The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

AUDJPY Short-term Elliott Wave Analysis 8.3.2016

Read MorePreferred Elliott wave count suggests that decline from wave X at 79.57 is unfolding as a triple three where wave ((w)) ended at 77.6, wave ((x)) ended at 79.51, wave ((y)) ended at 77.4 and second wave ((x)) ended at 78.18. Wave ((z)) is in progress with the internal unfolding as a double three where wave (w) […]

-

AUDJPY Short-term Elliott Wave Analysis 8.2.2016

Read MoreAUDJPY while below 78.18 the pair is expected lower toward 76.17-75.36 area to complete wave (X) & end the cycle from 7/15 & while the dip shows it will remain above the 6/23 cycle lows we expect the pair turns higher in wave (Y) of ((X))

-

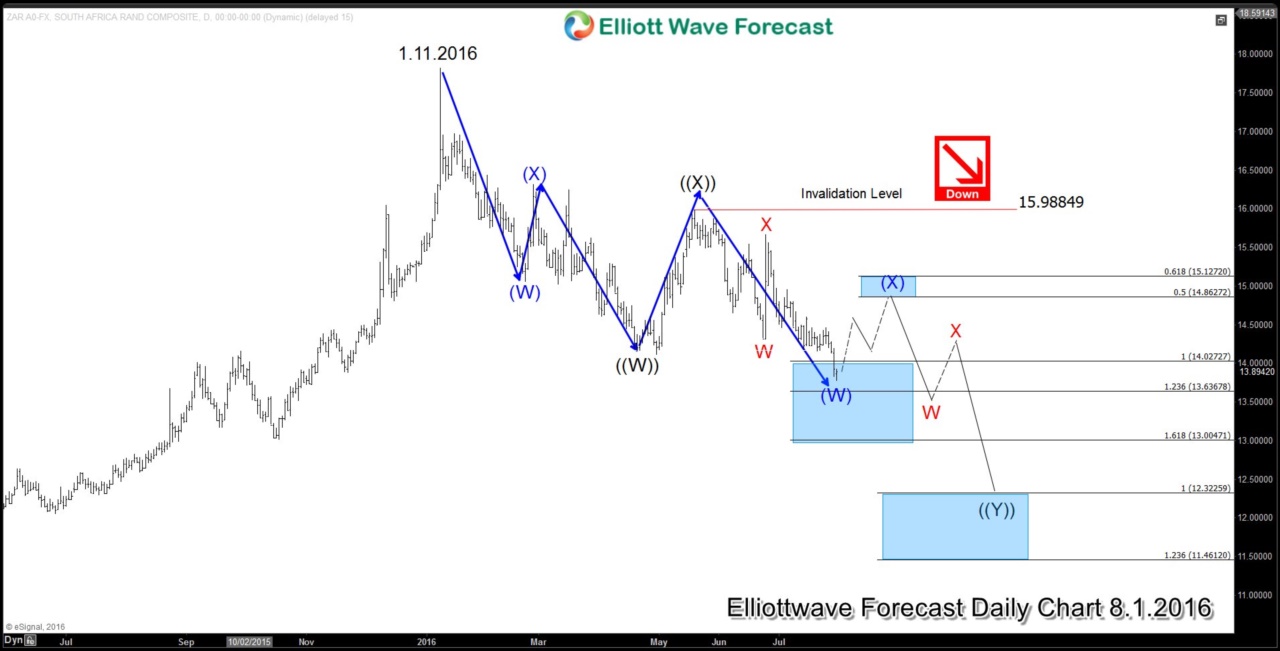

USDZAR may see more downside

Read MoreOne of the most common structures in today’s market is the double correction, or sometimes called WXY. A double correction WXY is called a double zigzag if the subdivision of the W and the Y is in an ABC zigzag. Below is the general structure of a 7 swing WXY As can be seen from the graph above, the […]

-

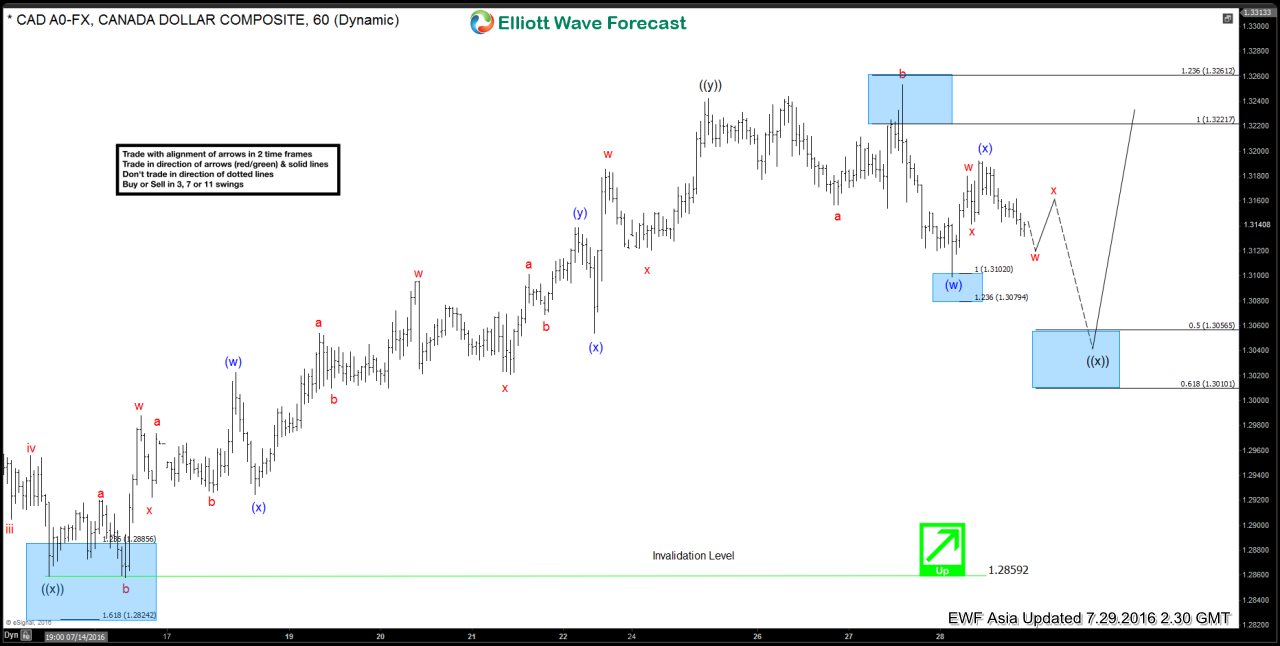

USDCAD Short-term Elliott Wave Analysis 7.29.2016

Read MorePreferred Elliott wave count suggests that move up from 1.2828 low is proposed to be unfolding as a triple three structure where wave ((w)) ended at 1.3139, wave ((x)) ended at 1.2859 and wave ((y)) ended at 1.3253. Second wave ((x)) pullback is in progress to correct the cycle from 7/15 (1.2859) low towards 1.301 – 1.3056 area before turning […]