The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

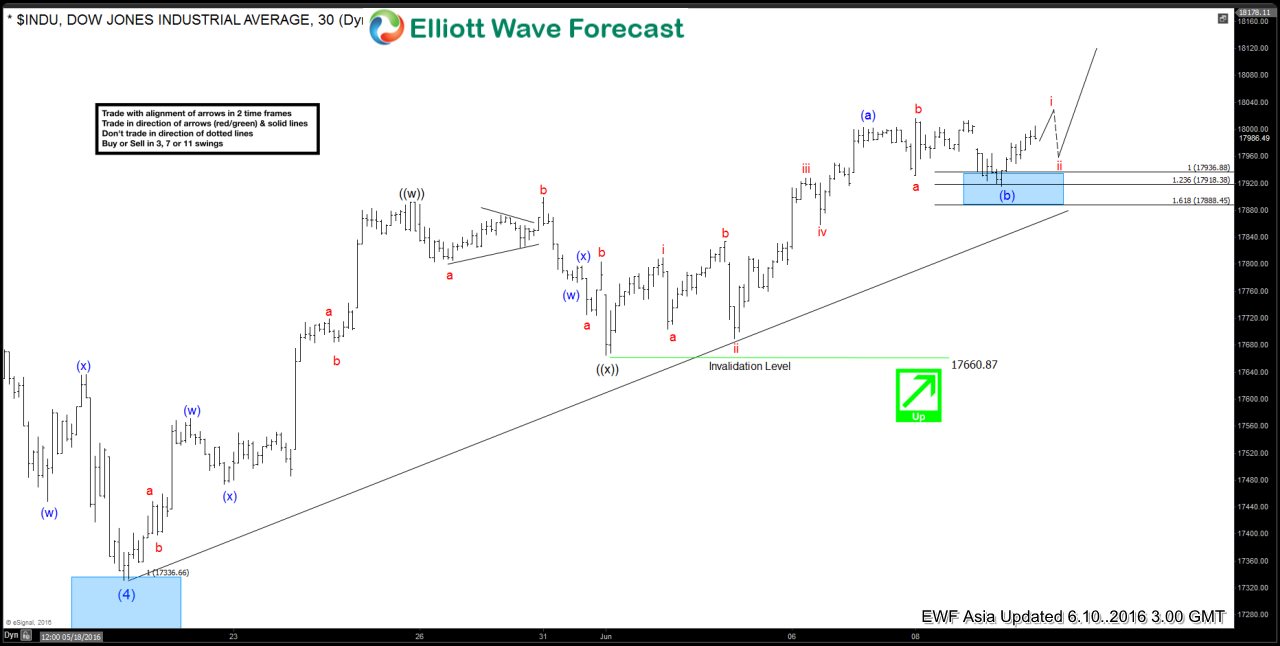

Dow Jones $DJIA Short-term Elliott Wave Analysis 6.10.2016

Read MoreShort Term Elliottwave structure suggests that dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three where wave ((w)) ended at 17891.6 and wave ((x)) ended at 17660.87. Internal of wave ((y)) is unfolding as a zigzag where wave (a) ended at 18003 and wave (b) is proposed complete at 17915. A break […]

-

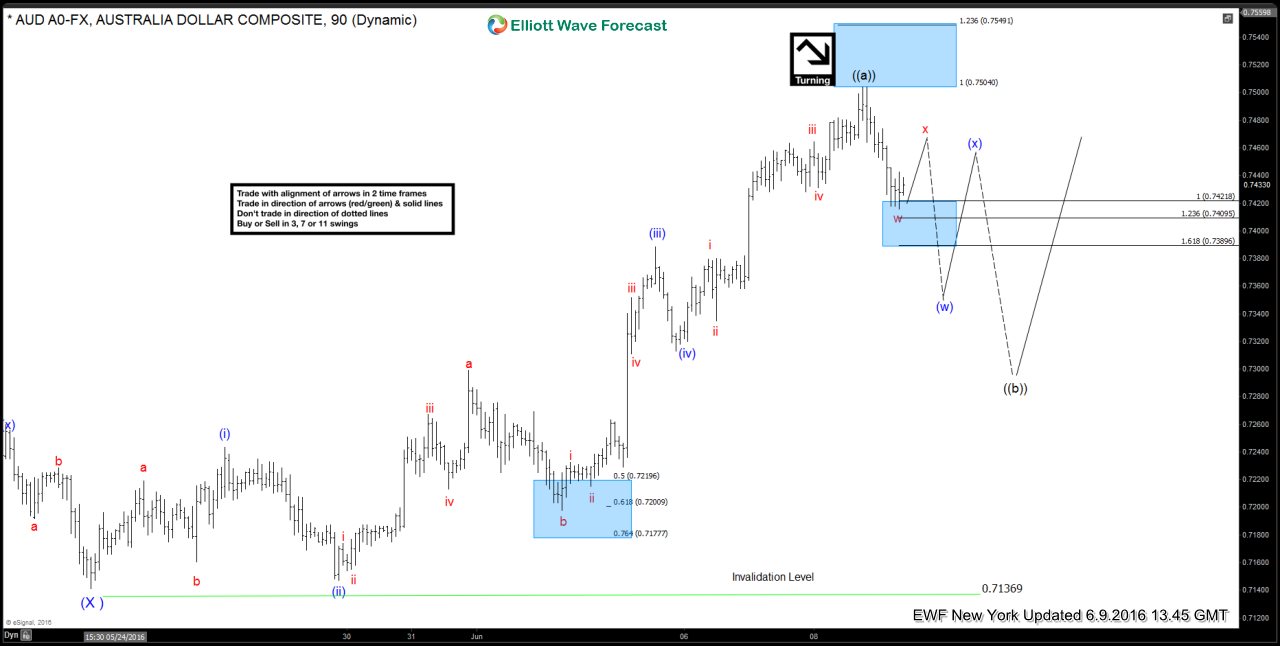

$AUDUSD Live Trading Room – Trade Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. Trading is […]

-

Dow Jones $DJIA Short-term Elliott Wave Analysis 6.9.2016

Read MoreShort Term Elliottwave structure suggests that dip to 17331.07 ended wave (4). Rally from there is unfolding as a double three where wave ((w)) ended at 17891.6 and wave ((x)) ended at 17660.87 on 6/1. From 6/1 low, pair then continues to rally higher as a 5 waves diagonal. There’s enough number of swing to call wave (a) completed although a marginal […]

-

NFP Number: Good or Bad. EURUSD doesn’t care

Read MoreThe surprisingly weak employment report takes a walk of June rate table and the chances of a motion at the next meeting July also fell sharply. The USA created only 38,000 new jobs in May, well below the forecast of an increase of 155,000. Is the smallest number of jobs added monthly work in almost […]