The Power of 3-7-11 and the Grand Super Cycle: How We Saw the Bullish Turn in April 2025 Back on April 9, 2025, while World Indices were dropping sharply and global sentiment had turned overwhelmingly bearish, we published an article that challenged the fear-driven narrative. We explained why selling was not the right approach and […]

-

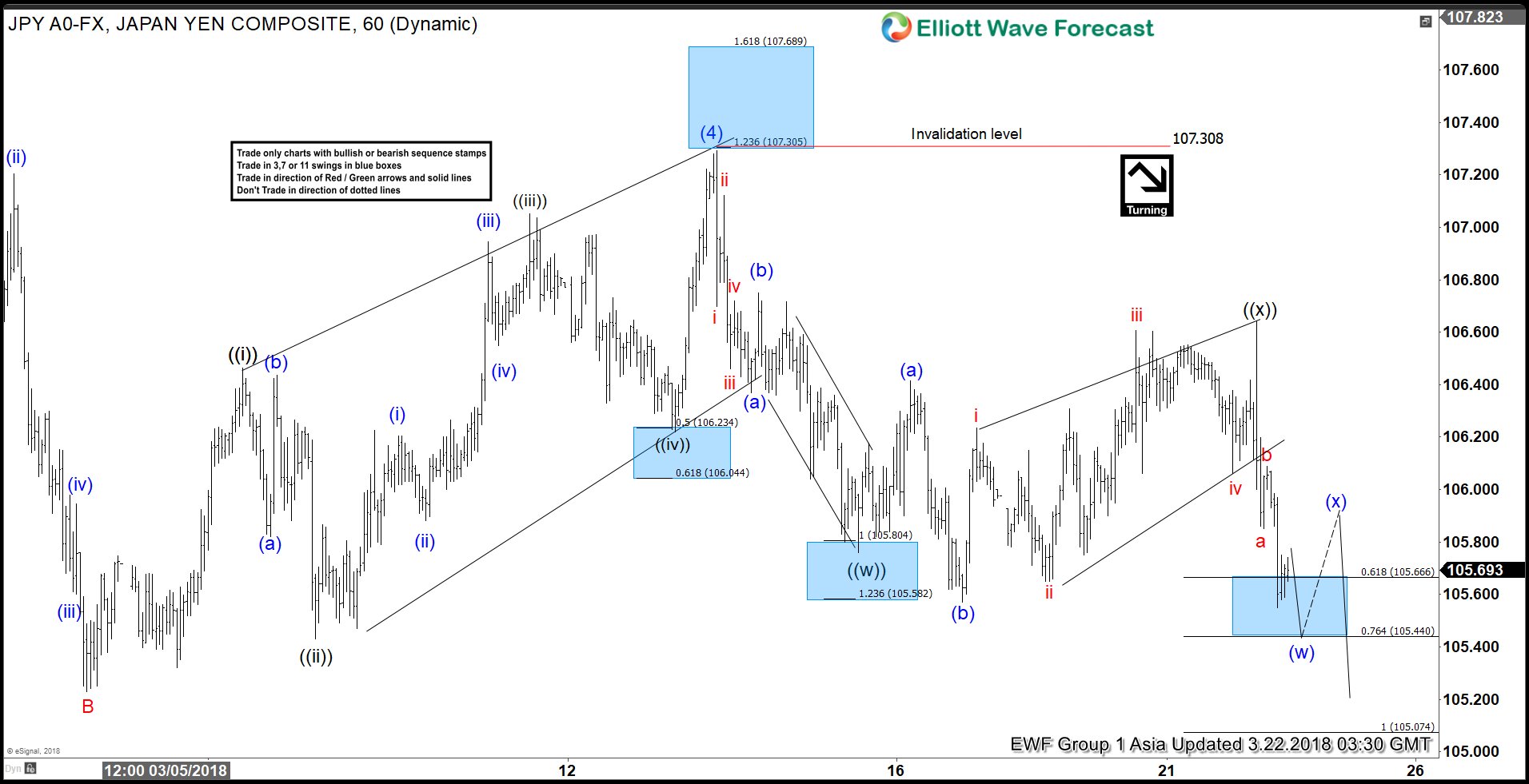

Elliott Wave Analysis: USDJPY Resumes Lower to 104

Read MoreUSDJPY Elliott Wave view suggests that the decline from 11.6.2017 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from 11.6.2017 high (114.73), Intermediate wave (1) ended at 110.84, Intermediate wave (2) ended at 113.75, Intermediate wave (3) ended at 105.55, and Intermediate wave (4) ended at 107.3. Intermediate wave (5) is […]

-

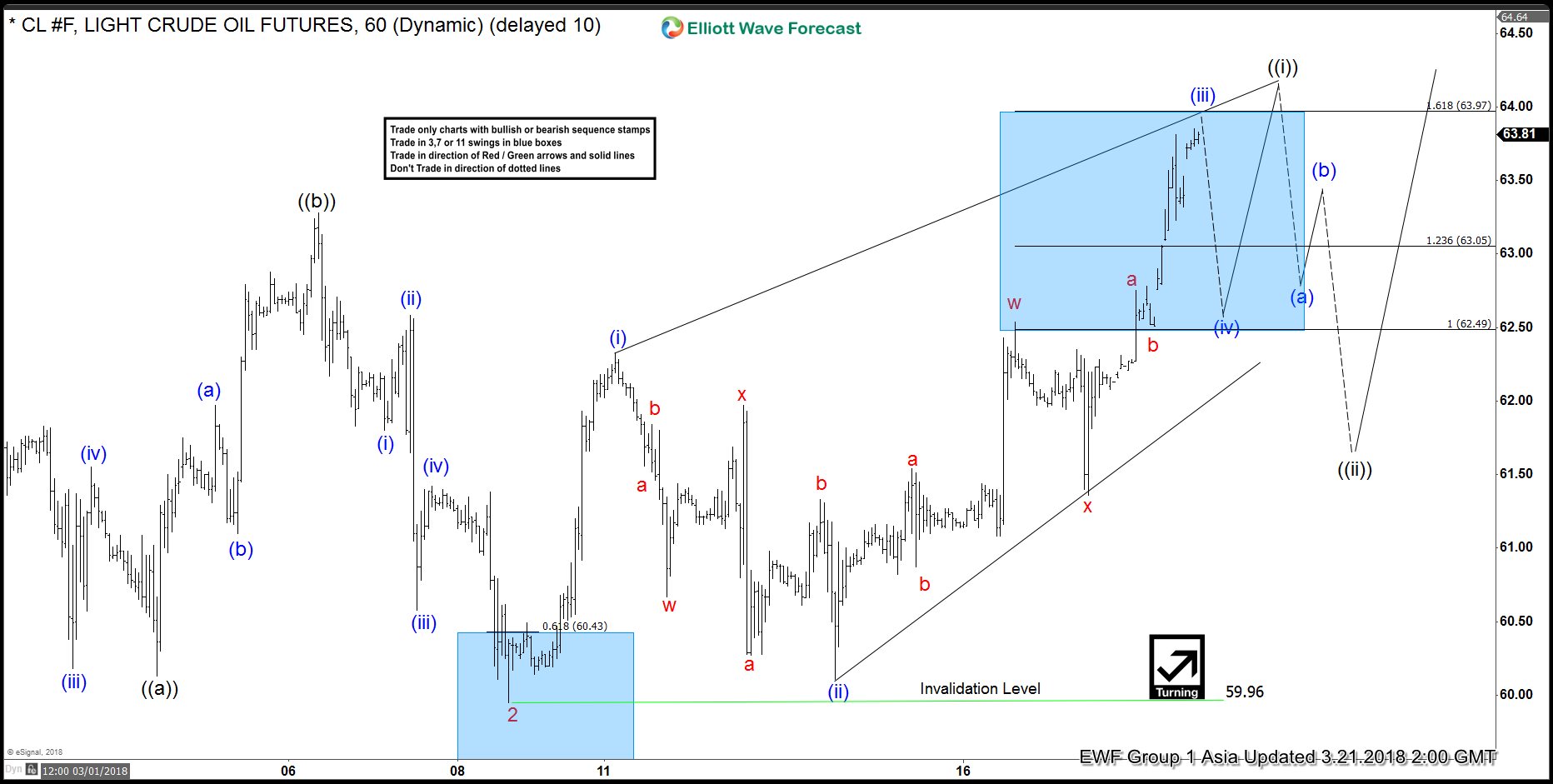

Elliott Wave Analysis: Oil (CL_F) Looking to Extend Higher in Wave 3

Read MoreOil (CL_F) Short Term Elliott Wave view suggests that the decline to 59.95 on 3/9 ended Minor wave 2. Minor wave 3 is unfolding as a 5 waves impulse Elliott Wave Structure where Minute wave ((i)) of 3 is currently in progress as a leading diagonal. Up from 59.96, Minutte wave (i) ended at 62.33, Minutte […]

-

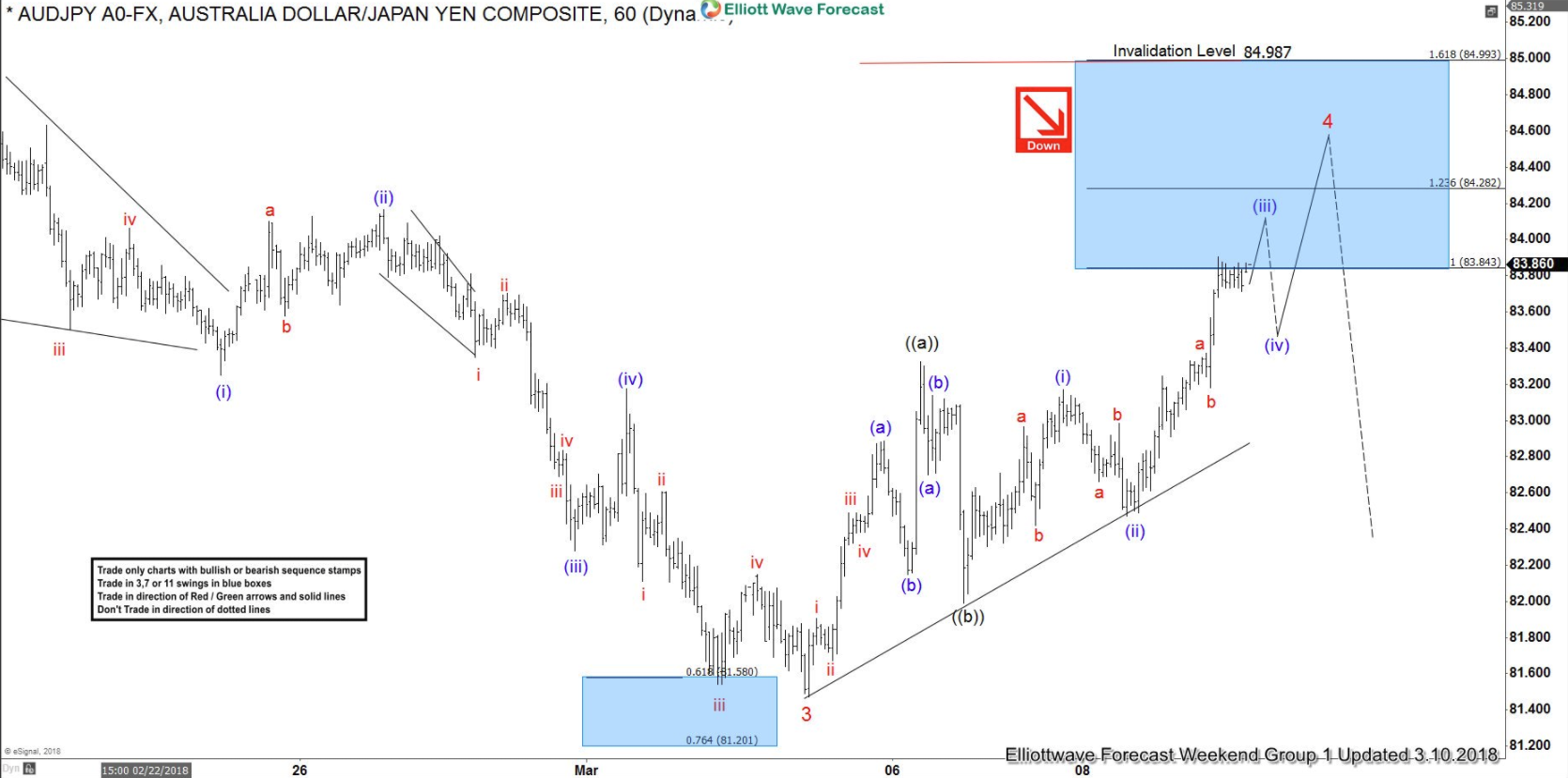

Elliott Wave Analysis: AUDJPY Calling the Decline

Read MoreIn this blog, we will have a look at some past Elliott Wave structures of the instrument AUDJPY. In the chart below, you can see the 1-hour weekend update presented to our members on the 03/10/18. Calling for a double correction in an Elliott Wave Flat correction as the internals from black ((a))-((b))-((c)) proposed to be […]

-

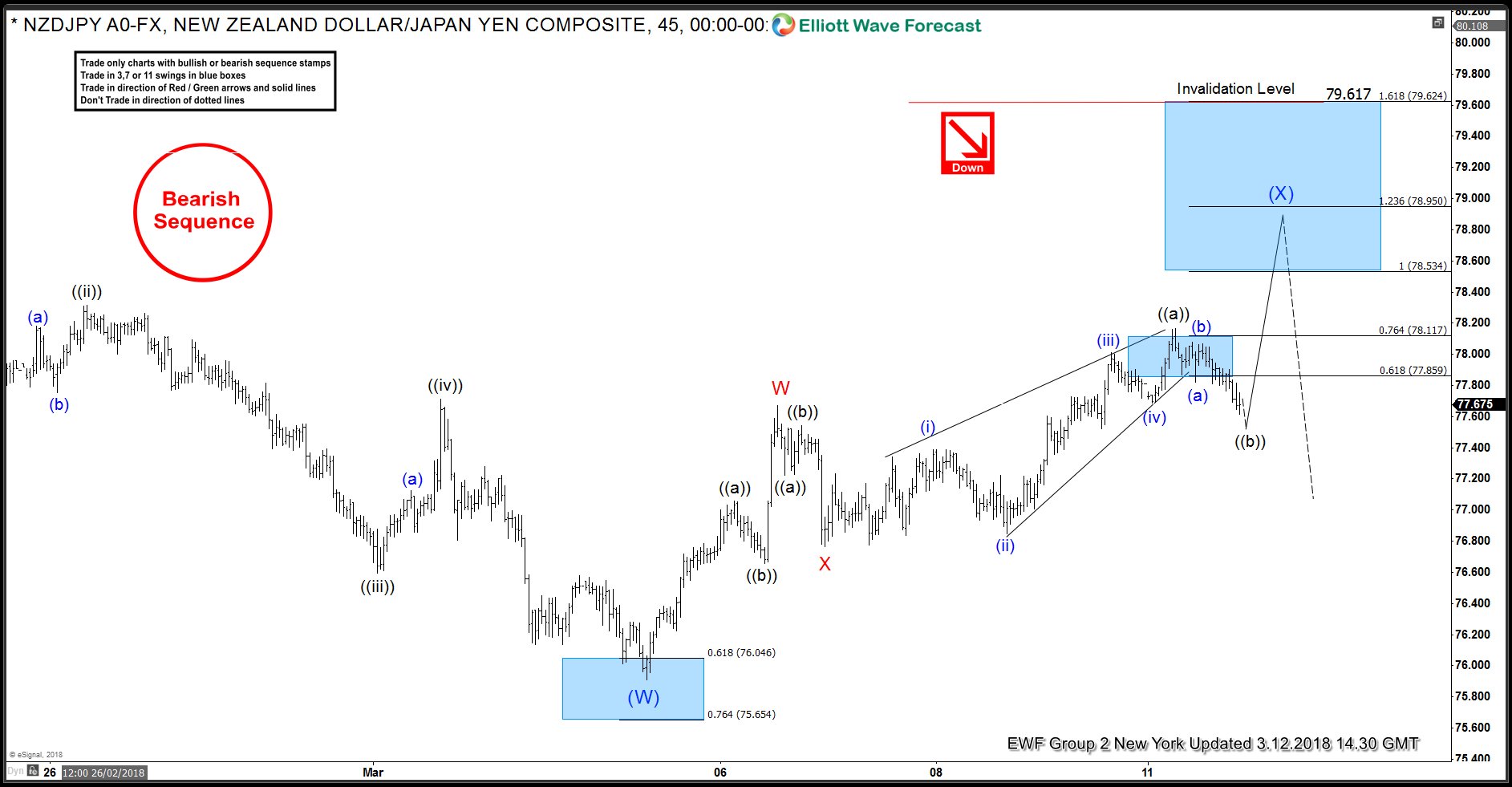

NZDJPY Selling the Elliott Wave bounces

Read MoreIn this Technical blog, we are going to take a quick look at the past Elliott Wave Chart performance of NZDJPY. Which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure and the forecast. As our members know, we were pointing out that the sequence from July 27 2017 peak is incomplete to the downside. Therefore, we advised […]