The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

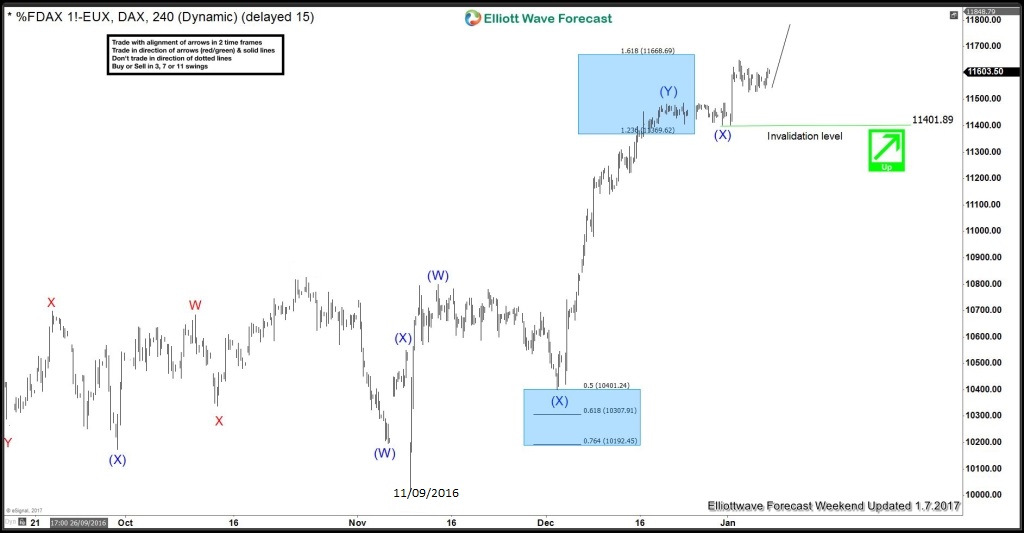

Elliott Wave Analysis: DAX

Read MoreIn this technical blog, let’s take a look at the $DAX instrument Elliott wave forecast we had since the beginning of 2017. Below is the $DAX 1/07/2017, 4 hr weekend updated chart suggesting the rally in DAX from 11/9/2016 is unfolding as a Elliott wave triple three structure (also known as 11 swing sequence), where […]

-

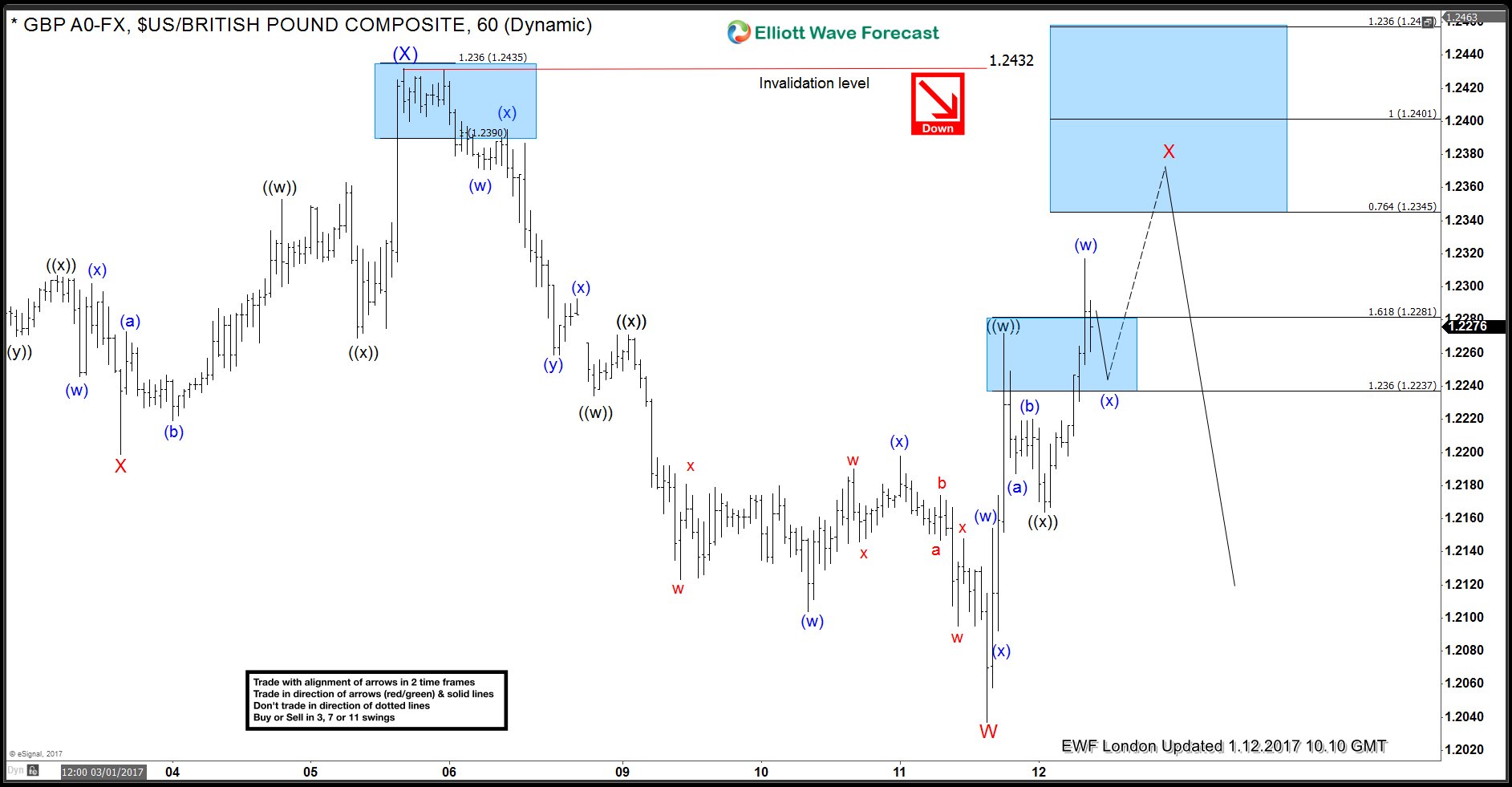

GBPUSD Elliott Wave Forecast 1.12.2017

Read MoreGBPUSD is showing a 5 swing bearish sequence from 12/6 peak (1.277) which favors more downside. The decline from 12/6 peak is unfolding as a double three where wave (W) ended at 1.2198 and wave (X) ended at 1.2432. GBPUSD has since broken below wave (W) at 1.2198 which suggests that the next leg Wave (Y) […]

-

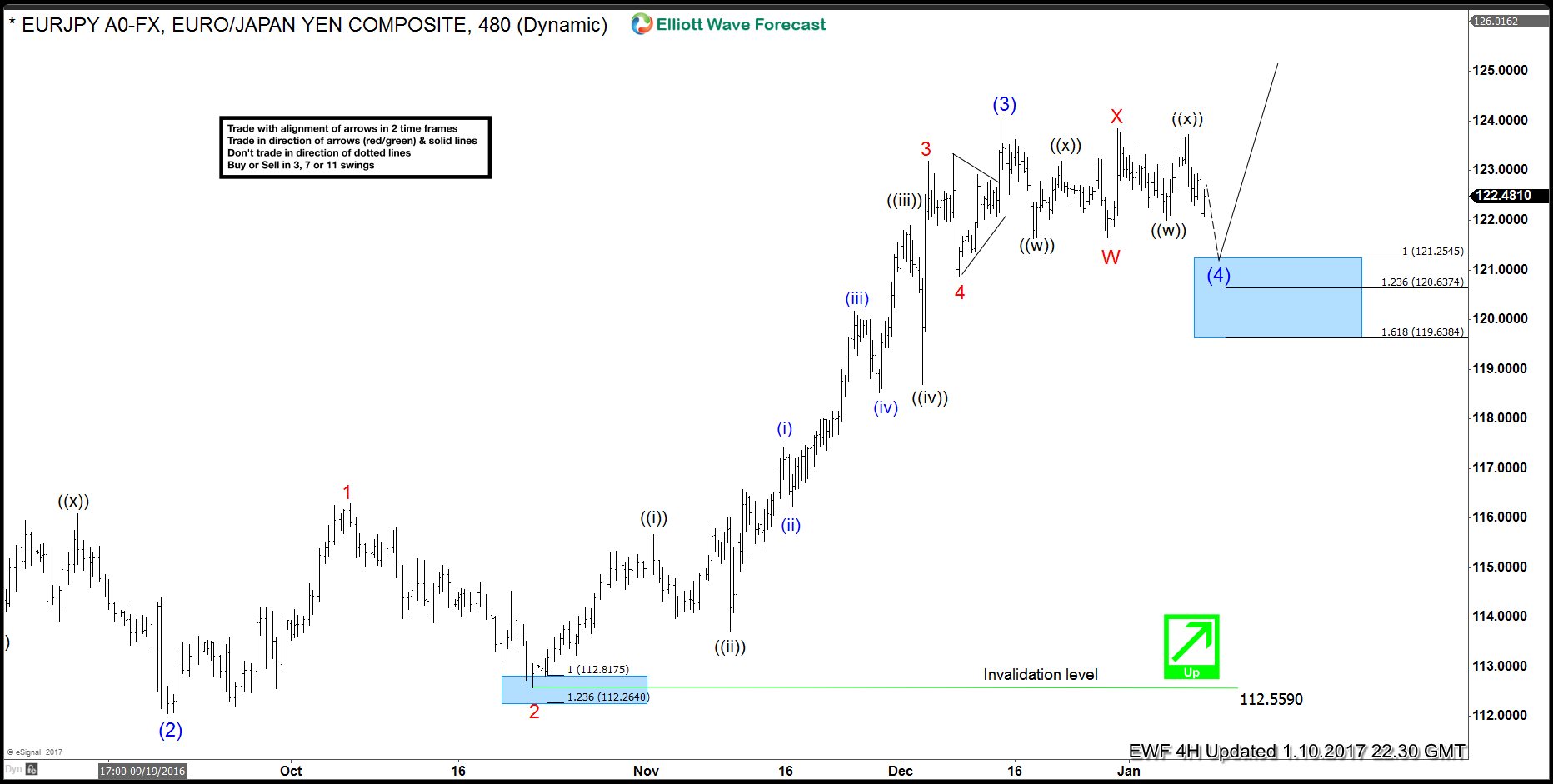

EURJPY Elliott Wave (4) nearing completion

Read MoreEURJPY has been in a sideways consolidation for the last few weeks and today it broke lower from the consolidation. Many might view it as start of a sustained decline but looking at the choppy nature of the decline from blue (3) peak, we are viewing it as a wave (4) blue pull back of an […]

-

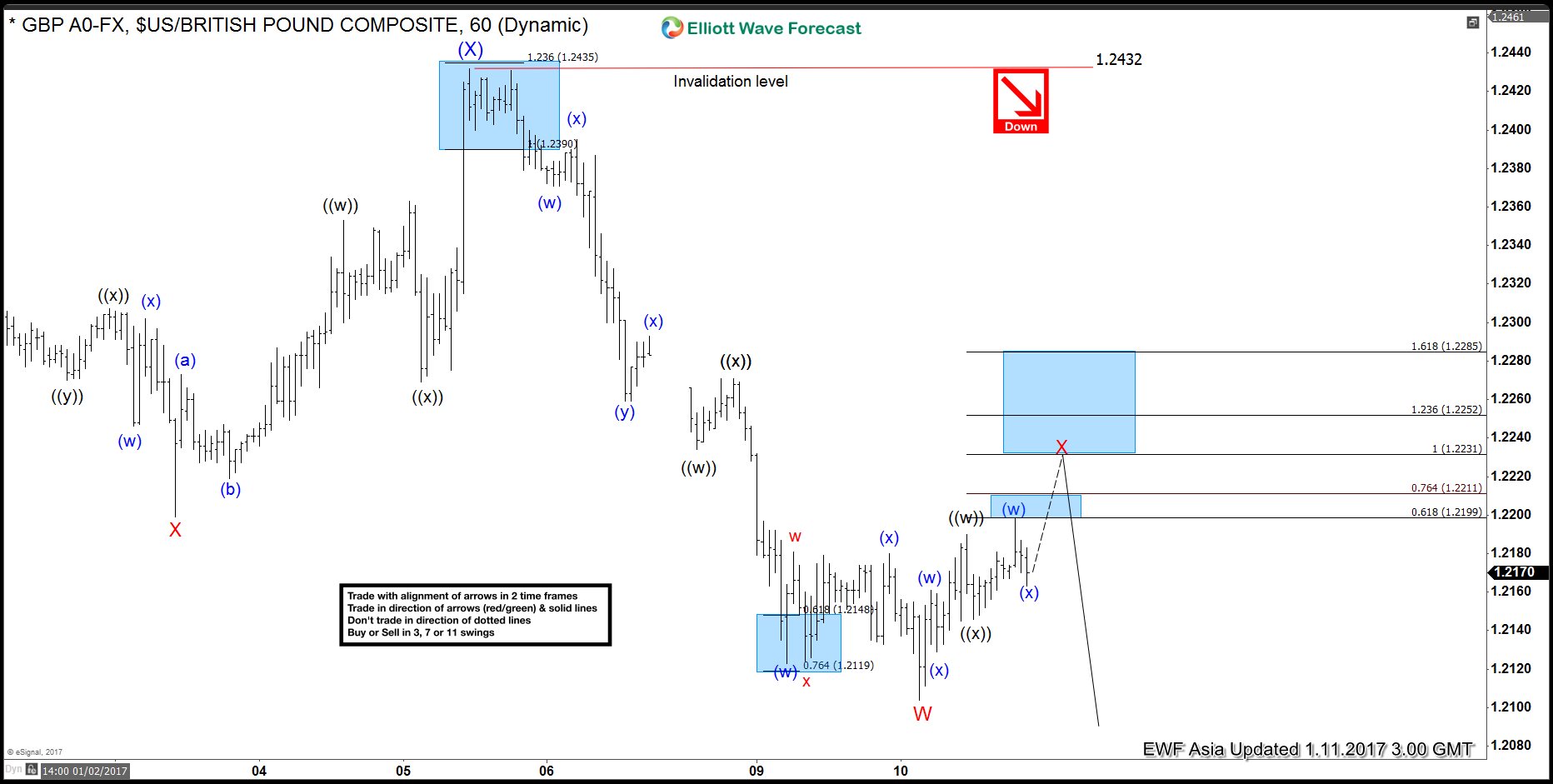

GBPUSD Elliott Wave Forecast 1.11.2017

Read MoreGBPUSD is showing a 5 swing bearish sequence from 12/6 peak (1.277) which favors more downside. The decline from 12/6 peak is unfolding as a double three where wave (W) ended at 1.2198 and wave (X) ended at 1.2432. GBPUSD has since broken below wave (W) at 1.2198 which suggests that the next leg Wave (Y) […]