The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

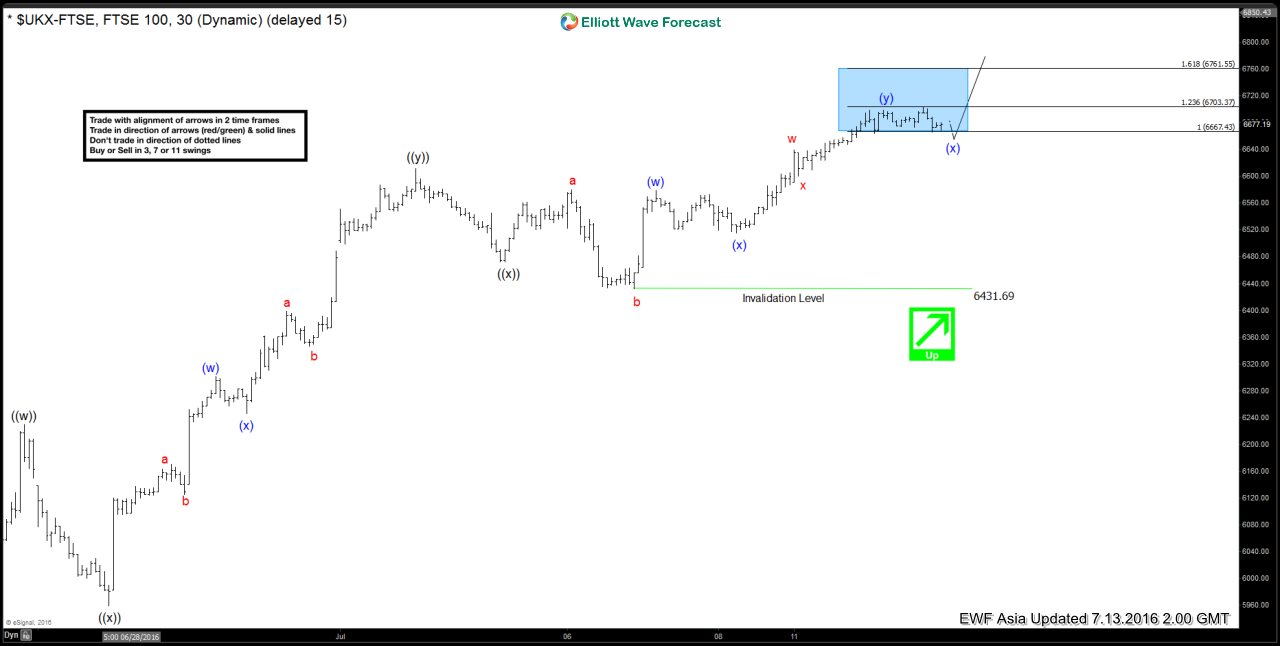

$FTSE Short-term Elliott Wave Analysis 7.14.2016

Read MoreShort term Elliottwave structure suggests rally from 7/8 low is unfolding as a triple three where wave (w) ended at 6579.25, wave (x) ended at 6515.24, wave (y) ended at 6698.54, and 2nd wave (x) ended at 6654.26. While pullback stays above 6654.26, Index is expected to extend 1 more leg higher towards 6810.46 – 6845.10 area before […]

-

$FTSE Short-term Elliott Wave Analysis 7.13.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X at 5788.7. Rally from there is unfolding as a triple three where wave ((w)) ended at 6229.18, wave ((x)) ended at 5958.66, wave ((y)) ended at 6612.13, and 2nd wave ((x)) ended at 6472.25. Near term, while 2nd wave (x) pullback stays above 6431.69, Index has scope to extend higher […]

-

$FTSE Short-term Elliott Wave Analysis 7.12.2016

Read MoreShort term Elliottwave structure suggests Index ended wave X at 5788.7. Rally from there is unfolding as a triple three where wave ((w)) ended at 6229.18, wave ((x)) ended at 5958.66, wave ((y)) ended at 6612.13, and 2nd wave ((x)) ended at 6431.69. Near term, wave (w) is expected to complete at 6702.37 – 6760.55 area, then […]

-

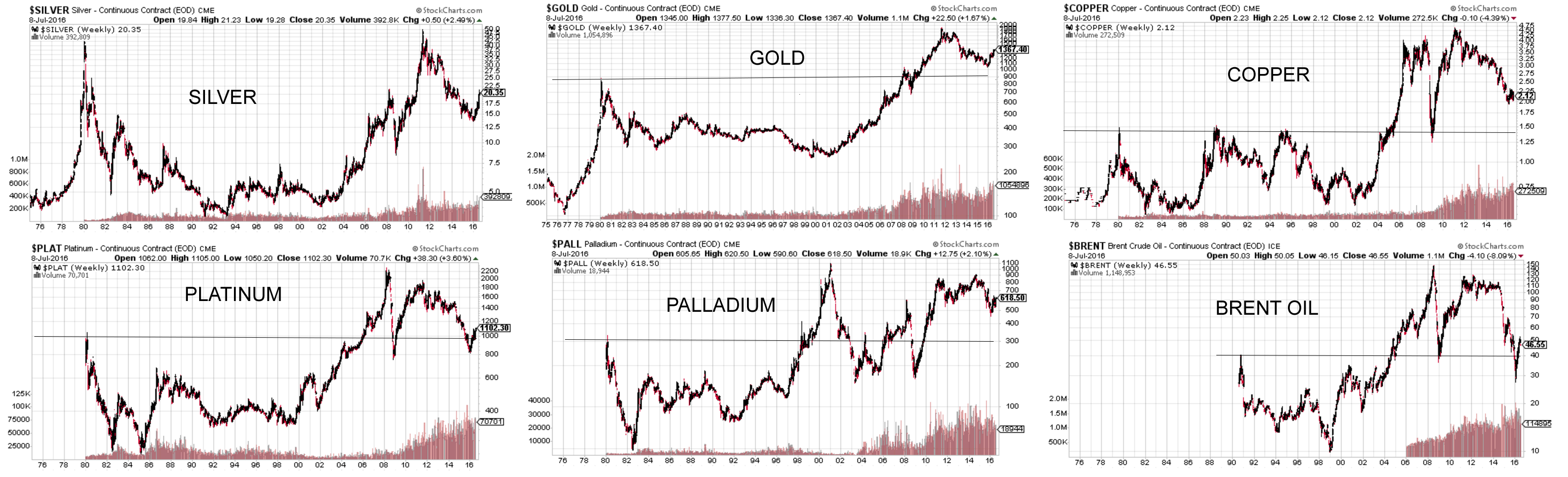

The Bullish Outlook for Silver: Is it the most undervalued metal?

Read MoreSilver’s Intrinsic Monetary Value Silver is a unique metal which belongs to the category of Precious Metal. Along with Gold, Silver has been used as money for thousands of years. It was the Roman Empire in 330 BCE who first used gold and silver in a widespread currency system. Under the Roman currency system, denarius is the name of a […]