The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Bitcoin: Technical and Psychological Perspective

Read MoreHello fellow traders, in this blog post, we will discuss the most hyped cryptocurrency Bitcoin in a technical as well as psychological perspective. From the zero line, we are calling bitcoin completed in the super cycle blue wave (a) at 17/12/17 top. From that high, the market completed the first leg of 3 of a double correction. […]

-

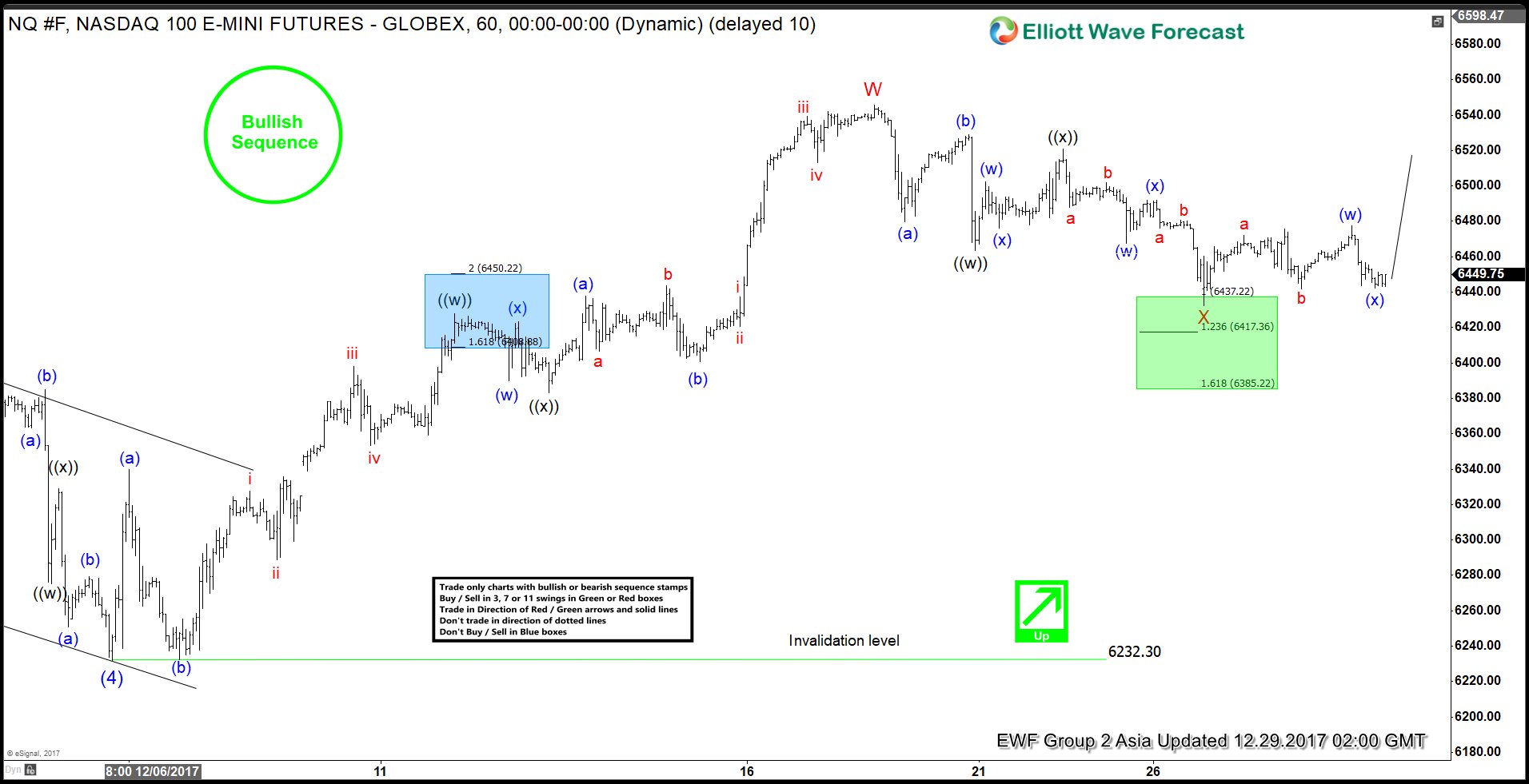

Nasdaq Elliott Wave Analysis: More Upside Favored While Above 6232.3

Read MoreNasdaq Short Term Elliott Wave view suggests that the Index remains bullish as far as pullbacks stay above Intermediate wave (4) at 6232.3. Rally from Intermediate wave (4) low unfolded as a double three Elliott Wave structure where Minor wave W ended at 6545.75 and Minor wave X is proposed complete at 6432.25 in the green box. Internal of Minor […]

-

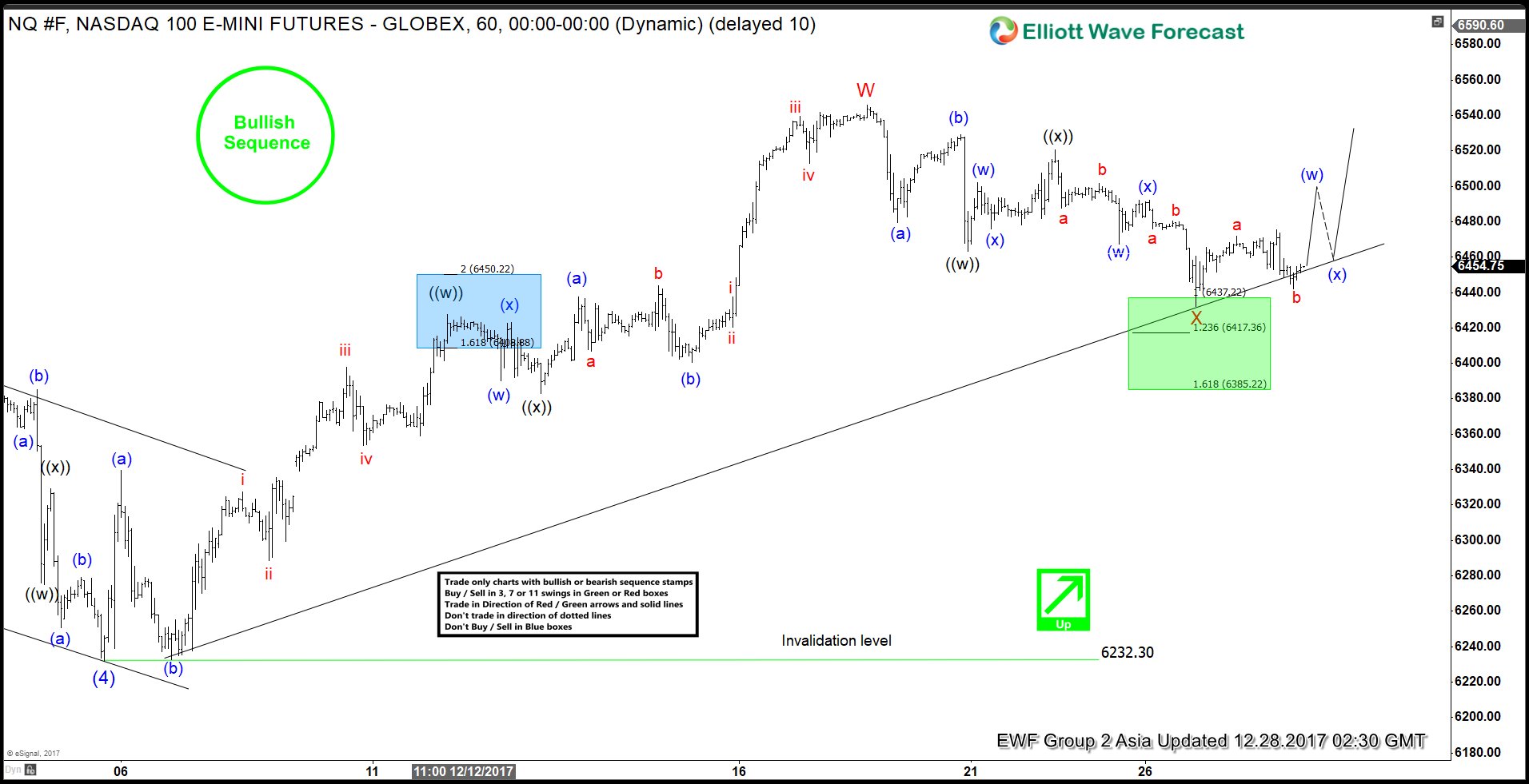

Elliott Wave Analysis: Nasdaq Looking to Extend Higher

Read MoreNasdaq Short Term Elliott Wave view suggests that Intermediate wave (4) ended at 6232.3. Since then, Nasdaq has resumed the rally higher as a double three Elliott Wave structure. The subdivision of the first leg Intermediate wave W unfolded as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at 6383, […]

-

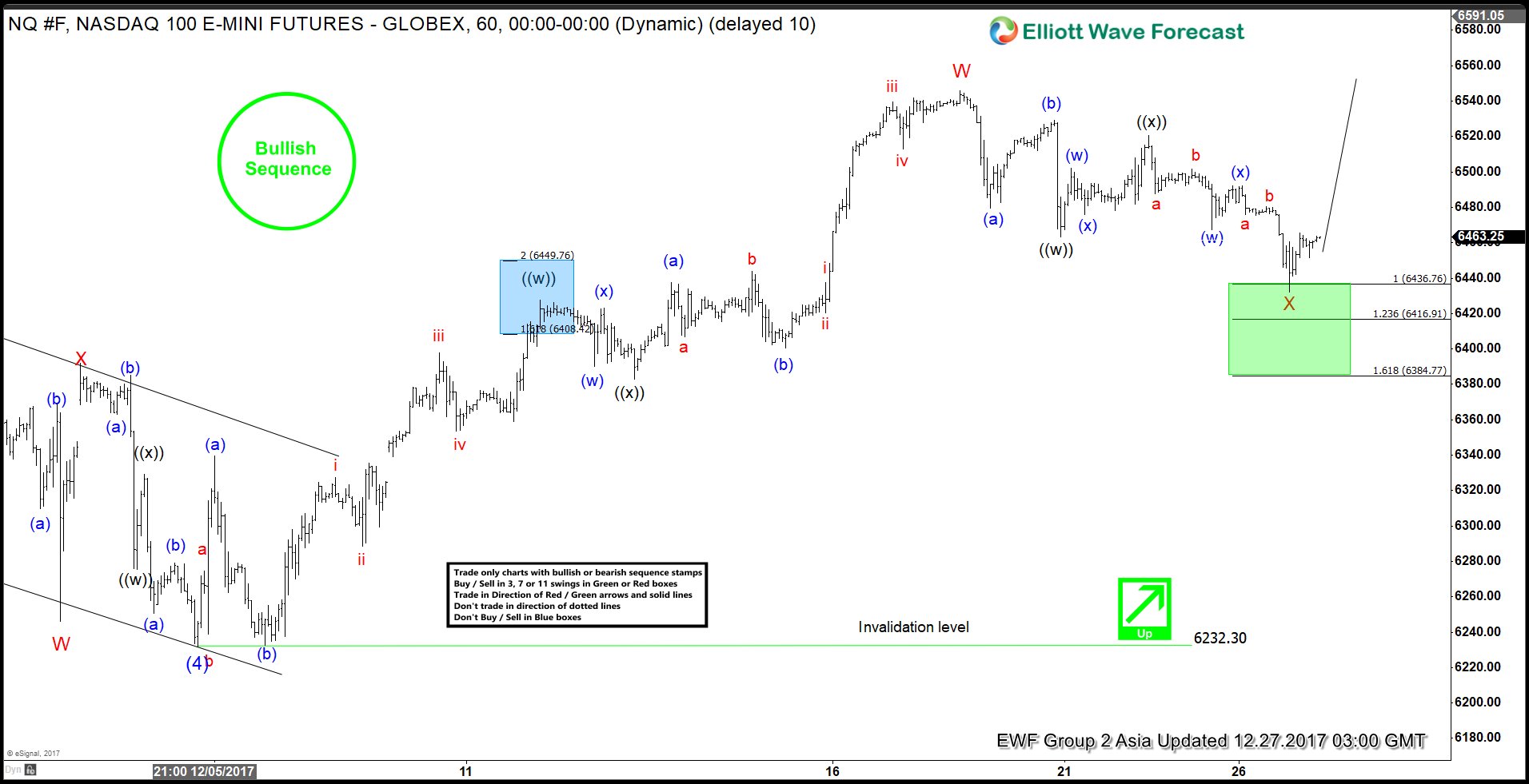

Nasdaq Elliott Wave Analysis: Upside Resumes

Read MoreNasdaq Short Term Elliott Wave view suggests that the decline to 6232.3 ended Intermediate wave (4). Up from there, Nasdaq has resumed the rally higher as a double three Elliott Wave structure. The first leg Intermediate wave W unfolded also as a double three Elliott Wave structure where Minute wave ((w)) ended at 6427.75, Minute wave ((x)) ended at […]