The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

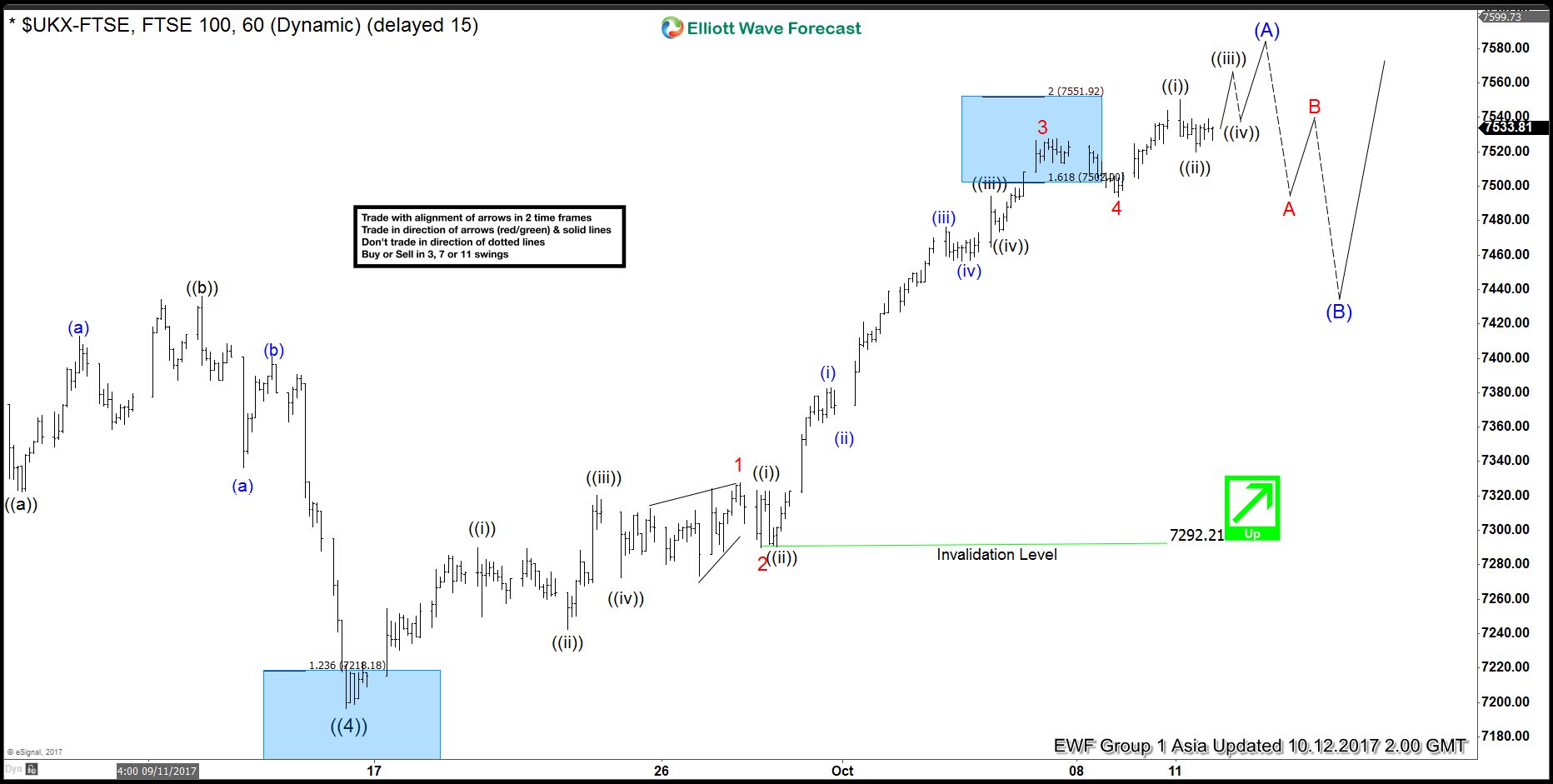

FTSE Short-term Elliott Wave Analysis 10/12

Read MoreFTSE Short term Elliott Wave structure shows Primary wave ((4)) ended at 7196.58 on 9/15 low. Rally in Primary wave ((5)) up from there has internal subdivision of a zigzag Elliott Wave structure. Intermediate wave (A) of this zigzag structure is in progress as 5 waves impulse where rally to 7327.50 ended Minor wave 1 and bounce to 7289.75 ended […]

-

DJ Commodity Index is supporting Higher GOLD

Read MoreThe Dow Jones Commodity Index is a broad measure of the commodity futures market that emphasizes diversification and liquidity through a equal-weighted approach. It doesn’t allow any sector to make up more than 33% of its portfolio or any single commodity to make up more than 15%. Gold is the top weighted commodity of the […]

-

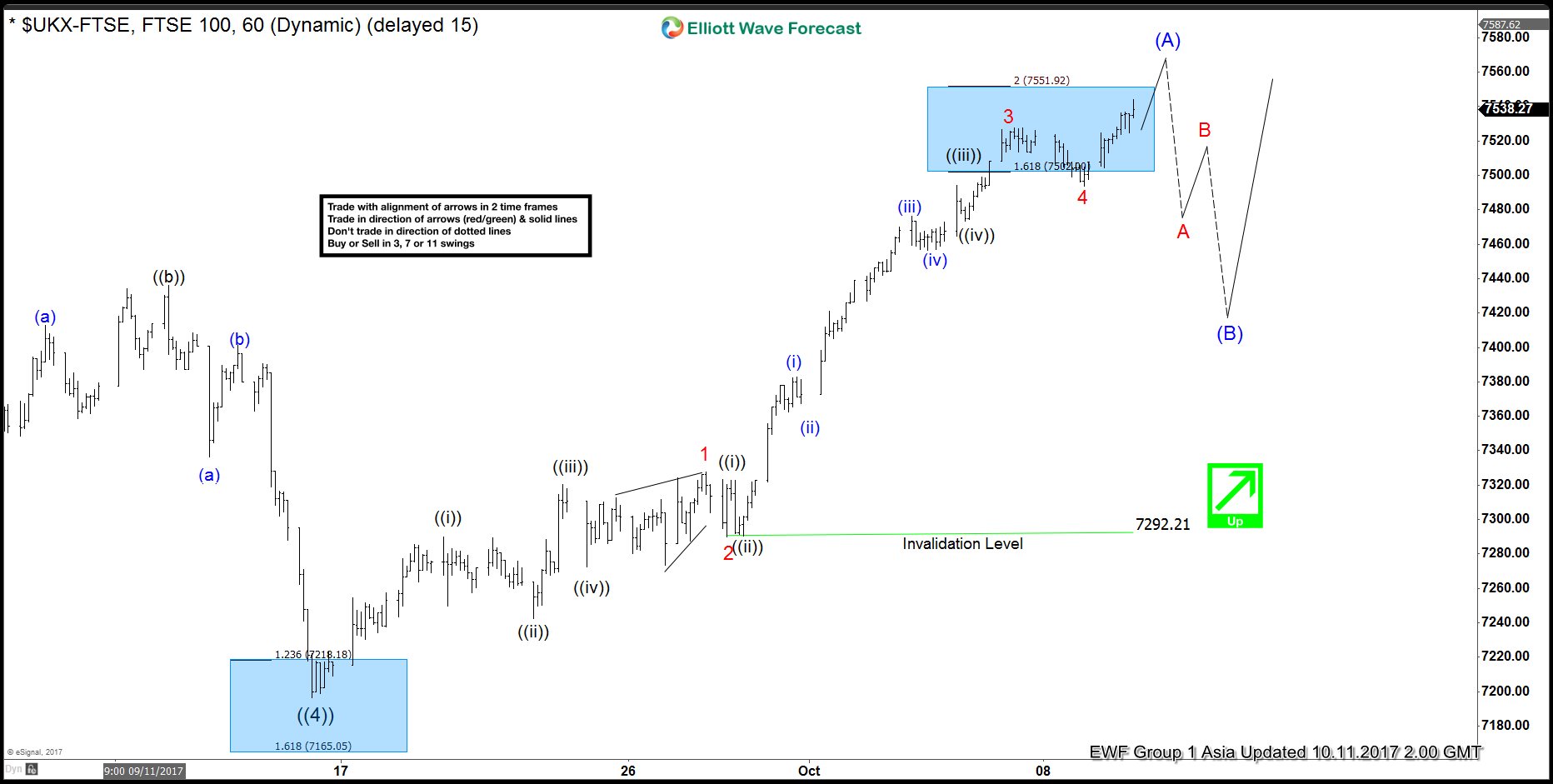

FTSE Elliott Wave Analysis 10.11.2017

Read MoreFTSE Short term Elliott Wave analysis suggests the decline to 7196.58 on 9/15 low ended Primary wave ((4)). The Index is currently within Primary wave ((5)) which is subdivided as a zigzag Elliott Wave structure. The first leg Intermediate wave (A) of this zigzag is in progress as 5 waves impulse where Minor wave 1 ended at 7327.50 […]

-

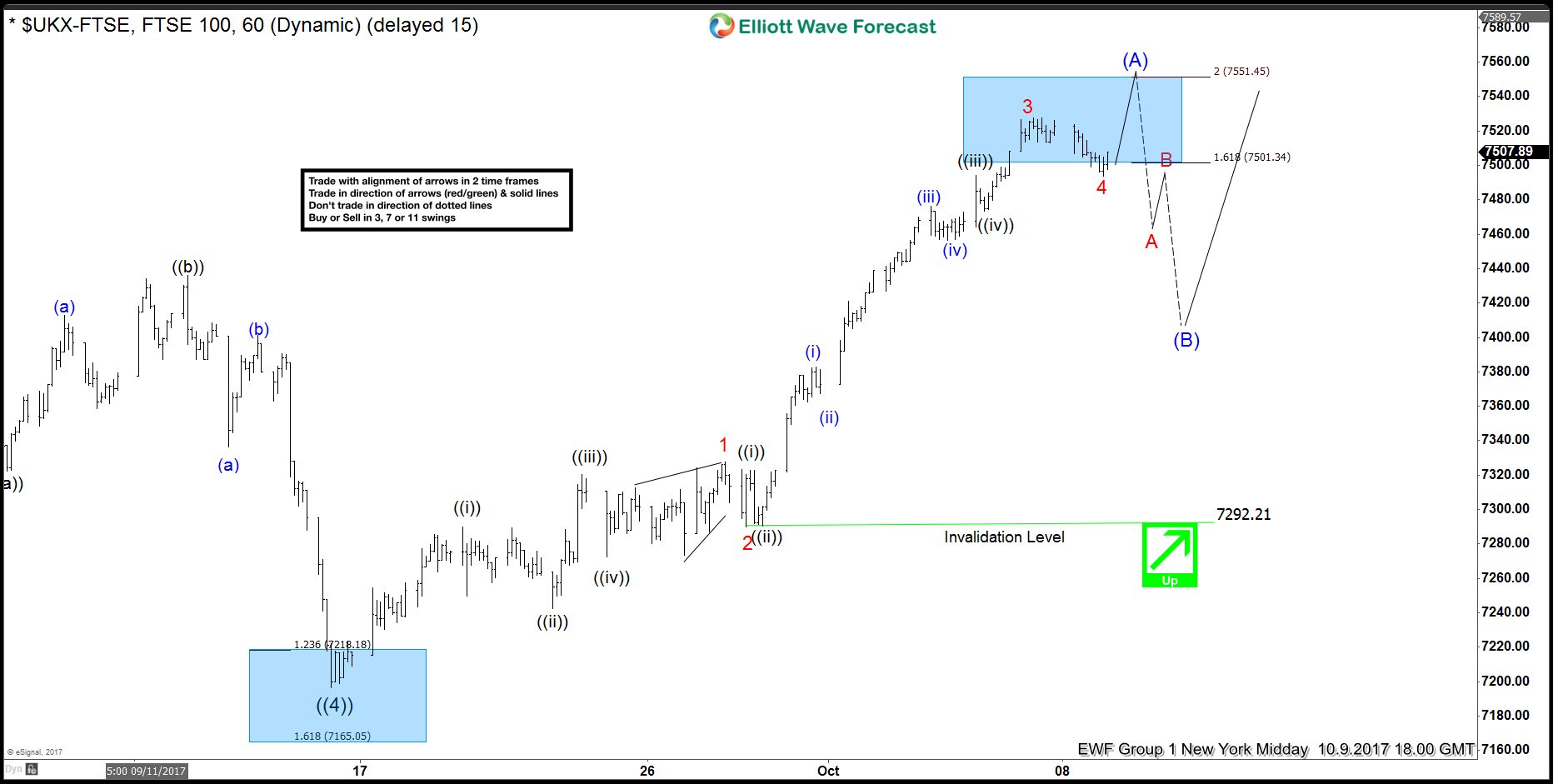

$FTSE 100 impulsive bounce from 9/15 lows

Read MoreThe $FTSE 100 index appears to be showing an impulsive bounce from the 9/15/17 lows. This is part of a larger leading diagonal up from the 2/11/16 lows. In an impulse that is bullish, market prices will go up in an impulsive manner on all time frames of trend. Impulses are always subdivided into smaller degree impulse […]