The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

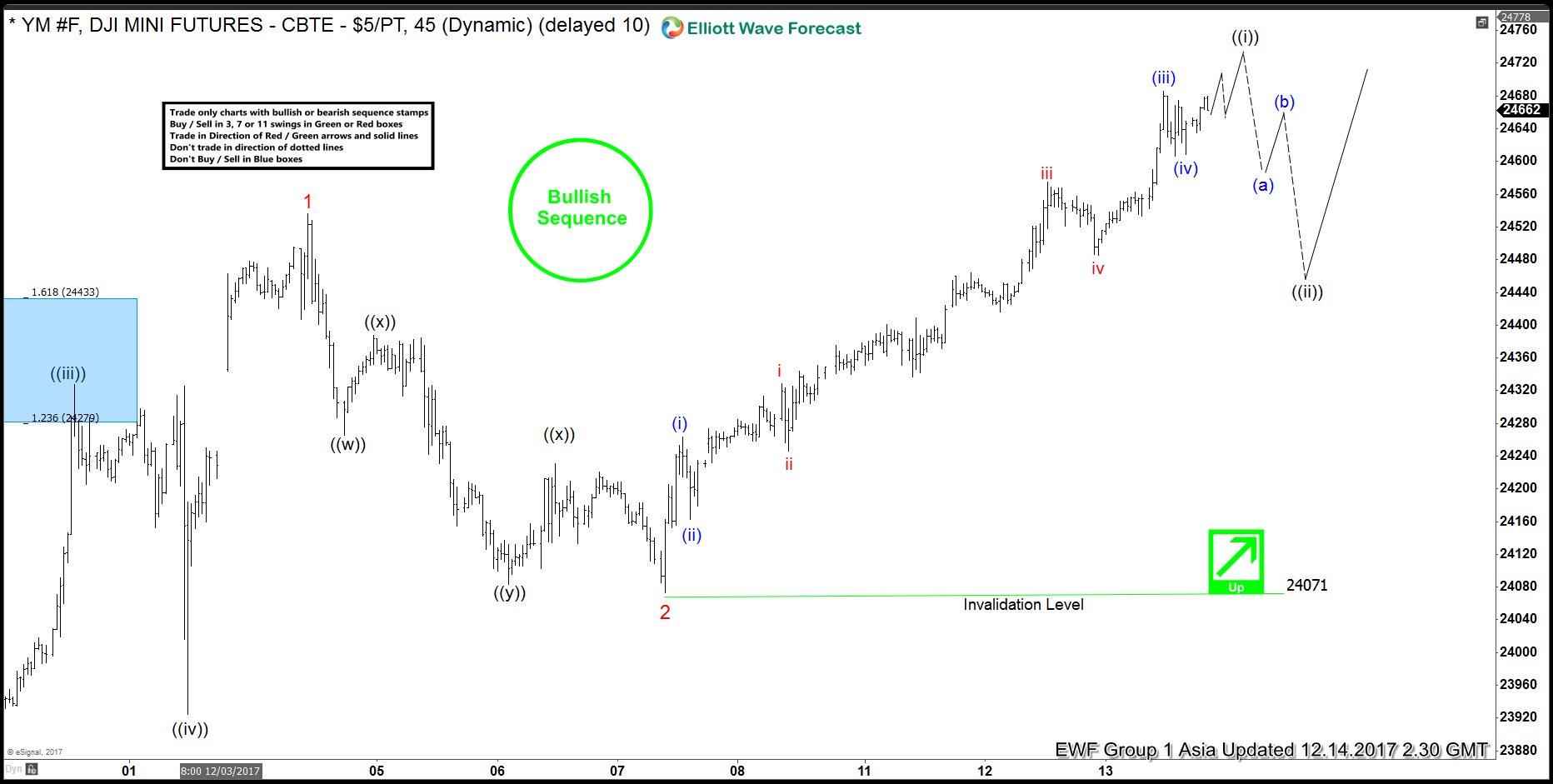

Dow Future Elliott Wave Analysis 12.15.2017

Read MoreDow Future Short Term Elliott Wave view suggests that rally to 24536 ended Minor wave 1 and Minor wave 2 ended at 24071 as a triple three Elliott Wave structure. The Index has since broken above Minor wave 1 at 24536 which suggests the next leg higher has started. Up from 24071, the rally is progressing as 5 […]

-

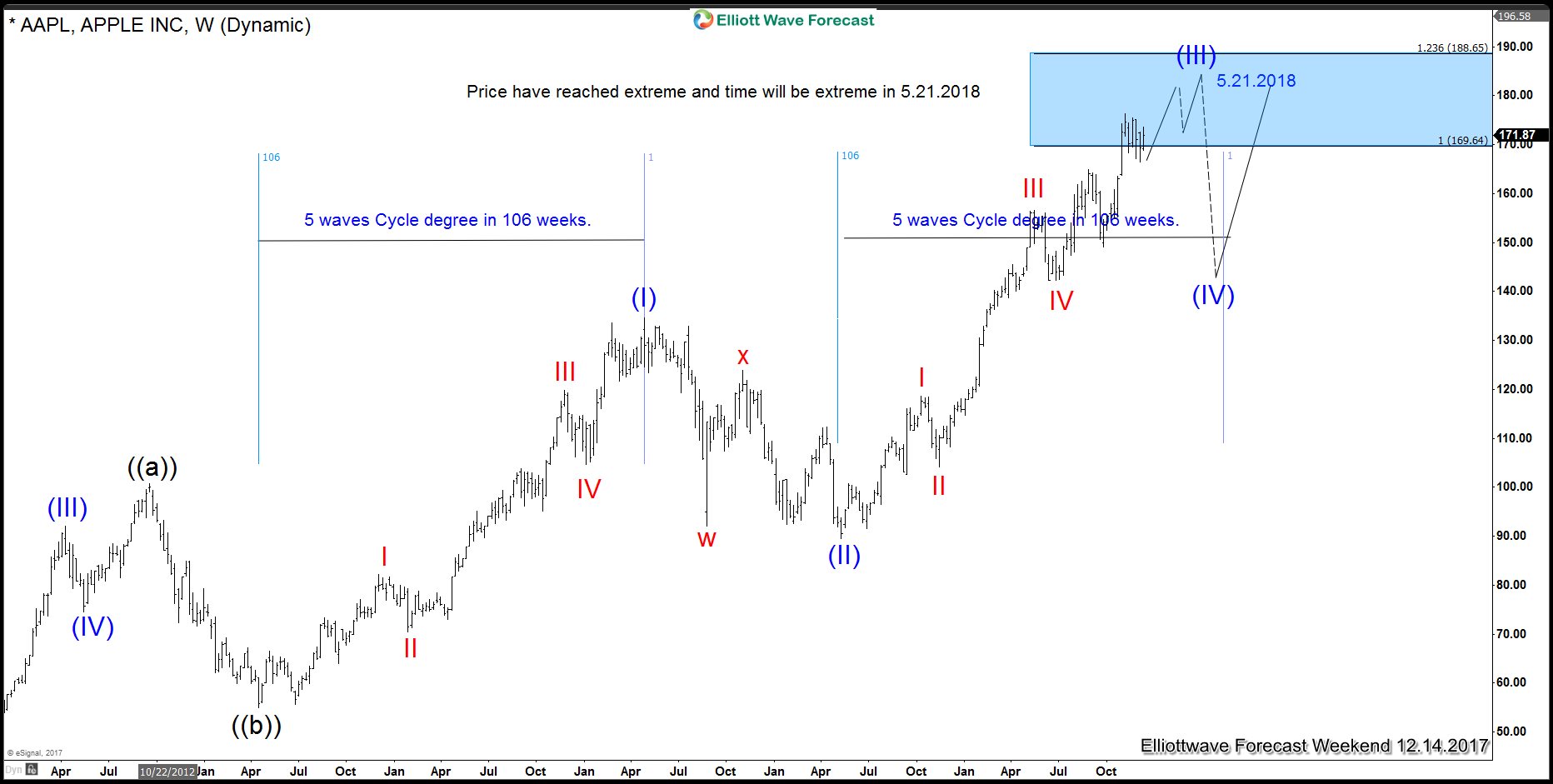

Sell In May And Go Away?

Read MoreMany Indices traders have heard about the phrase “Sell in May and go away”. We at Elliottwave-Forecast.com only trade based in the technicals do not use any Fundamental criteria or news events in our forecast. We trade based in Cycles, Sequences, Correlations and Elliott wave. We Identify extremes in Price and also time and provide members […]

-

FCX Showing Elliott Wave Impulse Sequence

Read MoreFCX ( Freeport Macmoran INC) Short-term Elliott Wave view suggests that the decline to November 15 low 13.25 ended Minute wave ((b)). Above from there, the stock is showing a strong rally to the upside and structure looks to be unfolding as an impulse Elliott Wave structure due to the extension in 3rd leg higher. Also, each leg has internal oscillations of 5 […]

-

Dow Future Intra-Day Elliott Wave Analysis

Read MoreDow Future Short Term Elliott Wave view suggests that the decline to 23205 ended Intermediate wave (4). Intermediate wave (5) is in progress as an Ending Diagonal Elliott Wave structure where Minor wave 1 ended at 24536 and Minor wave 2 ended at 24073. The Index has broken above Minor wave 1 at 24536 which suggests the […]