The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Nikkei $NKD Short-term Elliott Wave Analysis 9.28.2016

Read MoreShort term Elliott wave count suggests that rally to 17173 ended wave (W). Decline from there is unfolding as a double three where wave W ended at 16300 and wave X bounce ended at 16883. Near term, while Index stays below wave ((x)) at 16605 and more importantly as far as pivot at 9/22 (16883) high stays intact, expect Index […]

-

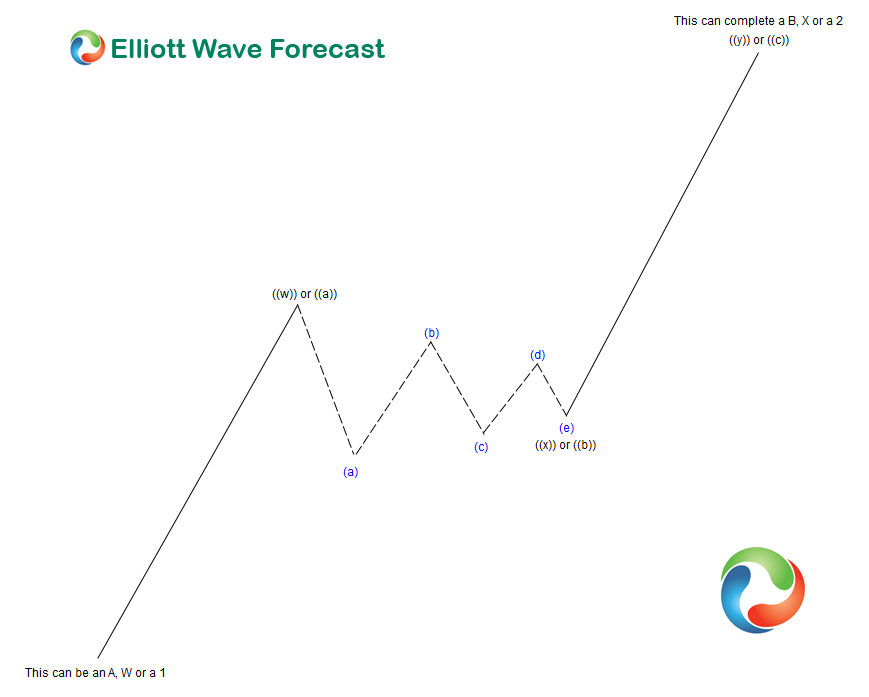

Elliott Wave Theory Structure : Double Three with a Contracting Triangle in the connector Wave B or X

Read MoreElliott Wave Theory Structure : Double Three with a Contracting Triangle in the connector Wave B or X As mentioned here before double three structures are common to see in the market and as it has been pointed out before they can also be the Elliott wave formation that a particular market instrument is trending […]

-

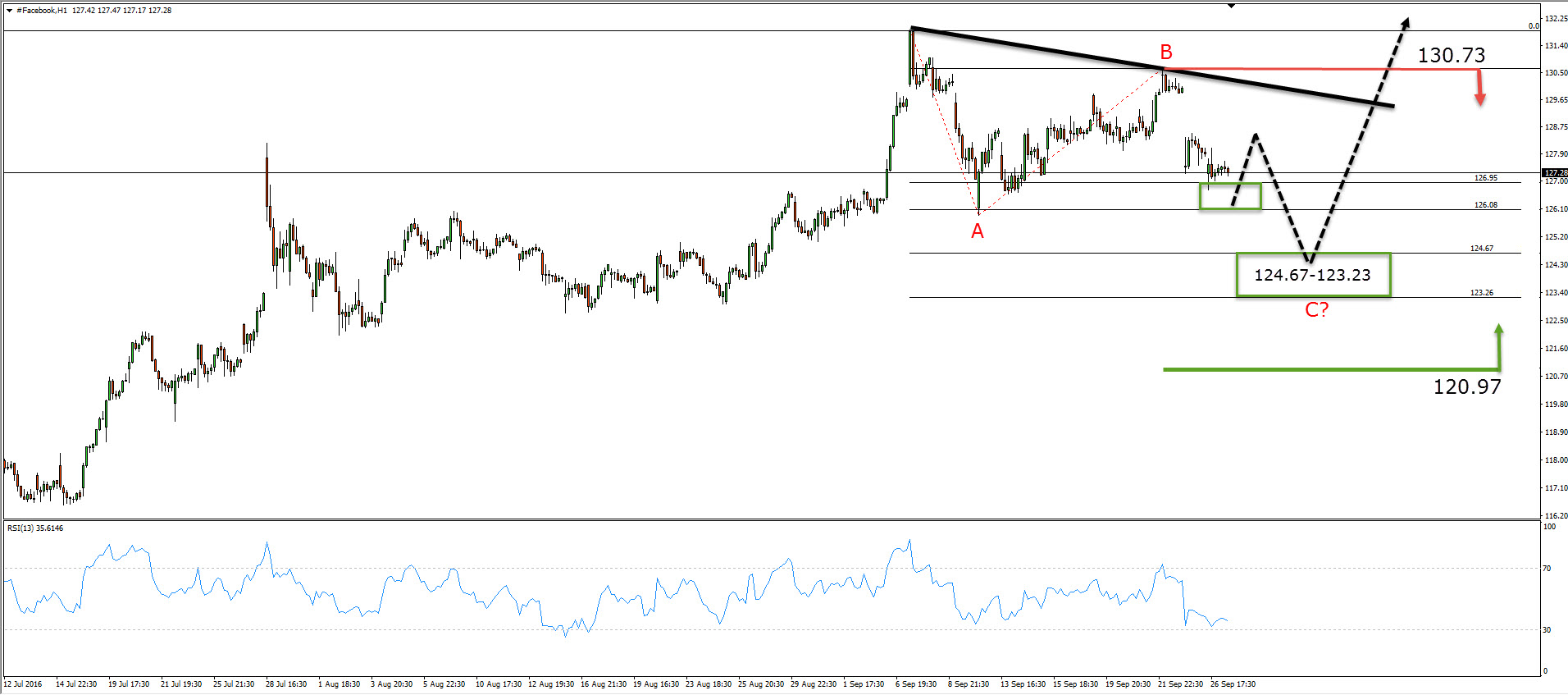

Anyone making money trading Facebook Inc ?

Read MoreFacebook was founded on February 4, 2004, by Mark Zuckerberg, along with his fellow students from the Harvard College. At the beginning it was intended for the site to be used only by Hardvard students, however it gradually allowed anyone of age 13 or above to become a registered user. After holding its initial public […]

-

Nikkei $NKD Short-term Elliott Wave Analysis 9.27.2016

Read MoreShort term Elliott wave count suggests that rally to 17173 ended wave (W). Decline from there is unfolding as a double three where wave W ended at 16300 and wave X bounce ended at 16880. Near term, Index is correcting cycle from 9/22 (16880) with potential target of 16542 – 16720 area, then as far as pivot at 16880 stays intact, expect […]