The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

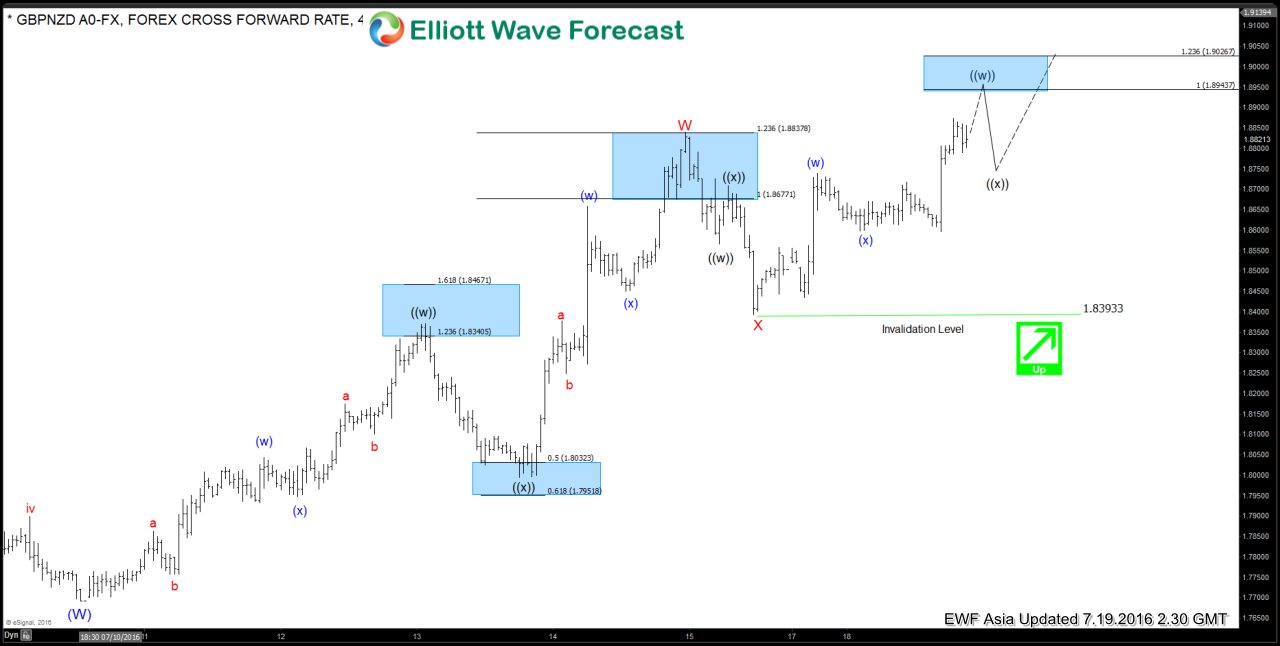

$GBPNZD Short-term Elliott Wave Analysis 7.19.2016

Read MoreShort term Elliottwave structure suggests cycle from 7/9 low is unfolding as a double three where wave W ended at 1.884 and wave X ended at 1.839. Rally from 1.839 is in progress as a double three where wave ((w)) is expected to complete at 1.894 – 1.9026 area, then it should pullback in wave ((x)) […]

-

Quantum Mechanics and Trading

Read MoreLet’s start by getting one thing straight: trading is not easy. There are so many pitfalls and traps that people create for themselves, even before they look at a chart. That’s right; most traders are setup to fail before even considering the validity of their system, or their style of trading. This is mainly because, […]

-

Reality vs Illusions: The case for $SPX short bias

Read MoreAs Humans, we tend to form a worldview about everything. For generations, many great individuals have fought wars and lost lives because they have a firm belief in a particular worldview. The same thing can be applied in trading. In the world of trading, we too tend to have particular view about the direction of the market. However, as […]

-

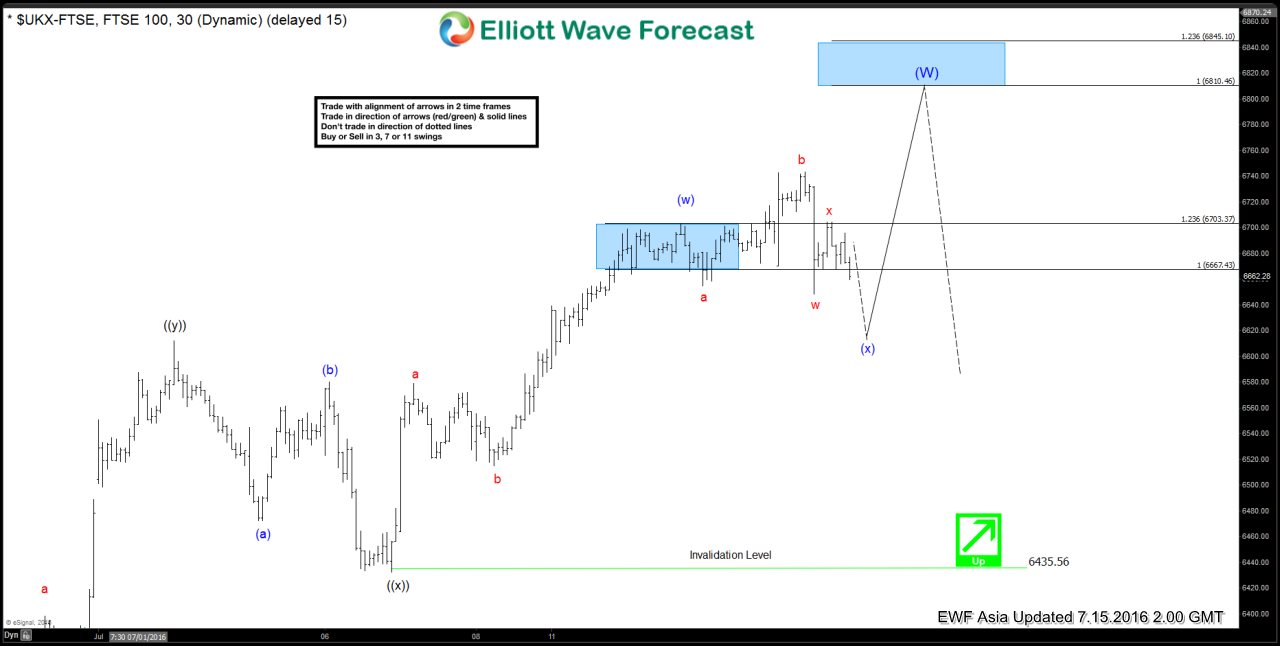

$FTSE Short-term Elliott Wave Analysis 7.15.2016

Read MoreShort term Elliottwave structure suggests rally from 7/6 low is unfolding as a double three where wave (w) ended at 6703.09 and wave (x) pullback is in progress towards 6587.2 – 6609.45 area before turning higher one more leg towards 6810.46 – 6845.1 area to complete wave (W) and end cycle from 2/11 low. Index has reached […]