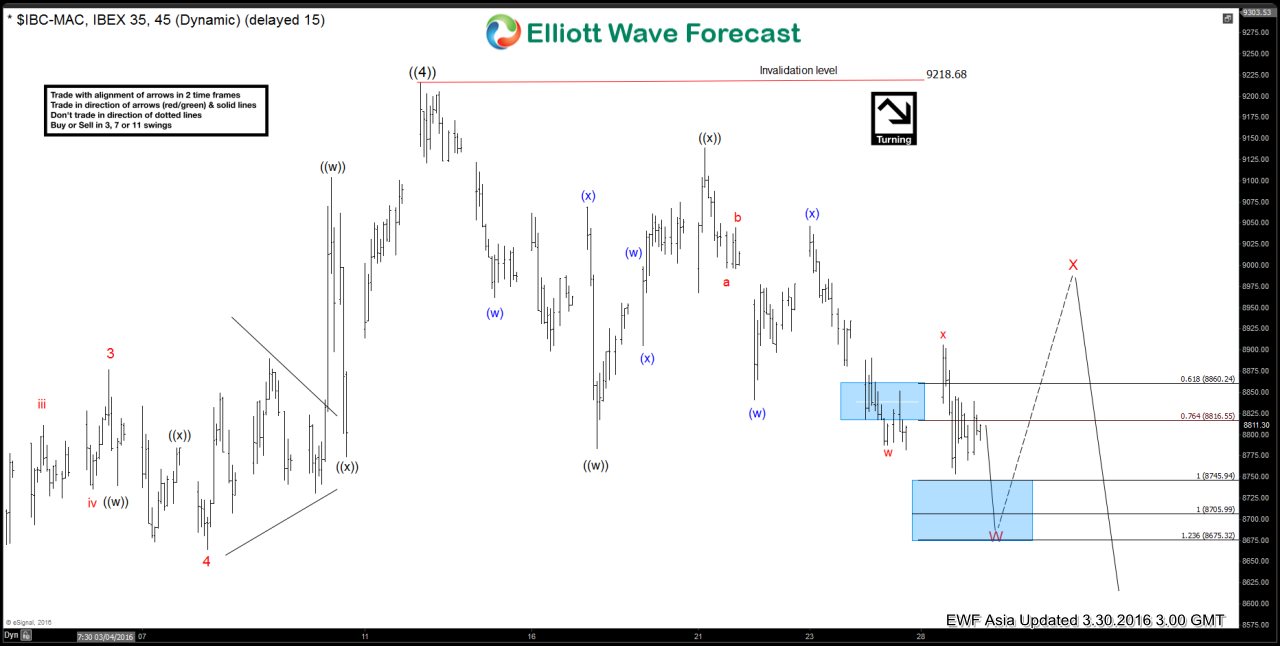

IBEX Short-term Elliott Wave Analysis 3.31.2016

Read MoreShort term Elliottwave structure suggests rally to 9218.68 ended wave ((4)) and the Index has resumed lower. Down from 9218.68, wave W ended at 8753. Wave X bounce is currently in progress as a double correction where wave ((w)) ended at 8960.7, and while wave ((x)) pullback stays above 8753, the Index has scope to do […]

-

IBEX Short-term Elliott Wave Analysis 3.30.2016

Read MoreShort term Elliottwave structure suggests rally to 9218.68 ended wave ((4)) and the Index has resumed lower. Wave W decline from 9218.68 is unfolding as a double correction where wave ((w)) ended at 8783.4, wave ((x)) ended at 9138.8, and wave ((y)) of W is in progress towards 8675.32 – 8745.94 area. Once wave W is complete, […]