The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

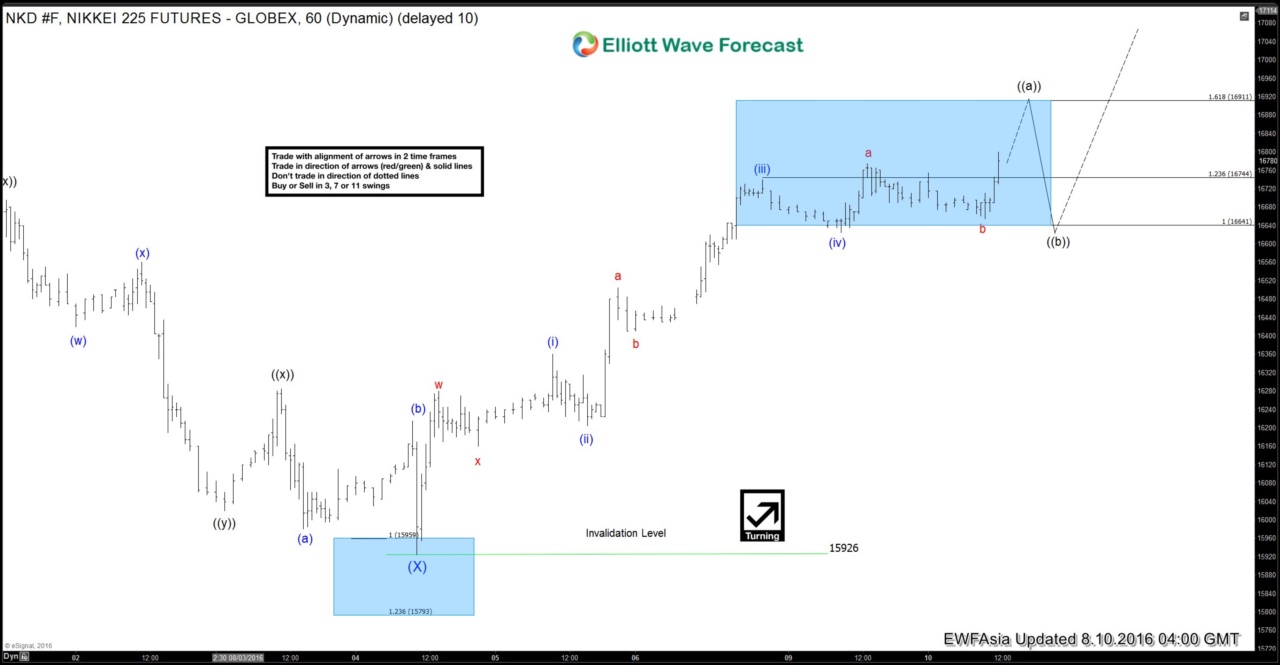

Nikkei Short-term Elliott Wave Analysis 8.10.2016

Read MorePreferred Elliott wave count suggests that dips to 15926 ended wave (X) and Index has started rally higher in the form of a zigzag structure where wave (v) of ((a)) is in progress and can reach as high as 16911, then it should pullback in wave ((b)) in 3, 7, or 11 swing to correct rally from 15926 […]

-

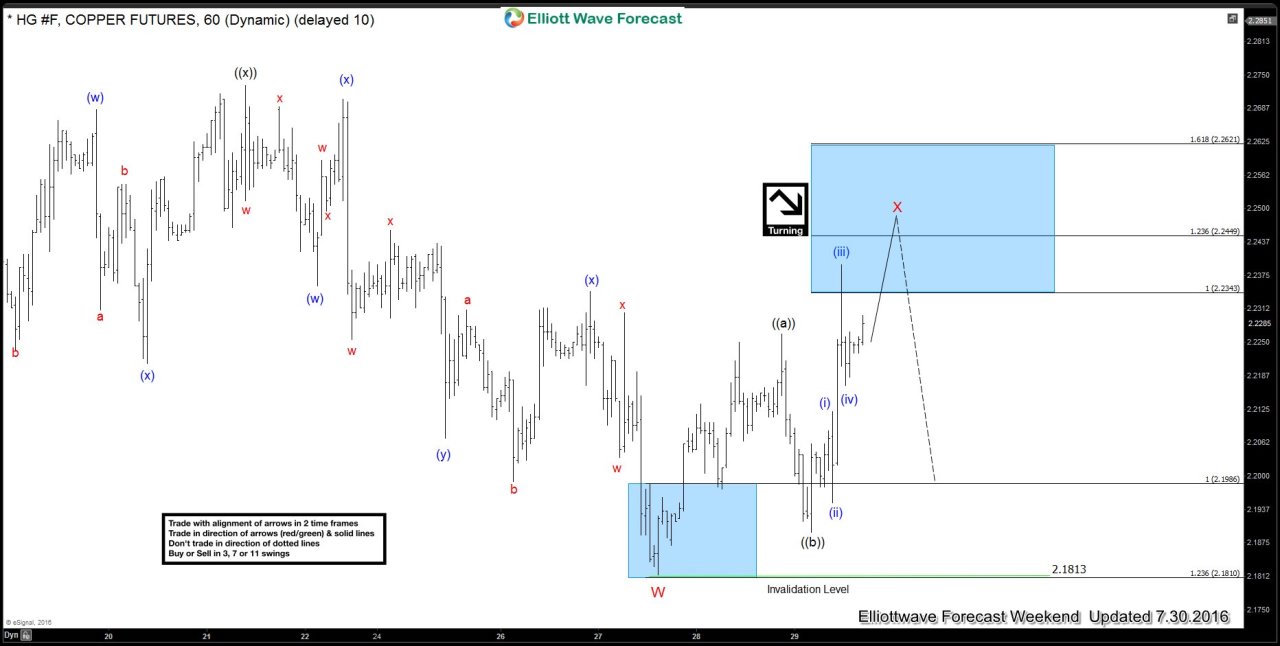

Elliottwaves forecasting the decline in Copper ( $HG #F)

Read MoreDuring the last days of July 2016 Copper Futures has been forming very interesting price patterns. Our Elliott Wave and Cycle analysis suggested the price has been correcting the decline from the 07/12 peak, looking for 2.233-2.260 area where sellers would be appear. Copper was proposed to reach the mentioned area and complete wave X […]

-

Nikkei Short-term Elliott Wave Analysis 8.9.2016

Read MorePreferred Elliott wave count suggests that dips to 15926 ended wave (X) and Index has started a rally higher in the form of a double three structure where wave ((w)) ended at 16740. While Index stays below there, expect the Index to pullback in wave ((x)) to correct the rally from 15926 in 3, 7, or 11 swing. Then, as far […]

-

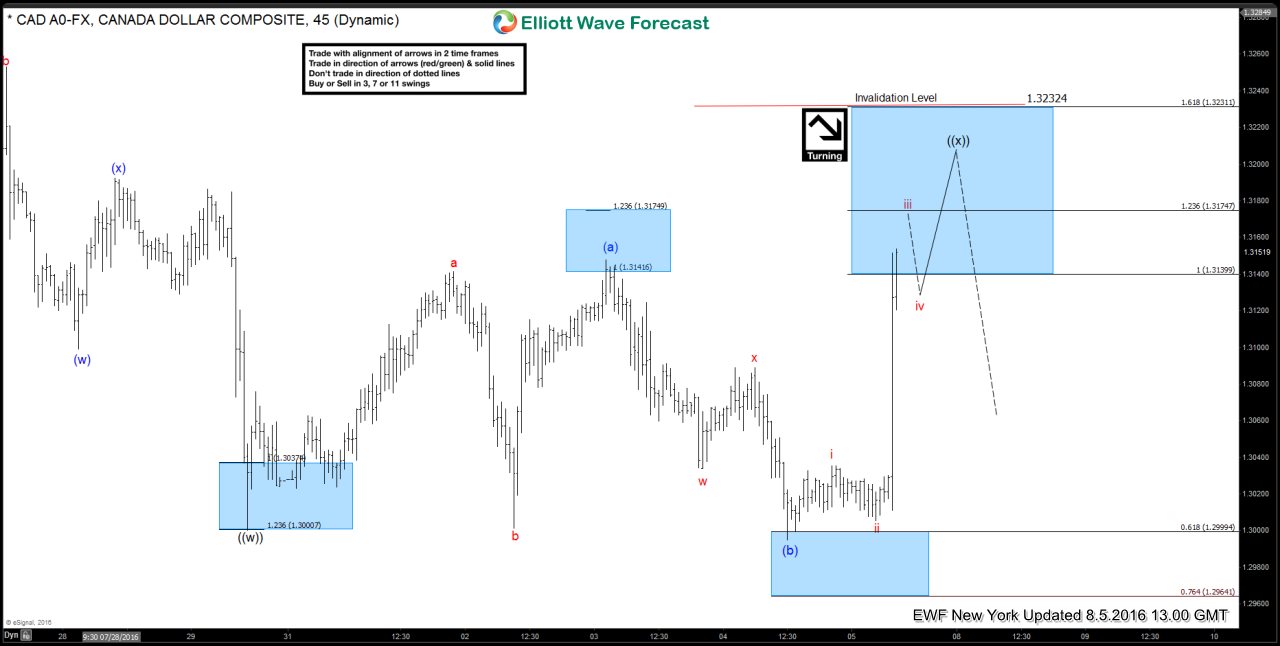

USDCAD Short-term Elliott Wave Analysis 8.5.2016

Read MorePreferred Elliott wave count suggests that rally to 1.324 ended wave W. Wave X pullback is in progress as a double three structure where wave ((w)) ended at 1.30, wave ((x)) is unfolding as as FLAT and should ideally fail below 1.3232 high for another push lower in wave ((y)) of X toward 1.2953 – […]