The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

Small Caps Providing Floor For The DAX Index

Read MoreHello fellow traders, in this blog post, we will discuss the related indices to the DAX from Germany in a more bigger picture. Those mid/small caps could give us a floor for the DAX Index. We will discuss the MDAX, SDAX, and the TECHDAX Let’s start with the MDAX. The MDAX is a German stock index […]

-

Elliott Wave Analysis: SPX Resumes Higher

Read MoreSPX Short Term Elliott Wave view suggests that the rally from 12/2/2017 low is unfolding as 5 waves impulsive Elliott Wave structure where Minute wave ((i)) ended at 2665.19, Minute wave ((ii)) ended at 2624.75, Minute wave ((iii)) ended at 2807.54, and Minute wave ((iv)) ended at 2768.64. Index has broken above Minute wave ((iii)) at 2807.54 […]

-

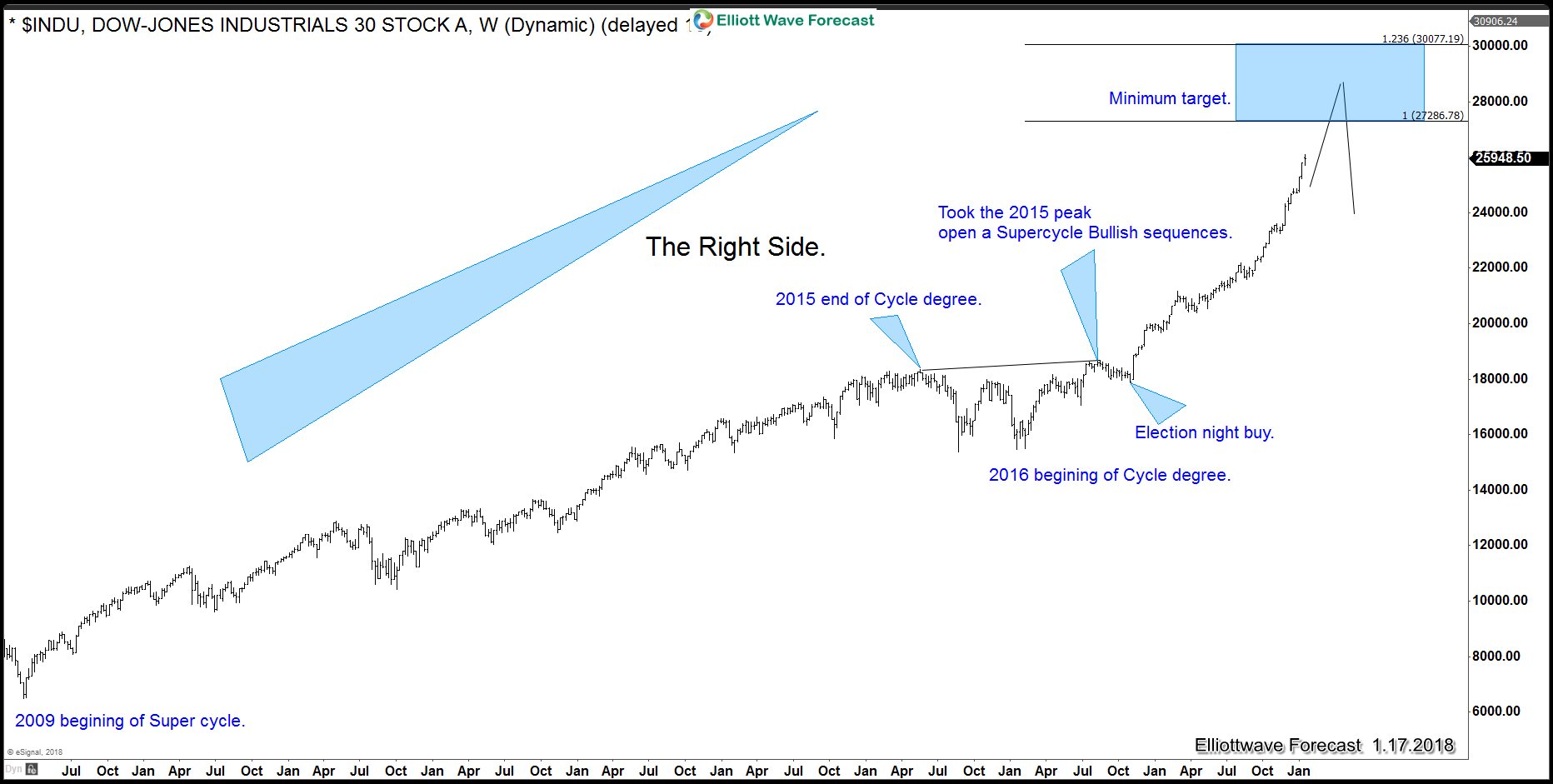

The Right side: The Only Way To Survive In Trading

Read MoreThe Reality of Market Participation The Market, as everyone knows, is a combination of buyers and sellers, when every second there are orders being executed on both sides. Many traders, when join this profession, come under the idea of trading every day, every hour and every swing in the market. There is a truth in […]

-

Elliott Wave Analysis: SPX Remains Buy in Dips

Read MoreSPX Short Term Elliott Wave view suggests that rally from 12/2/2017 low is unfolding as 5 waves impulsive Elliott Wave structure where Minute wave ((i)) ended at 2665.19, Minute wave ((ii)) ended at 2624.75, Minute wave ((iii)) ended at 2807.54, and Minute wave ((iv)) appears complete at 2768.64. Index still needs to break to a new high […]