The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

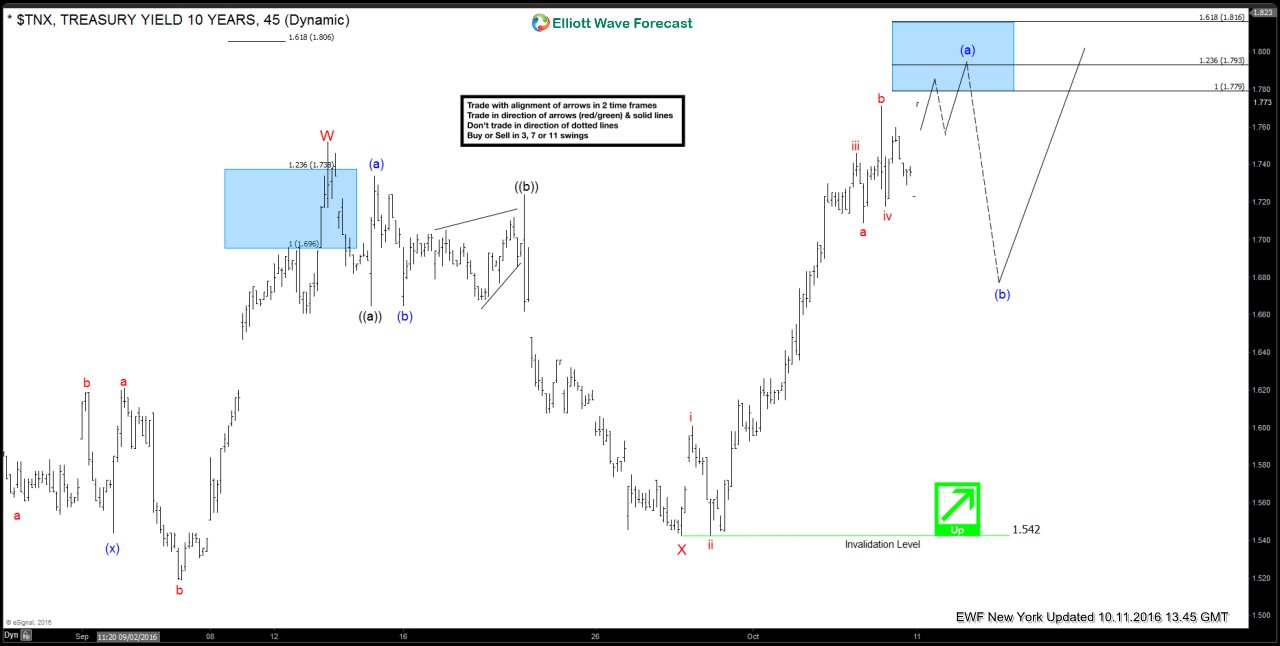

$TNX (10 Year Yields) Short-term Elliott Wave Analysis 10.11.2016

Read MoreShort term Elliott wave count suggests that pullback to 1.542 at 9/28 ended wave X. The rally from there looks to be unfolding as a 5 wave move and could complete in 1.779 – 1.816 area. Afterwards, it would need to break below the red wave iv low at 1.718 to confirm wave (a) completed and wave […]

-

TWTR (Twitter Inc) close to a bounce ?

Read MoreThe company was founded in 2006, Twitter is a social media platform that allows its users to post their thoughts in 140 characters or less, known as tweets. Twitter also allows users to broadcast and live-stream videos through its Vine and Periscope mobile applications. The company’s promoted products including promoted tweets, accounts, and trends help advertisers to […]

-

$GBPAUD Elliott Waves: Forecasting The Decline

Read MoreHello fellow traders, the video below is short capture from the London Live Analysis session held on 10/04 by EWF Senior Analyst Daud Bhatti. Back then, Daud presented Elliott Wave count of $GPBAUD, suggesting further decline due to a fact the pair was showing incomplete bearish swings sequences in the cycle from the September peak. […]

-

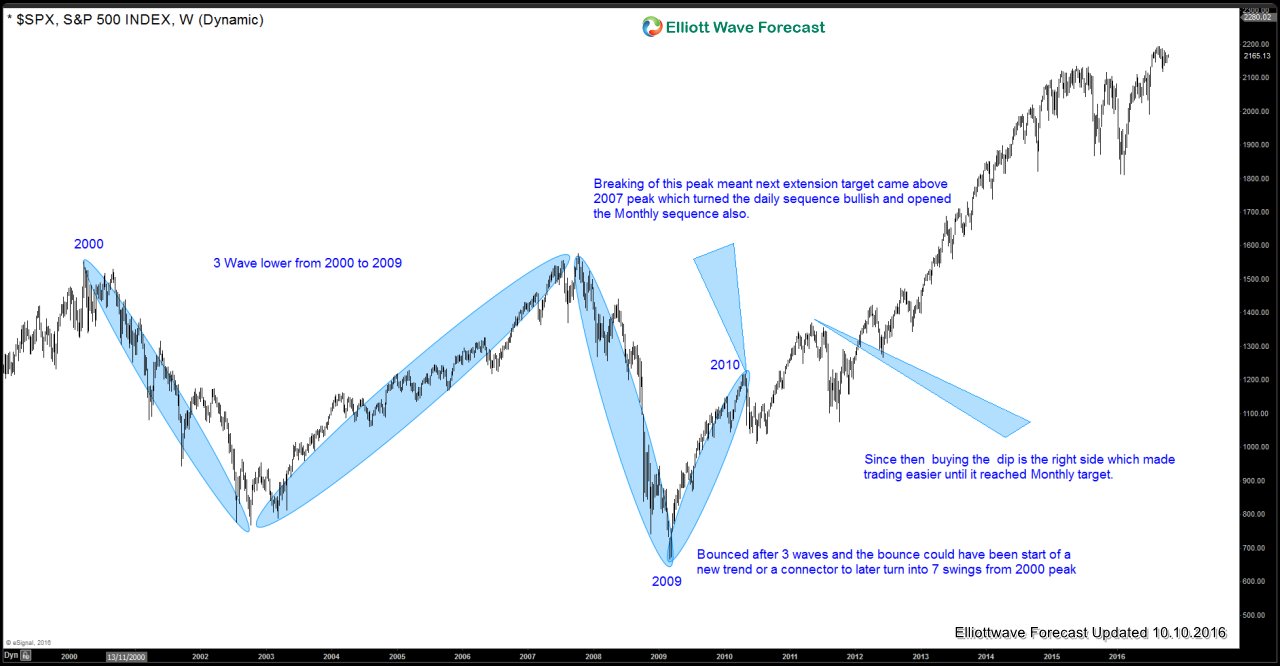

The Art of Trading

Read MoreThe Art of trading: Using Elliott wave as a compass Many years have passed since the creation of markets, trading and since the introduction of the Elliott wave Theory. The Reality is that for years traders have been trying the best way to get money out of the Market, which sometimes is easier than others. Trading, […]