The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

GBPJPY Shows 5 wave impulse up from 2/17 Lows

Read MoreGBPJPY Shows 5 wave impulse up from 2/17 Lows Firstly in the near term the GBPJPY pair shows 5 waves up from the 2/17 lows. The dip to 139.61 corrected the cycle up from the 2/7 lows. Secondly we favor seeing the pair ending this initial bounce from there in the 142.05 area. That per the […]

-

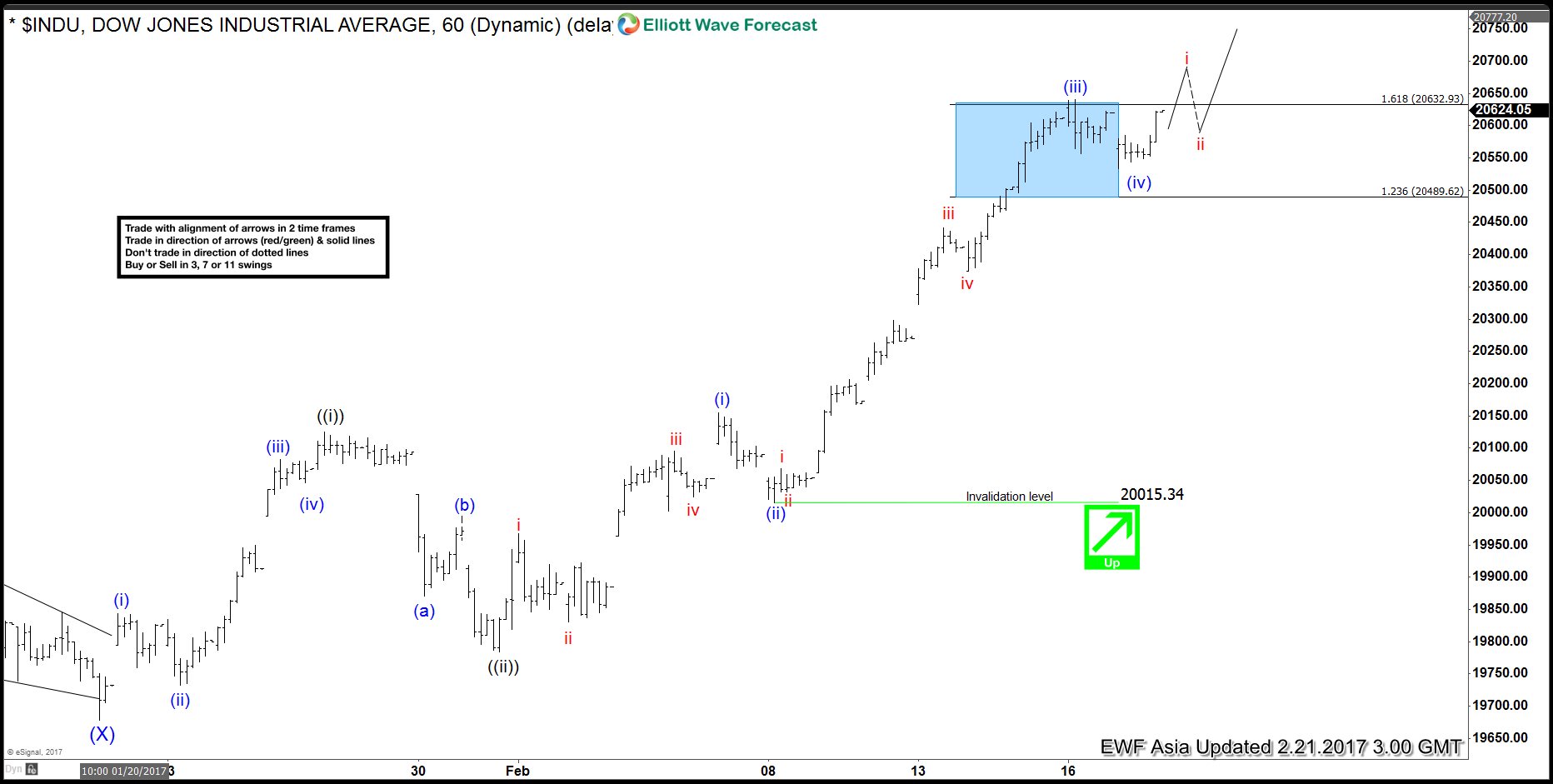

DJIA Elliott Wave View: Wave ((iii)) in progress

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) is showing an extension and […]

-

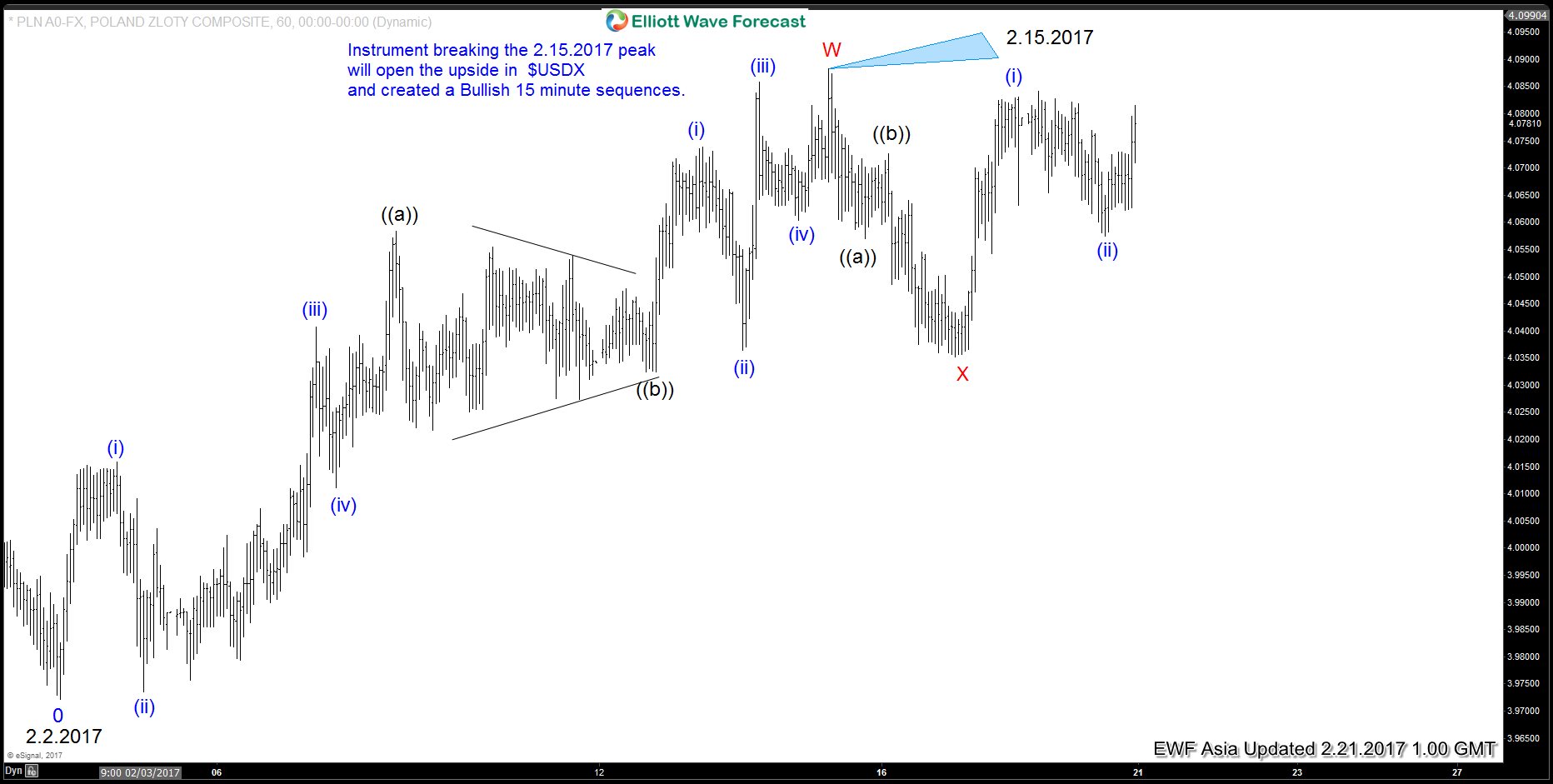

USDPLN Intraday Elliott wave view

Read MoreShort term Elliott wave view of USDPLN (Poland Zloty) suggests that the pair is on the verge of breaking above the 2.15.2017 high at 4.0883. Rally from 2.2.2017 low (3.9722) is unfolding as a double correction Elliott Wave structure where wave W ended at 4.0883 and wave X is proposed complete at 4.0352. Internal of wave W […]

-

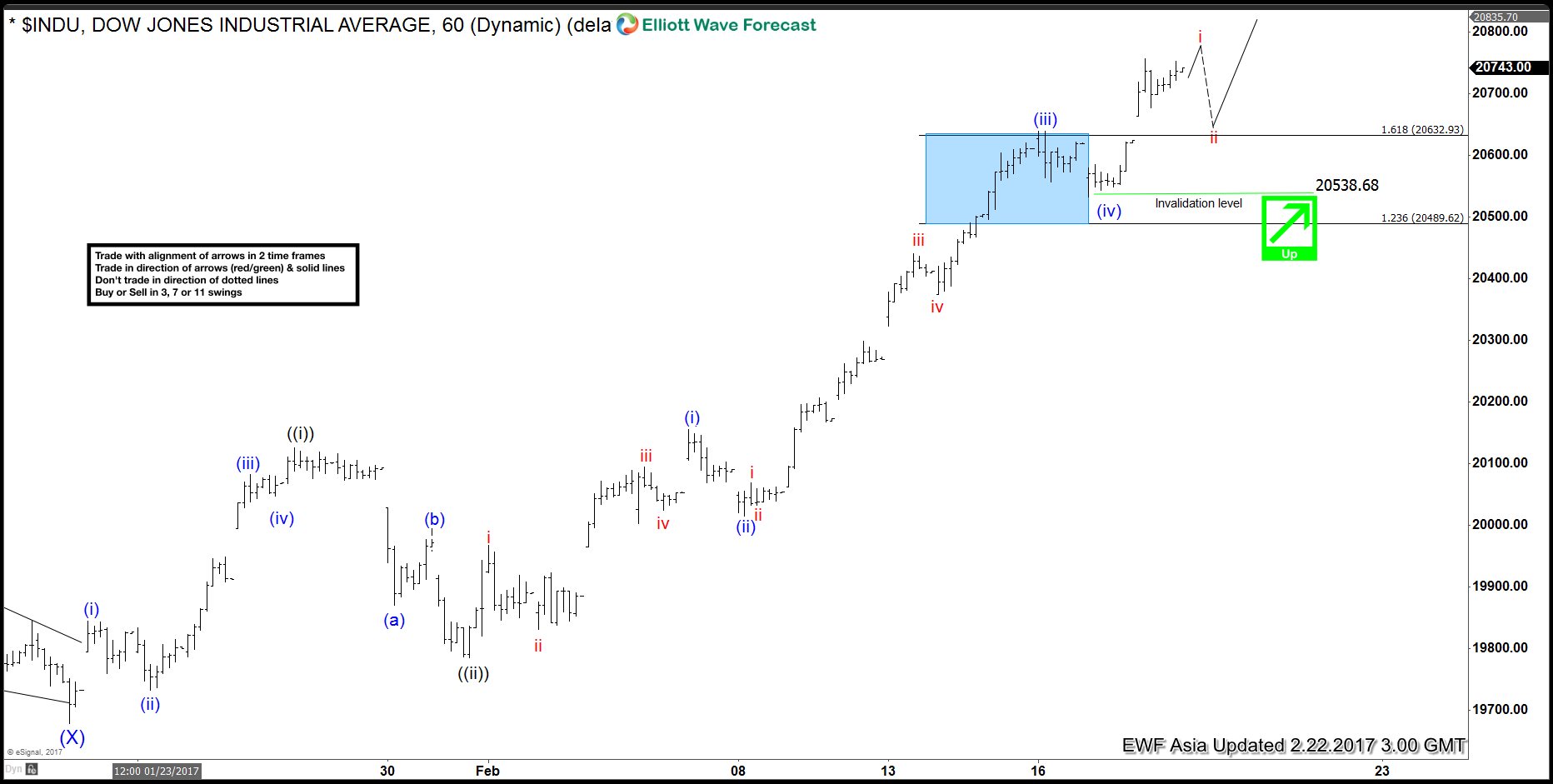

DJIA Elliott Wave View: Marching higher

Read MoreShort term Elliott wave view in DJIA (Dow Jones Industrial Average) suggests that the rally from 1/19 low is unfolding as a 5 waves Elliott wave impulse structure where Minute wave ((i)) ended at 20125.28, Minute wave ((ii)) ended at 19784.7, and Minute wave ((iii)) remains in progress. Internal of wave ((iii)) shows an extension and […]