The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

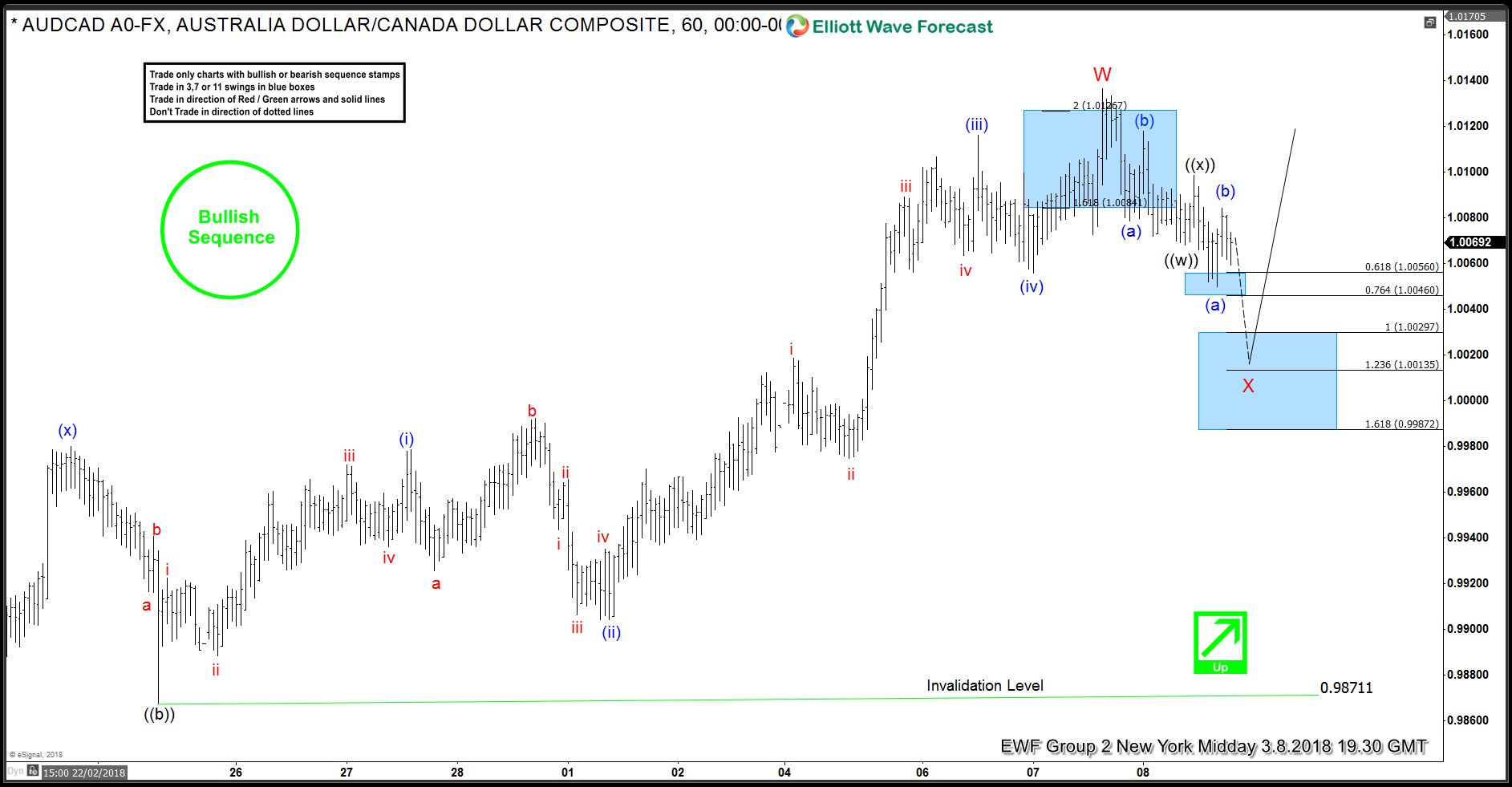

AUDCAD: Why We Were Bullish

Read MoreHello fellow traders. Another pair we have traded lately is AUDCAD. As our members know, AUDCAD is having incomplete bullish sequences in the 1 Hour cycle and suggesting further rally. Due to incomplete structure the pair is targeting 1.0212+ area according to Sequence Report. Consequently, we advised clients to avoid selling the pair and keep […]

-

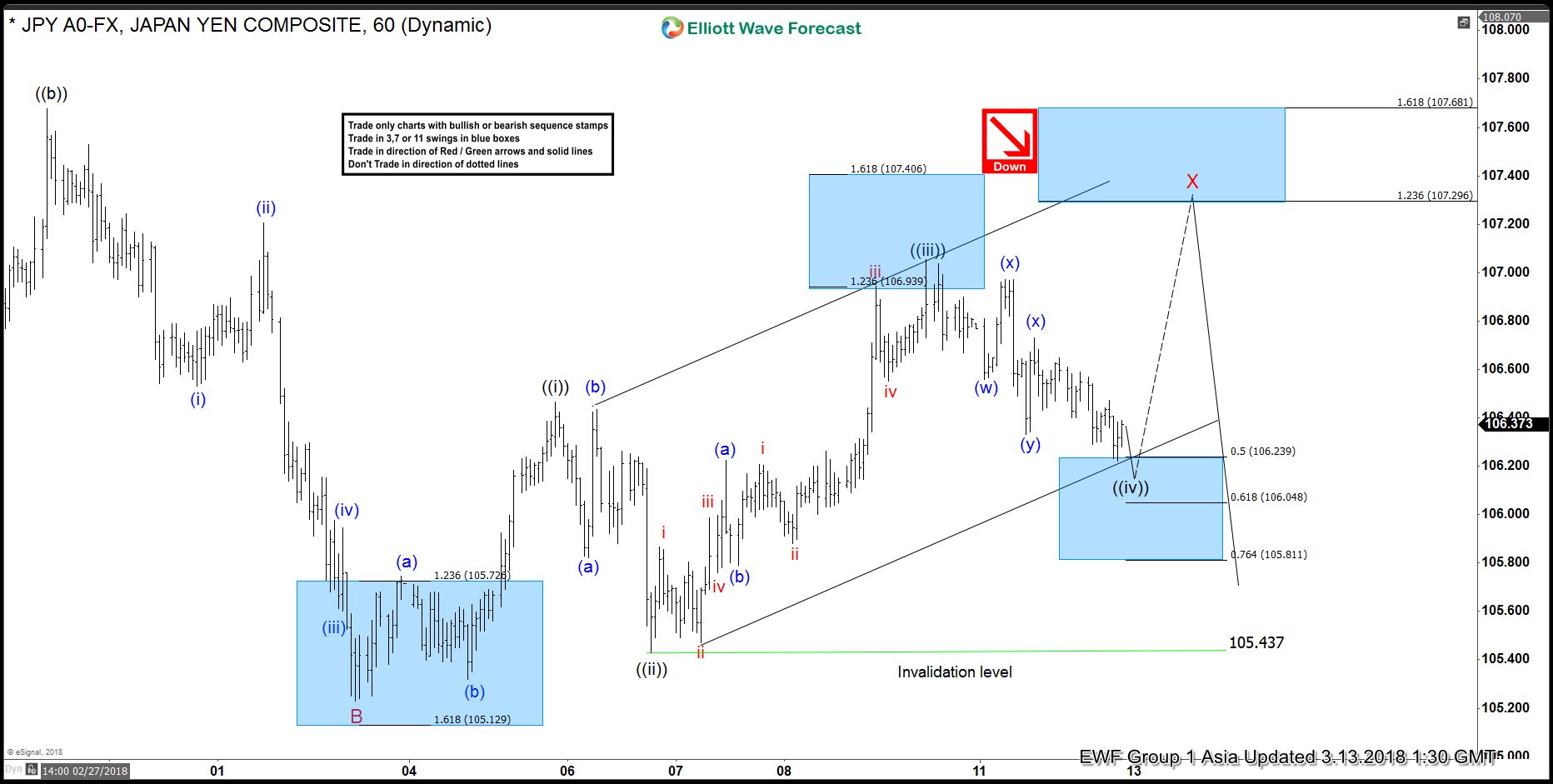

Elliott Wave Analysis: USDJPY Correcting in Flat Structure

Read MoreShort Term Elliott wave View suggests USDJPY is correcting cycle from 2/2 peak (110.5) as an Expanded Flat Elliott Wave Structure. Flat is a corrective Elliott Wave structure with ABC label, and it has a subdivision of 3-3-5. In the case of USDJPY, Minor wave A ended at 197.9 on Feb 21 and Minor wave […]

-

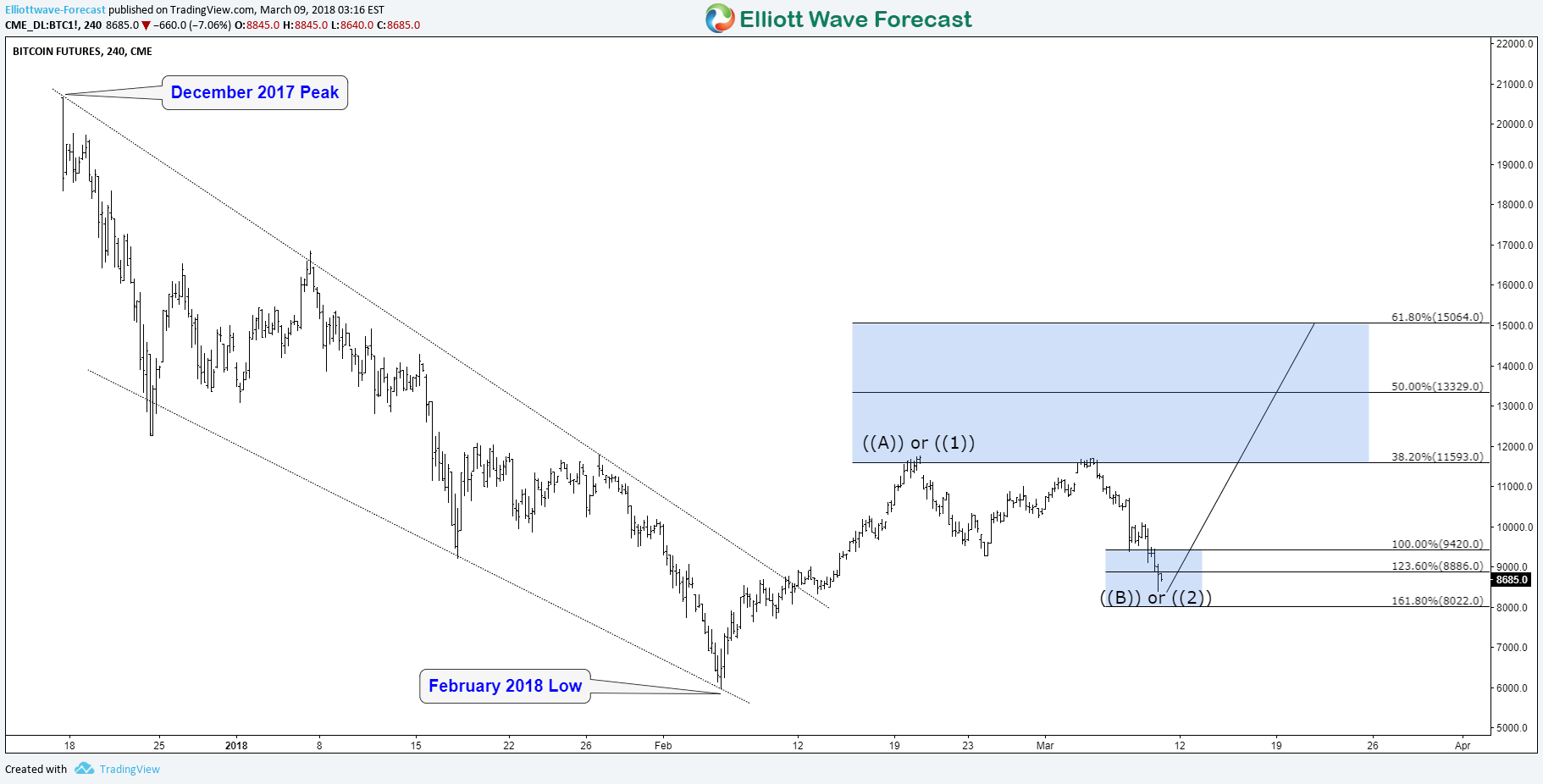

Bitcoin BTCUSD Elliott Wave View Calling for Rally toward $15,000

Read MoreSince all time high in December 2017, Bitcoin BTCUSD ( Value in US Dollar ) dropped 70% before finally bottoming around $6590 on the 6th of February 2018. The big decline drove fear into the digital market as many new investors / traders lost their money during that period so they decided to stay away […]

-

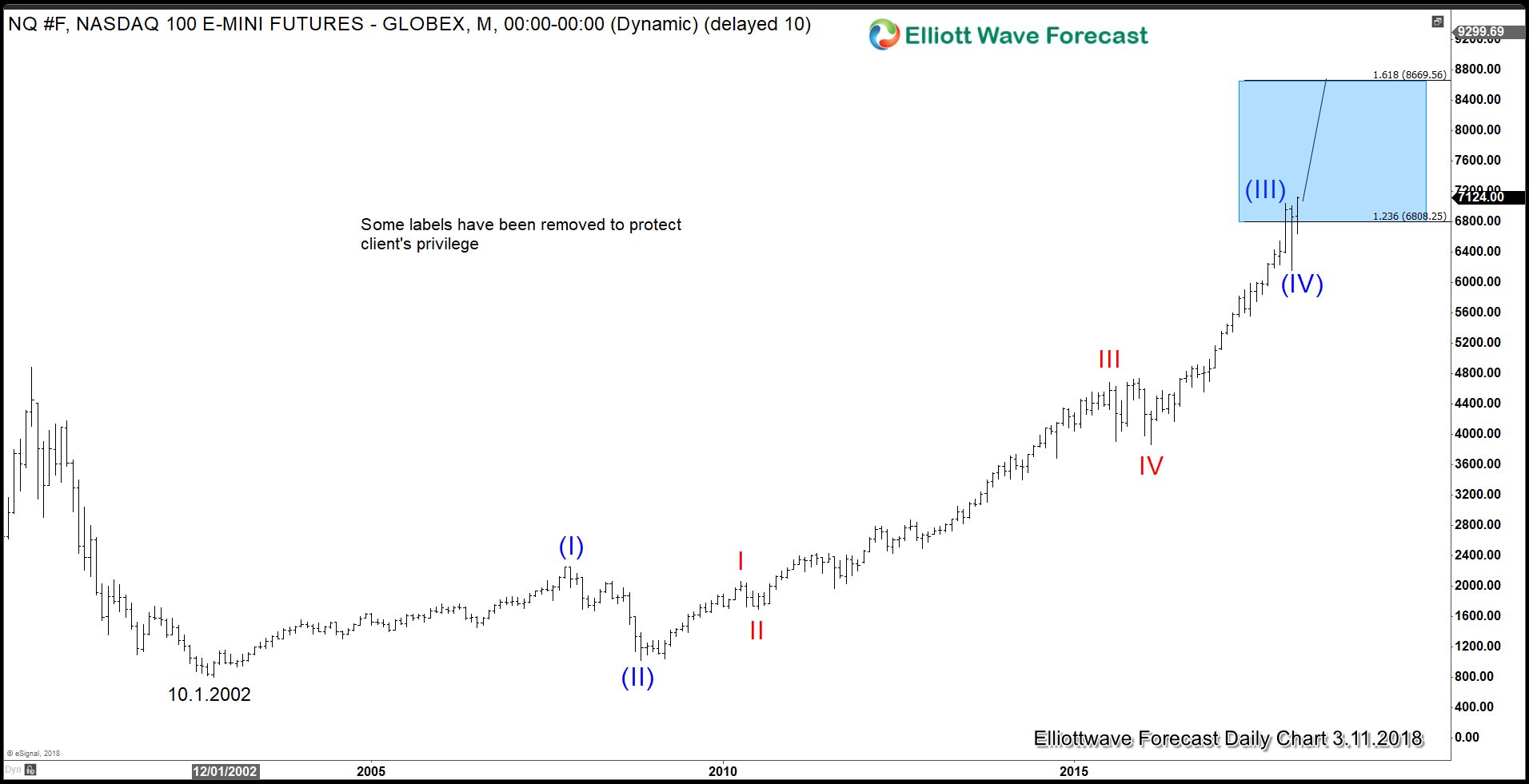

Nasdaq Soars to New Record High After Strong Job Reports

Read MoreNasdaq soars to an all-time high after last Friday’s U.S. employment report which saw a massive 313,000 growth in February. This is the biggest number of jobs since July 2016, handily smashing the expectation of 200,000 jobs gain. For the fifth month in a row, the jobless rate remains unchanged at 4.1%, a 17-year low. […]