The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

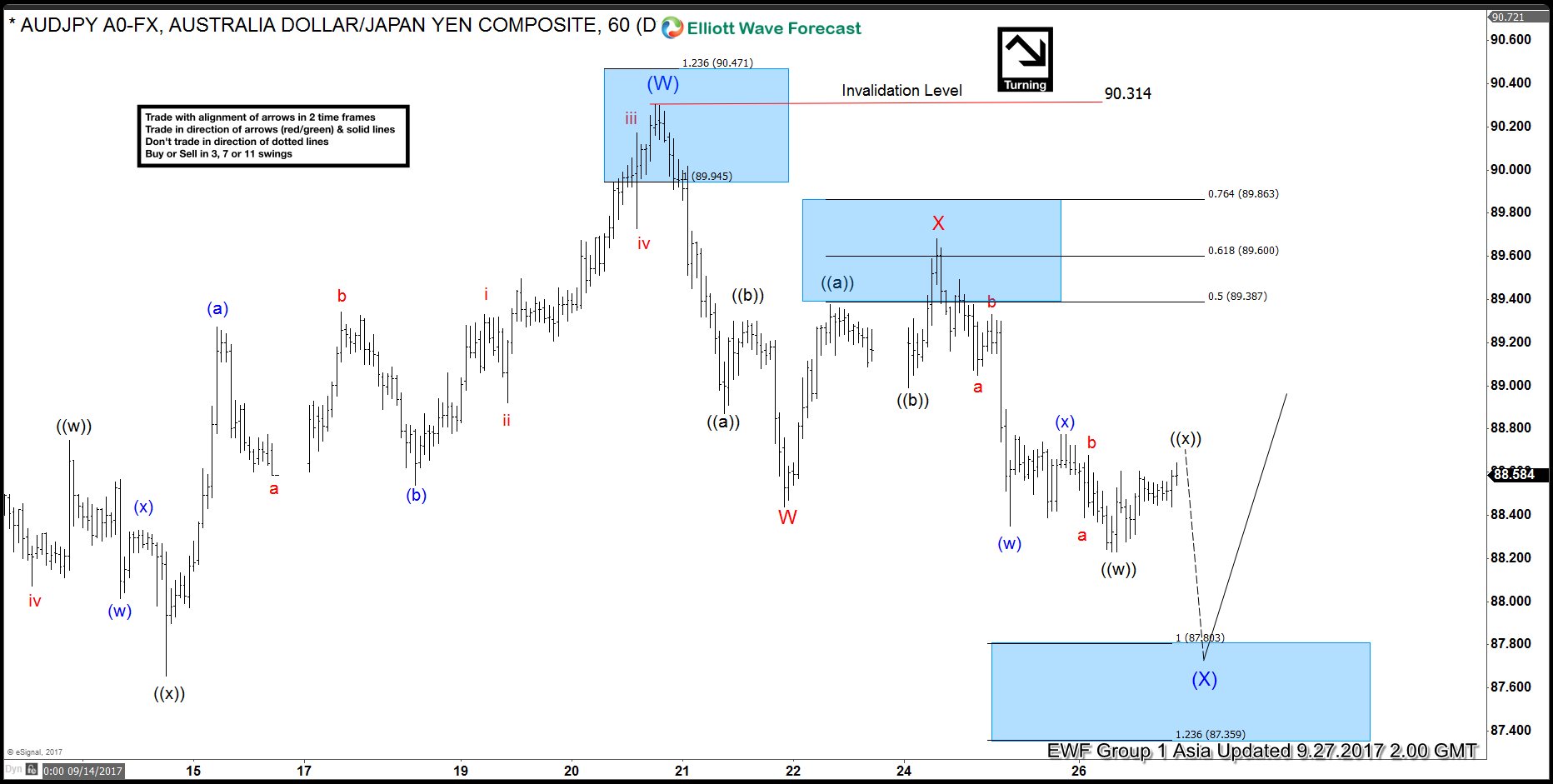

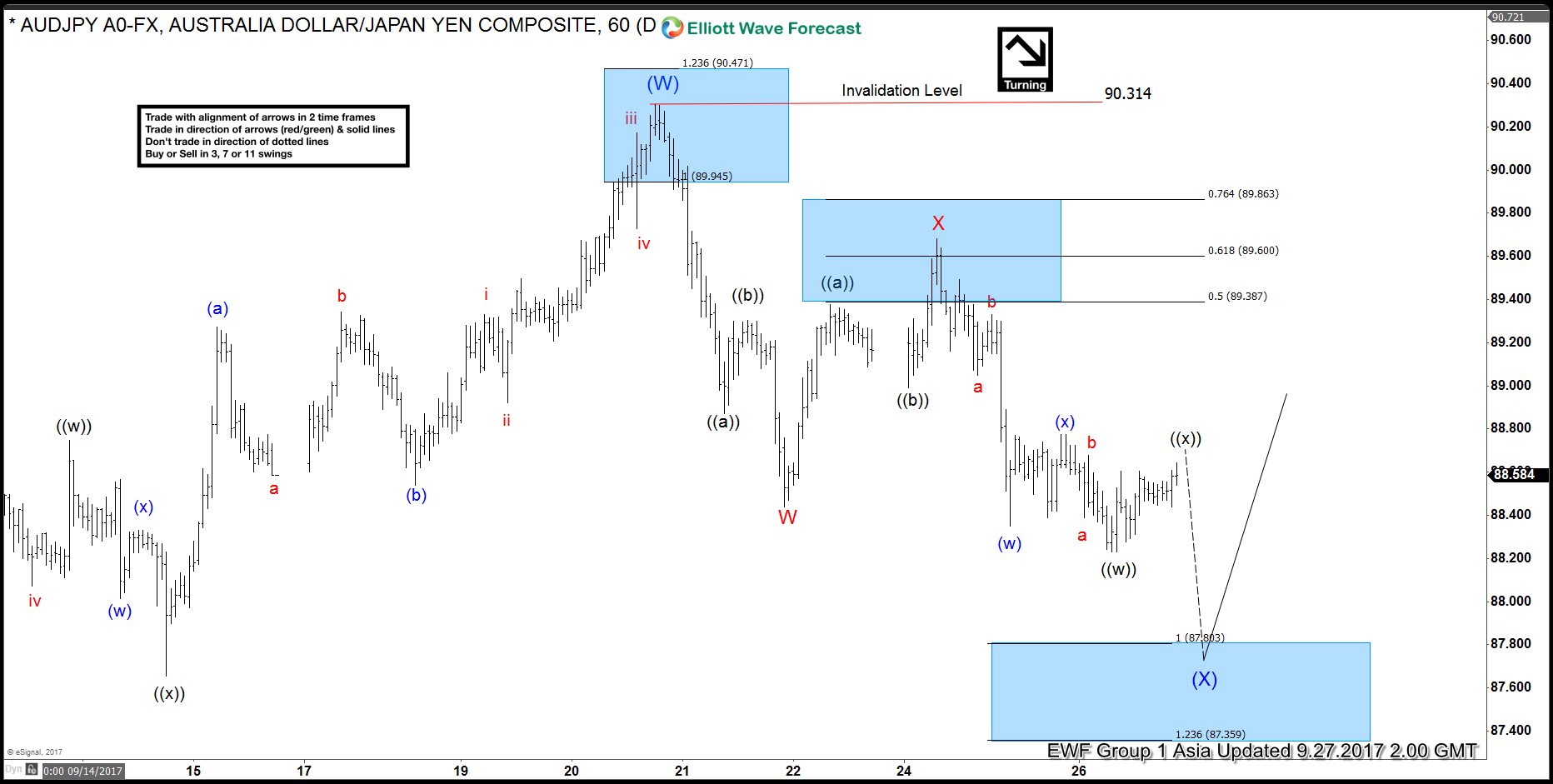

Elliottwave View: AUDJPY Correction in Progress

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave (W) ended at 88.44 and Minor wave (X) ended at 89.68. Near term, while bounces stay below 90.31, expect pair to extend lower towards 87.36 […]

-

Elliottwave View: AUDJPY Doing a Correction

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave (W) ended at 88.44 and Minor wave (X) ended at 89.68. Near term, while bounces stay below 90.31, expect pair to extend lower towards 87.36 […]

-

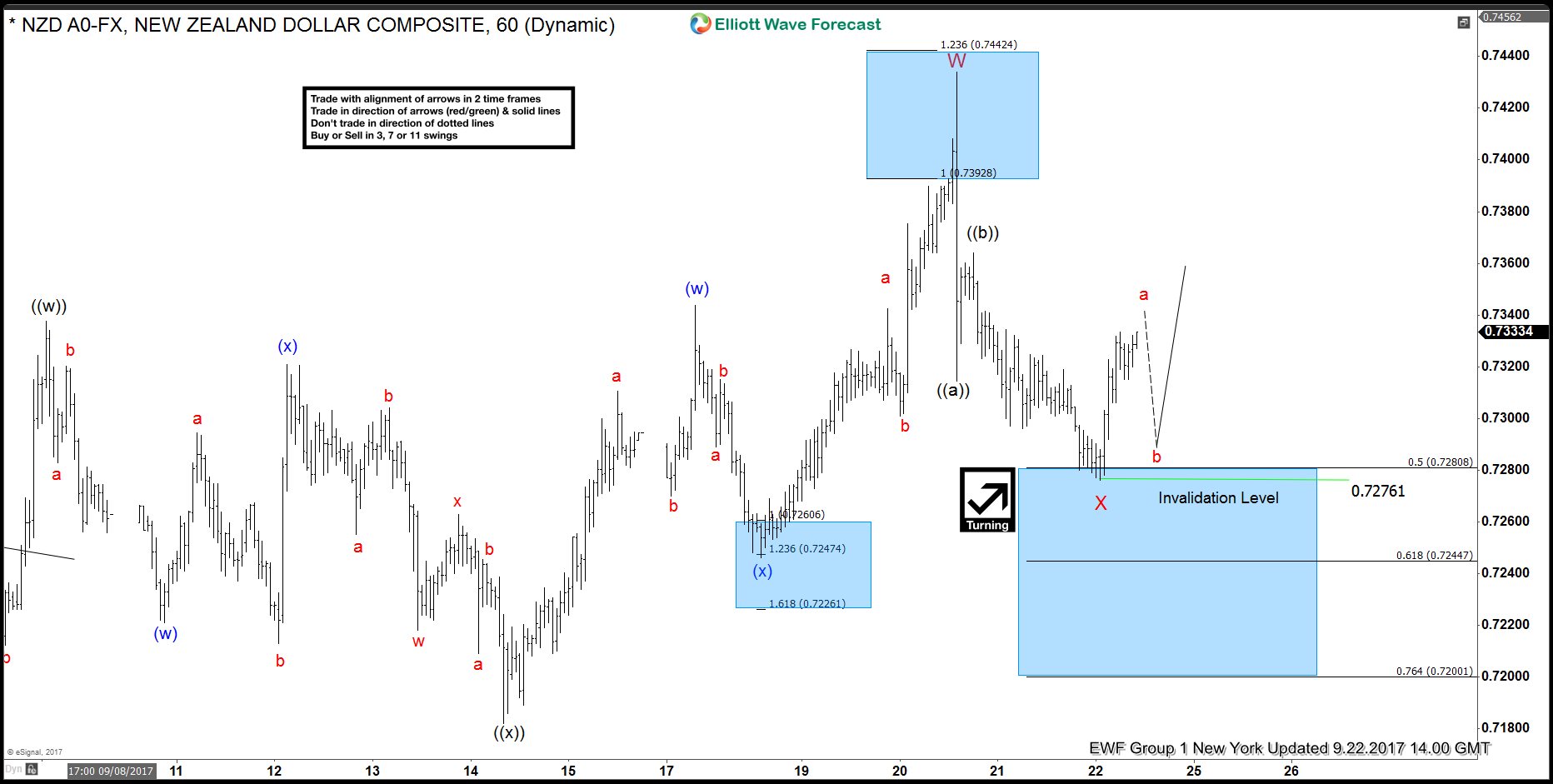

NZDUSD Elliott Wave View: Resuming Higher

Read MoreNZDUSD Short Term Elliott Wave view suggests the rally from 8/31 low unfolded as a double three Elliott Wave structure and ended with Minor wave W at 0.7434. Up from 8/31 low (0.7127), Minute wave ((w)) ended at 0.7337, Minute wave ((x)) ended at 0.7182, and Minute wave ((y)) of W ended at 0.7434. Minor […]

-

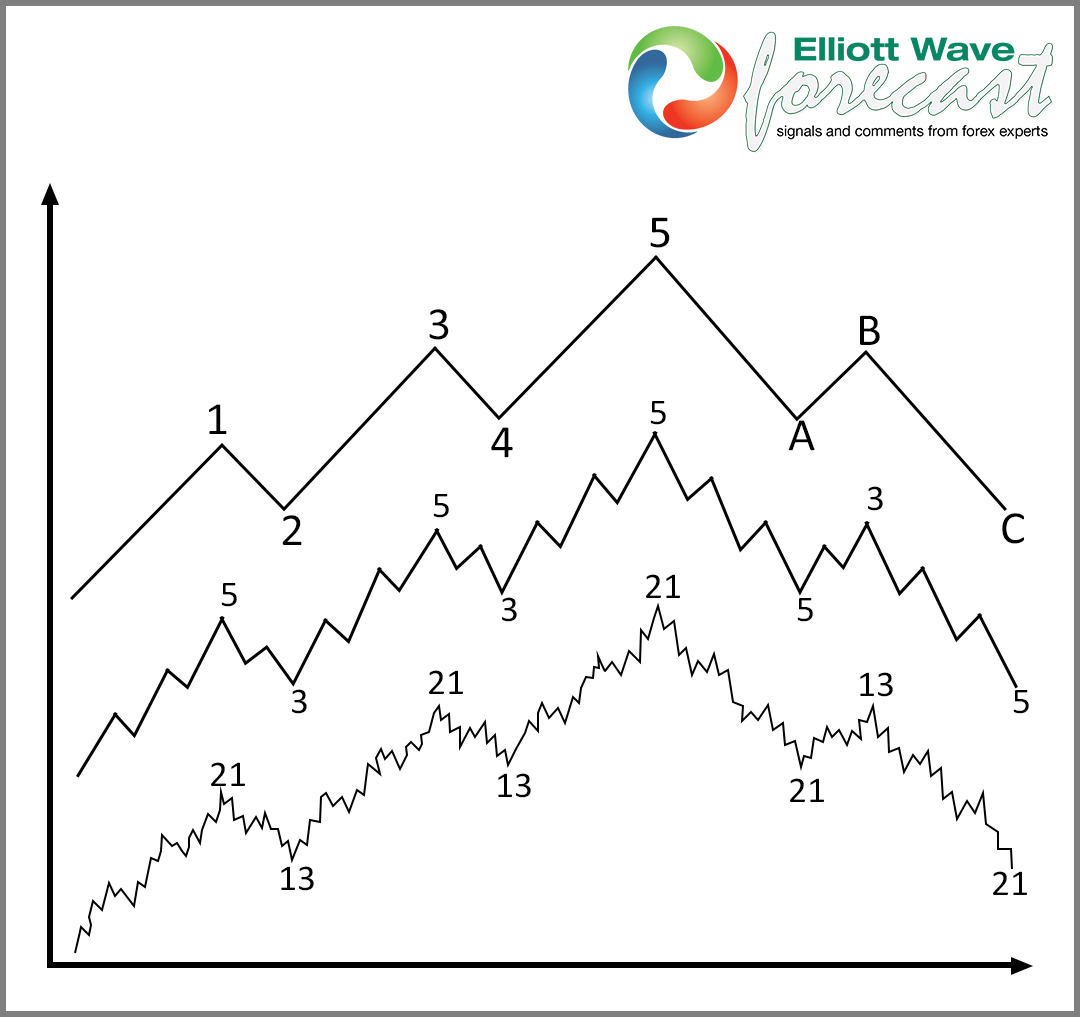

Elliott Wave Theory – Most Powerful Move: Wave 3/C

Read MoreThe Elliott wave Theory and the most powerful move The Elliott wave Theory was developed a century ago but the market has changed a lot since then. The market has become more computer driven and more popular. The volume has also increased tremendously. Despite these changes however, Elliott Wave Theory has stayed the same. As […]