The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

XAU AUD Elliott Wave View: 2016 Lows Still Holding

Read MoreBack in November 2016, we mentioned that XAUAUD should find buyers in 1540 – 1487 area and bounce ideally to resume the rally for new highs or in 3 waves at least. XAU AUD reached the mentioned area a few weeks later in December 2016, found a low at 1525 on 12/15/2016 and started rallying. Rally got rejected […]

-

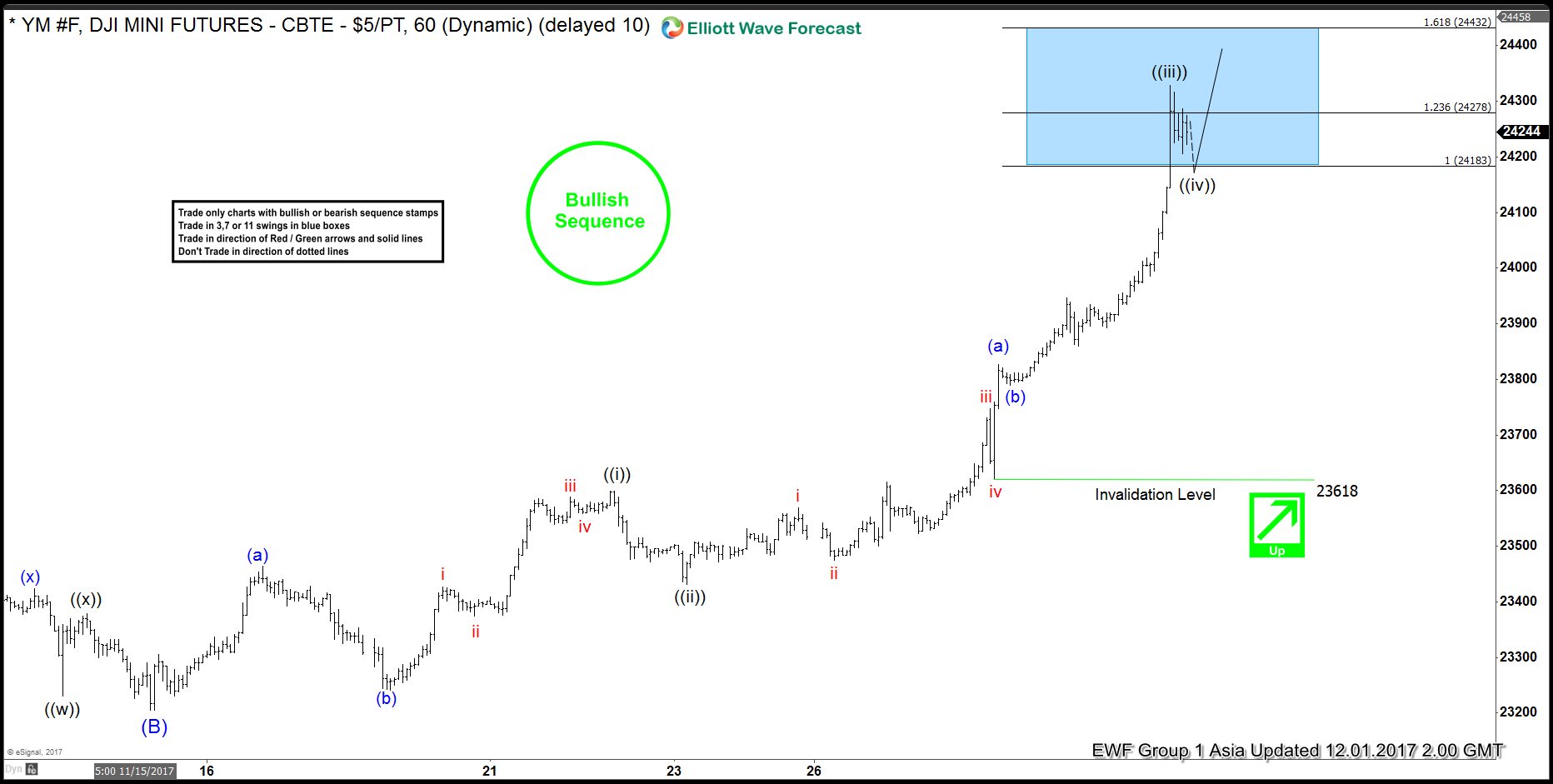

Dow Future Elliott Wave Analysis 12-1-2017

Read MoreDow Future Short term Elliott Wave view suggests that Intermediate wave (B) ended at 23204. The rally from there is proposed to be unfolding as a leading diagonal Elliott wave structure. Minute wave ((i)) ended at 23599, Minute wave ((ii)) ended at 23432, and Minute wave ((iii)) ended at 24328. Minute wave ((iv)) is in progress to correct cycle from 11/23 low and […]

-

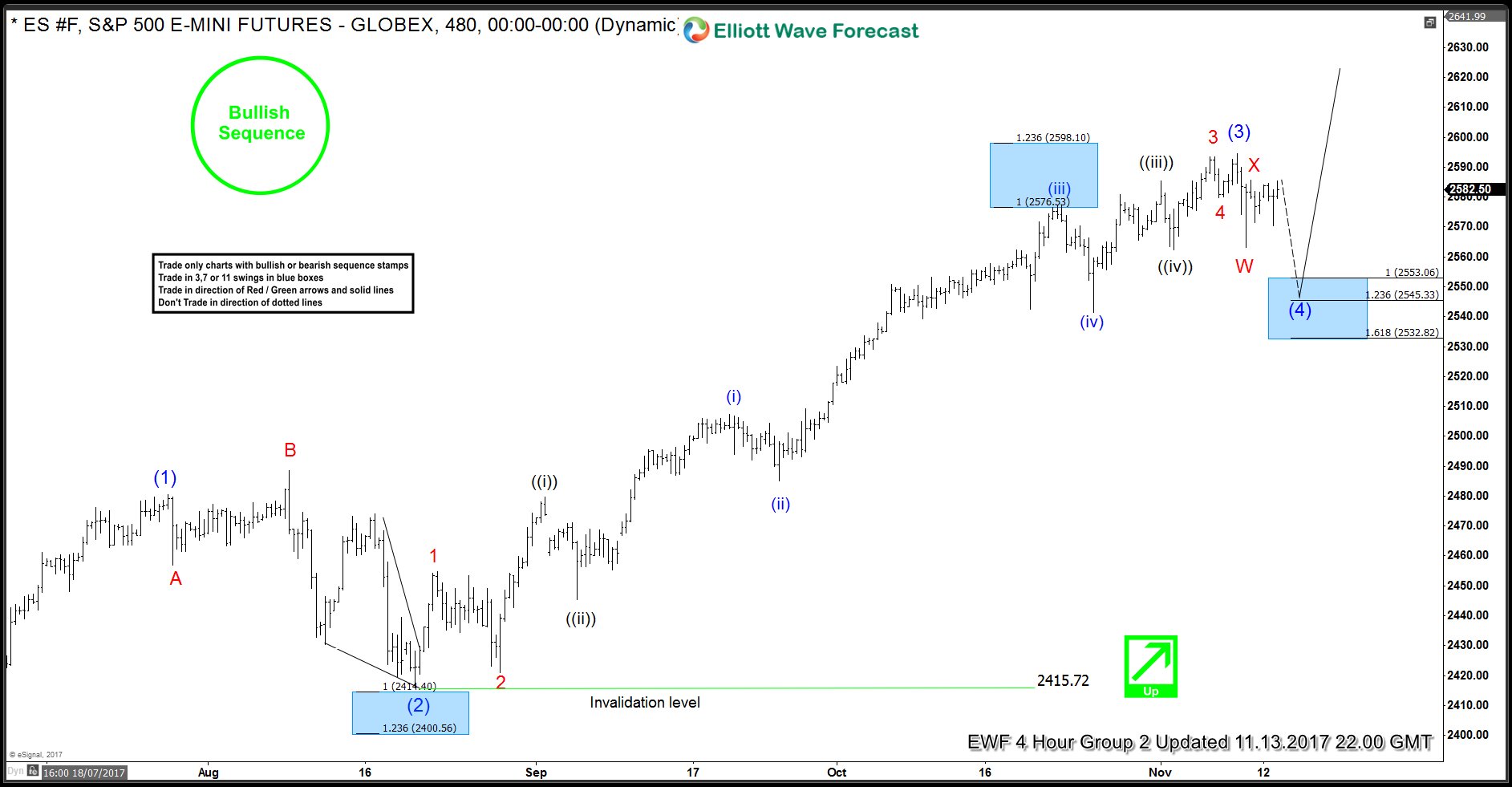

ES_F (S&P 500) Buying the Elliott Wave dips

Read MoreIn this Technical blog, we are going to take a quick look at the past Elliott Wave Chart performance of ES_F (S&P 500). Which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure and the forecast. As our members know, we were pointing out that ES_F (S&P 500) is trading within the larger bullish trend in […]

-

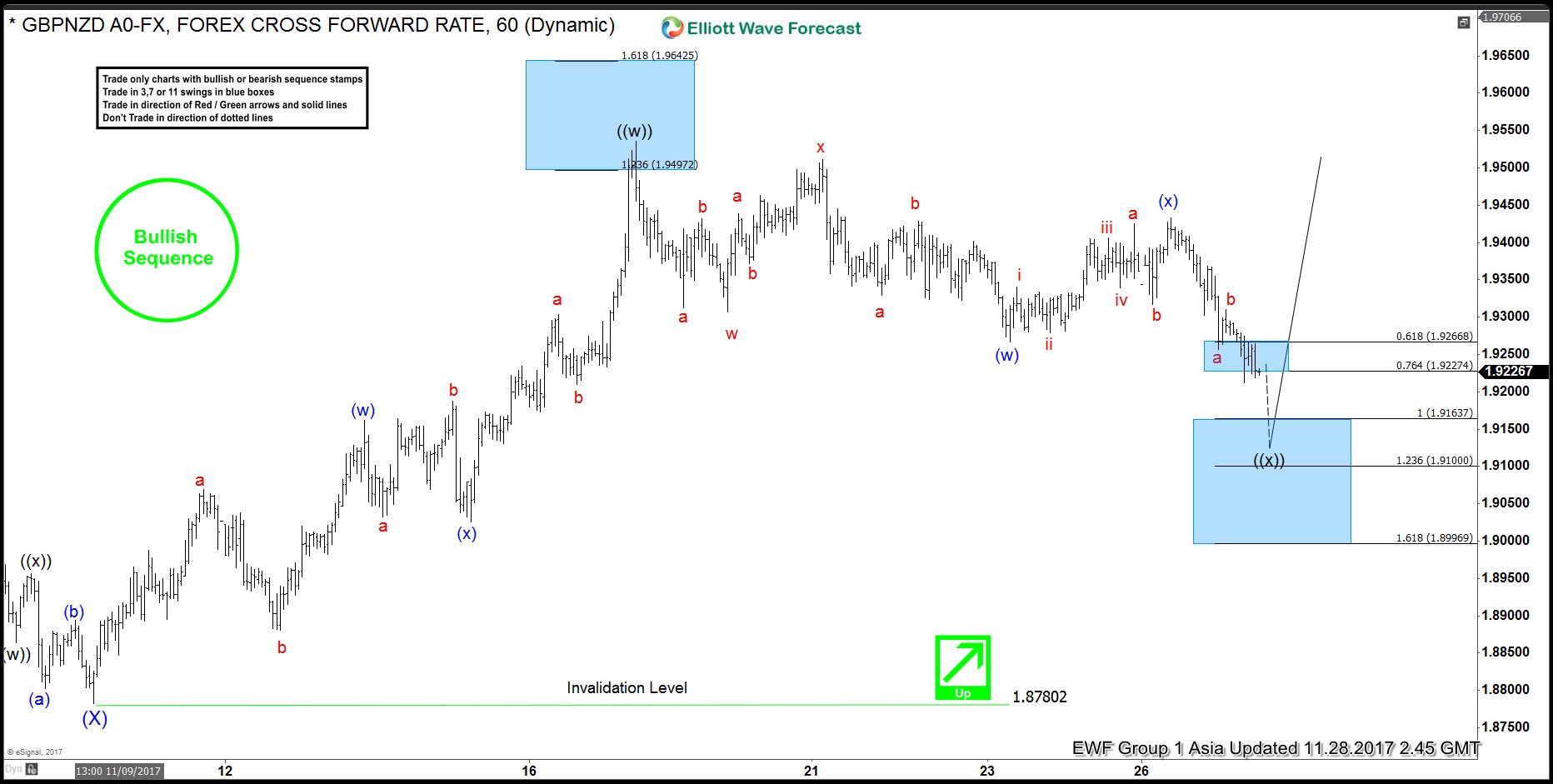

GBPNZD Forecasting Rally Based on Bullish Sequence

Read MoreIn this technical blog we’re going to take a quick look at the past Elliott Wave charts of GBPNZD published in members area of www.elliottwave-forecast.com. We’re going to explain the Elliott Wave forecast and our trading strategy As our members know , we were pointing out that GBPNZD is trading within larger bullish trend. The pair […]