The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

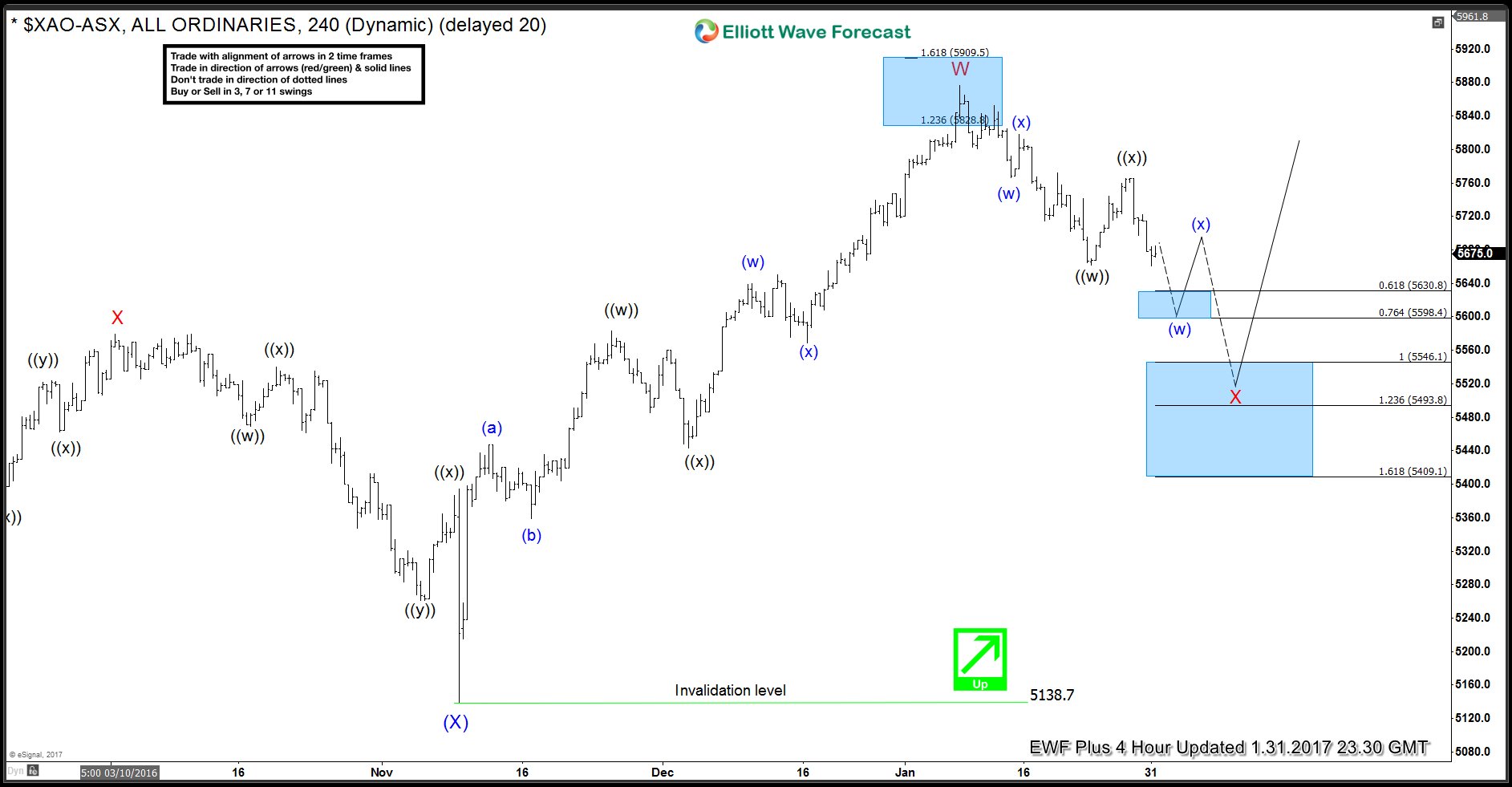

ASX All Ordinary ( $XAO) showing incomplete pattern

Read MoreIn this Technical blog we are going to take a quick look at ASX (XAO) All ordinary from Australia is correcting the cycle from November 9,2016 lows. Where as the structure from January 09,2016 peak suggesting the index has broken below the January 23 low (5661), as shown below the 4 hour chart of ASX from […]

-

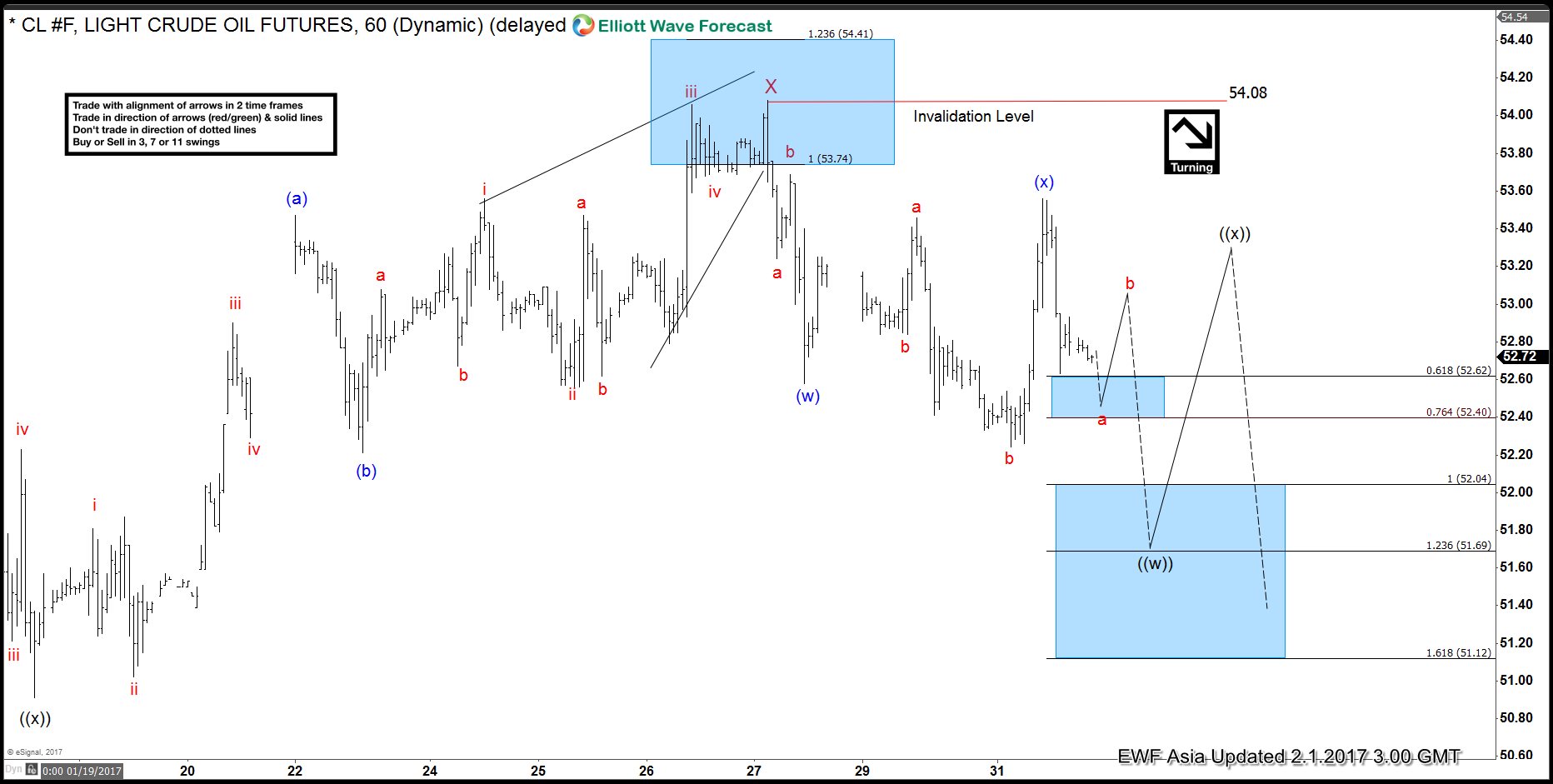

Oil CL_F: Correction Still in Progress – Elliott Wave Forecast

Read MoreRally to 55.24 completed Intermediate wave (W) and ended the cycle from 8/3/2016 low. From 55.24 high, oil turned lower to correct the cycle from 8/3 low as a double three structure where Minor wave W ended at 50.71 and Minor wave X ended at 54.08. Decline from 54.08 high is unfolding as a double […]

-

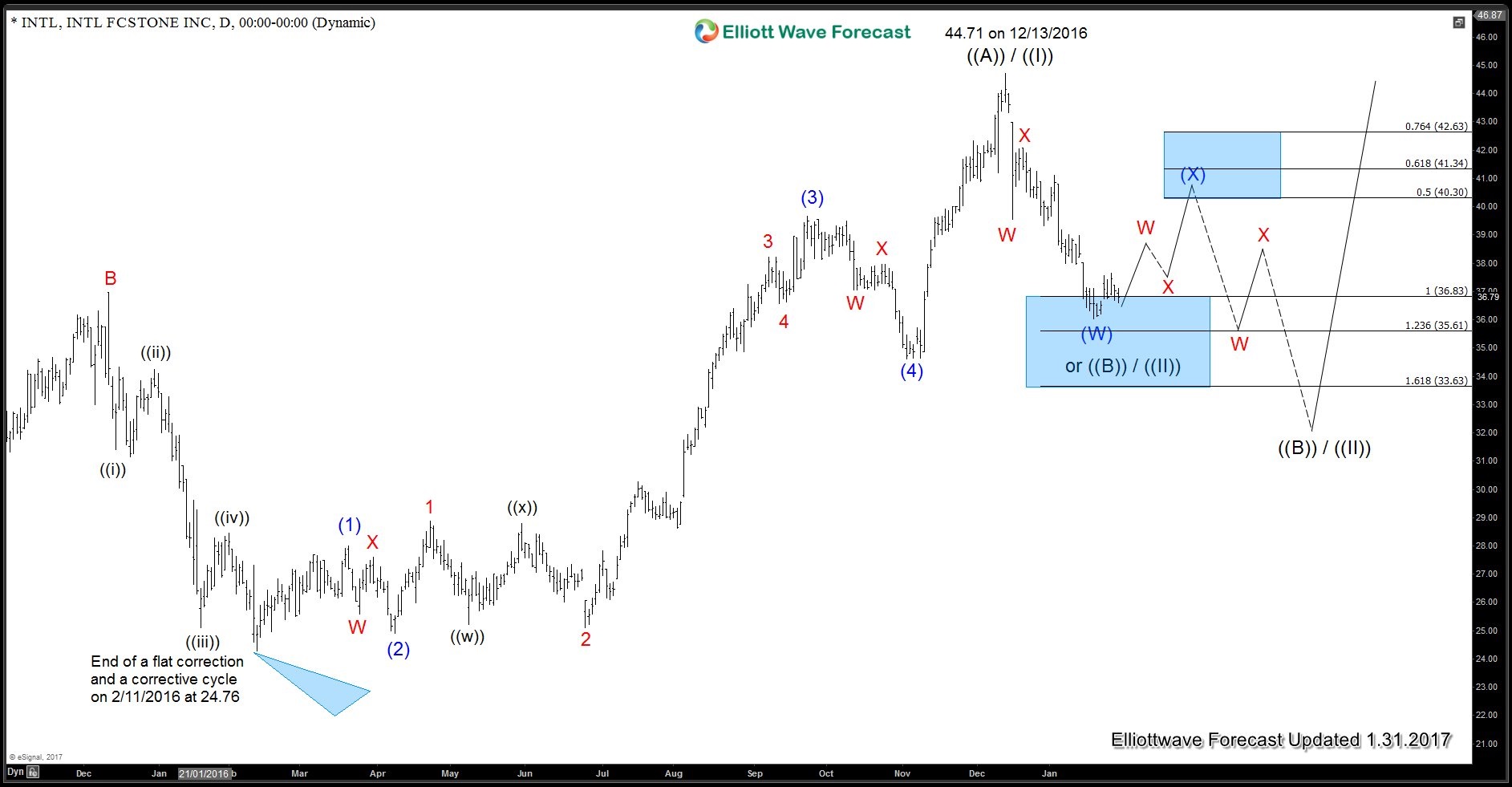

$INTL INTL Fcstone Inc Daily Elliott Wave Analysis

Read MoreThis is a daily Elliott Wave analysis of the aforementioned company. Firstly I will mention some of the company’s past history and merger. INTL Fcstone Inc is a Fortune 500 financial services industry firm listed on the Nasdaq exchange. The company has offices worldwide and is headquartered in New York City, NY in the United […]

-

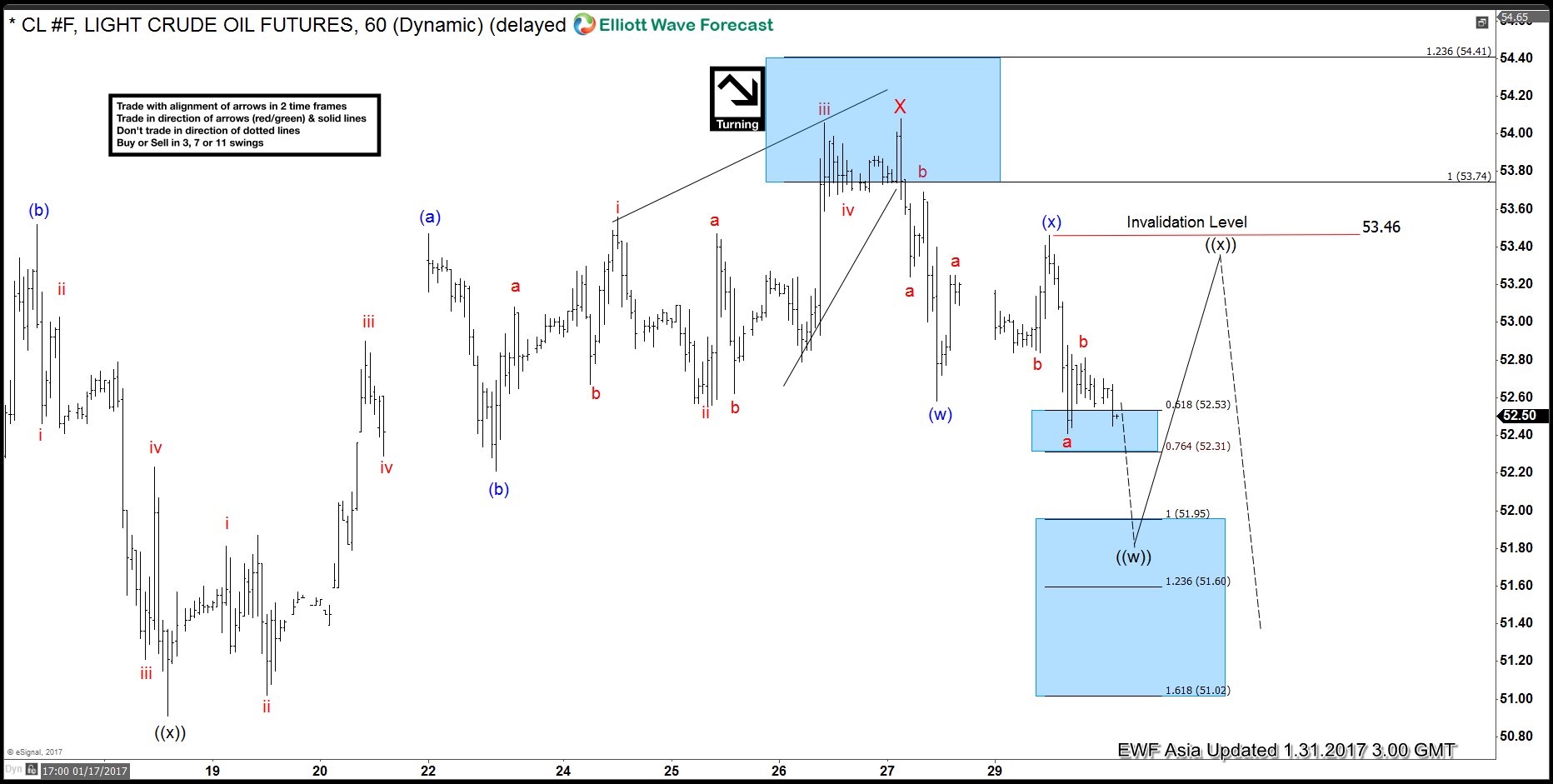

Oil CL_F: Buying Opportunity should come soon

Read MoreRally to 55.24 completed Intermediate wave (W) and ended the cycle from 8/3/2016 low. From 55.24 high, oil turned lower to correct the cycle from 8/3 low as a double three structure where Minor wave W ended at 50.71 and Minor wave X ended at 54.08. Decline from 54.08 high is showing a 5 swing […]